You've probably been too busy following the #FTX drama to have noticed some news this week:

The NY Fed along with Citi, HSBC, Mastercard, Wells Fargo and others are starting a 12-week digital dollar #CBDC pilot study.

Big deal or NBD? Get your ☕️ and follow along:

🧵

1/20

The NY Fed along with Citi, HSBC, Mastercard, Wells Fargo and others are starting a 12-week digital dollar #CBDC pilot study.

Big deal or NBD? Get your ☕️ and follow along:

🧵

1/20

2/

IMPORTANT CONTEXT (you'll see why later)-

The BIS (the final boss for #bitcoin imho), issued a 41 page report titled "The Future Monetary System" showing their vision for a central bank issued CBDC, which this pilot stems from.

We broke it down here:

IMPORTANT CONTEXT (you'll see why later)-

The BIS (the final boss for #bitcoin imho), issued a 41 page report titled "The Future Monetary System" showing their vision for a central bank issued CBDC, which this pilot stems from.

We broke it down here:

https://twitter.com/CoinbitsApp/status/1539257660888989699?s=20&t=-9rmxJUg4XjMz3nHy684Eg

3/

This project is piloting the "regulated liability network": to test how banks can use a tokenized USD in a distributed database, to "help speed up payments and settlement time in currency"

They're re-inventing... centralized ledgers 🤦♂️

SQL fixes this! h/t @BitcoinIsSaving

This project is piloting the "regulated liability network": to test how banks can use a tokenized USD in a distributed database, to "help speed up payments and settlement time in currency"

They're re-inventing... centralized ledgers 🤦♂️

SQL fixes this! h/t @BitcoinIsSaving

4/

The "technology" will allow banks to simulate issuing digital money emulating their customers' funds then settling with the central bank via the ledger.

The biggest problem they're looking to address is what @Strike is doing using #btc ⚡️⚡️: settling cash internationally

The "technology" will allow banks to simulate issuing digital money emulating their customers' funds then settling with the central bank via the ledger.

The biggest problem they're looking to address is what @Strike is doing using #btc ⚡️⚡️: settling cash internationally

5/

The testers?

BNY Mellon

HSBC

PNC

Toronto-Dominion

Truist

US Bancorp

Mastercard

Citi

Wells Fargo

This list is not random; they cover the majority of the different types of US Financial Institutions (see this thread for more info):

The testers?

BNY Mellon

HSBC

PNC

Toronto-Dominion

Truist

US Bancorp

Mastercard

Citi

Wells Fargo

This list is not random; they cover the majority of the different types of US Financial Institutions (see this thread for more info):

https://twitter.com/CoinbitsApp/status/1588382189242064898?s=20&t=-9rmxJUg4XjMz3nHy684Eg

6/

The regulated liability network is meant to follow all existing laws and regulations, including AML and KYC.

In other words, same as today, just on the "blockchain".

Although they don't use that word, now that it's no longer seen as innovative, but rather scammy 🤣#winning

The regulated liability network is meant to follow all existing laws and regulations, including AML and KYC.

In other words, same as today, just on the "blockchain".

Although they don't use that word, now that it's no longer seen as innovative, but rather scammy 🤣#winning

7/

Clearly the initial focus is to simulate digital exchange and clearance, but according to the NY Fed innovation center, the concept can be expanded to multicurrency operation and stablecoins, as "money and banking evolve".

A digital USD has been debated widely by the Fed...

Clearly the initial focus is to simulate digital exchange and clearance, but according to the NY Fed innovation center, the concept can be expanded to multicurrency operation and stablecoins, as "money and banking evolve".

A digital USD has been debated widely by the Fed...

8/

Earlier this year, the Fed published a report summarizing their perspective on the subject of CBDCs, which in their view should:

- benefit > risk for users

- more beneficial than other available methods

- protect privacy

- anti-criminal activity

- have broad support

Earlier this year, the Fed published a report summarizing their perspective on the subject of CBDCs, which in their view should:

- benefit > risk for users

- more beneficial than other available methods

- protect privacy

- anti-criminal activity

- have broad support

9/

1 important point of clarification on what they're actually piloting here:

a WHOLESALE digital money (wCBDC). Meaning it's for settlement between banks, not necessarily for retail use, at least for now.

1 important point of clarification on what they're actually piloting here:

a WHOLESALE digital money (wCBDC). Meaning it's for settlement between banks, not necessarily for retail use, at least for now.

10/

Given that distinction, it's unclear how this specific pilot would meet the criteria set forth by the Fed for a CBDC to be viable.

There's clearly varying takes on the usefulness of a CBDC all together, even within the Fed itself. Here's Neel Kashkari, for example:

Given that distinction, it's unclear how this specific pilot would meet the criteria set forth by the Fed for a CBDC to be viable.

There's clearly varying takes on the usefulness of a CBDC all together, even within the Fed itself. Here's Neel Kashkari, for example:

11/

Is this project to help show the Fed members opposing CBDCs their potential "usefulness"?

This is a part of a broader project going on at the Fed: Project Cedar, the inaugural project of a new team in the NY Fed: the NY innovation Center (NYIC).

Wait, who??

Get your 🍿:

Is this project to help show the Fed members opposing CBDCs their potential "usefulness"?

This is a part of a broader project going on at the Fed: Project Cedar, the inaugural project of a new team in the NY Fed: the NY innovation Center (NYIC).

Wait, who??

Get your 🍿:

12/

the NYIC is was established... get this.... in partnership with the Bank for International Settlements Innovation Hub, to QUOTE:

"aim to advance research regarding CBDCs within the US context."

