You should always have reasons for why you invest / trade the coins you are buying. Considerations for why you choose the coin you choose (be it $BTC $ETH $APE $XRP $SOL or random coins like $SHIB):

-Time horizon

-Risk Factor

-Liquidity

-Momentum

-Random

Notes below 👇

-Time horizon

-Risk Factor

-Liquidity

-Momentum

-Random

Notes below 👇

1) Time Horizon- Is it a trade or an investment? That's the #1 question you should ask yourself before buying anything right now. If it's a trade, you plan to sell and exit your position over x amount of time; an investment is a longer term hold. Key difference.

Trading is fine rn, there's arguably nothing you should really hold given the uncertainty. Too many people rush into buys in these situations and confuse a trade with an investment. Most are not active traders and don't have the time or knowledge for moving in/out regularly.

That's ok but be very careful with what you decide to DCA and invest in in these market conditions. It's very sketchy and unknown and you better be v. confident in your skills for analyzing shitcoins. Todays Aptos is tomorrows EOS. Tech changes fast and fundamentals can be iffy.

2) Risk Factor: In current market conditions, you have to be selective on the downside of your token. Finding the shitty meme coin in the bull market is great, market conditions are ripe for that 100x move. In bear markets, it's the opposite. Figure out the downside first IMO.

Sure, buying ETH and BTC is boring as fuck rn and won't give you great returns (relatively). People want to get rich (quickly) and don't want the 5x that BTC will give them.

But buying those shitcoins rn is extremely risky. And the longer you hold, the worse it can get.

But buying those shitcoins rn is extremely risky. And the longer you hold, the worse it can get.

ie. I can get rich as fuck off some random shit meme coin if I actively trade it right now...but it's probably more likely that I get rugged and lose 100% of my money.

Crypto is a giant casino, remember that.

Crypto is a giant casino, remember that.

The environment for the risky 200x meme coins is probably not right now IMO. So, while you can get rich off those coins at any point (there's always trash pumping), you better have some idea of the market before you start buying those. Don't invest in those coins either.

Risk factor kind of just boils down to 'fundamentals' when you think about it. FA in crypto is mostly a meme, but there are some useful coins with some useful products out there (arguably). You also have to batch the coins in diff. groups by sector.

3)Liquidity: How much liquidity is in the coin you are buying? Most retail traders (myself included) don't have to worry about price impacts/slippage for most trades. If you're a whale trading 40 million dollars, you probably can just trade BTC & ETH consistently. If you're us...

You can usually pick and choose what you want. With that said, even us retail traders can be whales for small small shitcoins- some tiny marketcap coins on dexes won't have much liquidity. They can obviously pump 100x easily but getting out / getting in w. any size is hard.

With liquidity being so fragmented, we're celebrating every 2% move like it's a 100% move in 2021. Everything is based on momentum and narrative (more on that later). It's really important to find the coins that fit your liquidity/size profile and not get stuck in 1 coin.

4) Momentum- Arguably the most important factor rn on this entire list, momentum and narrative are the key drivers for any big moves lately (and since 2021). The entire altcoin market has mostly died since May 2021 and you had to be an active trader/understand the market after...

The May dump. Meaning: Liquidity/activity bounced from 1 sector to the next while major indexes such as Defi and random shitcoins like BAND just died. So you had narratives of Gaming-> L1s-> metaverse->ZK coins->bridges-> etc....basically, all liquidity was a game of hot potato.

The same is still true today- coins are mostly doing nothing. But the narratives are still there and we saw this recently with the $ETH merge.

How do you play these moves? That's probably a thread topic for another day but you want to find the first big mover and the sector...

How do you play these moves? That's probably a thread topic for another day but you want to find the first big mover and the sector...

that is moving. ie. $ETH was moving due to the merge and other merge coins such as $LDO $OP $ETC were all going hard too. Understanding the fundamentals is really important in times like this; coins don't just move for the hell of it.

5) There are also random notes that you should know with each coin you trade. You buy something like $XRP or $SHIB because those can move 30% in a day without any rhyme or reason. You hop on the $GMX train because arbitrum is also merge related + you see other dex volumes.

