#RealMadrid 2021/22 accounts cover a season when they won La Liga, the Champions League and the Supercopa de Espana . Their finances benefited from the effects of COVID “gradually subsiding” and the consequent return of fans to the stadium. Some thoughts in the following thread.

#RealMadrid pre-tax profit improved from €1.7m to €20.2m (€12.9m after tax), as revenue rose €69m (10%) from €653m to €722m, though profit from player sales fell €44m to €62m and operating expenses shot up €323m (43%). Boosted by €316m capital gain from Sixth Street.

#RealMadrid have sold 30% of some new revenue from the Santiago Bernabéu stadium for 20 years to Sixth Street/Legends in exchange for €360m. Sixth Street are an investment firm, while Legends specialise in the management of stadiums and organisation of events.

Excluding €316m gain on the Sixth Street deal, but adding back €169m once-off expenses (€108m change in provisions, €61m impairment) means that #RealMadrid actually made a €127m underlying pre-tax loss. In other words, the result is not as good as the headlines figures.

Return of fans meant increases in #RealMadrid membership fees & stadium, up €94m to €104m, and competitions, up €23m (20%) to €139m. However, broadcasting fell €29m (14%) to €179m, partly due to deferred income in prior year, while marketing decreased €24m (8%) to €290m.

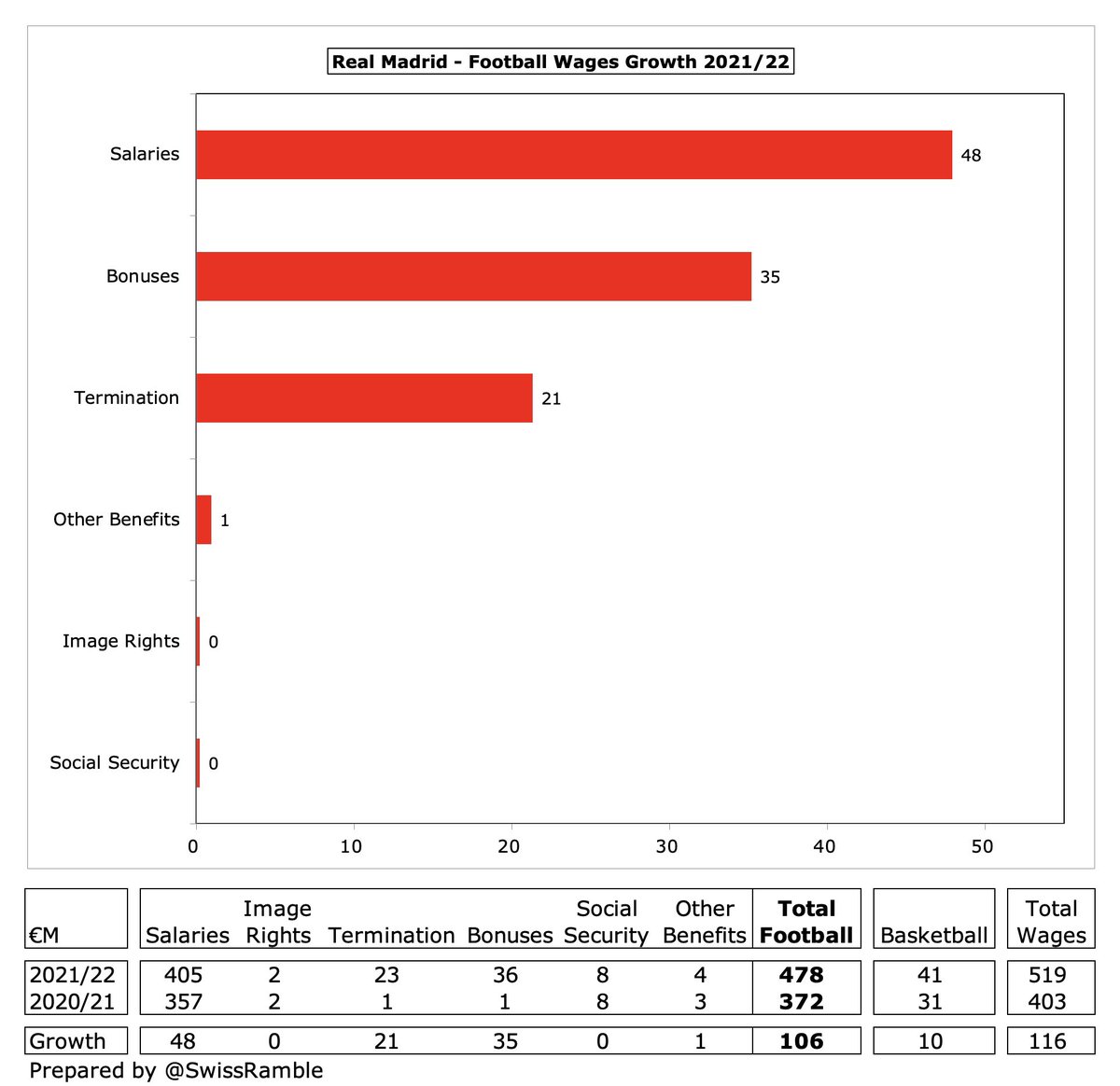

However, #RealMadrid expenses surged with wages up €116m (29%) from €403m to €519m, split football €478m & basketball €41m, while other expenses climbed €125m (65%) to €317m. Player amortisation rose €5m (3%) to €164m, and there was a €77m swing in impairment provision.

#RealMadrid are the first Spanish club to publish accounts for 2021/22, so comparison of their €20m pre-tax profit with 2020/21 (severely impact by the pandemic) is a bit misleading. Some large losses were made prior year, notably Barcelona’s massive €555m (€481m after tax).

This result means that #RealMadrid remained in profit over the 3 years affected by COVID. UEFA said that accumulated losses of European clubs in 2020 and 2021 were €6 bln, but Madrid actually made €4m profit, only surpassed by Bayern and Wolves (mainly loan write-off).

#RealMadrid said they have lost €390m revenue in the past 3 years due to COVID, including €90m in 2021/22 alone. This excluded new revenue that could have been obtained had then pandemic not struck and lower profit from player sales due to the depressed transfer market.

#RealMadrid profit on player sales fell €44m from €106m to €62m, mainly from the sales of Raphael Varane to #MUFC and Martin Odegaard to #AFC. Despite the fall, this was still better than any other La Liga club in 2020/21, especially Barcelona, who only generated €4m.

#RealMadrid are normally highly profitable, due to their ability to generate revenue. In the 7 years before 2020, they accumulated an impressive €318m profit before tax, averaging €45m a season. Even after the pandemic struck, they still managed to deliver (small) profits.

