1/ In my new article for @BitcoinMagazine, I explore why every real estate investor should own #bitcoin.

bitcoinmagazine.com/business/every…

bitcoinmagazine.com/business/every…

2/ Bitcoin is digital #property and should appeal to any real estate investor as such. Real estate capitalizes on scarcity in the physical realm. Bitcoin introduced scarcity to the digital realm.

3/ Bitcoin established the first instance of digital ownership. Bitcoin is digital property. Therefore, real estate investors whose business is the acquisition and construction of physical property are destined to hold bitcoin as it is the digitized form of physical property.

4/ Who would have thought in 1995 that most retail stores would eventually also have a website? This is a good comparison to show the need for #realestate investors to get involved with #bitcoin.

5/ As I explained in my article “Why Bitcoin Is Digital Real Estate,” one of the many things real estate and bitcoin have in common is that they both act as a store of value. bitcoinmagazine.com/business/why-b…

6/ However, real estate cannot compete with #bitcoin as a store of value. Bitcoins characteristics make it an ideal store of value. Its supply is limited, it’s easily portable, divisible, durable, fungible, censorship-resistant and noncustodial.

7/ Bitcoin can be sent anywhere in the world at almost no cost and at the speed of light. On the other hand, real estate is easy to confiscate and very difficult to liquidate in times of crisis. This was recently illustrated in #Ukraine. cnbc.com/2022/03/23/ukr…

8/ #Bitcoin vs. #RealEstate: Bitcoin’s superior monetary properties could mean that once it has reached full adoption, the value of physical property may collapse to utility value and no longer carry the monetary premium of being used as a store of value. nakamotoinstitute.org/mempool/hyperb…

9/ Real estate investors are experts at using leverage. As I detailed in one of my articles, using existing real estate to incur debt and buy bitcoin is a great business opportunity as the value of bitcoin is likely to grow faster than fiat interest rates. bitcoinmagazine.com/business/lever…

10/ #Realestate development is highly dependent on the ability to build creditworthiness. Bitcoin can help here too.

11/ #Bitcoin should be part of every #realestate investor's strategy as it’s pristine collateral that will help you build your creditworthiness over time. bitcoinmagazine.com/business/why-b…

12/ Sensibly using your #realestate as collateral to borrow money and buy bitcoin may solve another problem: liquidity. Real estate is an illiquid and immovable asset.

13/ The ‚worlds’ of real estate and bitcoin will merge sooner or later. Both share similarities and complement each other. Real estate is an income-producing asset (rent), but it is very immobile. Bitcoin does not generate income but is highly liquid and mobile. A good match.

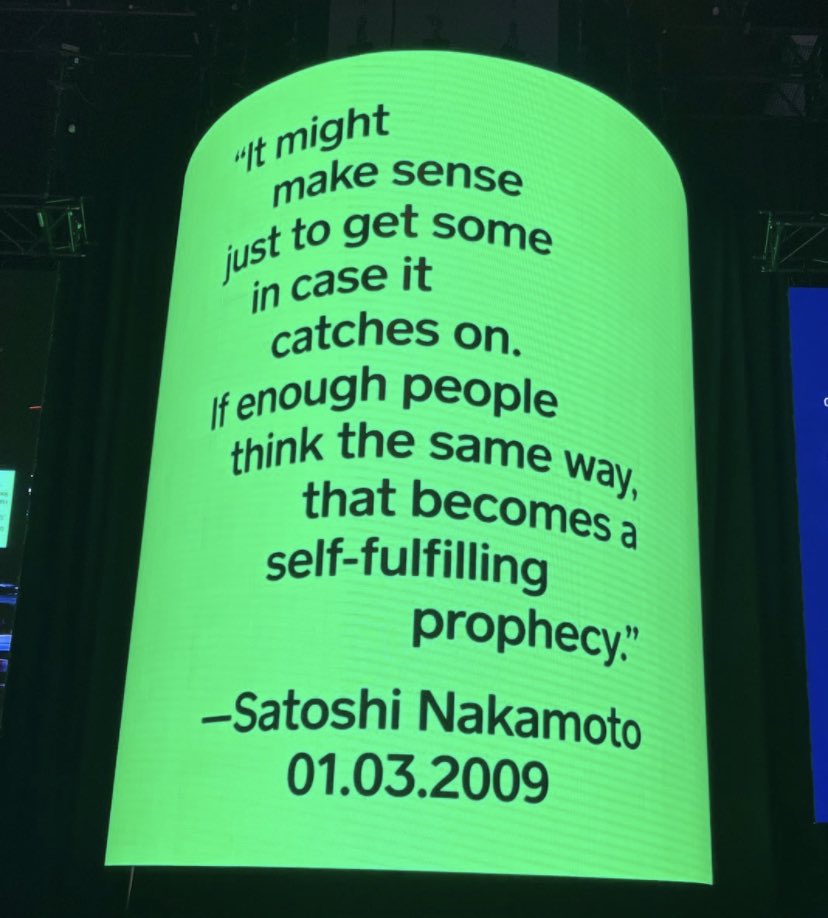

14/ #Bitcoin's volatility shouldn’t distract from the opportunity it presents. Those who rejected the internet missed out on one of the greatest opportunities of their lives. Those who reject bitcoin will meet the same fate.

• • •

Missing some Tweet in this thread? You can try to

force a refresh