PPFAS agm2022

A thread

*Views are personal. Retweet if you like. Mute if you don't like. ;)

#onefund #ppfas

A thread

*Views are personal. Retweet if you like. Mute if you don't like. ;)

#onefund #ppfas

Neil, talks about value of cash and how fund is absolutely fine holding cash. Had 28% cash almost in 2018.

The returns would be lumpy. Minimum 5 years if not more

Underperformance is guaranteed in short term, so is volatility.

Over long term, the returns are satisfactory

The returns would be lumpy. Minimum 5 years if not more

Underperformance is guaranteed in short term, so is volatility.

Over long term, the returns are satisfactory

Do you have a process or plan to invest. The fund prefers to follow their own plan. Circle of competence about 500 stocks.

Can't Chase / pick up all opportunity.

I recall, last few years their were question on some Spanish companies like Zara or Chinese companies.

Can't Chase / pick up all opportunity.

I recall, last few years their were question on some Spanish companies like Zara or Chinese companies.

Lot of FOMO :)

Crypto guys, happy staying rich.

Crypto guys, happy staying rich.

No flavour of the month funds, no fancy NFO, AMC doesn't stand for asset marketing companies.

No new fund till there is no conviction to invest own money.

Skin in the game for PPFAS is far more than mandatory.

They invest their own company money too

No sales target

No new fund till there is no conviction to invest own money.

Skin in the game for PPFAS is far more than mandatory.

They invest their own company money too

No sales target

Easy to market 2 better working schemes out of 30 but this fund has one :)

No where to hide :)

No back tests, no weekday or weekend.

No taking case.

No where to hide :)

No back tests, no weekday or weekend.

No taking case.

Flexicap

No caps, take advantage of arbitrage opportunity, cash calls .. one answer to multiple needs. Less confusion.

Tax saver is another focused fund hence no need to launch additional funds.

This question comes every year.

My take

open.substack.com/pub/crazynaval…

No caps, take advantage of arbitrage opportunity, cash calls .. one answer to multiple needs. Less confusion.

Tax saver is another focused fund hence no need to launch additional funds.

This question comes every year.

My take

open.substack.com/pub/crazynaval…

Low credit risk in conservative hybrid fund. No private companies as of now in debt. Almost all state bonds .

No papers of less quality.

Btw the trends of state bonds catching up.

My take: debt is not where you want to hit six. Protect, prudent investing, beat inflation.

No papers of less quality.

Btw the trends of state bonds catching up.

My take: debt is not where you want to hit six. Protect, prudent investing, beat inflation.

No clarity on opening of overseas investment.

Investor do deserve better communication from rbi in my view.

Investor do deserve better communication from rbi in my view.

Rajeev on Dias

Quips around throwing jute bags because fund has underperformance in last one year ;)

Quips around throwing jute bags because fund has underperformance in last one year ;)

Rajeev at its funny best.

No Gyan today ;) only memes to feel the same vibe as social media chatter

Confession 1

Fund has underperformed in the past.

Team has underperformed in past.

So welcoming first timers by showing 2016/2017 performance

8% underperformed in 2017

No Gyan today ;) only memes to feel the same vibe as social media chatter

Confession 1

Fund has underperformed in the past.

Team has underperformed in past.

So welcoming first timers by showing 2016/2017 performance

8% underperformed in 2017

Confession 2: not the biggest magnitude

2007 (PMS times) 30% underperformance at that time.

2017, people called Neil to remove rajeev ;)

2007 (PMS times) 30% underperformance at that time.

2017, people called Neil to remove rajeev ;)

AUM comes in picture

Rajeev says i can underperform at any aum size. 50 cr, 1000 cr or 25000.

I can underperform with or with out overseas stocks.

Underperformance is guaranteed because index deviation is meant to create active trough or crest against index

Rajeev says i can underperform at any aum size. 50 cr, 1000 cr or 25000.

I can underperform with or with out overseas stocks.

Underperformance is guaranteed because index deviation is meant to create active trough or crest against index

Three group of questions this time ( NO ITC)

1/ fund underperformance and action demanded ;)

2/ fangs kyu hai portfilo me. Why did we not sell or why do we own.