You see $SOL popping bc SOL NFTs are going off really strongly. You see $APE having staking fundamentals and that's another catalyst for why it's moving. Crypto moves so fast and there are always opportunities, even in the shitty bear market we're currently experiencing.

6) Putting it all together: Ok, so we talked about a lot of random things in this thread. How do you put it all together?

Ex. 1 from before-I buy $XRP because it has momentum with the recent lawsuit stuff. I like the liquidity because you can go in/out of 6- low 7 figures fairly easily and not get destroyed by slippage. Risk factor wise, it's a long time coin and won't rug, this is also a TRADE...

NOT an investment. I have some targets above (that didn't hit) and I actually ended up taking a loss on this trade.

But I'm combining all the factors above that I discussed in this thread for the reasons why I took the trade I did.

But I'm combining all the factors above that I discussed in this thread for the reasons why I took the trade I did.

Ex 2. $SOL: I bought #Solana at $30. This is an investment and I threw it into a cold wallet, not to be touched for a while. I bought SOL bc I think it's a decent non ETH L1 and I think the R:R is better than ETH overall. It has a great community and, though I might be underwater

I will still probably be laughing about this buy 1-2 years from now (fingers crossed). Risk factor wise, this is obviously a great coin and should stick around and also it has excellent liquidity.

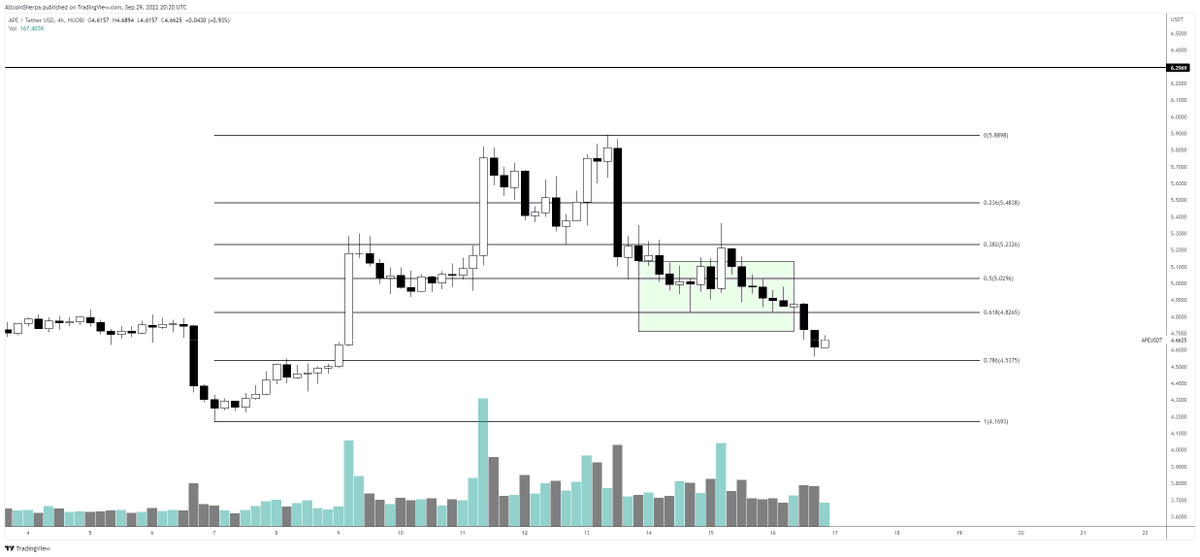

Ex 3. $APE: I bought #APECOIN as a trade at 4.80-$5.10. I was bad with my entry but I bought this because the liquidity was relatively good and it also had a decent catalyst with regards to staking rewards (you had to buy APE in order to qualify for it).

I hope you liked this thread and it gave you some ideas for why you should buy /trade the coins you are trading right now. It's important to have logic and reason behind any buy in this environment. Good luck and stay safe.

• • •

Missing some Tweet in this thread? You can try to

force a refresh