Thus the thread nested in tweet 2 above, about the BIS' perspective on CBDCs

😑

the NYIC is was established... get this.... in partnership with the Bank for International Settlements Innovation Hub, to QUOTE:

"aim to advance research regarding CBDCs within the US context."

Thus the thread nested in tweet 2 above, about the BIS' perspective on CBDCs

😑

13/

Now the regulated liability network isn't their first initiative... They've already successfully (surprise surprise) completed a 12 week demonstration of "distributed ledger technology" to enable instant and atomic settlement of FX spot transactions in under 10 seconds...

Now the regulated liability network isn't their first initiative... They've already successfully (surprise surprise) completed a 12 week demonstration of "distributed ledger technology" to enable instant and atomic settlement of FX spot transactions in under 10 seconds...

14/

between the NY Fed and different counterparties across separate and homogeneous ledgers, using a really novel, ground breaking, state of the art consensus protocol, and I kid you not:

"proof-of-authority"

They are literally inventing their own 💩coin.

ICO whitepaper 🔜

between the NY Fed and different counterparties across separate and homogeneous ledgers, using a really novel, ground breaking, state of the art consensus protocol, and I kid you not:

"proof-of-authority"

They are literally inventing their own 💩coin.

ICO whitepaper 🔜

15/

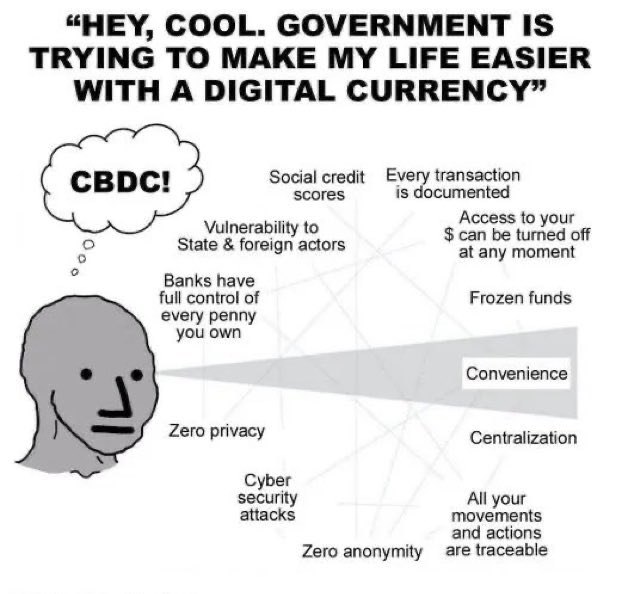

All in all, the likelihood of this specific pilot program ushering in the CBDC dystopia we're headed towards, is at least for now, unlikely.

The approach makes sense though: slowly boil the frog: Get people used to the idea of a CBDC between banks to get them comfortable...

All in all, the likelihood of this specific pilot program ushering in the CBDC dystopia we're headed towards, is at least for now, unlikely.

The approach makes sense though: slowly boil the frog: Get people used to the idea of a CBDC between banks to get them comfortable...

16/

...then once they are, send in the full CBDC panopticon dystopia.

The timing is also very suspect:

- FTX debacle

- immediately post midterm elections

- on the cusp of, at the very least, a recession

- US Treasury exploring buy back of debt, AKA: NOT!!! QE or QT 🤡

...then once they are, send in the full CBDC panopticon dystopia.

The timing is also very suspect:

- FTX debacle

- immediately post midterm elections

- on the cusp of, at the very least, a recession

- US Treasury exploring buy back of debt, AKA: NOT!!! QE or QT 🤡

17/

Then in the midst of all the financial vulnerability of everyday citizens, you introduce the "innovative solution": CBDC.

This is NOT conspiracy nor hyperbole

This IMF working paper from 2015 ‼️ called for this exactly to eliminate the "zero lower bound" (interest rates):

Then in the midst of all the financial vulnerability of everyday citizens, you introduce the "innovative solution": CBDC.

This is NOT conspiracy nor hyperbole

This IMF working paper from 2015 ‼️ called for this exactly to eliminate the "zero lower bound" (interest rates):

18/

abstract: "all that is needed to empower monetary policy to cut interest rates as much as

needed for economic stimulus now is to change from a paper standard to an electronic money standard, and to be willing to have paper currency go away from par."

A clear gameplan for:

abstract: "all that is needed to empower monetary policy to cut interest rates as much as

needed for economic stimulus now is to change from a paper standard to an electronic money standard, and to be willing to have paper currency go away from par."

A clear gameplan for:

19/

#Bitcoin fixes this.

It is THE distributed ledger of choice for people who value their privacy and their freedom.

Any other distributed ledger for value exchange is obsolete and useless from the start. A solution in search of a problem, because Bitcoin already solved it.

#Bitcoin fixes this.

It is THE distributed ledger of choice for people who value their privacy and their freedom.

Any other distributed ledger for value exchange is obsolete and useless from the start. A solution in search of a problem, because Bitcoin already solved it.

20/20

Thank you for reading! If you've enjoyed or learned something from this thread, give us a follow and a RT!

🙏

And be sure to check out all our other informative and sometimes entertaining threads here:

Thank you for reading! If you've enjoyed or learned something from this thread, give us a follow and a RT!

🙏

And be sure to check out all our other informative and sometimes entertaining threads here:

https://twitter.com/CoinbitsApp/status/1569178869244076037?s=20&t=-9rmxJUg4XjMz3nHy684Eg

• • •

Missing some Tweet in this thread? You can try to

force a refresh