3/ How it effects us if overseas doesn't open

Told you, this time AGM would be around AMG

1/ fund underperformance and action demanded ;)

2/ fangs kyu hai portfilo me. Why did we not sell or why do we own.

3/ How it effects us if overseas doesn't open

Told you, this time AGM would be around AMG

One gentleman asked why nav is going up ;) even family is asking the same question on their own wealth ;)

Rajeev, can be a stand up comedian with a positive wealth creation effect too.

@RajeevThakkar @npparikh6

Rajeev, can be a stand up comedian with a positive wealth creation effect too.

@RajeevThakkar @npparikh6

Rajeev continues

Meme continues. This time on physics and chemistry.

Analogy to farm. Good soil, better quality seeds, right time and care but what if there is flood.

Points towards fundamentals of invest with good quality promoter/manager, low leverage, attractive valuation.

Meme continues. This time on physics and chemistry.

Analogy to farm. Good soil, better quality seeds, right time and care but what if there is flood.

Points towards fundamentals of invest with good quality promoter/manager, low leverage, attractive valuation.

Circle of concern

War, pound, China Taiwan,srilanka, north korea wants to fire missiles, recession, rbi, xi jinping deciding he is god

Can fund anything about it. Nops

Focus on fundamental tenet which are consistent and controllable.

War, pound, China Taiwan,srilanka, north korea wants to fire missiles, recession, rbi, xi jinping deciding he is god

Can fund anything about it. Nops

Focus on fundamental tenet which are consistent and controllable.

Rajeev continues

Talks about fantasizing about owning some stocks like multi baggers. 21.28% cagr since listing. (Alphabet chart on screen)

Google has seen 80%++ drawdown.

20-40% drops are regular.

Talks about fantasizing about owning some stocks like multi baggers. 21.28% cagr since listing. (Alphabet chart on screen)

Google has seen 80%++ drawdown.

20-40% drops are regular.

Next is Bajaj finance. Point to draw that 20-40% drop is possible in any stocks and not just in overseas stock.

Had 90% drop in 2009.

40-60% few times.

Drawdown is guaranteed.

Had 90% drop in 2009.

40-60% few times.

Drawdown is guaranteed.

Expected question. Why didn't you sell the stock last year.

Rajeev says i don't know how to catch bottom. Serious mismatch in expectations if investor has those questions.

Stock can fall for any reason.

Continuing..

Rajeev says i don't know how to catch bottom. Serious mismatch in expectations if investor has those questions.

Stock can fall for any reason.

Continuing..

Rehashing the same point

If you want to invest for less than 5 years, don't invest.

Figure out what your expectation is.:)

I am personally invested since 2018, not a single sell txn.

If you want to invest for less than 5 years, don't invest.

Figure out what your expectation is.:)

I am personally invested since 2018, not a single sell txn.

The three questions to alleviate fears of foreign stocks

Are we holding Enron or kingfisher kind of companies

Are we holding myspace/ Yahoo kinds

Are we holding companies which will stop working tomorrow or a 209 p/e company

Are we holding Enron or kingfisher kind of companies

Are we holding myspace/ Yahoo kinds

Are we holding companies which will stop working tomorrow or a 209 p/e company

Talks about it's not about overseas or indian stocks. The return can be generated from any country

Overseas helps in diversifying and pick companies which are not available in india

3 year tax saver returns are better than 3 year flexicap.

Overseas helps in diversifying and pick companies which are not available in india

3 year tax saver returns are better than 3 year flexicap.

The group of questions split in 2 parts

One segment of investor wants why foreign stock, sell sell sell

Other, thank God the limit is capped!!

Evident in 100's of tweets too since February:)

One segment of investor wants why foreign stock, sell sell sell

Other, thank God the limit is capped!!

Evident in 100's of tweets too since February:)

Talks about individual stocks.

$alphabet first

Knows more about you than your siblings

Did we hold $alphabet at 200p/e or obscene valuation?

P/e ratio was 28 in 2021.. not equivalent to own similar to Infosys in 1999 at 208 p/e

$alphabet first

Knows more about you than your siblings

Did we hold $alphabet at 200p/e or obscene valuation?

P/e ratio was 28 in 2021.. not equivalent to own similar to Infosys in 1999 at 208 p/e

$msft

Runs the world computer system/ number 2 player in cloud, dominating and quite well.

