In my opinion, there is a strong chance the majority is about to be caught offguard by this next #altcoin move.

I understand the common wisdom that $BTC leads, everything follows later.

At least for now, I am fading that consensus.

#Altcoin Cap / $BTC

Thread 🧵...

1/

I understand the common wisdom that $BTC leads, everything follows later.

At least for now, I am fading that consensus.

#Altcoin Cap / $BTC

Thread 🧵...

1/

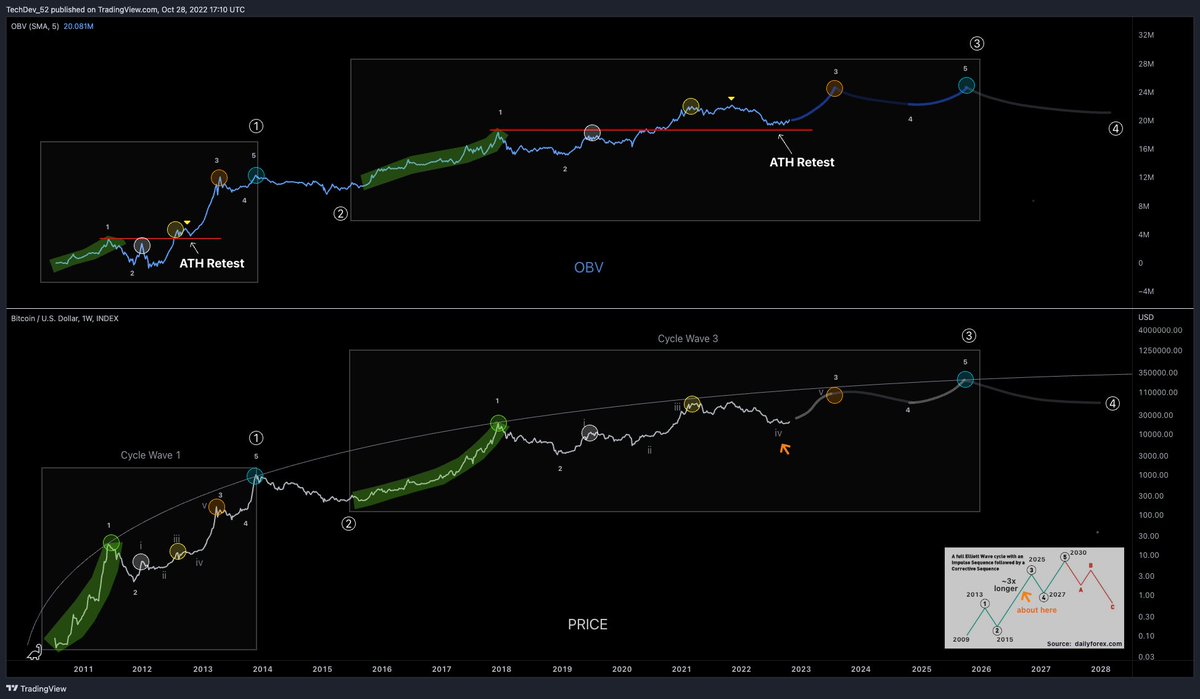

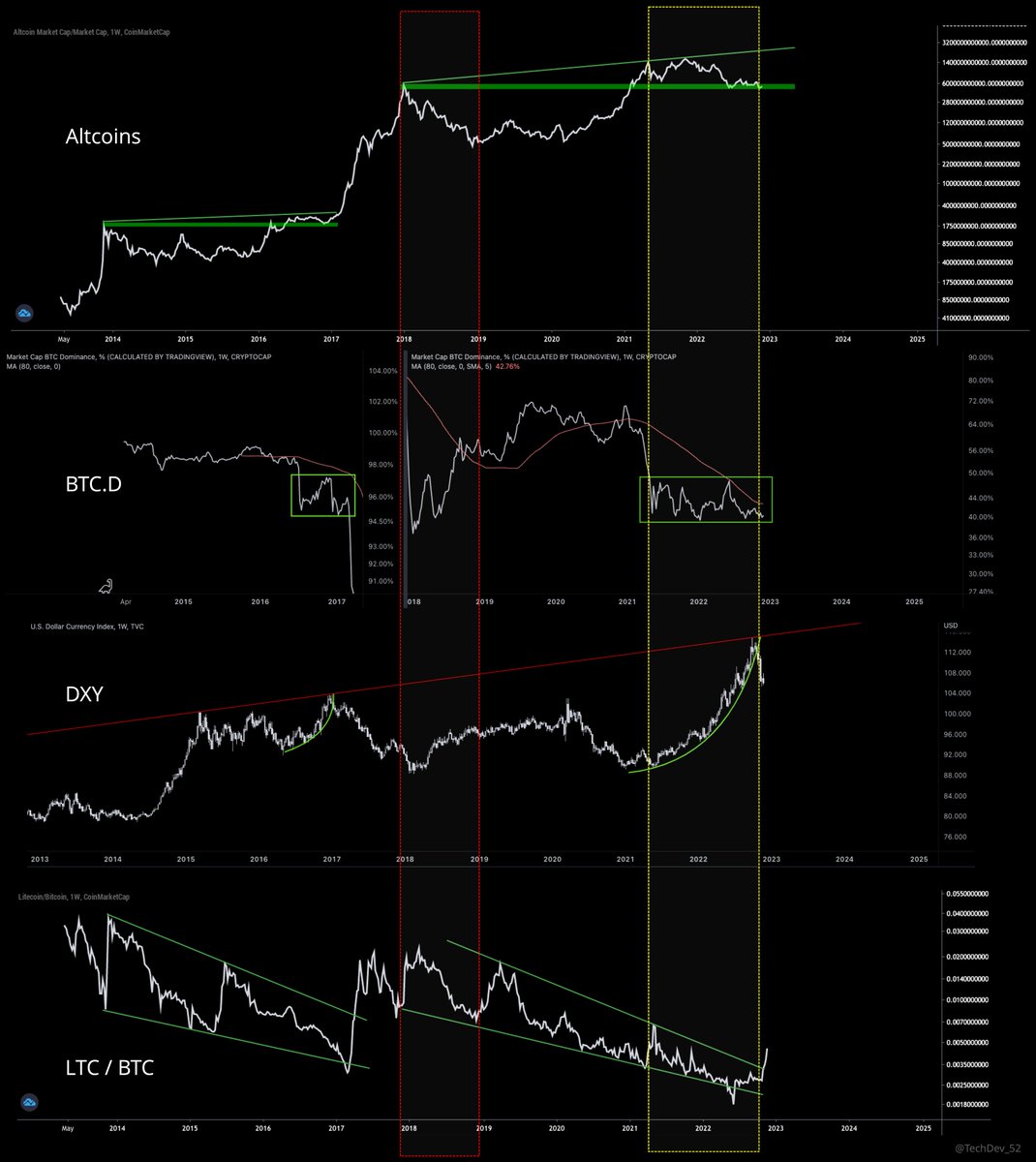

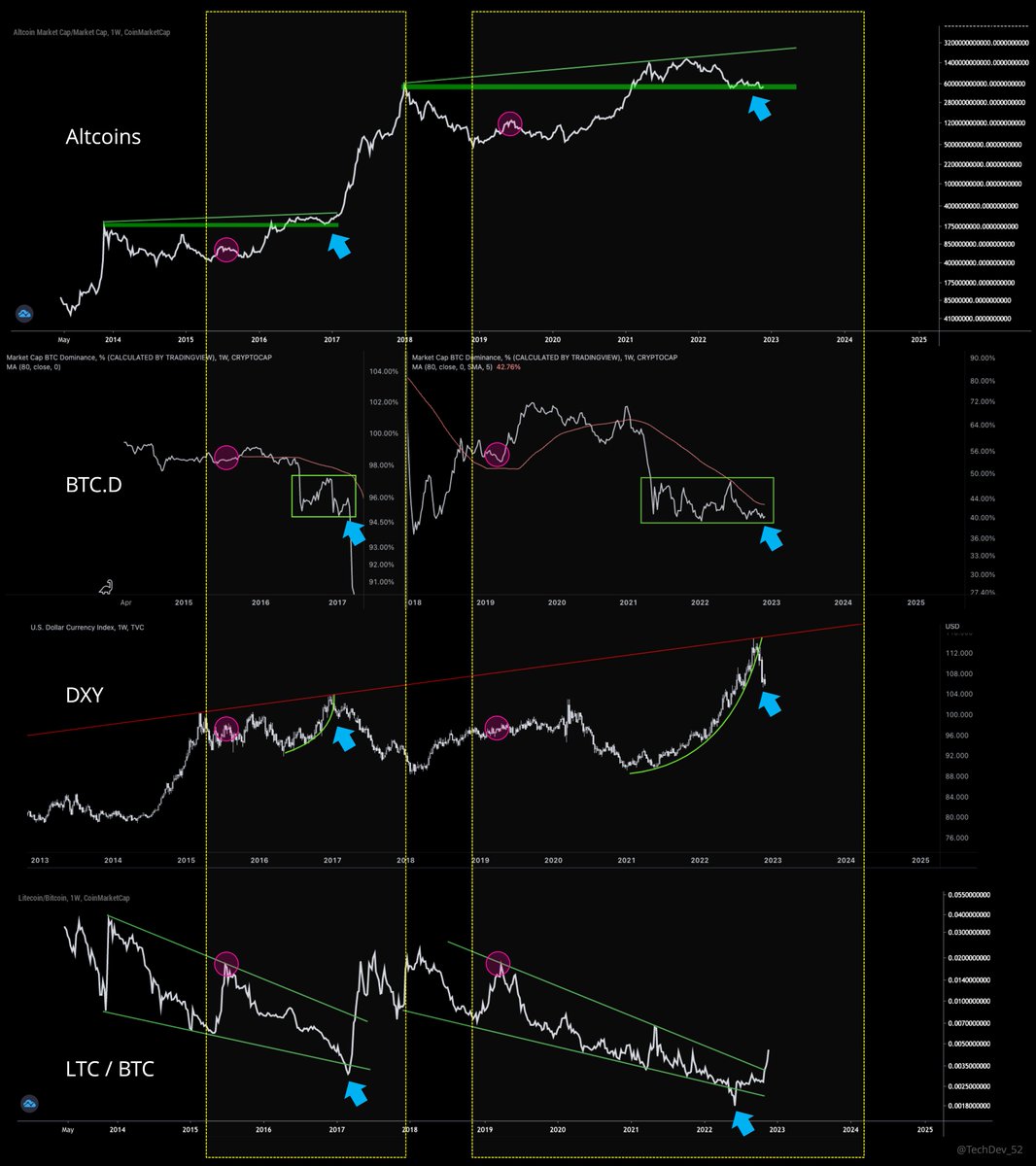

A problem with arbitrarily dividing the market into discrete "cycles", based on arbitrary definitions of "bear markets", is it may leave you blind to the rest of it.

Not all 80% corrections are created equal.

Last 2 shown. See the difference in literally everything else?

2/

Not all 80% corrections are created equal.

Last 2 shown. See the difference in literally everything else?

2/

Why?

Because imo, this year+ #Bitcoin correction sits in an entirely different macro wave position from the last.

3/

Because imo, this year+ #Bitcoin correction sits in an entirely different macro wave position from the last.