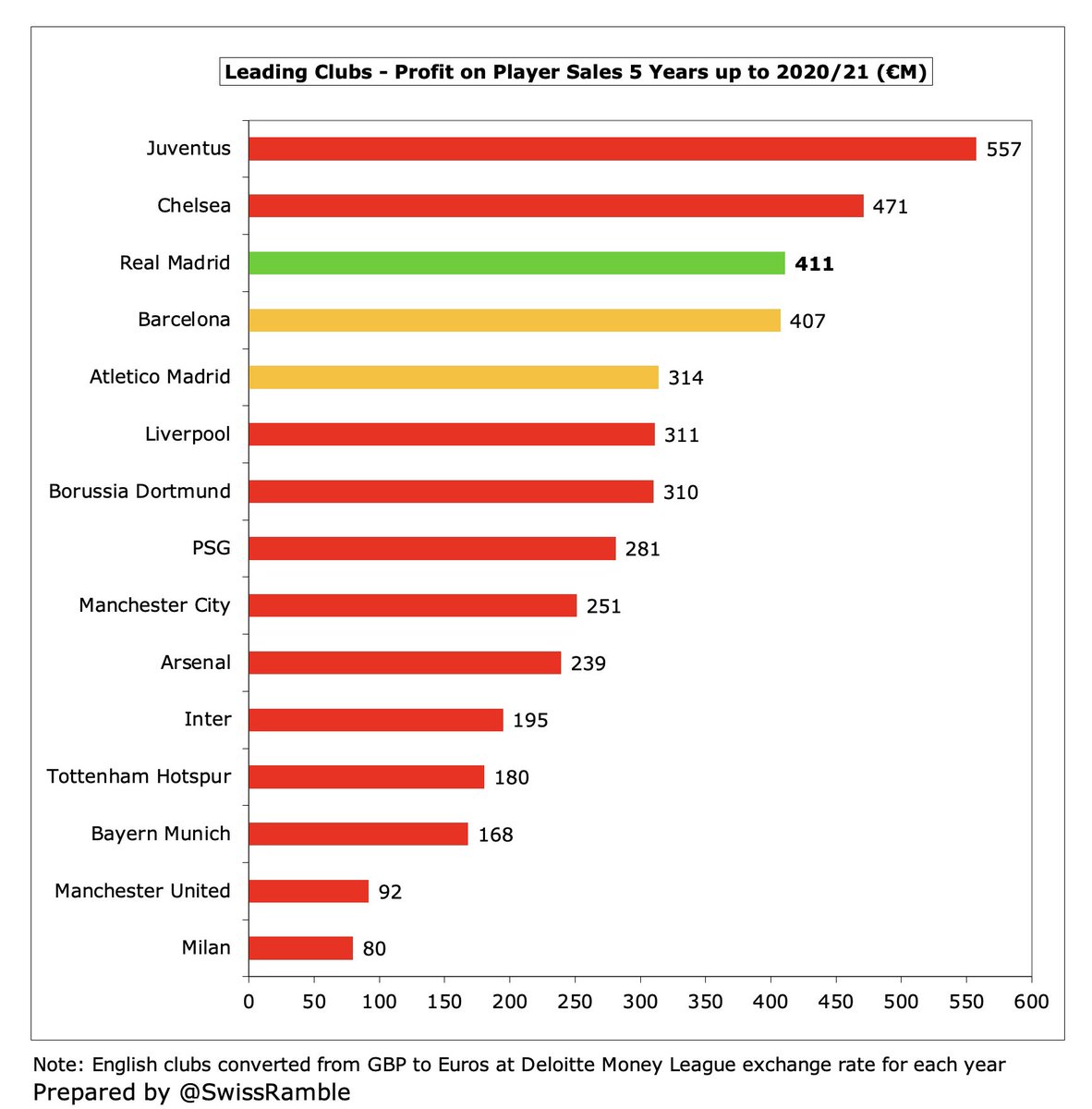

#RealMadrid have become more reliant on player sales, making more than €400m from this activity in the 5 years up to 2021, one of the best in Europe, though lower prices contributed to 2022 fall. The 2022/23 accounts will include Casemiro’s big money move to #MUFC this summer.

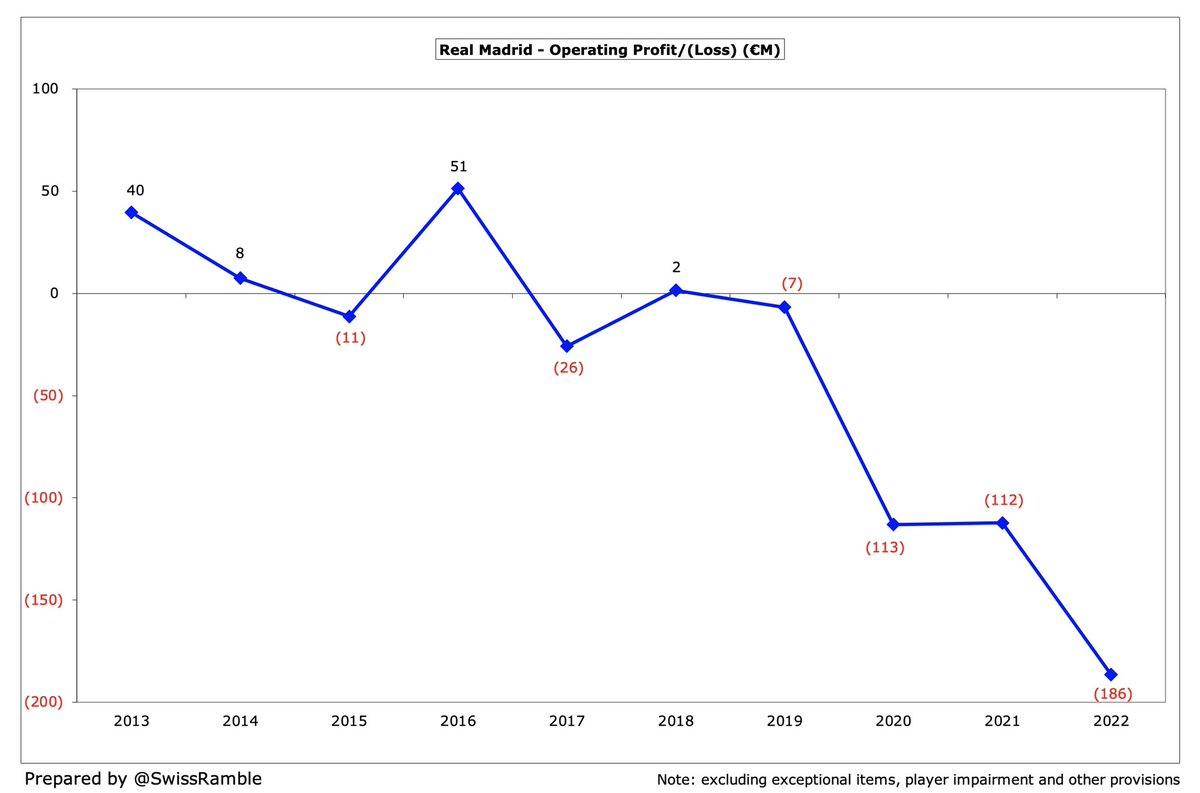

#RealMadrid operating loss, excluding player sales and exceptional items, has understandably slumped during the last 3 years, falling from €112m to €186m in 2022. In fairness, most football clubs post operating losses, but Madrid’s result was one of the highest in Spain.

Despite #RealMadrid revenue bouncing back to €722m in 2022, it is still down €36m (5%) from the 2019 pre-COVID €757m peak, largely due to some stadium capacity restrictions last season. Club said that revenue was around €100m lower than the 2019/20 budget before the pandemic.

#RealMadrid €722m revenue is currently highest of most recent accounts in Spain, though others will increase when they release 2021/22 figures because of growth in match day income. Madrid overtook Barcelona in 2020/21, but both clubs earn much more than domestic rivals.

According to the Deloitte Money League, #RealMadrid had the second highest revenue in the world in 2020/21, with their €641m only surpassed by #MCFC €645m, but comfortably ahead of Bayern Munich €611m, Barcelona €582m, #MUFC €558m and PSG €556m.

#RealMadrid marketing revenue fell €24m (8%) from €314m to €290m (no pre-season tour), but still highest in Spain, ahead of Barcelona €270m, Atleti €96m & Valencia €20m. In 2021 they had 3rd highest commercial income in Europe (per Deloitte), only behind Bayern and PSG.

It’s an “arms race” in shirt sponsorships and kit deals, but #RealMadrid’s are among the very highest in the world with Emirates and Adidas paying €70m and €110m a year respectively. Both deals have been extended: Emirates to 2026 and Adidas to 2028 (merchandising is on top).

#RealMadrid broadcasting income was flat at €311m, as higher revenue from winning Champions League & La Liga was offset by €37m in prior year deferred from 2019/20 for games played after accounting close. 2nd highest in Europe in 2020/21, only below #MCFC (Deloitte definition).

