Without Decentralization, Cardano Will Die.

☠️

- Thread Time 🧵-

#axotrade #cardano #cardanocommunity #ada $ada #defi

☠️

- Thread Time 🧵-

#axotrade #cardano #cardanocommunity #ada $ada #defi

1/ Decentralization

The philosophy underpinning blockchain is that no person could or should be in power, as this leads to the abuses and oligarchies that we see in our everyday lives.

Instead, every user is given the ability to decide the best course of action for themselves.

The philosophy underpinning blockchain is that no person could or should be in power, as this leads to the abuses and oligarchies that we see in our everyday lives.

Instead, every user is given the ability to decide the best course of action for themselves.

2/ The Basics

Cardano is a decentralized network run by computers called "stake pools" that process the transactions. Users can support these stake pools by delegating ADA, and in turn they receive a reward for keeping the network operational. This action is called "staking".

Cardano is a decentralized network run by computers called "stake pools" that process the transactions. Users can support these stake pools by delegating ADA, and in turn they receive a reward for keeping the network operational. This action is called "staking".

3/ Voting for Pools

On Cardano, you never lose access to your funds when you stake. Your ADA stays in your wallet, it's not locked, it's more like a vote you continuously cast in the network - and how often stake pools get to process transactions is proportional to their stake.

On Cardano, you never lose access to your funds when you stake. Your ADA stays in your wallet, it's not locked, it's more like a vote you continuously cast in the network - and how often stake pools get to process transactions is proportional to their stake.

4/ Future at Stake

Supporting a Stake Pool Operator (SPO) makes them better able to pursue their goals. Staking with them not only increases their chance to mint a block & get paid but indirectly promotes their vision of the chain (like @SmaugPool and pool.pm)

Supporting a Stake Pool Operator (SPO) makes them better able to pursue their goals. Staking with them not only increases their chance to mint a block & get paid but indirectly promotes their vision of the chain (like @SmaugPool and pool.pm)

5/ Centralizing Forces

Some early players, like centralized exchanges, built competitive advantages and absorb delegation in a monopolistic fashion as their advantages compounded on themselves.

They weaken the network's strength by making it very difficult for new entrants.

Some early players, like centralized exchanges, built competitive advantages and absorb delegation in a monopolistic fashion as their advantages compounded on themselves.

They weaken the network's strength by making it very difficult for new entrants.

6/ Monopoly

The problem with multipool SPOs is that there's a fixed max amount of pools that can profitably exist at given ADA prices, so stake pools are a zero-sum game. Past a point, multipool SPOs harm the network more than they could possibly contribute via other means.

The problem with multipool SPOs is that there's a fixed max amount of pools that can profitably exist at given ADA prices, so stake pools are a zero-sum game. Past a point, multipool SPOs harm the network more than they could possibly contribute via other means.

7/ Multiple Stakepool Operators

It's easy to villainize SPOs with many pools at once, but they're doing the economically rational thing given the current incentive structure. Yet, in so doing, they indirectly worsen the economic outcome of everyone else on the network.

It's easy to villainize SPOs with many pools at once, but they're doing the economically rational thing given the current incentive structure. Yet, in so doing, they indirectly worsen the economic outcome of everyone else on the network.

8/ Decentralization is the Crown Jewel

If the network starts being controllable by single entities, then much of the value proposition of crypto disappears as it devolves into an expensive and inefficient Excel spreadsheet, rather than revolutionary censorship-resistant tech.

If the network starts being controllable by single entities, then much of the value proposition of crypto disappears as it devolves into an expensive and inefficient Excel spreadsheet, rather than revolutionary censorship-resistant tech.

9/ Retail is Looking for Alternatives

Normal people are realizing that in centralized institutions the game is often rigged against them. They're looking for fairer, more transparent systems. Crypto holds the promise of being this.

If it succeeds, institutions will embrace it.

Normal people are realizing that in centralized institutions the game is often rigged against them. They're looking for fairer, more transparent systems. Crypto holds the promise of being this.

If it succeeds, institutions will embrace it.

10/ How Institutions Think

Institutions will go where there's money. If they see enough small fish in the crypto pond, they'll embrace it.

JP Morgan went from having their CEO say he'd fire any trader for holding BTC, to having its own digital payments and blockchain division.

