Don't mix up the recent collapse in EU gas spot prices with the pain for consumers and CPI readings yet to come.

Take GER consumers/SMEs: they are yet to absorb the pain from higher wholesale gas future prices for utilities in the coming months.

1/n #TTF #LNG @kittysquiddy

Take GER consumers/SMEs: they are yet to absorb the pain from higher wholesale gas future prices for utilities in the coming months.

1/n #TTF #LNG @kittysquiddy

Following a one-off payment in Dec of 8.3% of the annual household bill for gas, Germany will cap consumer prices for gas for households at €120/MWh for 80% of their usual consumption. Beyond that, consumers/SMEs will pay the wholesale (future) price for any additional gas.

2/n

2/n

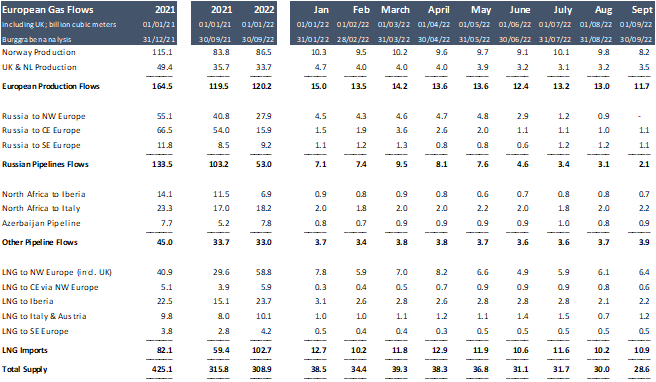

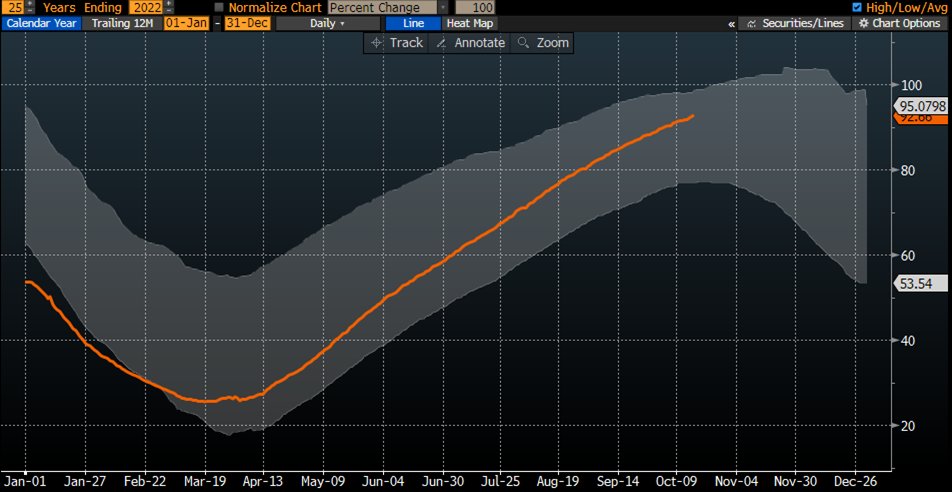

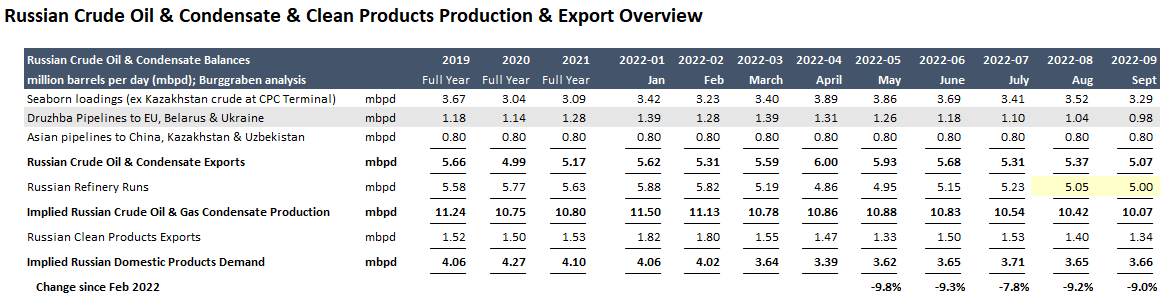

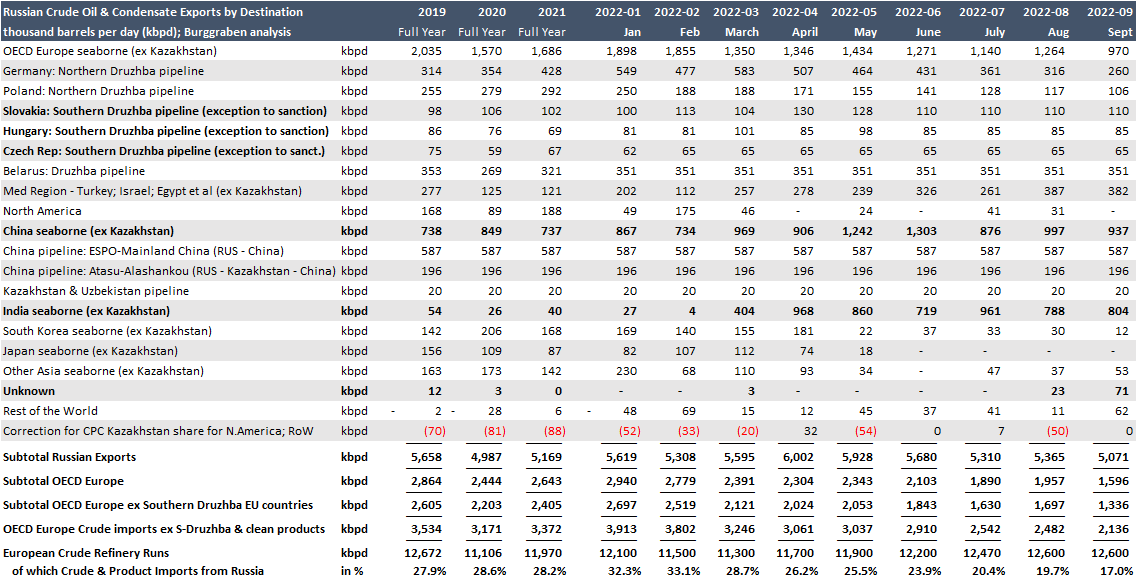

1M forward TTF (EU wholesale natgas hub price) surged as high as €313/MWh in Aug 2022 (hight of NS1 sabotage panic) and are now €114/MWh (€33/MMBtu).

However, as GER still gets some gas under long-term contracts, actual IMPORT prices are a better proxy for pain to come.

3/

However, as GER still gets some gas under long-term contracts, actual IMPORT prices are a better proxy for pain to come.

3/