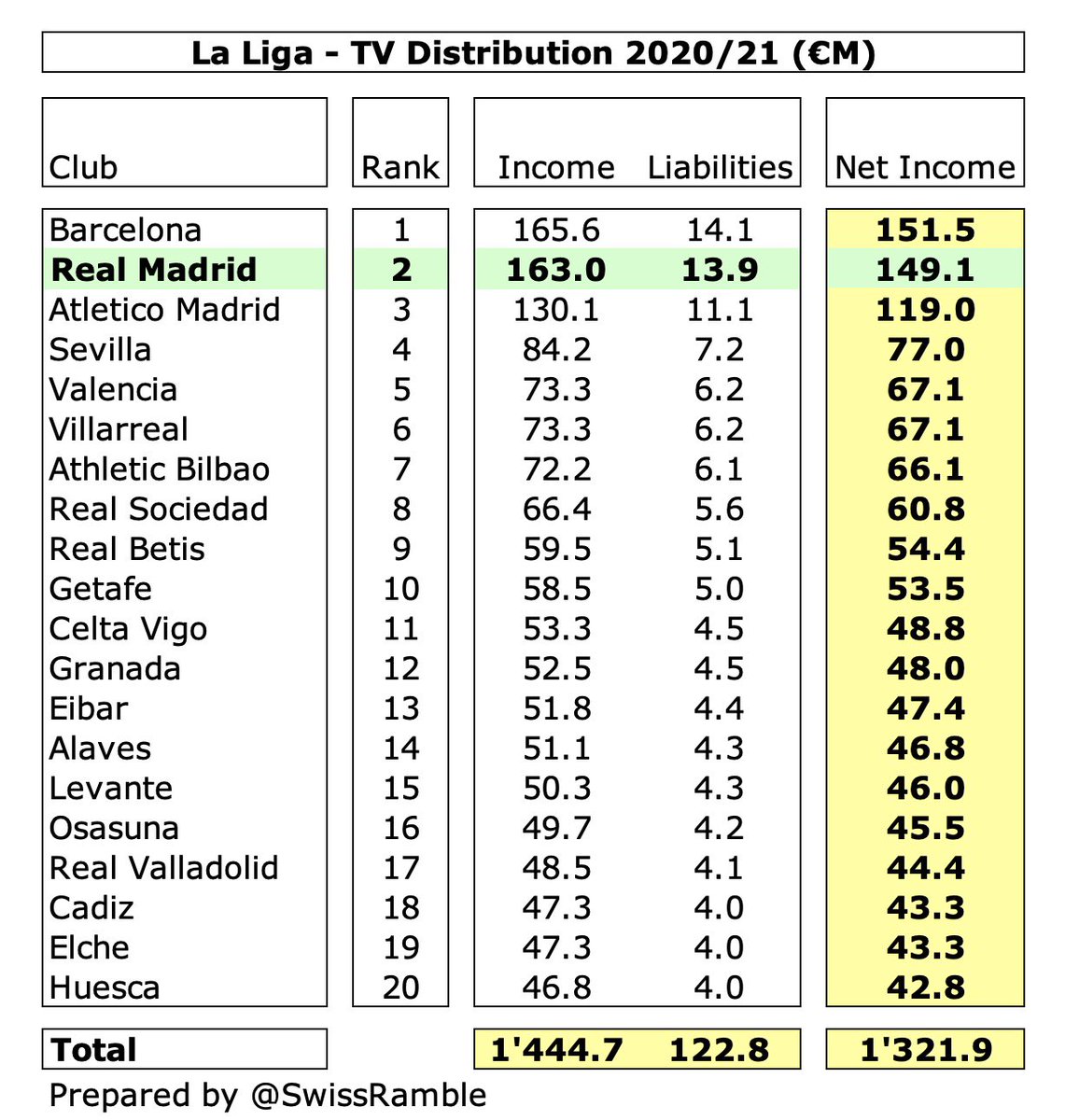

After years of individual deals in Spain, La Liga introduced a collective deal, based on 50% equal share, 25% performance over last 5 years and 25% popularity (1/3 for average match day income, 2/3 for number of TV viewers). Gross income reduced by liabilities (7%).

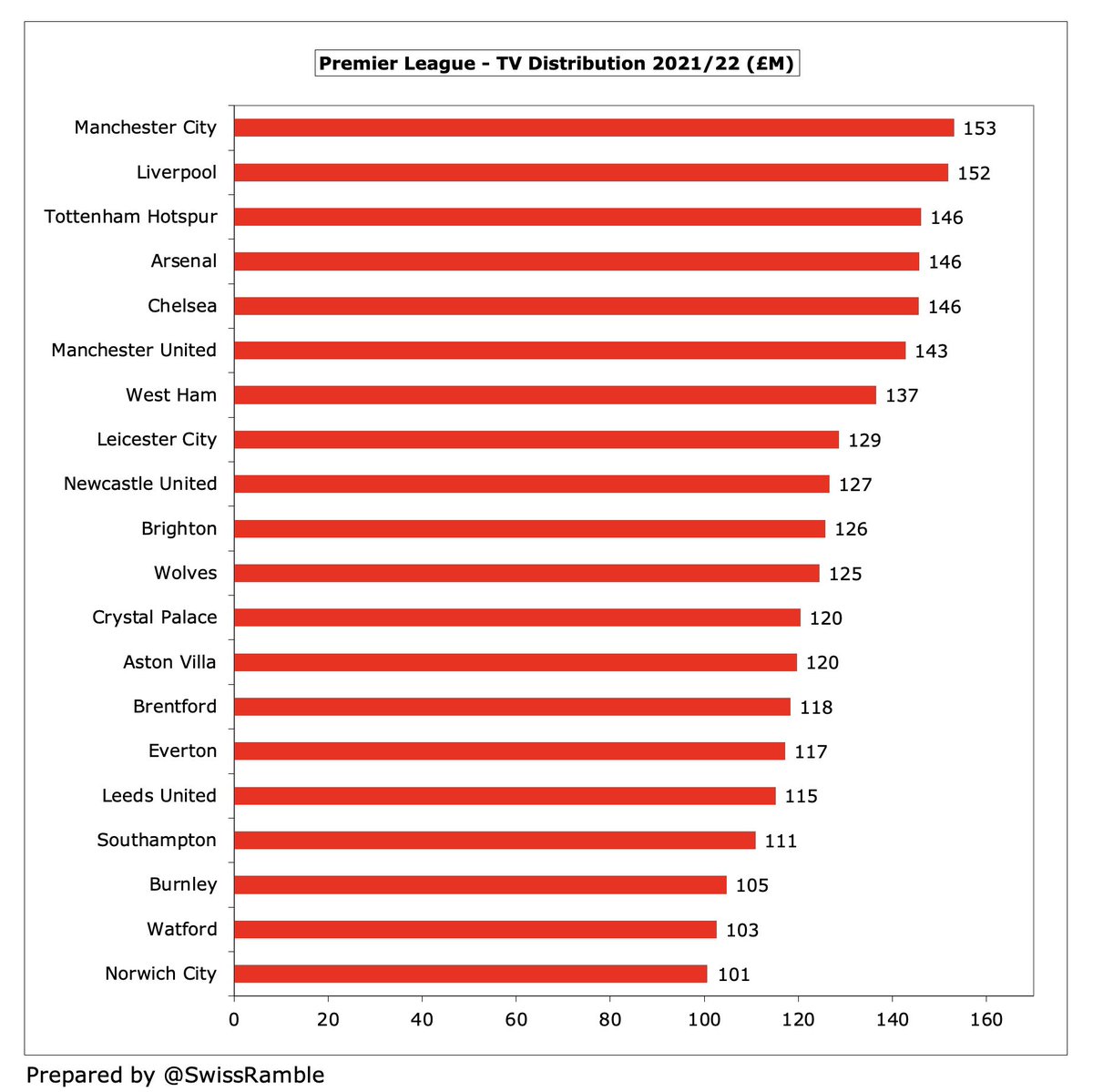

Even after the changes, the big two still receive by far the highest TV income from La Liga’s TV deal. No figures yet for 2022, but in 2021 Barcelona and #RealMadrid got €166m and €163m, followed by Atletico Madrid €130m, then a big gap to Sevilla €84m and Valencia €73m.

The new 5-year €2.1 bln La Liga TV deal from 2022/23 is slightly up: domestic (Movistar & DAZN) €1.2 bln, overseas €0.9 bln. Although far behind the Premier League €3.9 bln, it is much higher than other leagues: Bundesliga €1.4 bln, Serie A €1.1 bln and Ligue 1 €0.7 bln.

