As @WatcherGuru muted my tweets. Here again without any censorship. 🤡

#MoonstoneBank #Farmington #FTX #Alameda #Tether #Deltec #crypto #SIG

#MoonstoneBank #Farmington #FTX #Alameda #Tether #Deltec #crypto #SIG

Interesting. SIG invested in #Voyager, bankrupt. SIG invested in #BlockFi, bankrupt.

inflation.us/content/susque…

Why does that matters? Where is the connection?

Jean Chalopin is the connection. Who is that? Chairman of Deltec Bank Bahamas (banking provider of Tether and FTX). /1

inflation.us/content/susque…

Why does that matters? Where is the connection?

Jean Chalopin is the connection. Who is that? Chairman of Deltec Bank Bahamas (banking provider of Tether and FTX). /1

Jean Chalopin was director of SIG Investment II Limited SIG Investment I Limited

offshoreleaks.icij.org/nodes/152449

But Jean is also former CEO (2020) and current director of FTX Farmington State Bank or Moonstone Bank. The bank with few staff but with a huge vision. 🤡 /2

offshoreleaks.icij.org/nodes/152449

But Jean is also former CEO (2020) and current director of FTX Farmington State Bank or Moonstone Bank. The bank with few staff but with a huge vision. 🤡 /2

The vision of the bank was so big, that the San Francisco FED approved them to become member of the federal reserve system, so they can trade with less colleteral and more liquidity. The american dream still exist it seems. /3

Usually I would say, it's just a coincidence, but... Jane Street? Wait... who worked there?

ft.com/content/679d0f…

- Oh well, almost the whole Alameda management 🤣

Also here a connection between Jane Street and SIG.

/4

ft.com/content/679d0f…

- Oh well, almost the whole Alameda management 🤣

Also here a connection between Jane Street and SIG.

/4

I really don't know how the FED works, but when I see one name in different offshore laked papers, I wouldn't trust him. I guess I'm to sceptic. 🤡🤣