Institutions will go where there's money. If they see enough small fish in the crypto pond, they'll embrace it.

JP Morgan went from having their CEO say he'd fire any trader for holding BTC, to having its own digital payments and blockchain division.

11/ Next Evolution

If we want to expand and become more than a space for gambling, then we must guarantee a fair platform where financial applications are built - we need a decentralized network for digital assets that single entities can't tamper with & normal people can trust.

If we want to expand and become more than a space for gambling, then we must guarantee a fair platform where financial applications are built - we need a decentralized network for digital assets that single entities can't tamper with & normal people can trust.

12/ Responsibility

Digital assets present a radical departure from the status quo, where users are given full control over their actions. In an age of overbearing government policies, this is a breath of fresh air and very rewarding. But not one without risks and obligations.

Digital assets present a radical departure from the status quo, where users are given full control over their actions. In an age of overbearing government policies, this is a breath of fresh air and very rewarding. But not one without risks and obligations.

13/ Decentralization is Your Choice

Especially when starting out, DeFi can be very daunting. Many people default to staying in the supposed safety of centralized exchanges, or the familiarity of large social media personalities with many pools.

Yet this harms us all!

Especially when starting out, DeFi can be very daunting. Many people default to staying in the supposed safety of centralized exchanges, or the familiarity of large social media personalities with many pools.

Yet this harms us all!

14/ MAV

Cardano's Minimum Attack Vector, or the number of entities that you need to compromise to take control over ADA, is 24. This is better than ETH and BTC but the trend has been downwards, we're becoming less decentralized and losing what makes Cardano worth investing in.

Cardano's Minimum Attack Vector, or the number of entities that you need to compromise to take control over ADA, is 24. This is better than ETH and BTC but the trend has been downwards, we're becoming less decentralized and losing what makes Cardano worth investing in.

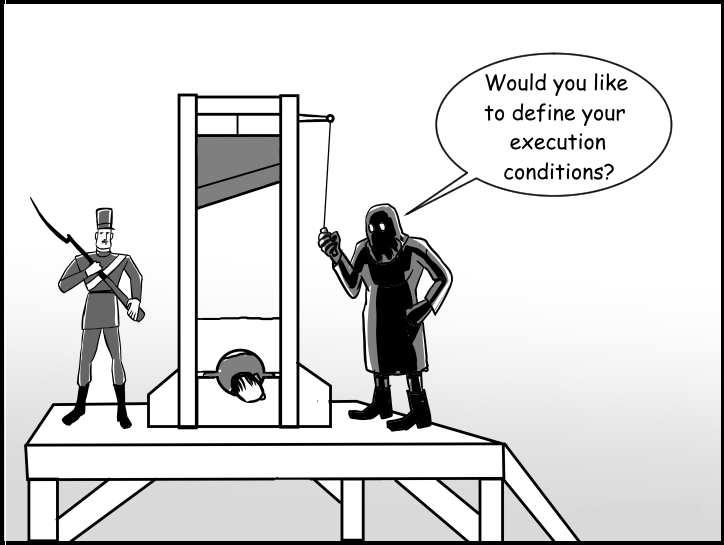

15/ Tragedy of the Commons

Decentralization is like the environment, it's much easier to preserve it while we still have it, than to recover it once lost

Someone that has several pools at once damages the ecosystem, is what they bring to the table worth the price? It depends.

Decentralization is like the environment, it's much easier to preserve it while we still have it, than to recover it once lost

Someone that has several pools at once damages the ecosystem, is what they bring to the table worth the price? It depends.

16/ Conclusion

Decentralization is the primary value proposition of digital assets. It might take a while for it to be valued properly by the market, but the day will come.

It's up to us to decide whether we'll be ready when that day comes, or if we’re caught unprepared.

Decentralization is the primary value proposition of digital assets. It might take a while for it to be valued properly by the market, but the day will come.

It's up to us to decide whether we'll be ready when that day comes, or if we’re caught unprepared.

If you enjoyed this thread, please like, retweet the first post, and subscribe to @axotrade 🧵

Make sure to check out our past #TradFiTales series too:

axo.trade/newsroom/posts…

Make sure to check out our past #TradFiTales series too:

axo.trade/newsroom/posts…

• • •

Missing some Tweet in this thread? You can try to

force a refresh