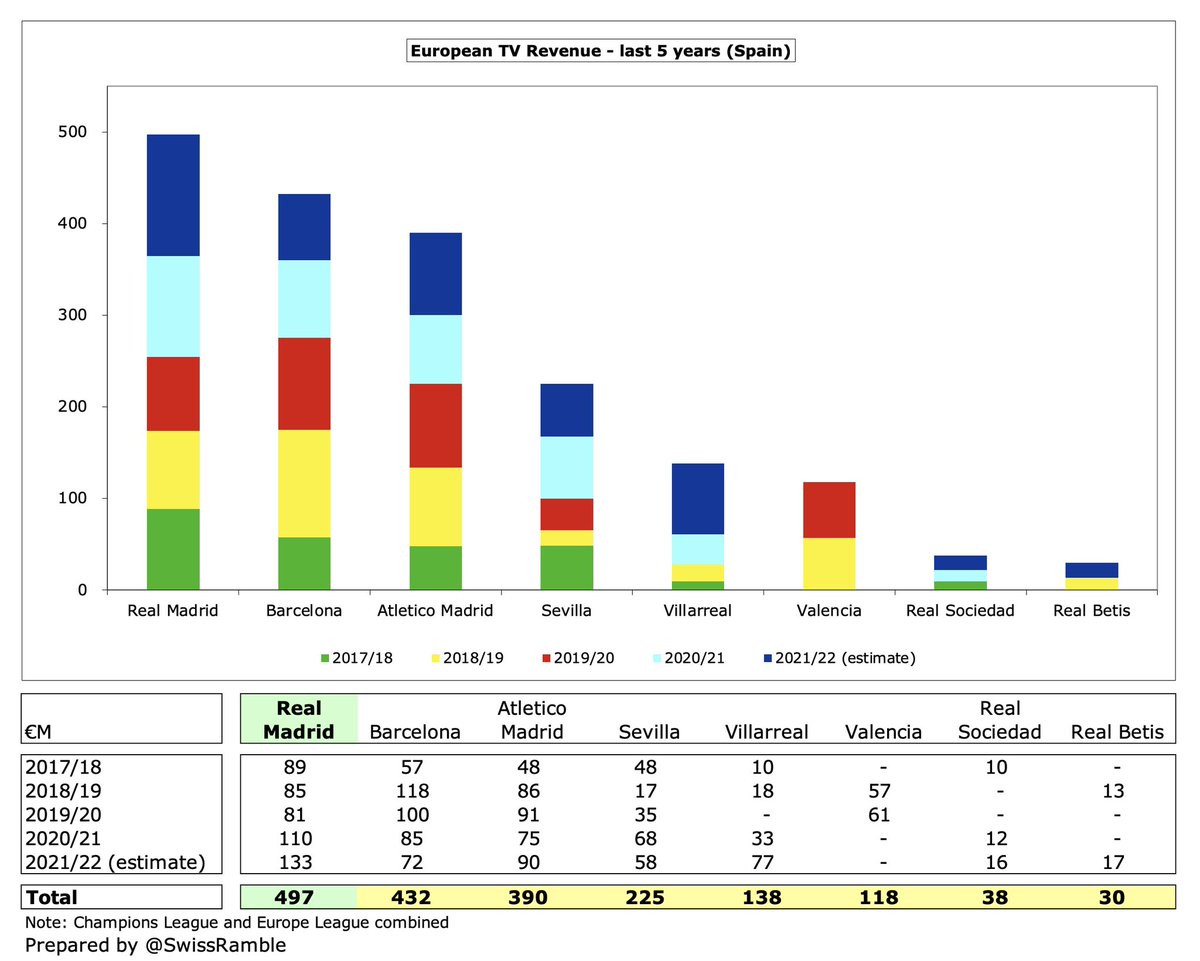

Based on my estimate, #RealMadrid earned €133m for winning the Champions League, €23m more than prior season €110m (when they reached the semi-finals). Much more than Atletico Madrid €90m, Villarreal €77m, Barcelona €64 and Sevilla €52m.

It is worth noting the influence on Champions League distribution of the UEFA coefficient payment (based on performances in Europe over 10 years), where #RealMadrid had the highest ranking, thanks to their fantastic record, giving them €36m.

#RealMadrid have earned around half a billion Euros from European competition in the last 5 years, which is €65m and €107m more than Barcelona and Atletico Madrid respectively. Madrid have won the Champions League an incredible five times since 2014.

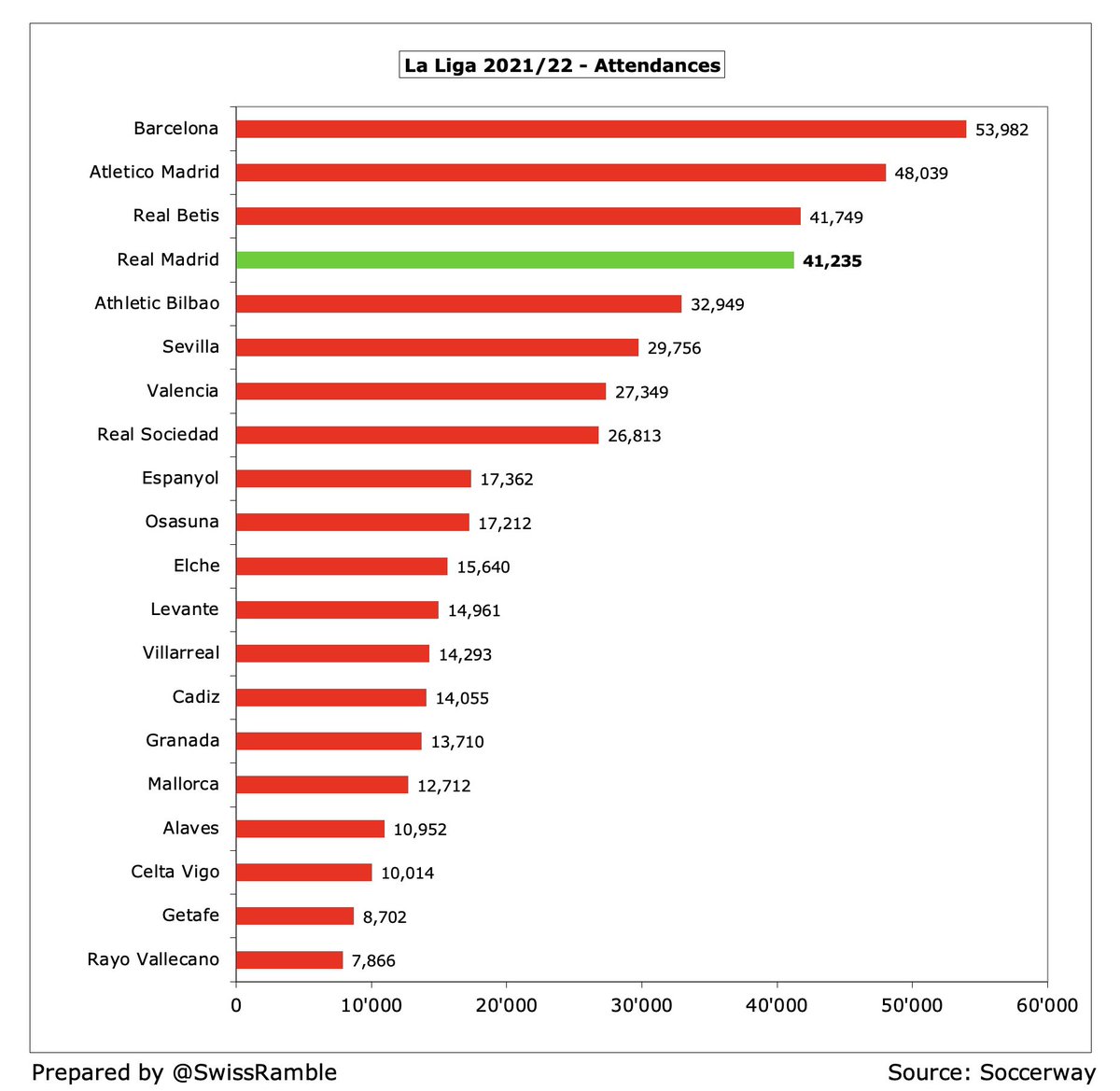

#RealMadrid match day revenue rose from €9m to €94m, due to return of fans to stadium, while games played behind closed doors in 2020/21. Capacity hit by COVID restrictions in 2021/22: 40% to October, then 100%, down to 75% in December, up to 75% in February and 100% in April.

#RealMadrid had the fourth highest crowds in Spain in 2021/22 with 41,000, which was lower than Barcelona 54,000, Atletico Madrid 48,000 and Real Betis 42,000. As well as COVID restrictions, Madrid crowds were also limited by work being done on the stadium redevelopment.

Work on the development of #RealMadrid’s Santiago Bernabéu stadium continues with €538m investment to date (€259m in 2021/22)). Expected to be fully operational for the 2023/24 season with a revised cost of €800m, but driving a “significant” increase in revenue.

#RealMadrid football wages rose €106m (28%) from €372m to €478m, due to prior year’s 10% salary cut in response to COVID, higher bonuses following success on the pitch and higher termination payments. Total wage bill, including basketball €41m, was €519m.