33.37 p/e in 2021.. was in bubble

Was it wrong to hold or just a random outcome like war leading to stocks sell off.

No significant learning in investment process per se.

Runs the world computer system/ number 2 player in cloud, dominating and quite well.

33.37 p/e in 2021.. was in bubble

Was it wrong to hold or just a random outcome like war leading to stocks sell off.

No significant learning in investment process per se.

$amzn

Delivery time decreasing, most of logistics inhouse + expanding logistic, has cloud , ad business

Very dominating business

You may feel it as a bubble company at 90 p/e but owns 8-10 seperate business.

May do 100 billion from cloud in 1-2 year.

Delivery time decreasing, most of logistics inhouse + expanding logistic, has cloud , ad business

Very dominating business

You may feel it as a bubble company at 90 p/e but owns 8-10 seperate business.

May do 100 billion from cloud in 1-2 year.

The entire Amazon may be valued on cloud alone.

Other areas are yet to be fully monetize. Retailing business making losses but AWS alone can justify 1 trillion valuation.

Still not overvalued

Other areas are yet to be fully monetize. Retailing business making losses but AWS alone can justify 1 trillion valuation.

Still not overvalued

$meta

The most famous company of this year AGM. ITC of 2021 :)

That was me for the ITC quip;)

Everyone and then death of facebook has been announced.

Narrative is very strong to uninstall. Mark Zuckerberg fav child boy of US hearings.

The most famous company of this year AGM. ITC of 2021 :)

That was me for the ITC quip;)

Everyone and then death of facebook has been announced.

Narrative is very strong to uninstall. Mark Zuckerberg fav child boy of US hearings.

$meta 23 times earning in 2021.

Did we buy in bubble or hold in to bubble. Today it's at 9 p/e

All time high number of users. WhatsApp is growing in America too

Tiktok a challenge. 10 billion revenue versus 283 billion of revenue

Did we buy in bubble or hold in to bubble. Today it's at 9 p/e

All time high number of users. WhatsApp is growing in America too

Tiktok a challenge. 10 billion revenue versus 283 billion of revenue

39 billion profit of $meta has called to 29 billion profit.

Mind you 29 billion profit.

Part impact of ios privacy impact

Other is 12$ billion investing or burning as per your POV in Metaverse.

Mind you 29 billion profit.

Part impact of ios privacy impact

Other is 12$ billion investing or burning as per your POV in Metaverse.

Why do ppfas continues to own $meta

Biggest loser when share price falls for Google/ meta/ Amazon

The founders. Much more than you and i are agonizing about.

Emphathize with employees who losing esops valuation.

Biggest loser when share price falls for Google/ meta/ Amazon

The founders. Much more than you and i are agonizing about.

Emphathize with employees who losing esops valuation.

Talks about Metaverse now.

Side bets is a culture of all 4 companies they own

Example of Instagram, WhatsApp, Google acquiring nest, maps, YouTube as side projects.

If meteverse success happens , good else 3/4 of profit of Metaverse is for shareholder.

Side bets is a culture of all 4 companies they own

Example of Instagram, WhatsApp, Google acquiring nest, maps, YouTube as side projects.

If meteverse success happens , good else 3/4 of profit of Metaverse is for shareholder.

Did $meta or other firm for arrogant with hiring specially meta.

Fund also believes yes but all companies taking corrective actions

Largely imapct of it will be known after many many years.

Points towards 2009 Google waymo project. 11 years and yet continuing.

Fund also believes yes but all companies taking corrective actions

Largely imapct of it will be known after many many years.

Points towards 2009 Google waymo project. 11 years and yet continuing.

All four companies are doing their buybacks.

Whether limit stays or not, the fund will keep attempting the good ideas

Rajeev completes 20 years next year as a professional investor.

@ActusDei takes over as an anchor this time for questions.

Whether limit stays or not, the fund will keep attempting the good ideas

Rajeev completes 20 years next year as a professional investor.

@ActusDei takes over as an anchor this time for questions.

Question on why not alternative market other than us/Europe

Talks about few European/Japanese companies which are already part of portfolio in past.

Why not china

Talks about their earlier talk on China on their YouTube channel.

All Answer here

Talks about few European/Japanese companies which are already part of portfolio in past.

