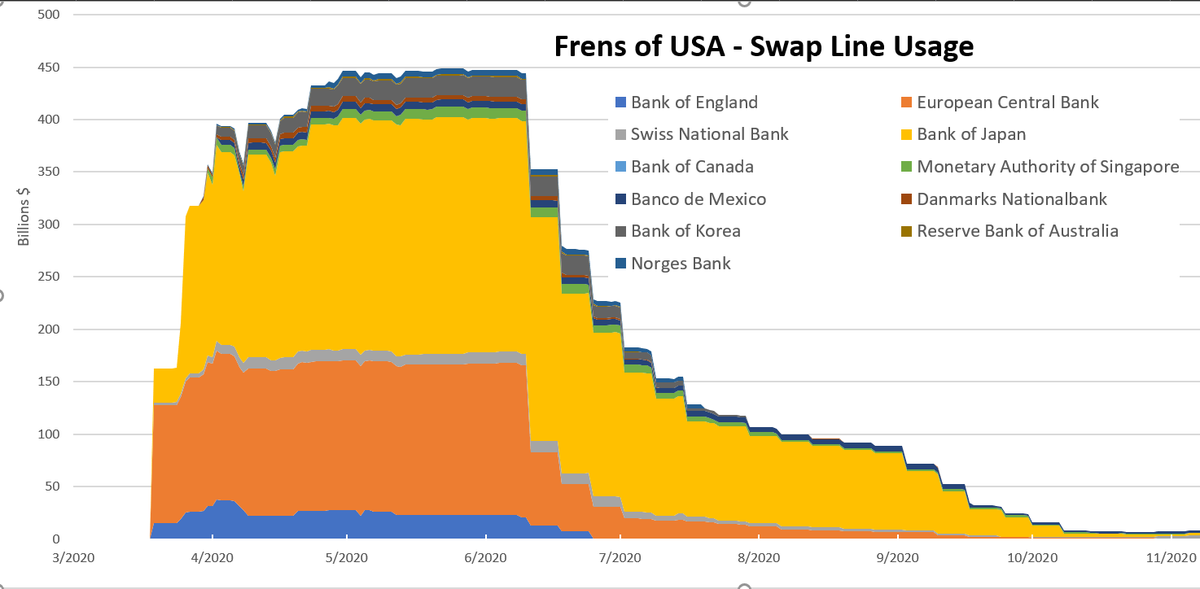

Since Central Bank swap lines are probably going to start blowing up again because of energy and FX issues, I decided I would make some charts on their usage during COVID. Because why not.

short thread

#btc #macro #DXY

1/

short thread

#btc #macro #DXY

1/

Currency swaps are a loan. Fed buys foreign currency from a central bank, and agrees to sell back later for same amount of $, plus interest (in $). The € or ¥ could devalue vs $ in meantime, making that loan cost more than the published interest rate