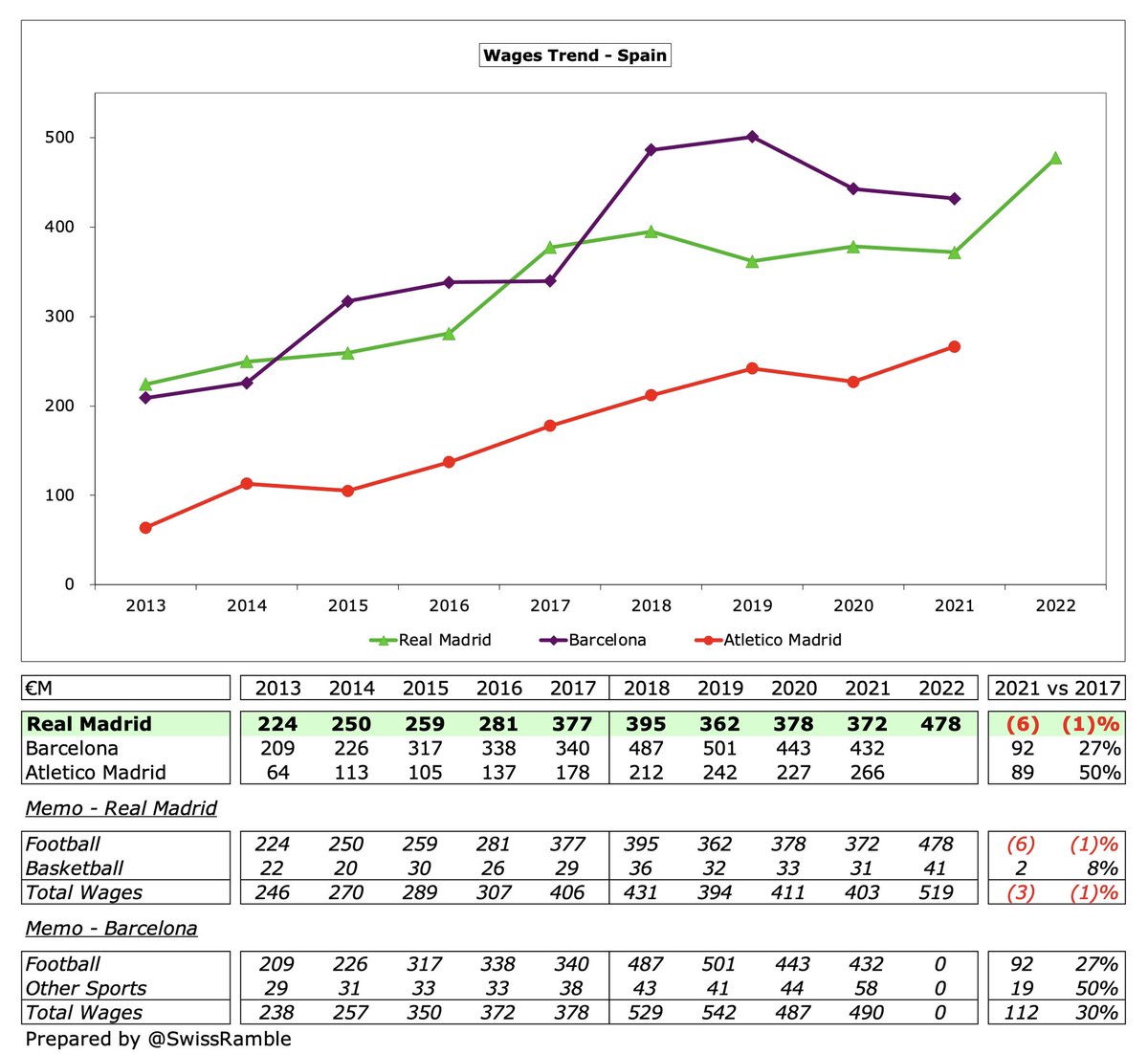

#RealMadrid €478m wage bill is now higher than Barcelona’s €432m, though the Catalans’ new figure when they publish 2021/22 accounts will be interesting. Big gap to Atletico Madrid €266m, then Sevilla €133m and Athletic Bilbao €99m. Sixth highest in Europe in 2020/21.

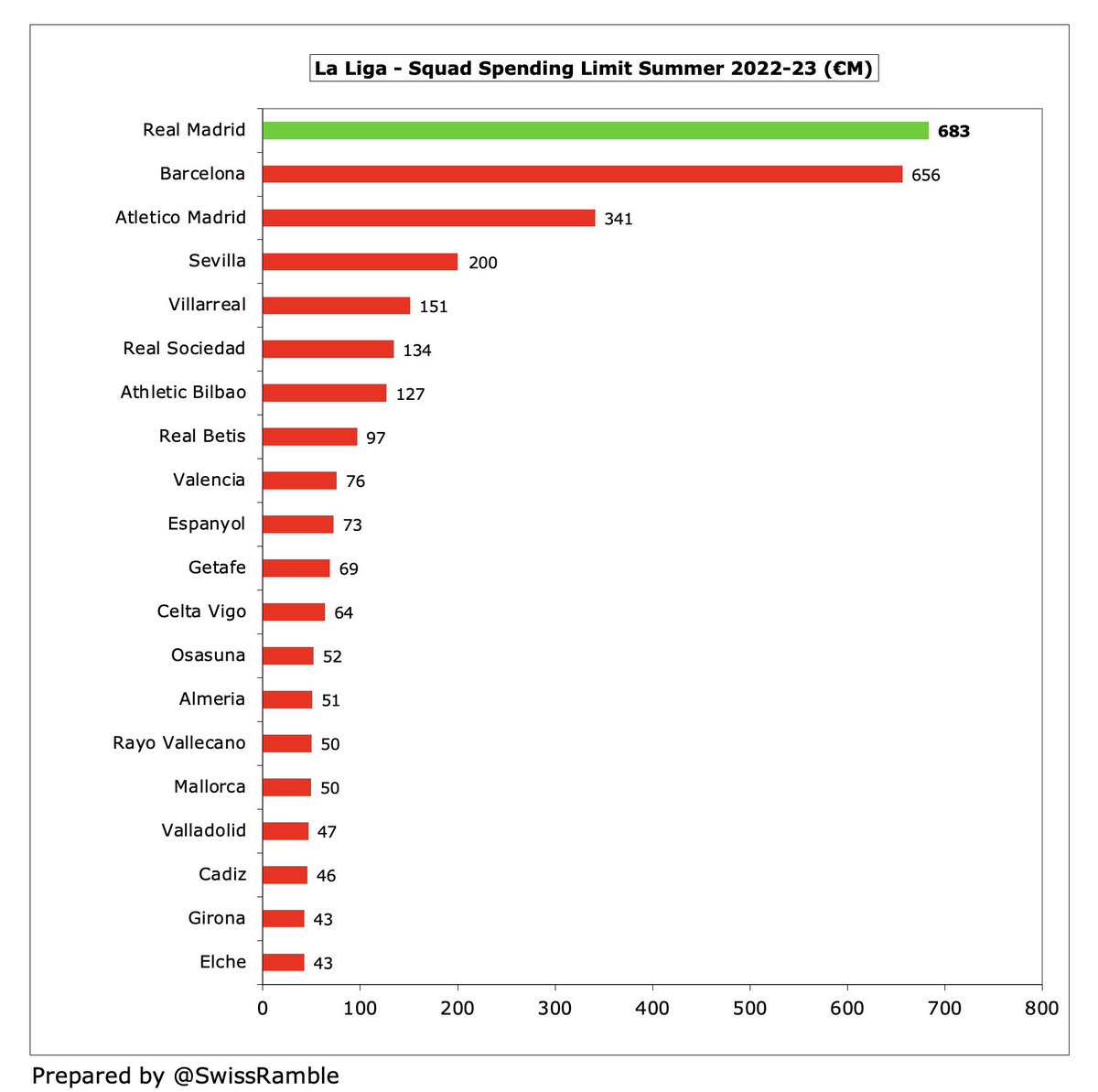

La Liga reduced #RealMadrid squad spending limit from €739m to €683m for 2022/23, though this was still the highest in Spain. Barcelona’s limit bounced back to €656m from previous season’s minus €144m, thanks to money generated by their famous economic levers.

Despite the revenue increase, #RealMadrid wages to turnover ratio increased from 57% to 66%, though still one of the lowest in Spain, much better than Barcelona 85%. The club has budgeted a €69m reduction in football wage bill for 2022/23 from €478m to €409m.