Why not china

Talks about their earlier talk on China on their YouTube channel.

All Answer here

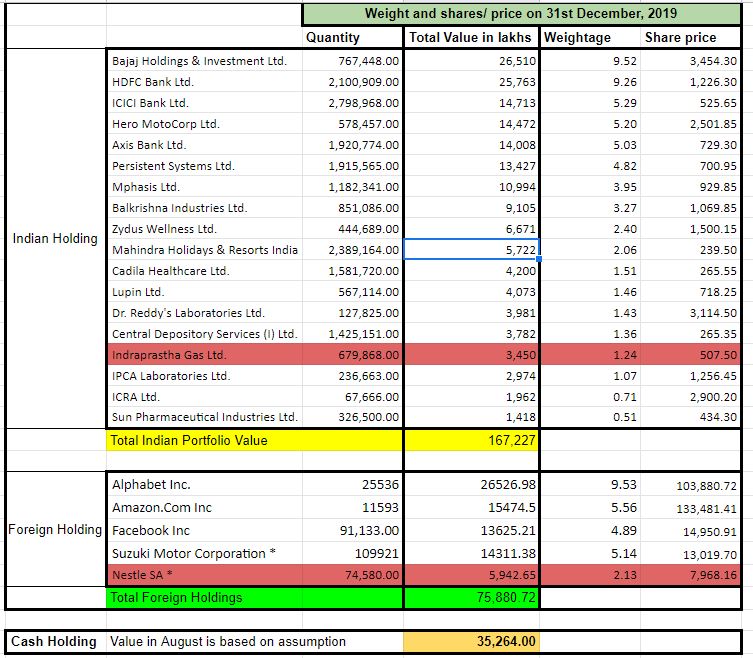

Repeat questions on how weight is decided or why less than 1% weightage stocks like icra ofss etc.

Had 6% in icra earlier. Sold off when prices were high.

As a percentage they own 3-5% of 6-7 companies.

Mcx, mofs, icra, iex, cdsl and few more.

Had 6% in icra earlier. Sold off when prices were high.

As a percentage they own 3-5% of 6-7 companies.

Mcx, mofs, icra, iex, cdsl and few more.

Repeat question on why pharma is largely in generic market of US and why not more bullish on other subsector of indian pharma

Raunak answers

Biggest challenge earlier were FDA warnings.

Watch recording please if you like pharma.

I don't understand pharma a bit:)

Raunak answers

Biggest challenge earlier were FDA warnings.

Watch recording please if you like pharma.

I don't understand pharma a bit:)

#psu love affair question

Psu are wealth destroyer than why do we have psu stocks.

What's changing/forcing rajeev opinion on PSU.

Talks about govt intent on privatization of banks (actually did), airindia , getting better governance and exit few sectors.

Psu are wealth destroyer than why do we have psu stocks.

What's changing/forcing rajeev opinion on PSU.

Talks about govt intent on privatization of banks (actually did), airindia , getting better governance and exit few sectors.

#PSU

Valuation very very attractive. Single digit price earning ratio + 6-11% dividend yield.

While there are risks , quotes example of IRCTC scare last year or Powergrid acquiring REC loan book etc etc but good part is GOVT taking their stance back.

Gradual shift.

Valuation very very attractive. Single digit price earning ratio + 6-11% dividend yield.

While there are risks , quotes example of IRCTC scare last year or Powergrid acquiring REC loan book etc etc but good part is GOVT taking their stance back.

Gradual shift.

Why not invest in Oil companies in 2020 covid .

Fund hasn't tracked oil companies. Rajeev mention, as long as portfolio is doing ok, not possible to run after every opp.

Usually waits for evidence. How fund house waited for some time evidence on building PSU postions.

Fund hasn't tracked oil companies. Rajeev mention, as long as portfolio is doing ok, not possible to run after every opp.

Usually waits for evidence. How fund house waited for some time evidence on building PSU postions.

Question on #banks

When the flavour is icici and sbi, why are we overweight on hdfc.

HDFC has had longer history of good credit history. Icici and axis have had impact in bad cycles but getting better

HDFC valuation lower to their history.

Will hold

When the flavour is icici and sbi, why are we overweight on hdfc.

