We are short $PVBC, a small #bank with massive crypto loan exposure. The loans are already #defaulting and share price is #rapidly declining. We think it’s a zero. Read our report: bit.ly/3OisAKH

$PVBC expanded its #crypto lending business to $138m within 18 months and yesterday impaired more than half of it. A 200yr old #bank went tits-up in a matter of months. Read our report: bit.ly/3OisAKH

The $PVBC crypto lending business was led by Paul #Mansfield, who we think, is an immediate family member of the bank’s CEO David Mansfield. Read our report: bit.ly/3OisAKH

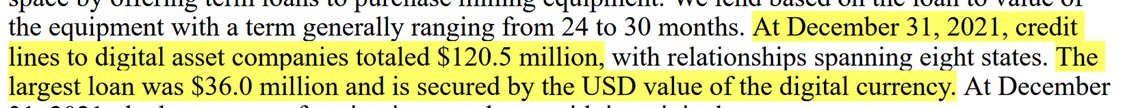

Only after a write-down of repossessed collateral did $PVBC a formal review of the crypto loan portfolio. These #loans are backed by crypto-miners or solely #cryptocurrencies and used for crypto lending and #margin trading. Read our report: bit.ly/3OisAKH

In our opinion the #board of directors #failed its duties and was influenced by favors from $PVBC's management. Read our report: bit.ly/3OisAKH

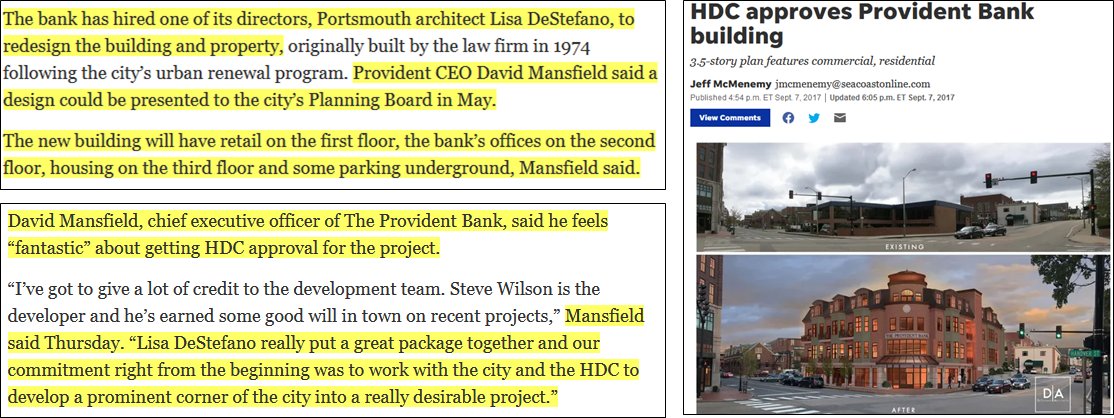

The chairwoman of #compensation committee was awarded a contract for designing the $PVBC headquarter in 2017, five years later executives compensation totaled 27pct of the bank’s net profits. Read our report: bit.ly/3OisAKH

On top of it, in 2021 $PVBC switched its retirement plans from a collective trust to a self-managed one. More than 40% of savings were invested in its own stock. We estimate the #losses YTD at $7m. Read our report: bit.ly/3OisAKH

We think trust in $PVBC, the executives, and the board of directors has been completely lost. We expect further #revelations and #regulatory actions in the coming weeks. We are short $PVBC. Read our full report: bit.ly/3OisAKH

• • •

Missing some Tweet in this thread? You can try to

force a refresh