2/

2/

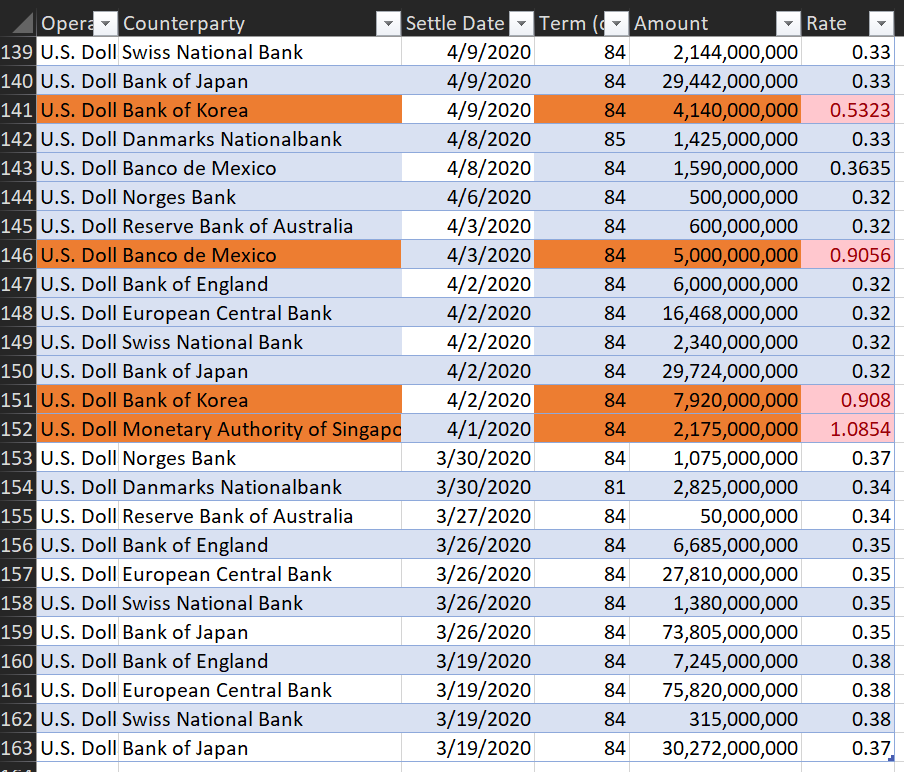

Mexico, Korea, and Singapore got really screwed on their 12-week swap interest rates early in the pandemic. (1.08% vs 0.3%). Mexico's own policy rate at this time was pretty high, but the others were basically zero. Later they all got the same rates.