3/

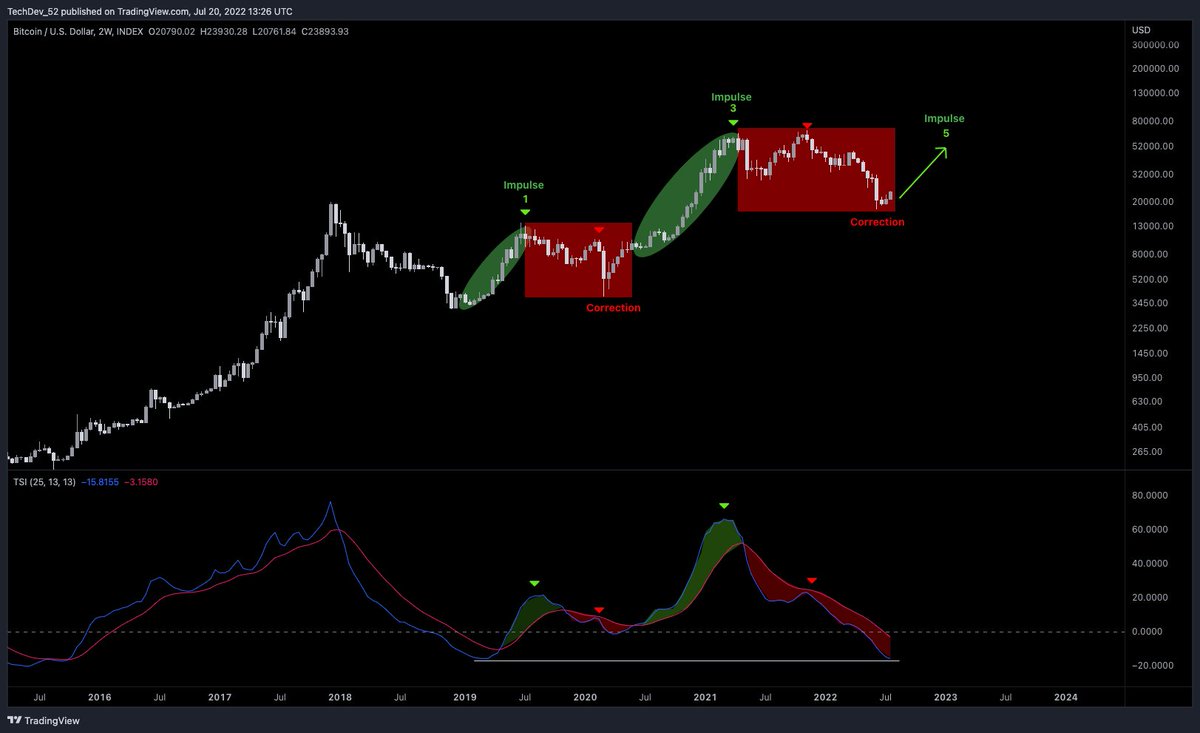

Flip TOTAL2/BTC from the OP upside down.

Basically $BTC.D (Bitcoin dominance).

I believe we're seeing HTF redistribution.

Now, distribution and accumulation can be deceptively similar, where folks often mistake the "spring" for the last SOW.

Volume gives it away imo.

4/

Basically $BTC.D (Bitcoin dominance).

I believe we're seeing HTF redistribution.

Now, distribution and accumulation can be deceptively similar, where folks often mistake the "spring" for the last SOW.

Volume gives it away imo.

