So today was the first day I started to delve into @summitnational the bank that #nexo announced end of Sep 2022 that it had taken an undisclosed stake in and a 'game changer for the industry'.

Does anyone remember that song "pretty fly for a white guy"

well of summit's directors is way more fly than that guy. back in 2011 said director managed to launch his #Porshe 35 feet in the air into the second story of a house.

So the next thing I found out about @summitnational isn't as cool as the flying Porshe guy. But I thought it was pretty interesting. Is that most of the current directors are not from the US.

Current board/officers include 2 #russian's and 1 from #austria. I've mapped out some of their legacy networks but its incomplete...I'll post when its in better shape.

but one thing I will say there appears to be an emerging thematic and that is - just because located in the US, called a US bank, requires regulatory approval, big, small, rural or run locally doesn't mean its owned or controlled domestically.

When looking at #moonstone I (along with everyone else) puzzled that it could be swooped by offshore interests. As it was it turned out it had been owned by offshore interest since at least 1994 back when it only had $1.6m in deposits

So no one really should be too surprised that an international group like #Nexo is buying into a local bank.

Since Nexo originated from #bulgaria and the bank they are investing into has a couple of #russian directors doesn't appear unreasonable.

Since Nexo originated from #bulgaria and the bank they are investing into has a couple of #russian directors doesn't appear unreasonable.

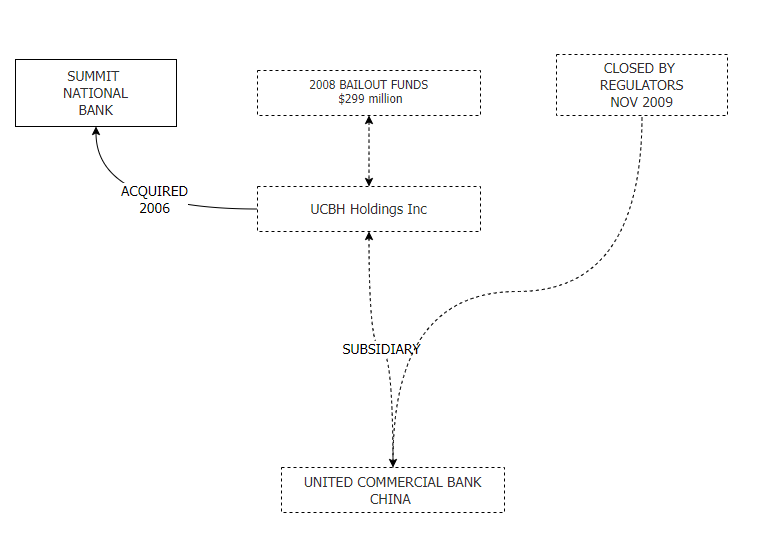

especially when you dig back into the past of Summit and realise it was acquired back in 2006 by a #chinese banking group (which blew up in financial crisis)...I haven't pieced together ownership between then and now.....but I doubt it was breaking any performance records.

I'll get back to the original purpose of these tweets....

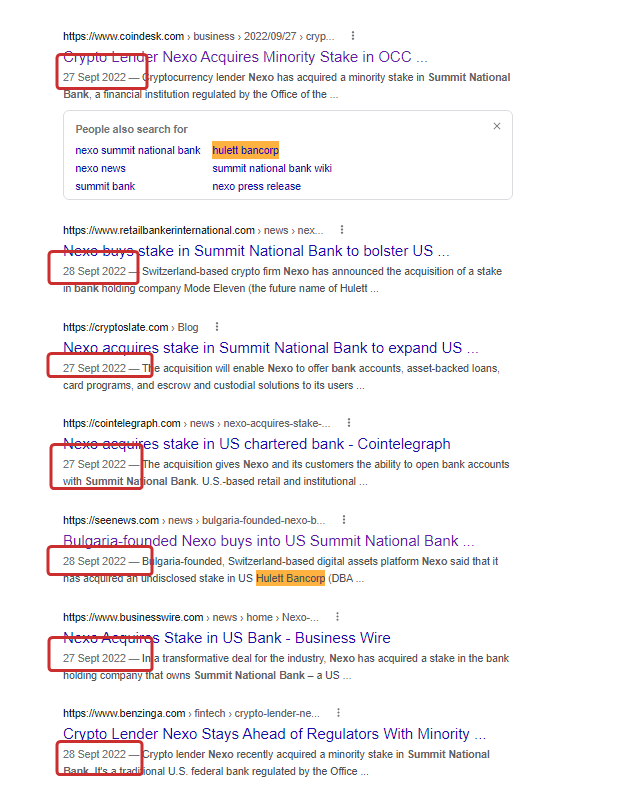

Note the date that the news first broke that #nexo had made an industry changing investment into #summit.

Everyone covered it all at once and the story was consistent and sounded pretty good "industry changer"

Note the date that the news first broke that #nexo had made an industry changing investment into #summit.

Everyone covered it all at once and the story was consistent and sounded pretty good "industry changer"

If you wind back a day...there was some #nexo news that got some coverage but not quite the same amplification...

To be fair it was just #fud. I mean what else could you call 8 US states filing action against a #crypto group?

To be fair it was just #fud. I mean what else could you call 8 US states filing action against a #crypto group?

and you have to feel bad for whoever was running the #PR campaign for 'industry changing announcement'. imagine having the game changer of all game changers dropping the day after being #fudded by 8 jealous regulators. Talk about bad timing.

You then have to ask the question....when did #nexo actually make the investment into @summitnational

and no I don't have a definative answer (as the filings are not as transparent as Washington in the case of #moonstone

and no I don't have a definative answer (as the filings are not as transparent as Washington in the case of #moonstone

What I can say is there are a few markers that strongly suggest that perhaps #nexo had got involved a fair bit before the end of Sep 2022.

Here's a couple of screenshots to peruse... and make your own mind up

Here's a couple of screenshots to peruse... and make your own mind up

Here's the next year's annual report filing dated 31 December 2021 (nearly a year ago).

Note: the change in directors/officers. There's now 2 Russians and an Austrian in the mix.

Note: the change in directors/officers. There's now 2 Russians and an Austrian in the mix.

Kinda alludes to a change in control.....and I'm betting that #nexo's investment was way before September 2022.....A #fudder might suggest the announcement wasn't just bad timing...more ....maybe we should disclose it before it gets disclosed by the #fudders

• • •

Missing some Tweet in this thread? You can try to

force a refresh