Protocols like @helium will play a pivotal role in building #Web3, but unfortunately they are often ignored or misunderstood by most investors

Here’s why this “picks and shovels” token has the potential to increase in value by 50x-100x

Here’s why this “picks and shovels” token has the potential to increase in value by 50x-100x

2/

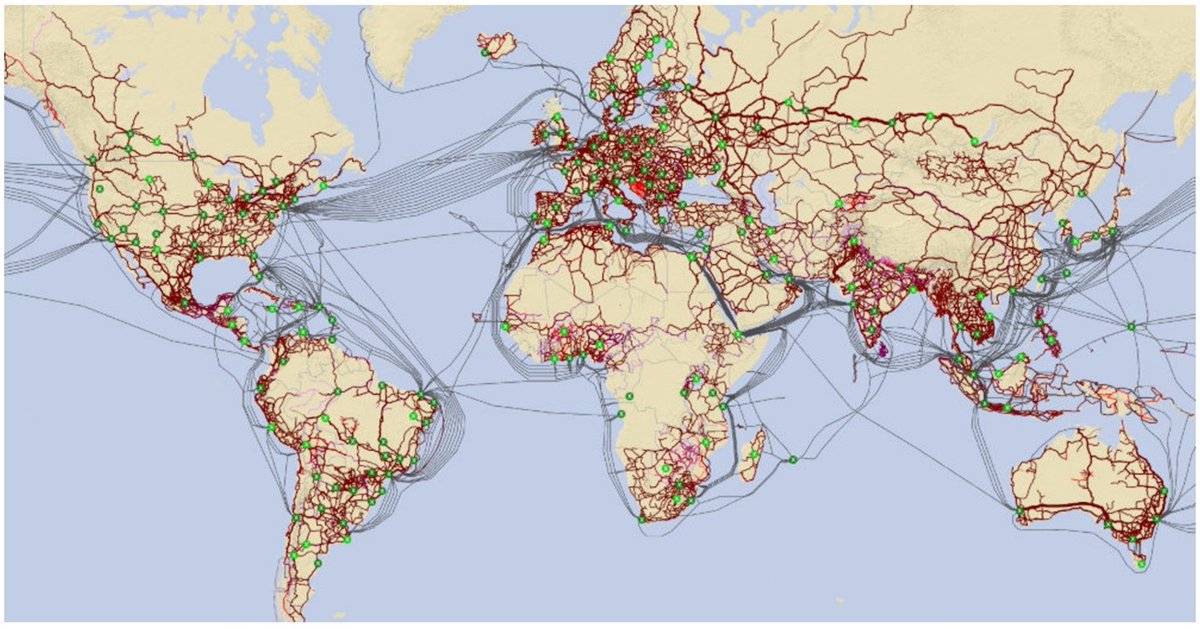

Helium is a “user-owned internet” that allows private citizens to buy #wireless hotspots, provide #internet services and receive $ in return

(vs. the traditional internet backbone which is hosted by companies like AT&T)

It has deployed nearly 1M devices across 182 counties

Helium is a “user-owned internet” that allows private citizens to buy #wireless hotspots, provide #internet services and receive $ in return

(vs. the traditional internet backbone which is hosted by companies like AT&T)

It has deployed nearly 1M devices across 182 counties

3/

Helium has a market cap of $319M and FDV of $544M, and is backed by the $HNT token, which trades at $2.44

During the #crypto bull market of 2021, the token price exceeded $50.

Helium has a market cap of $319M and FDV of $544M, and is backed by the $HNT token, which trades at $2.44

During the #crypto bull market of 2021, the token price exceeded $50.

4/

This thread will analyze Helium on the following fundamental metrics:

• Industry overview

• Problem solved

• How it works

• Potential market size

• Competitive landscape

• Traction

• Team

• Partnerships

• Tokenomics

• Potential value

This thread will analyze Helium on the following fundamental metrics:

• Industry overview

• Problem solved

• How it works

• Potential market size

• Competitive landscape

• Traction

• Team

• Partnerships

• Tokenomics

• Potential value

5/

🔶 Industry Overview

Internet Service Providers (“ISPs”) like AT&T, Verizon & China Mobile build the infrastructure that powers the internet

They provide everything from the fiber-optic cables that allow signals to cross oceans to the radio towers that power wireless #5G

🔶 Industry Overview

Internet Service Providers (“ISPs”) like AT&T, Verizon & China Mobile build the infrastructure that powers the internet

They provide everything from the fiber-optic cables that allow signals to cross oceans to the radio towers that power wireless #5G

6/

The networks these companies have built handle massive amounts of data

Internet usage has increased from 7% in 2000 to 66% in 2022 and we generate 2.5 quintillion bytes of data every day!