#RealMadrid other expenses surged 65% (€125m) from €193m to €317m, partly due to additional costs from staging games with fans, but also €108m change in provisions. Large increases in professional services, royalties, maintenance & materials. Cost savings plan in prior year.

#RealMadrid player amortisation, the annual cost of writing-off transfer fees, only rose €5m (3%) to €164m, though this expense has nearly doubled from €83m in 2018. Highest in Spain, just ahead of Barcelona €155m, followed by Atleti €117m and Sevilla €65m.

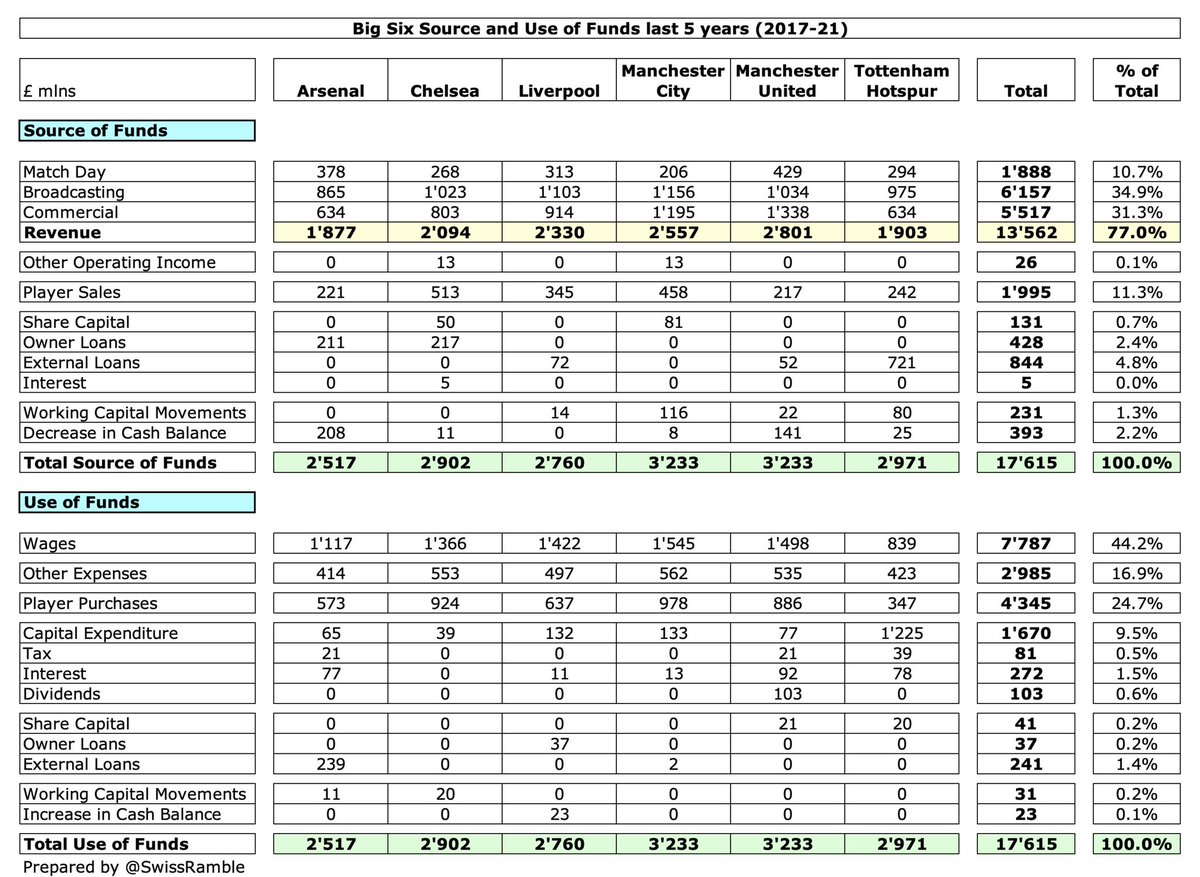

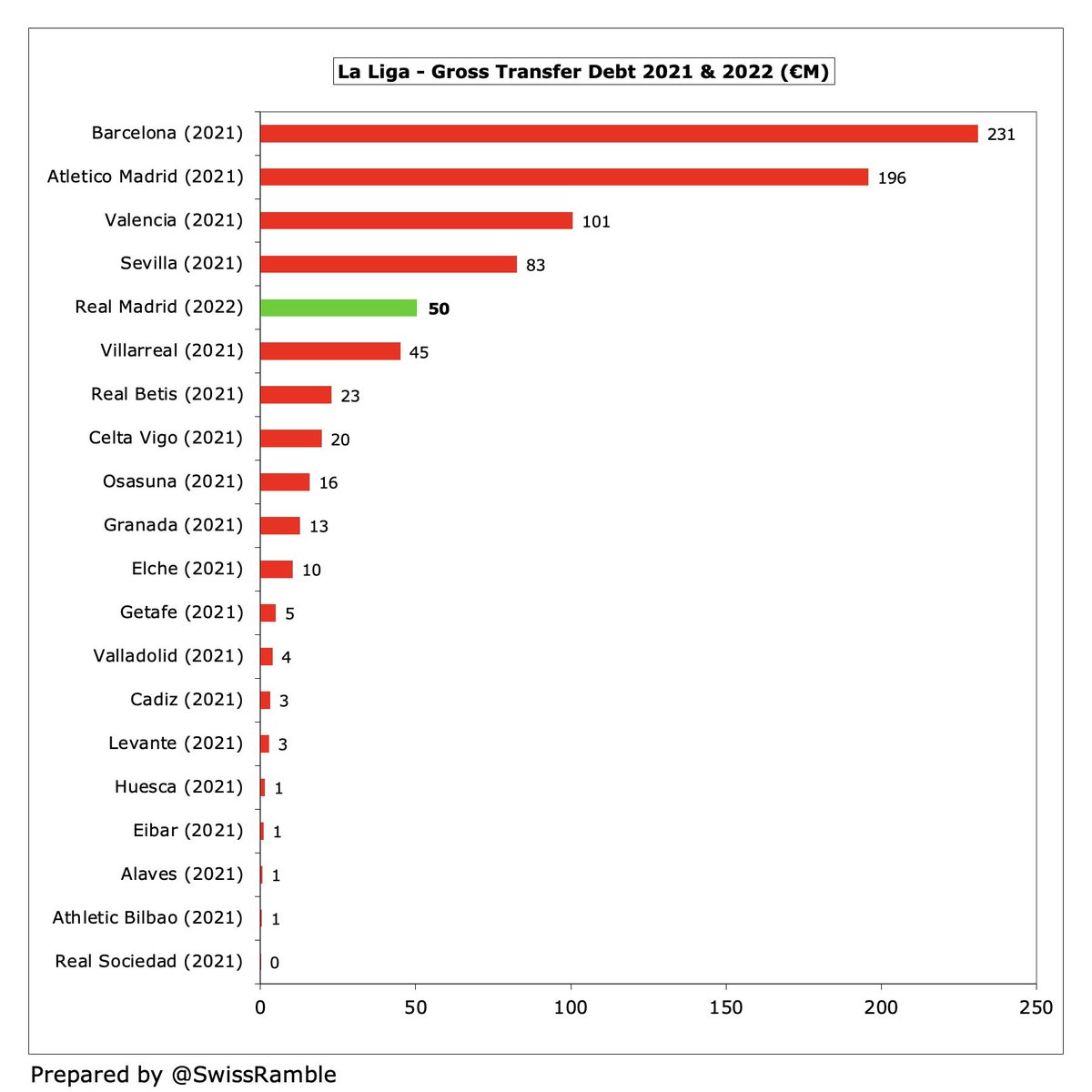

#RealMadrid spent €116m on player purchases in 2021/22, including contingent payments from prior year acquisitions, with €49m net spend. Their €832m gross spend in 5 years up to 2021 was the 6th highest in Europe, despite spending only €45m in 2020/21.

