Some L1 protocols, such as #Bitcoin, rely on Proof-of-work (PoW) mining for network operation and security.

The creator of a PoW token can set a pre-mine. This means they can create a number of tokens immediately before PoW mining starts.

#tutorial #tokenomics #powmining

The creator of a PoW token can set a pre-mine. This means they can create a number of tokens immediately before PoW mining starts.

#tutorial #tokenomics #powmining

Back in the day, this was a standard procedure to ensure the creators could cash in at a later time when their token gained some traction.

If a pre-mine is too large compared to the total supply of the token, this was a strong indicator not to invest in the project.

The creators could dump large amounts of tokens on the market and the price would tank.

The creators could dump large amounts of tokens on the market and the price would tank.

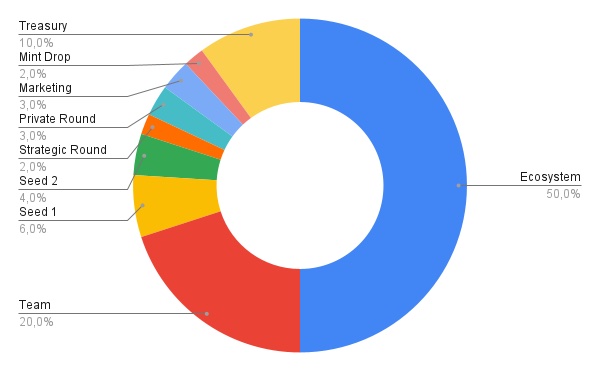

While pre-mines are now mostly outdated, it is always a good idea to look at token distribution.

Knowing who owns how many tokens and when they could sell them is an important insight.

Knowing who owns how many tokens and when they could sell them is an important insight.

In #tokenomics we study token-based incentive mechanisms.

This is important to understand #web3 and to become a successful builder and investor in the space.

You can learn this super quickly, with our course!

tokenomicsdao.thinkific.com/courses/tokeno…

This is important to understand #web3 and to become a successful builder and investor in the space.

You can learn this super quickly, with our course!

tokenomicsdao.thinkific.com/courses/tokeno…

• • •

Missing some Tweet in this thread? You can try to

force a refresh