The networks these companies have built handle massive amounts of data

Internet usage has increased from 7% in 2000 to 66% in 2022 and we generate 2.5 quintillion bytes of data every day!

7/

But that’s just the beginning…researchers expect the demand for data to increase 20x over the next 10 years due to the introduction of:

• Autonomous vehicles

• IoT

• Smart cities

• XR environments

• #Metaverse

But that’s just the beginning…researchers expect the demand for data to increase 20x over the next 10 years due to the introduction of:

• Autonomous vehicles

• IoT

• Smart cities

• XR environments

• #Metaverse

8/

🔶 Problem

Unfortunately, today’s ISPs can’t meet this demand

High barriers to entry – including substantial capital expenditures and operational expenses, complicated logistics, and regulatory hurdles – have limited the space to a handful of players

🔶 Problem

Unfortunately, today’s ISPs can’t meet this demand

High barriers to entry – including substantial capital expenditures and operational expenses, complicated logistics, and regulatory hurdles – have limited the space to a handful of players

9/

#5G will require SIGNIFICANTLY more radios and antennas than previous systems, so it’s unlikely that these three firms will be able to satisfy the demand even in urban areas

When you consider the expansion of 5G to rural areas, this problem becomes even more severe

#5G will require SIGNIFICANTLY more radios and antennas than previous systems, so it’s unlikely that these three firms will be able to satisfy the demand even in urban areas

When you consider the expansion of 5G to rural areas, this problem becomes even more severe

10/

🔶 Solution

The solution is the creation of “decentralized ISPs” – wireless networks that rely on a system of independently owned “small cell” devices that can transmit signals to nearby internet-enabled devices

🔶 Solution

The solution is the creation of “decentralized ISPs” – wireless networks that rely on a system of independently owned “small cell” devices that can transmit signals to nearby internet-enabled devices

11/

Because these "small cell" devices are the size of a pizza box and cost less than $10K, they can be purchased by individuals who

can install them on their property and collect payment for providing wireless services

Because these "small cell" devices are the size of a pizza box and cost less than $10K, they can be purchased by individuals who

can install them on their property and collect payment for providing wireless services

12/

Going forward, the FCC expects that 80% of all #5G services will be provided by these “small cell” devices rather than traditional cell towers

Going forward, the FCC expects that 80% of all #5G services will be provided by these “small cell” devices rather than traditional cell towers

13/

“DeWi” protocols can disrupt the industry because they are often cheaper to install and operate, eliminating many costs such as:

• Spectrum license fees

• Hardware

• Property leases

• Installation costs

• Maintenance costs

• Onboarding, billing, customer support

“DeWi” protocols can disrupt the industry because they are often cheaper to install and operate, eliminating many costs such as:

• Spectrum license fees

• Hardware

• Property leases

• Installation costs

• Maintenance costs

• Onboarding, billing, customer support

14/

🔶 Why Now?

The concept of “decentralized wireless” (#DeWi) is only possible now due to recent developments including:

• eSIMs make it easier to switch carriers

• Opening of #wireless spectrums provide bandwidth

• #Blockchains incentivize users to host infrastructure

🔶 Why Now?

The concept of “decentralized wireless” (#DeWi) is only possible now due to recent developments including:

• eSIMs make it easier to switch carriers

• Opening of #wireless spectrums provide bandwidth

• #Blockchains incentivize users to host infrastructure

15/

🔶 Protocol Overview

@helium is the largest decentralized wireless network

Although it was originally built to host #LoWaRan services – a low bandwidth technology optimized for #IoT – it is now expanding into several adjacent markets such as 5G (Cellular), WiFi and VPN

🔶 Protocol Overview

@helium is the largest decentralized wireless network

Although it was originally built to host #LoWaRan services – a low bandwidth technology optimized for #IoT – it is now expanding into several adjacent markets such as 5G (Cellular), WiFi and VPN

16/

To use Helium, users purchase a device, install this device on their property and then transmit the signal to nearby internet-enabled devices.