4/

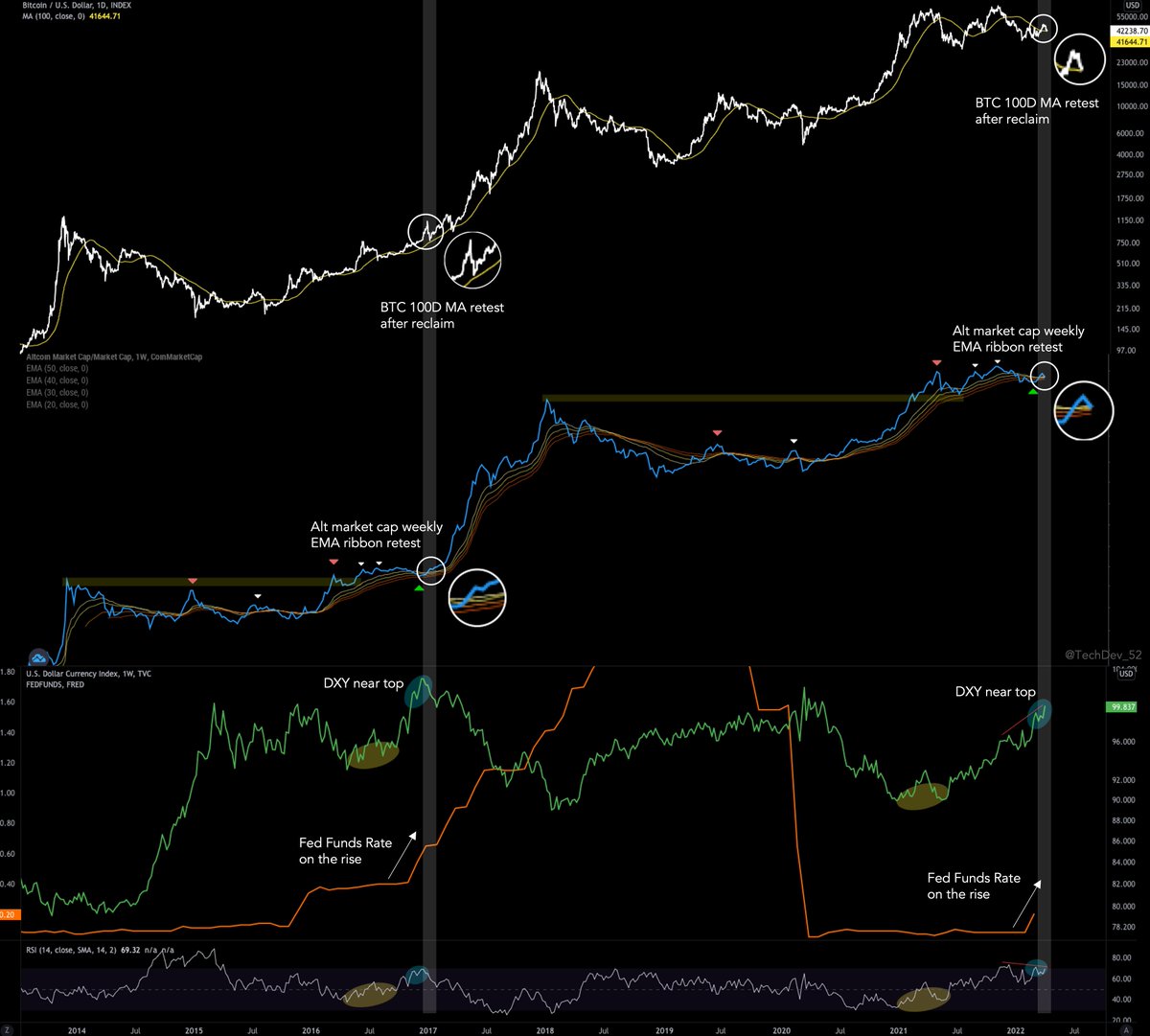

Don't get me wrong, I expect #Bitcoin to move swiftly out of its correction.

A confirmed "breakdown" likely sends it to new "lows" sooner than most think.

Doesn't matter what you call the wedge.

Correction. "Bull" market.

It's a continuation pattern for me.

5/

A confirmed "breakdown" likely sends it to new "lows" sooner than most think.

Doesn't matter what you call the wedge.

Correction. "Bull" market.

It's a continuation pattern for me.

5/

But, on the balance of everything, I am expecting the #altcoin market to surprise many in 2023.

This market is more complicated than bear or bull.

END/

This market is more complicated than bear or bull.

END/

• • •

Missing some Tweet in this thread? You can try to

force a refresh