HDFC has had longer history of good credit history. Icici and axis have had impact in bad cycles but getting better

HDFC valuation lower to their history.

Will hold

Expectation from merged #HDFC

Frees some capital. Cost of fund will get lower. Expects will be beneficial in longer term

6-12 month could be tough due to merger formalities. Nothing to worry as per fund house.

Frees some capital. Cost of fund will get lower. Expects will be beneficial in longer term

6-12 month could be tough due to merger formalities. Nothing to worry as per fund house.

Question on #motilaloswal

Discount brokerage + NPA of 9%. Same question as last year.

Btw fund owns 5% of Motilal Oswal now :)

3-4 business. Brokerage/pms/ ibanking / mutual fund.

Consolidation in physical brokers due to increase cost of compliance

Discount brokerage + NPA of 9%. Same question as last year.

Btw fund owns 5% of Motilal Oswal now :)

3-4 business. Brokerage/pms/ ibanking / mutual fund.

Consolidation in physical brokers due to increase cost of compliance

#motilaloswal

Gaining in physical brokerage. One of the biggest institutional brokerage. Reasonably large in PMS and mutual fund piece which is higher yielding.

Good business, high margins business.

Gaining in physical brokerage. One of the biggest institutional brokerage. Reasonably large in PMS and mutual fund piece which is higher yielding.

Good business, high margins business.

#motilaloswal

Housing finance, mix feeling. They have taken corrective action and balance sheet looks clean.

Founders have 75% wealth tied up here.

Housing finance, mix feeling. They have taken corrective action and balance sheet looks clean.

Founders have 75% wealth tied up here.

#insurance sector

Why no participation.

Rajeev: value capturing happens in insurance companies and agents.

If we own icici bank/hdfc bank, we get the benefit of participating

Valuation wise, not cheap.

Watching the space and participating via banks/ Bajaj holding.

Why no participation.

Rajeev: value capturing happens in insurance companies and agents.

If we own icici bank/hdfc bank, we get the benefit of participating

Valuation wise, not cheap.

Watching the space and participating via banks/ Bajaj holding.

#auto #heromoto

Losing market share. No growth for several years. Why holding

Hero had double whammy. Losing market share specially scooter and export + auto market been not doing well + raw material price + ev slow.

FM hops it will pay out in future. (I didn't like answer)

Losing market share. No growth for several years. Why holding

Hero had double whammy. Losing market share specially scooter and export + auto market been not doing well + raw material price + ev slow.

FM hops it will pay out in future. (I didn't like answer)

#auto why both hero and Bajaj

Is it sector approach or individual merit

Relative attractive companies to own, cash flow, no debt, owns the design etc

On contrary, four wheeler doesn't have better balance sheet.

Is it sector approach or individual merit

Relative attractive companies to own, cash flow, no debt, owns the design etc

On contrary, four wheeler doesn't have better balance sheet.

Why #ICRA . Crisil growing etc.

Repeat question from last year.

Largely a duopoly kind of business. More regulation weeding out low quality rating companies.

Repeat question from last year.

Largely a duopoly kind of business. More regulation weeding out low quality rating companies.

#banks why invest in only large bank and not small Bank at attractive valuation

In a high leverage business, diversification matters other than credit quality.

In a downturn, if the particular region suffers, the bank will suffer.

Quotes example on Andhra example.

In a high leverage business, diversification matters other than credit quality.

In a downturn, if the particular region suffers, the bank will suffer.

Quotes example on Andhra example.

Prefers bank with scale which can invest in technology. Having a full. Suit of product like MF, brokerage, loans.

Prefers large banks

Prefers large banks

Missed a question on #ITC

Why trim at every 10%. Now someone asking why sell ITC ;)

Full circle.

Rajeev says regulations about passive breach and time window of 1 month.

Full circle.

Rajeev says regulations about passive breach and time window of 1 month.

Same question on $apple why not considering apple

Raunak mentions, we use to hold apple and sold at double the valuation. On matter of valuation earlier.

Still tracking

Raunak mentions, we use to hold apple and sold at double the valuation. On matter of valuation earlier.

Still tracking

$apple

Rajeev mentions personally he believes it's a very vulnerable company.

What if Microsoft ask for every online txn on their laptop but app store, apple charges money 30%. Not justifiable.