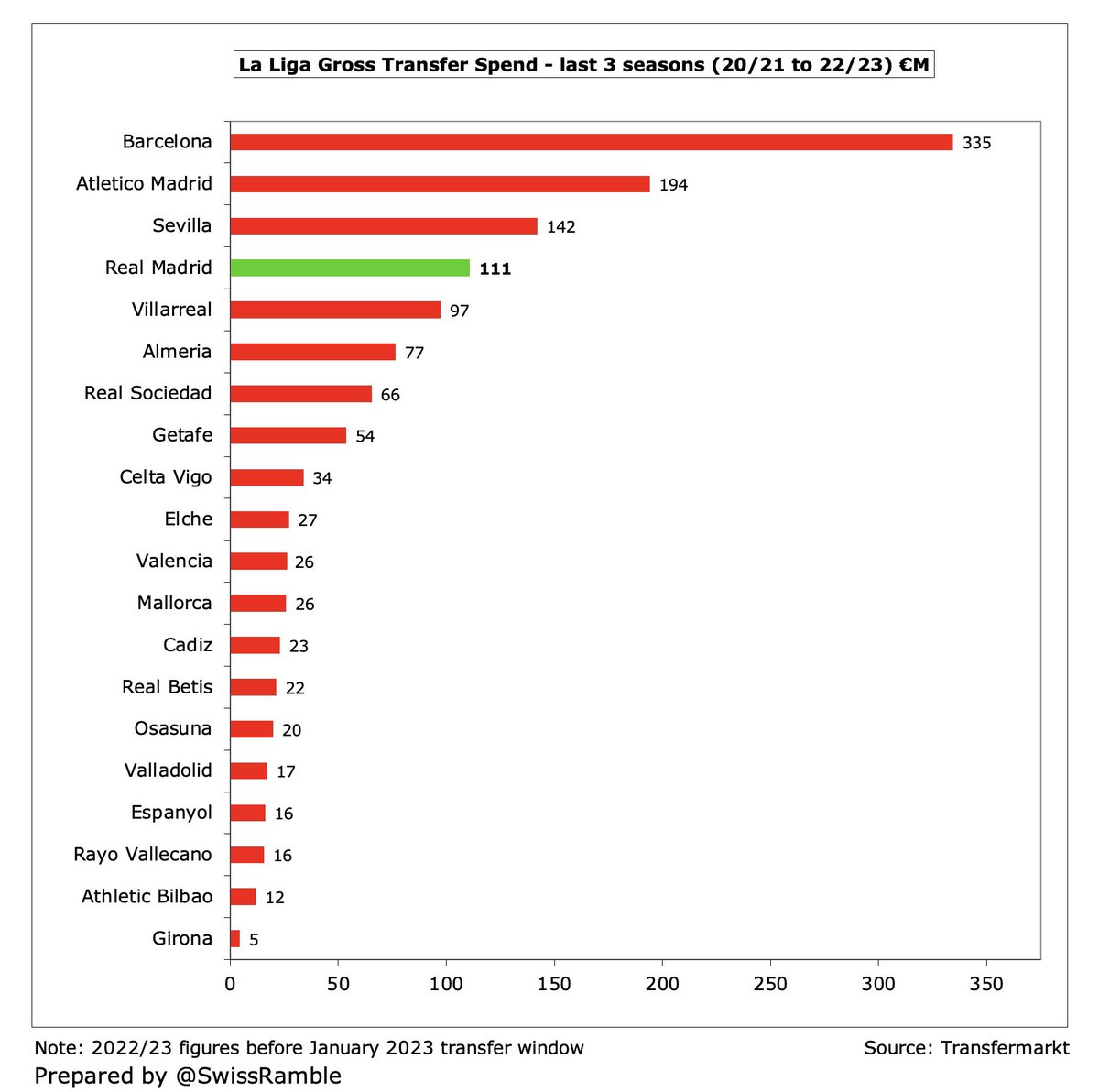

Including 2022/23, #RealMadrid actually had €163m net sales in the last 3 years, in stark contrast to Atletico Madrid €81m and Barcelona €79m net spend. Their gross spend of €111m was only 4th highest in La Liga, behind Barcelona €335m, Atleti €194m and Sevilla €142m

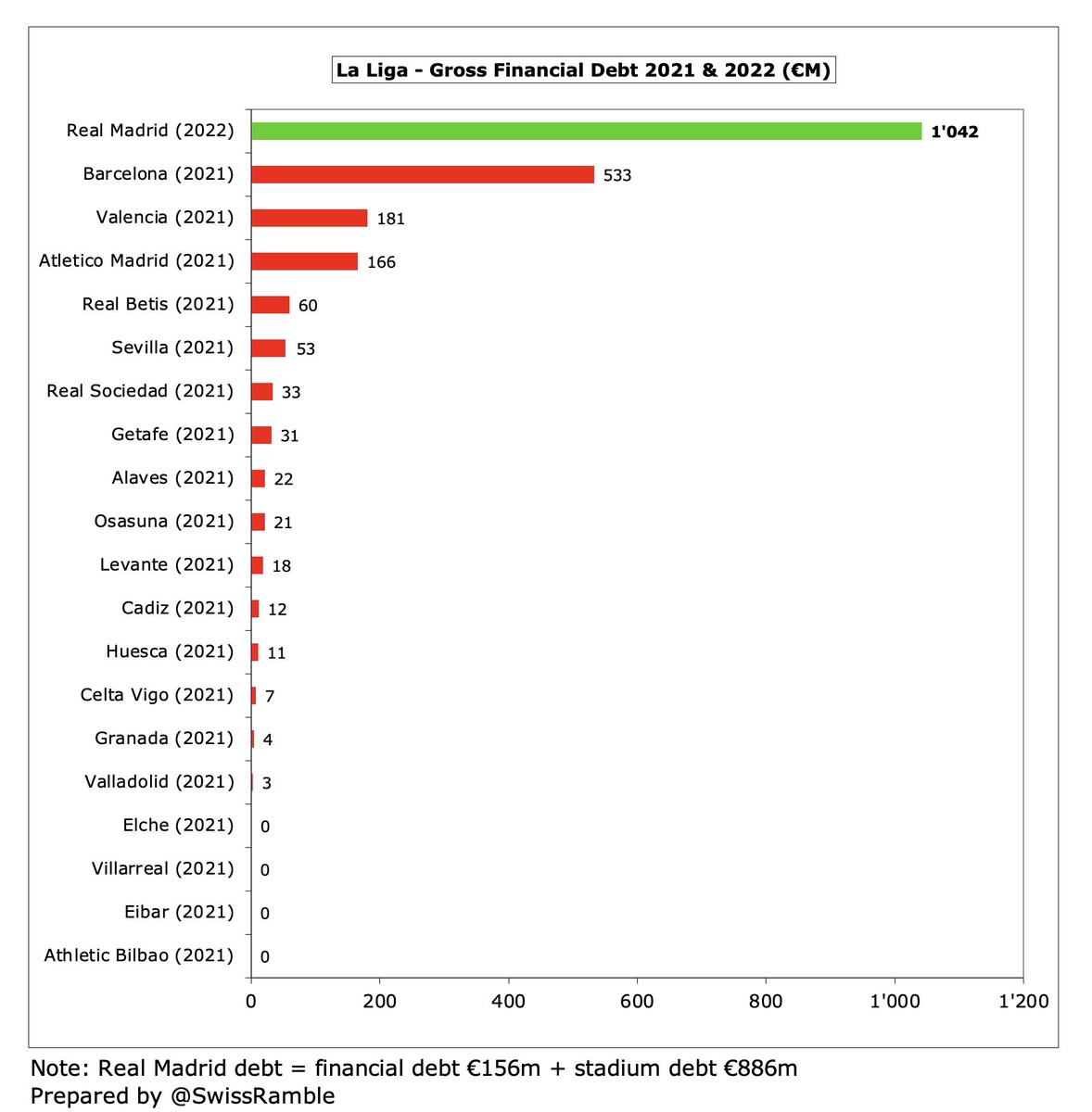

Excluding stadium, #RealMadrid net debt fell €310m from €46m to €263m net funds (club definition including transfer debt). Gross financial debt fell slightly to €156m. In addition, stadium debt doubled from €423m to €886m (net €538m), giving €1,042m total financial debt

In terms of purely financial debt, #RealMadrid €1.0 bln was much higher than Barcelona €533m from 2021, though the Catalans’ figure will increase as their own stadium development progresses. Madrid’s debt is split: financial debt €156m plus stadium debt €886m.

#RealMadrid interest payments unchanged at €4m, so much lower than most elite European clubs in 2021, especially Barcelona €41m. However, worth noting that start of (fixed) interest on stadium loans has been delayed: €575m (2.5%) to July 2023, €225m (1.53%) to July 2024.

#RealMadrid cut transfer fees debt from €80m to €50m, while amounts owed by other clubs were down to €91m, giving net receivables of €40m. Amount owed significantly reduced from €196m two years ago, so in much better position than Barcelona €231m and Atletico Madrid €196m.