So, he is directly mentioned in Bahama papers, Offshore Leaks... 🤣

offshoreleaks.icij.org/nodes/21000602

/5

So, he is directly mentioned in Bahama papers, Offshore Leaks... 🤣

offshoreleaks.icij.org/nodes/21000602

/5

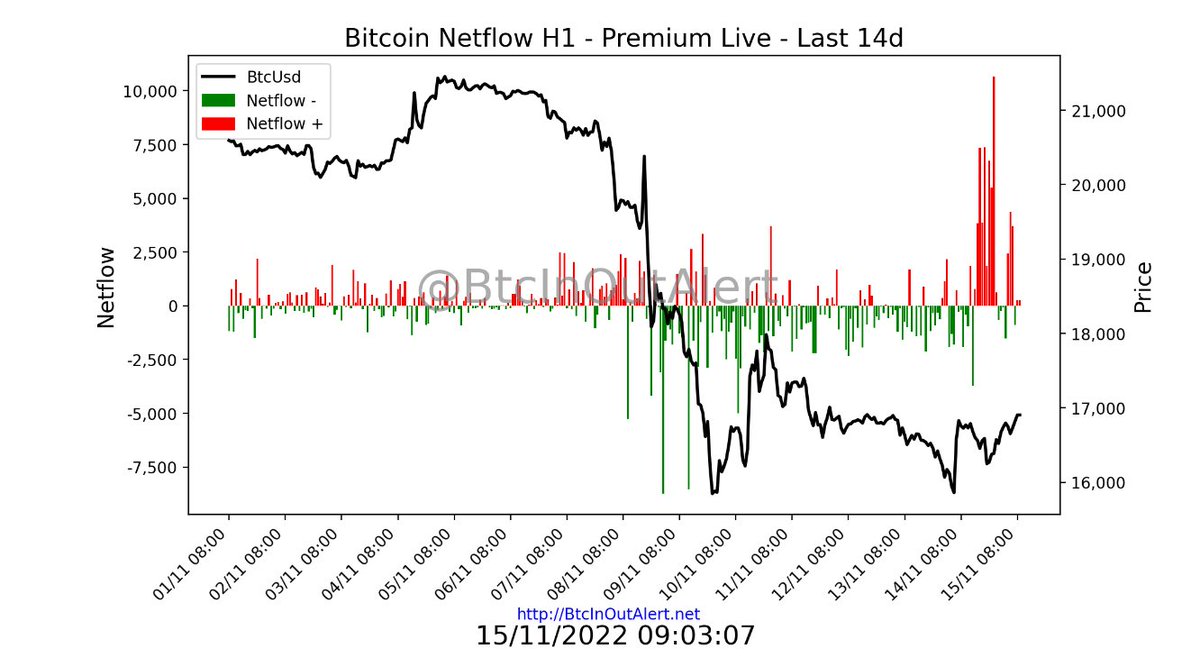

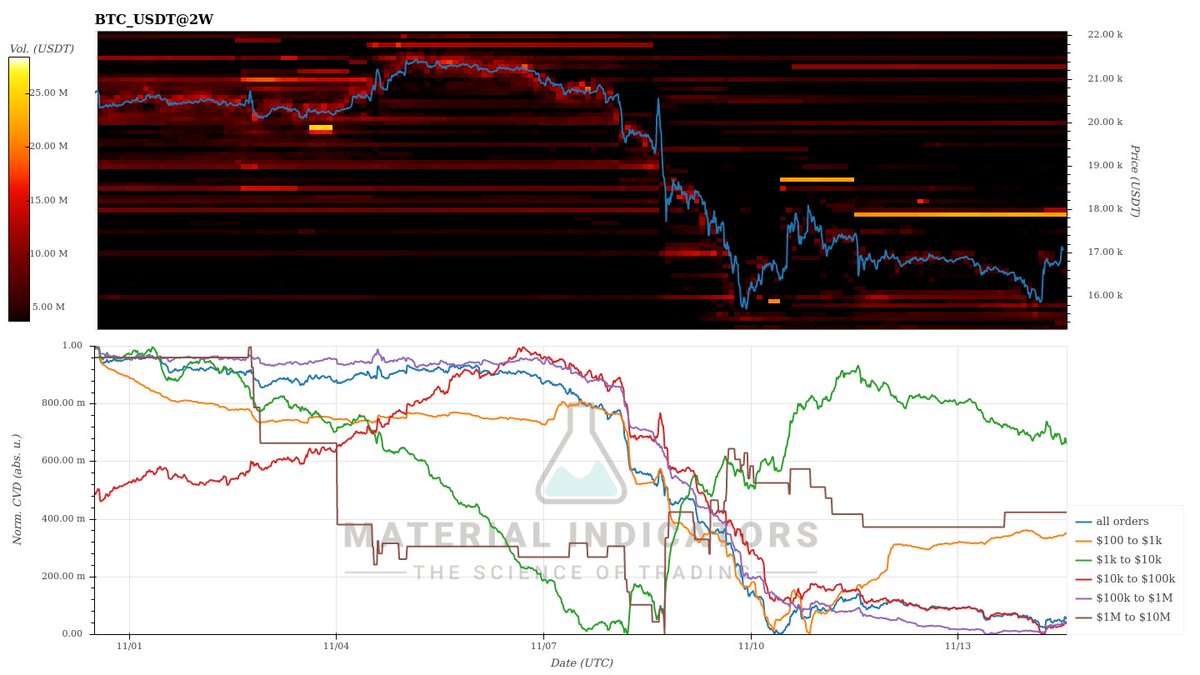

I guess just a coincidence, but you remember the super pump driven by FTX buying 75,000 BTC in July 21st, 2021? That was 3 weeks after the Farmington State Bank became member of the FED system. I would like to see their books tbh. /6

I need to add another source here, thats proofs that Jean Chalopin was CEO of Farmington State Bank in 2020.

sec.gov/Archives/edgar…

sec.gov/Archives/edgar…

• • •

Missing some Tweet in this thread? You can try to

force a refresh