Bharat Bond ETF invests in Public-Sector companies' Bonds

This can be your VERY SAFE alternate to FDs, PPF etc.🤯

The LAST date to subscribe in latest issue today😬

Here's everything you need to know about Bharat Bond ETF👇

This can be your VERY SAFE alternate to FDs, PPF etc.🤯

The LAST date to subscribe in latest issue today😬

Here's everything you need to know about Bharat Bond ETF👇

1/ What is Bharat Bond ETF?

- A fund which invests in BONDS

- of Govt owned entities having AAA-rating

- having a target maturity

The latest issue will invest in govt companies' bonds maturing in April, 2033

Does this mean I can't get the money invested till Apr, 2033? Read👇

- A fund which invests in BONDS

- of Govt owned entities having AAA-rating

- having a target maturity

The latest issue will invest in govt companies' bonds maturing in April, 2033

Does this mean I can't get the money invested till Apr, 2033? Read👇

2/ Liquidity and lock-in conditions

No. An ETF is freely tradable on exchanges.

This means that even though the bonds will pay you back money in April, 2033

Just like you sell stocks,

You can sell these bonds to an investor on the exchanges who wants it from you

No. An ETF is freely tradable on exchanges.

This means that even though the bonds will pay you back money in April, 2033

Just like you sell stocks,

You can sell these bonds to an investor on the exchanges who wants it from you

3/ What about Returns?

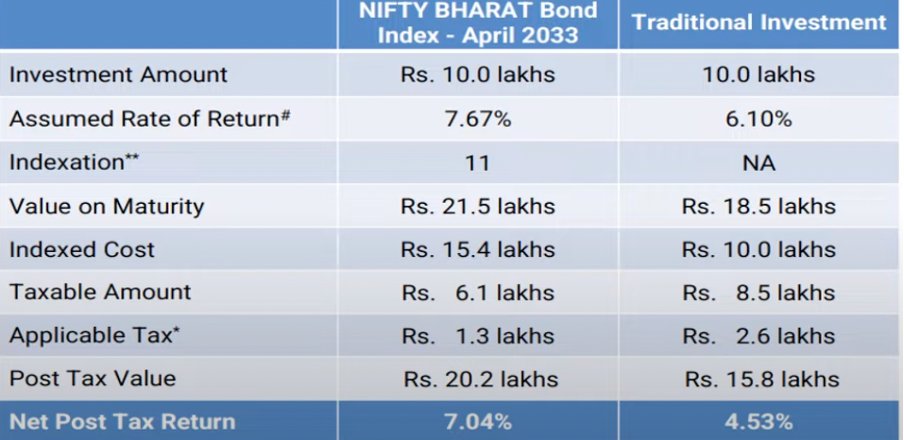

The present day return (YTM) on these public sector bonds is ~7.67%

Your expected returns can be around the same

A comparison between Bharat Bond ETF and FD (at 6.1% interest rate) has been made by Edelweiss AMC👇

The present day return (YTM) on these public sector bonds is ~7.67%

Your expected returns can be around the same

A comparison between Bharat Bond ETF and FD (at 6.1% interest rate) has been made by Edelweiss AMC👇

4/ Are the returns guaranteed?

Just like the debt funds,

the value of a debt fund moves up and down with the change in interest rates

So, if interest rates

--> Go up, value of bonds goes down

--> Go down, value of bonds goes up

In PPF, FD etc. this risk isn't there

Just like the debt funds,

the value of a debt fund moves up and down with the change in interest rates

So, if interest rates

--> Go up, value of bonds goes down

--> Go down, value of bonds goes up

In PPF, FD etc. this risk isn't there

5/ What about costs?

The Bharat Bond ETF comes with lowest possible expense ratio😄

of just 0.0005% 🤯

This is where it beats Debt Mutual Funds having 0.2-0.5% expense ratios

You are getting almost all the interest that these companies are declaring

The Bharat Bond ETF comes with lowest possible expense ratio😄

of just 0.0005% 🤯

This is where it beats Debt Mutual Funds having 0.2-0.5% expense ratios

You are getting almost all the interest that these companies are declaring

6/ Will I have regular income?

No. Unlike FDs, regular coupon payment bonds,

Bharat Bond ETF pays at the end of maturity

But this is rather beneficial from two perspectives:

- Taxation (taxed at just 20% after Indexation)🤩

- Compounding (because you won't withdraw interest)

No. Unlike FDs, regular coupon payment bonds,

Bharat Bond ETF pays at the end of maturity

But this is rather beneficial from two perspectives:

- Taxation (taxed at just 20% after Indexation)🤩

- Compounding (because you won't withdraw interest)

7/ What about risks?

A. Interest Rate Cycle

- As explained in 4/, if interest rates go up, your return might suffer but the chance of principal value of bonds going down is less

B. Default by entities

- The chance of public sector entities default is damn low

A. Interest Rate Cycle

- As explained in 4/, if interest rates go up, your return might suffer but the chance of principal value of bonds going down is less

B. Default by entities

- The chance of public sector entities default is damn low

8/ Who is managing my money?

Bharat Bond ETF is a govt-led initiative only

The bid to run it was won by Edelweiss AMC

Govt launched this initiative because to issue bonds or seek for loans from banks came with a heavy cost

This was a win-win for both public and govt entities

Bharat Bond ETF is a govt-led initiative only

The bid to run it was won by Edelweiss AMC

Govt launched this initiative because to issue bonds or seek for loans from banks came with a heavy cost

This was a win-win for both public and govt entities

Wanna learn more about:

- Technical Analysis

- Mutual Funds

- Fundamental Analysis

- Personal Finance

- Basics of Stock Markets?

Join our community with over 2,200+ learners within 4 months :)

learnpersonalfinance.in

- Technical Analysis

- Mutual Funds

- Fundamental Analysis

- Personal Finance

- Basics of Stock Markets?

Join our community with over 2,200+ learners within 4 months :)

learnpersonalfinance.in

Wanna learn more about Personal Finance and Investing?

Follow me @BahlKanan :)

I post a thread daily

If you liked this thread, kindly retweet the first tweet 👇

And share in your family and friends' WhatsApp groups

Follow me @BahlKanan :)

I post a thread daily

If you liked this thread, kindly retweet the first tweet 👇

And share in your family and friends' WhatsApp groups

https://twitter.com/BahlKanan/status/1600791543270453249?s=20&t=dg_GK4eCN0S_ttBB627xdA

Join our free community to read more Personal Finance stuff for FREE

Make your goal statement and check how much you should invest with our calculators

learnpersonalfinance.in/courses/Learn-…

Make your goal statement and check how much you should invest with our calculators

learnpersonalfinance.in/courses/Learn-…

Disclaimer: This is not an investment advice. Please do your own diligence or consult a SEBI Registered Investment Adviser before taking any decision

#BharatBondETF #bharatbond #etf #investing #investments #stocks #publicsector #indiainvestments #investmentopportunities #alternativeinvestments #investment #investmentopportunities #investmentideas #indiainvestment

• • •

Missing some Tweet in this thread? You can try to

force a refresh