3/

3/

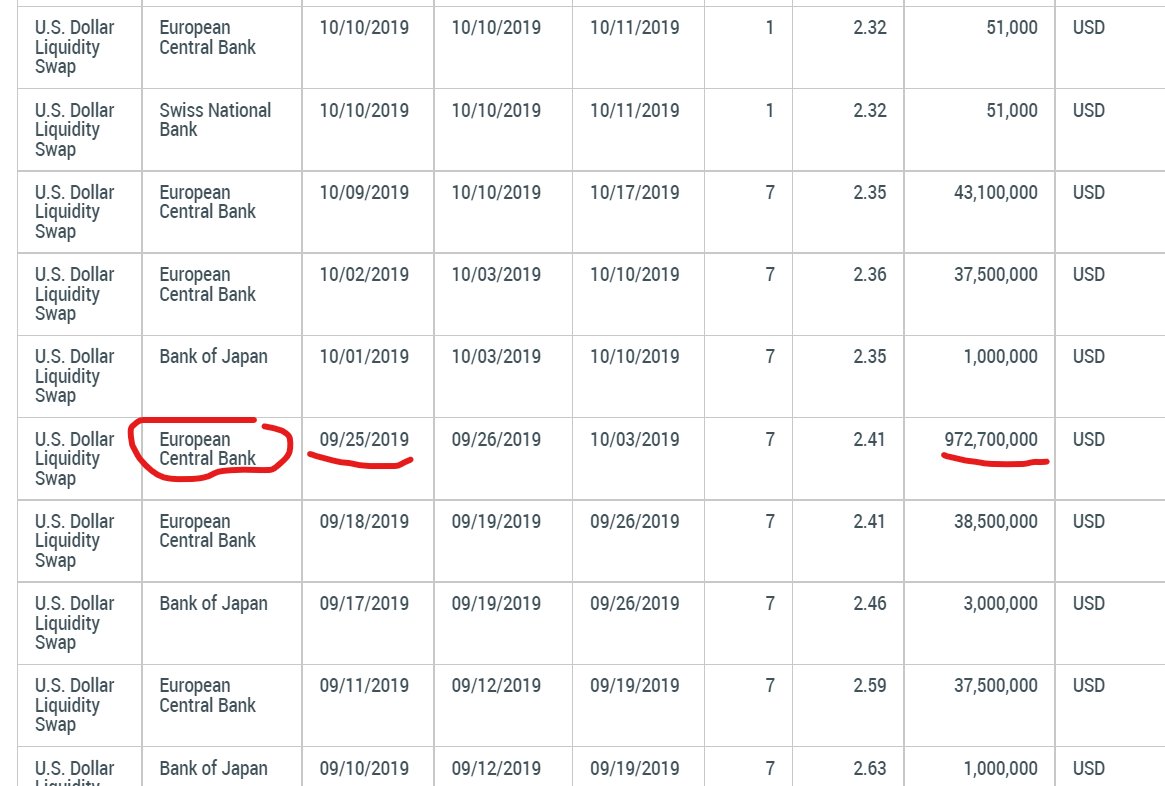

Europe gets the BASKET CASE award for actually borrowing before Covid started. I'm sure there's a super normal reason for borrowing a yard from the USA in Sep 2019 and it has nothing to do with the EU monetary experiment being rickety

4/

4/

Japan gets the GO BIG OR GO HOME award for totally sending it, topping out at $225 billion

Canada gets the ABSTINENCE award for not actually using the swap line (ok they tested $60,000 but didn't inhale).

5/

Canada gets the ABSTINENCE award for not actually using the swap line (ok they tested $60,000 but didn't inhale).

5/

Denmark and Norway get ITS COMPLICATED award for being in NATO but not part of the Euro so they need their own swap line.

Taiwan, India, and Vietnam -- #8, 9, 10 largest trade partners with the US get the MAYBE NEXT TIME award for not making the list. Swaps for frens only

6/

Taiwan, India, and Vietnam -- #8, 9, 10 largest trade partners with the US get the MAYBE NEXT TIME award for not making the list. Swaps for frens only

6/

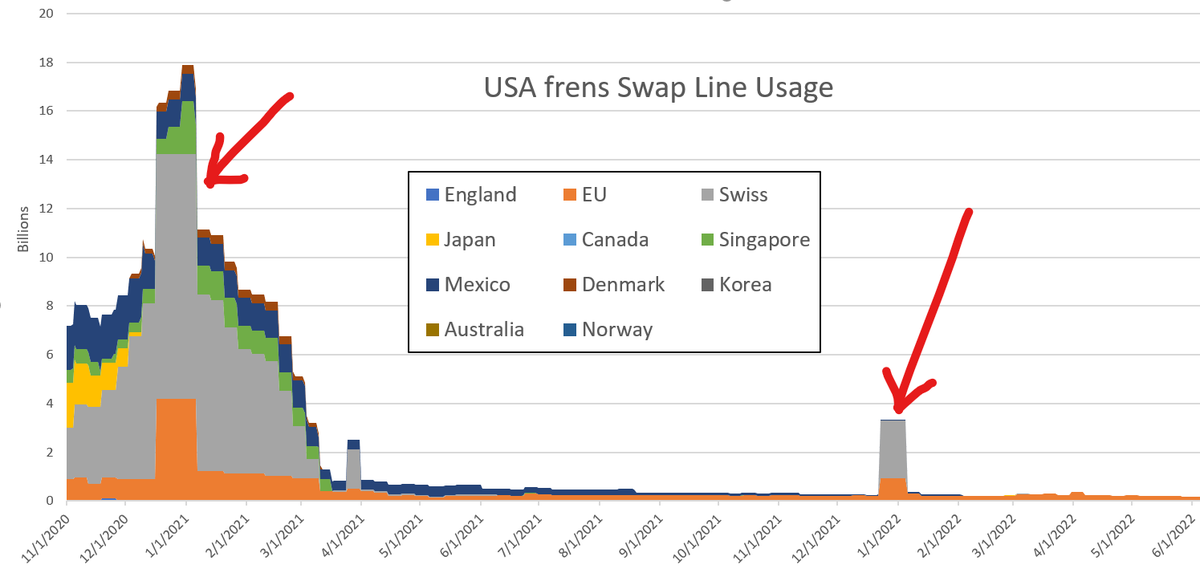

The Swiss get the HOLIDAY SPIRIT award for always borrowing a lot for Xmas and New Years for some reason 🎅🎄. Not sure why because their FAANG portfolio was still doing OK both festive periods.