In return, they are compensated in cryptocurrency

Devices can range from hundreds to thousands depending on their function

To use Helium, users purchase a device, install this device on their property and then transmit the signal to nearby internet-enabled devices.

In return, they are compensated in cryptocurrency

Devices can range from hundreds to thousands depending on their function

17/

Helium eliminates many of the traditional concerns of centralized ISPs and may offer several benefits to the consumer:

• Lower fees through increased competition

• Less censorship due to decentralization

• Fewer outages due to overlapping coverage

Helium eliminates many of the traditional concerns of centralized ISPs and may offer several benefits to the consumer:

• Lower fees through increased competition

• Less censorship due to decentralization

• Fewer outages due to overlapping coverage

18/

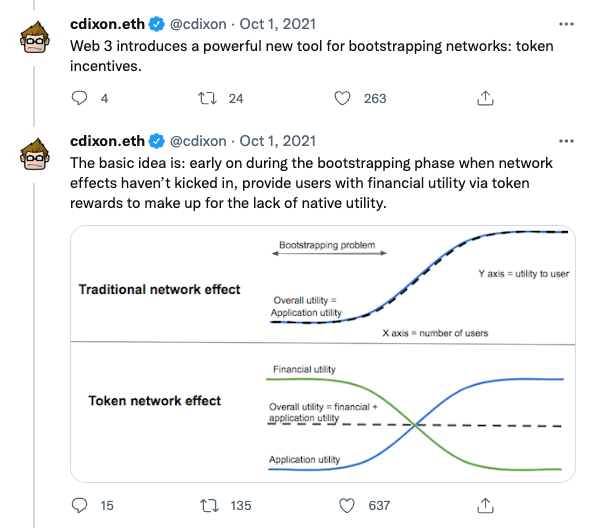

Although many have tried to disrupt the existing network of ISPs, Helium is the only company to make headway on this endeavor

This is largely due to its use of #cryptocurrencies as an incentivization mechanism

Although many have tried to disrupt the existing network of ISPs, Helium is the only company to make headway on this endeavor

This is largely due to its use of #cryptocurrencies as an incentivization mechanism

19/

To ensure the stability of the network, Helium uses a process known as “Proof-of-Coverage”, which randomly pings hotspots to verify that they are in the correct location and actively transmitting a signal

To ensure the stability of the network, Helium uses a process known as “Proof-of-Coverage”, which randomly pings hotspots to verify that they are in the correct location and actively transmitting a signal