GER import prices were €100/MWh above historical avg in Aug & Sep. Judging by the increase in the heating-gas component of the German national consumer price index, some €60/MWh of the surge in import prices had been passed onto consumers by Oct.

4/n

4/n

https://twitter.com/BurggrabenH/status/1582877610622988288?s=20&t=KQUPd2LnU6dNCLSm0UCTcQ

The German price cap model for consumers/SME is a risky strategy for the government's household financing.

Wholesale prices are likely to go higher once winter weather commences because EU utilities are yet to replace lost l-term natgas contracts with l-term LNG contracts...

6/

Wholesale prices are likely to go higher once winter weather commences because EU utilities are yet to replace lost l-term natgas contracts with l-term LNG contracts...

6/

...while the LNG spot market will become tight come 2023 and beyond as more LNG export & import terminal capacity does NOT equal more UPSTREAM GAS capacities globally.

7/n #LNG

7/n #LNG

https://twitter.com/BurggrabenH/status/1587575350522953732?s=20&t=KQUPd2LnU6dNCLSm0UCTcQ

Remember, the only certainty for EU natgas prices is more volatility as we explain below in much detail.

8/8 Thx

8/8 Thx

https://twitter.com/BurggrabenH/status/1584964699946614785?s=20&t=KQUPd2LnU6dNCLSm0UCTcQ

Oh, and then this

https://twitter.com/menthorqpro/status/1588576686769025029

• • •

Missing some Tweet in this thread? You can try to

force a refresh