Preferred search engine earning - anti competitive

Advertisement privacy misused

Rajeev mentions personally he believes it's a very vulnerable company.

What if Microsoft ask for every online txn on their laptop but app store, apple charges money 30%. Not justifiable.

Preferred search engine earning - anti competitive

Advertisement privacy misused

#NMDC

Why now when iron ore prices all time low.

Have used cashflows from iron ore to build steel plant.

On average cycle, 3500 crore of cashflows, market was valuing it only for iron ore business

upside potential via NMDC steel with a limited downside.

Got one business free

Why now when iron ore prices all time low.

Have used cashflows from iron ore to build steel plant.

On average cycle, 3500 crore of cashflows, market was valuing it only for iron ore business

upside potential via NMDC steel with a limited downside.

Got one business free

#coveredcall learning from coal india and strategy?

Fund doesn't do all the time. I don't understand this so please watch video.

Fund doesn't do all the time. I don't understand this so please watch video.

Why concentrated position in single group in terms of Bajaj holding and Maharashtra scooter 14% in tax saver

Reasonably diversified business

Reasonably diversified business

Late entrant finally comes on Dias

#IEX (they own 5%)

Why didnt sell at 100 p/e and bad news and competitive intensity

Rajeev says in small cap companies the base effect is very strong. Power trading in india is at very nascent stage, new segment awaited

Continue

#IEX (they own 5%)

Why didnt sell at 100 p/e and bad news and competitive intensity

Rajeev says in small cap companies the base effect is very strong. Power trading in india is at very nascent stage, new segment awaited

Continue

#IEX

Given trends in renewable, trading energy and all

The current reason to sell didn't seem appropriate.Overall attractiveness of sector is looking good.

A big market .. GDP growth + massive power need in EV etc etc.

Given trends in renewable, trading energy and all

The current reason to sell didn't seem appropriate.Overall attractiveness of sector is looking good.

A big market .. GDP growth + massive power need in EV etc etc.

Question back on #CHF

Why state bond of over leverage states

Rajeev mentions india govt consider these bonds as default free / lot of banks own it.

These are yielding higher than corporate aaa bond.

Why state bond of over leverage states

Rajeev mentions india govt consider these bonds as default free / lot of banks own it.

These are yielding higher than corporate aaa bond.

Question for Neil

When are you launching 8 other categories of fund

Neil says: na ho payega. Not excited yet about a new scheme.

When are you launching 8 other categories of fund

Neil says: na ho payega. Not excited yet about a new scheme.

Fun question with raunak on Tesla, Berkshire hathway and twitter

Learns from BH, wants to save his twitter account and talks about missed opportunity in Tesla.

Gives reason on why they didn't pick Tesla.

Learns from BH, wants to save his twitter account and talks about missed opportunity in Tesla.

Gives reason on why they didn't pick Tesla.

Audience questions

Are we missing adani, Ambani and Tatas

# keep evaluating tata . TCS in tax saver.

# adani , never attractively valued

Finally have to make peace with 25-30 companies and keep evaluating.

Are we missing adani, Ambani and Tatas

# keep evaluating tata . TCS in tax saver.

# adani , never attractively valued

Finally have to make peace with 25-30 companies and keep evaluating.

A very enthusiastic question from a gentleman on lot of data points (bahut padha hai fintwit se) . Some.buffet, some Munger. You have to watch it on video.

Rajeev had to intervene, is it a question or an opinion.

Explains about price to sales vagaries

Rajeev had to intervene, is it a question or an opinion.

Explains about price to sales vagaries

A question on as a startegy why don't we buy on ipo and sell on listing

Buy on ipo: yes, cdsl and my cams

Question on why not sell on listing gain. Somehow the investor wants to figure if that's mutual fund startegy

Wah wah, website padh lete bhai

Buy on ipo: yes, cdsl and my cams

Question on why not sell on listing gain. Somehow the investor wants to figure if that's mutual fund startegy

Wah wah, website padh lete bhai

Finally a question on

"Kitna milega" from fcf. Expected this question:)

No guidance can be provided

"Kitna milega" from fcf. Expected this question:)

No guidance can be provided

• • •

Missing some Tweet in this thread? You can try to

force a refresh