20/

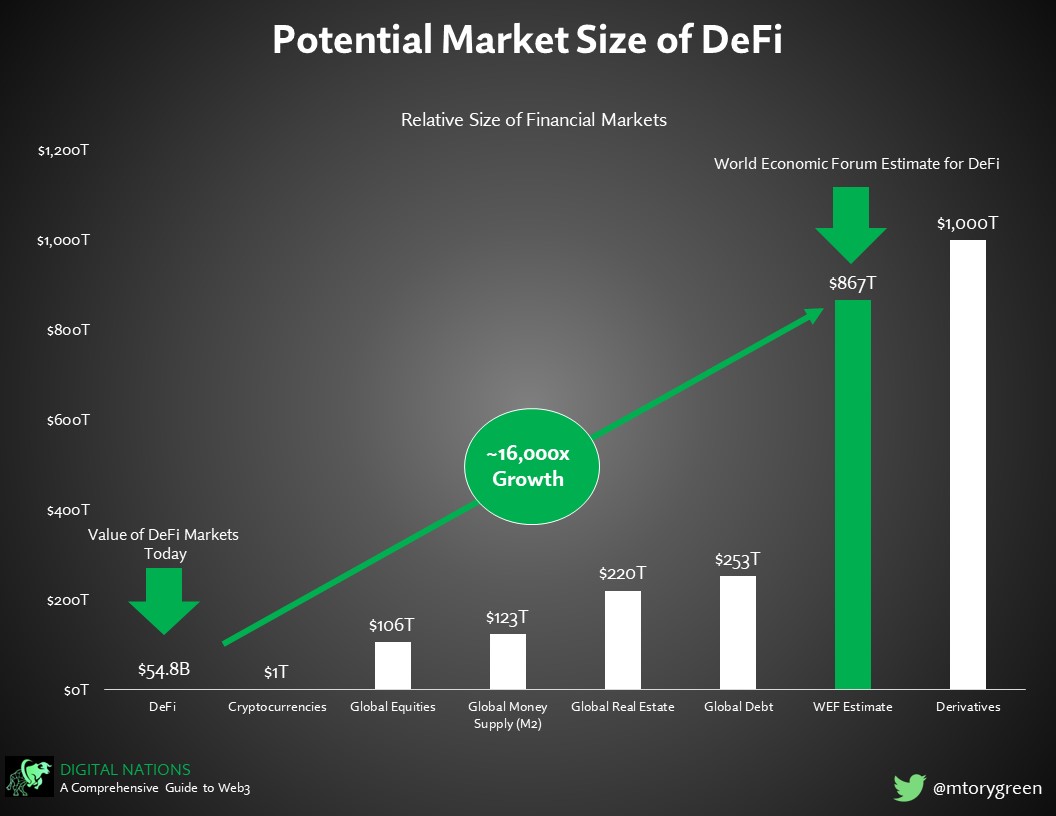

🔶 Market Size

Helium’s largest market – the market for global #5G services – is expected to grow at a yearly CAGR of 57% to a total value of $2.7T in 2030.

🔶 Market Size

Helium’s largest market – the market for global #5G services – is expected to grow at a yearly CAGR of 57% to a total value of $2.7T in 2030.

21/

🔶 Competitive Landscape:

There are several notable players in the decentralized wireless space, including:

• 5G: Helium, Pollen Mobile

• WiFi: WayRu, Dabba

• LoWaRan: Helium, Foam, Chirp

• Bluetooth: Nodle

• Hybrid: Althea, World Mobile Token

🔶 Competitive Landscape:

There are several notable players in the decentralized wireless space, including:

• 5G: Helium, Pollen Mobile

• WiFi: WayRu, Dabba

• LoWaRan: Helium, Foam, Chirp

• Bluetooth: Nodle

• Hybrid: Althea, World Mobile Token

22/

🔶 Traction:

@helium has taken an early lead in the space, deploying nearly 1 million LoWaRan devices across 182 countries (and as of March 2022, the company said it had another 3.5 million on backorder)

🔶 Traction:

@helium has taken an early lead in the space, deploying nearly 1 million LoWaRan devices across 182 countries (and as of March 2022, the company said it had another 3.5 million on backorder)

23/

The protocol has inked several high-profile partnerships, including one with T-Mobile for its 5G services

Under this agreement, users will be able to access @TMobile's network in areas where Helium does not yet have coverage (a major benefit as the network grows)

The protocol has inked several high-profile partnerships, including one with T-Mobile for its 5G services

Under this agreement, users will be able to access @TMobile's network in areas where Helium does not yet have coverage (a major benefit as the network grows)

24/

🔶 Team:

Helium was founded in 2013 by Shawn Fanning of Napster, Amir Haleem, and Sean Carey, and is backed by a notable list of investors that includes @PanteraCapital, @multicoincap, @khoslaventures and @a16z

🔶 Team:

Helium was founded in 2013 by Shawn Fanning of Napster, Amir Haleem, and Sean Carey, and is backed by a notable list of investors that includes @PanteraCapital, @multicoincap, @khoslaventures and @a16z

25/

🔶 Criticisms:

One of the biggest criticisms of Helium is that its revenue has declined in the #crypto bear market (dropping 88% from Q2 2022 to Q3 2022)

As such, many hot spot hosts that were once earning thousands a month have seen their take decline to a few bucks

🔶 Criticisms:

One of the biggest criticisms of Helium is that its revenue has declined in the #crypto bear market (dropping 88% from Q2 2022 to Q3 2022)

As such, many hot spot hosts that were once earning thousands a month have seen their take decline to a few bucks

26/

While much of this is due to the overall decline in #crypto, it’s also a function of the protocol's young age

As investor @KyleSamani of @multicoincap notes, bootstrapping takes a long time and as the network grows, service will only get better and rewards will increase

While much of this is due to the overall decline in #crypto, it’s also a function of the protocol's young age

As investor @KyleSamani of @multicoincap notes, bootstrapping takes a long time and as the network grows, service will only get better and rewards will increase

27/

🔶 Tokenomics

Helium’s network is powered by its $HNT token.

Like Bitcoin, $HNT is an inflationary token with a fixed supply of 223M. The protocol will begin by issuing 5M $HNT each month and halving this every two years.

To date 131M tokens have been issued

🔶 Tokenomics

Helium’s network is powered by its $HNT token.