#RealMadrid total debt increased from €890m to €1.5 bln (including wages, tax authorities debt and trade creditors), mainly due to the growing stadium debt. In 2020/21 they were only below #CFC €1.9 bln, #THFC €1.3 bln, Barcelona €1.2 bln and Atletico Madrid €946m.

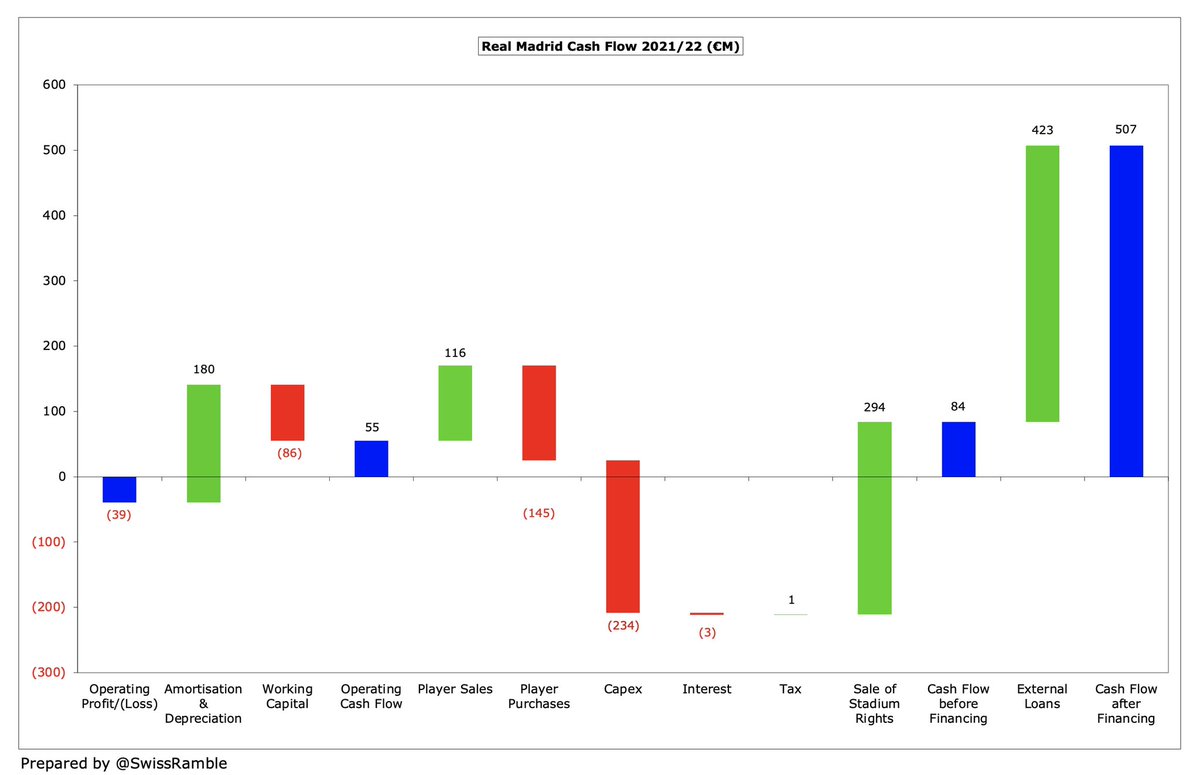

After adjusting for non-cash items, #RealMadrid generated €55m cash in 2021/22, boosted by €116m player sales, but then spent €145m on player purchases and €234m on the stadium. However, cash increased by €507m due to €294m from Sixth Street deal and €423m new loans.

As a result, cash balance increased from €266m to €773m, split €425m operations and €348m stadium. Easily the highest in Spain, though it is a bit misleading, as much is ring-fenced for stadium development, while balance always high before July semi-annual wage payment.

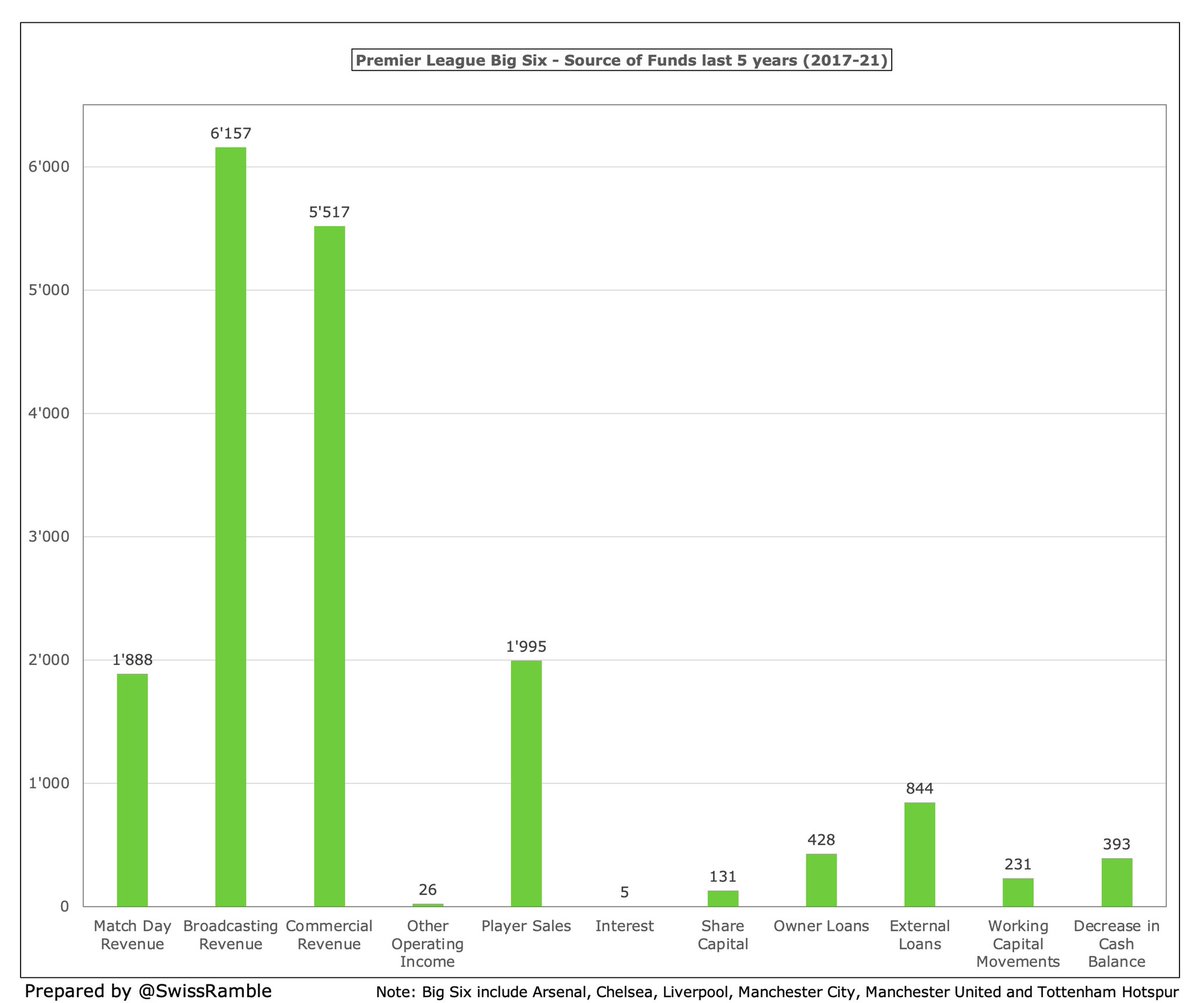

Of course, #RealMadrid do not benefit from owner funding (loans and share capital), unlike many other leading clubs, whose business model is reliant on benevolent owners, e.g. in the last 10 years Inter and Milan have received over €900m, with #CFC and #MCFC just under €800m.

Although Florentino Pérez argued that #RealMadrid finances were awful and football was “sick” when pushing for the European Super League, his club has performed better than others during COVID, though these figures obviously benefited from the major Sixth Street/Legends deal.

#RealMadrid have budgeted for a further increase in revenue to €770m in 2022/23, as the recovery from the pandemic continues. Looking further ahead, the Bernabéu stadium development will represent a major challenge, but also an opportunity to generate more money.

• • •

Missing some Tweet in this thread? You can try to

force a refresh