7/

7/

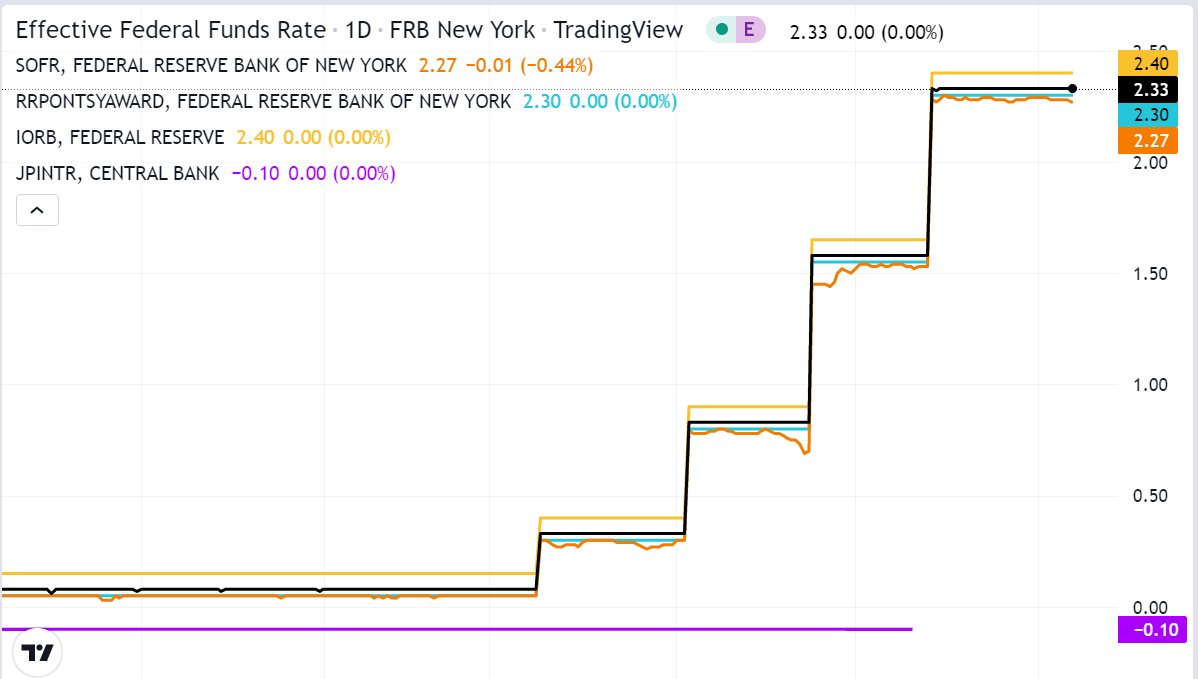

Current rate for a 7 day swap is 2.58% annualized- similar to other rates in the US. But for Japan with a policy rate of -.10%, this is pretty high (purple line).

Check out this page as winter approaches to see if the swap lines take off again:

newyorkfed.org/markets/desk-o…

8/

Check out this page as winter approaches to see if the swap lines take off again:

newyorkfed.org/markets/desk-o…

8/

Some of the central banks that didn't get swap lines in 2020 (but did in GFC) include:

Brazil

New Zealand

Sweden

Probably still frens of USA, especially 5-eye NZ. From now we barely have free markets anymore-- geopolitics is at the forefront until things settle down.

9/

Brazil

New Zealand

Sweden

Probably still frens of USA, especially 5-eye NZ. From now we barely have free markets anymore-- geopolitics is at the forefront until things settle down.

9/

Just a little bit of humor (not a PhD thesis) and a few charts to get us ready for swap line extravaganza, winter 2023!

tagging swap line nerds out there to see what they have to add

@matthew_pines @chilipiper234 @jameslavish @Max__Fin @LukeGromen @JeffSnider_AIP @huskerrx

end/

tagging swap line nerds out there to see what they have to add

@matthew_pines @chilipiper234 @jameslavish @Max__Fin @LukeGromen @JeffSnider_AIP @huskerrx

end/

• • •

Missing some Tweet in this thread? You can try to

force a refresh