Like Bitcoin, $HNT is an inflationary token with a fixed supply of 223M. The protocol will begin by issuing 5M $HNT each month and halving this every two years.

To date 131M tokens have been issued

28/

While $HNT powers the Helium network as a whole, each specific service (e.g. LoRaWAN, 5G, WiFi) will have its own subDAO and own token that it uses to compensate hosts.

For instance, the LoRaWAN network will use the $IOT token and the 5G network will use the $MOBILE token.

While $HNT powers the Helium network as a whole, each specific service (e.g. LoRaWAN, 5G, WiFi) will have its own subDAO and own token that it uses to compensate hosts.

For instance, the LoRaWAN network will use the $IOT token and the 5G network will use the $MOBILE token.

29/

While subDAOs can tailor these tokens to their own specific needs (setting supply, inflation schedules, voting rights, etc.) they all backed by $HNT and redeemable for $HNT at any time

This ultimately leaves the underlying tokenomics (and value) of the $HNT token unchanged

While subDAOs can tailor these tokens to their own specific needs (setting supply, inflation schedules, voting rights, etc.) they all backed by $HNT and redeemable for $HNT at any time

This ultimately leaves the underlying tokenomics (and value) of the $HNT token unchanged

30/

🔶 Valuation

As stated earlier, the global market for #5G services is expected to be $2.7T by 2030

If we assume that #DeWi networks capture 20% of that, we arrive at a serviceable addressable market of $540B

🔶 Valuation

As stated earlier, the global market for #5G services is expected to be $2.7T by 2030

If we assume that #DeWi networks capture 20% of that, we arrive at a serviceable addressable market of $540B

31/

Capturing 20% is not unreasonable, as we've seen disruptive technologies capture significant market share before:

• 72% of entertainment revenues are digital

• Online advertising is 2/3rds of total advertising

• eCommerce is expected to capture 25% of retail by 2025

Capturing 20% is not unreasonable, as we've seen disruptive technologies capture significant market share before:

• 72% of entertainment revenues are digital

• Online advertising is 2/3rds of total advertising

• eCommerce is expected to capture 25% of retail by 2025

32/

If Helium remains the market leader, it's reasonable to assume that it could capture up to a third of the DeWi market (as leaders in the tech space tend to average a 28% market share)

If Helium remains the market leader, it's reasonable to assume that it could capture up to a third of the DeWi market (as leaders in the tech space tend to average a 28% market share)

33/

Even if we're conservative and assume a 10% share, that still implies a market cap of $54B.

Divided by the expected 223M tokens, that gives us a price of $242 (a ~100x increase over today’s price and ~5x increase over its ATH)

Even if we're conservative and assume a 10% share, that still implies a market cap of $54B.

Divided by the expected 223M tokens, that gives us a price of $242 (a ~100x increase over today’s price and ~5x increase over its ATH)

34/

A $54B valuation is by no means unreasonable, and many would argue conservative, given that the largest ISPs in the US – Verizon, Comcast and AT&T – have market caps of $162B, $149B and $135B, respectively

A $54B valuation is by no means unreasonable, and many would argue conservative, given that the largest ISPs in the US – Verizon, Comcast and AT&T – have market caps of $162B, $149B and $135B, respectively

35/

🔶 The Big Picture

Decentralized wireless providers have the potential to play a material roll in the global rollout of #5G

Not only can they supplement traditional ISPs, but they may ultimately be better for the consumer

But that’s not even their most important benefit!

🔶 The Big Picture

Decentralized wireless providers have the potential to play a material roll in the global rollout of #5G

Not only can they supplement traditional ISPs, but they may ultimately be better for the consumer

But that’s not even their most important benefit!

36/

Currently, one of the biggest flaws of Web3 is that it is reliant on centralized internet providers

If they choose to turn off the network, the whole system shuts down

#DeWi providers such as @helium could prevent that, ultimately securing the future of #Web3

Currently, one of the biggest flaws of Web3 is that it is reliant on centralized internet providers

If they choose to turn off the network, the whole system shuts down

#DeWi providers such as @helium could prevent that, ultimately securing the future of #Web3

37/

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

I hope you've found this thread helpful.

Follow me @MTorygreen for more fundamental analysis on Web3 protocols.

Like/Retweet the first tweet below if you can:

https://twitter.com/MTorygreen/status/1596186978394914816

• • •

Missing some Tweet in this thread? You can try to

force a refresh