1/42 Interviewing company mgmt. can be a daunting task. You may feel overwhelmed or intimidated jumping on a call with executive leaders. But at the end of the day, going the extra mile gives you a huge investing edge. This #Thread discusses this topic & 8 interview process tips.

2/42 By the way, this #Thread is longer than recommended by the “experts.” However, I wanted to put a lot of thought into the mgmt. interview process topic for those who are deeply into #stockpicking or want to learn how to pick stocks. Investing successfully requires effort.

3/42 It helps to realize that you shouldn't be intimidated by mgmt. Many want to tell their story, especially in #microcap land. I can’t tell you how many times I've reached out to a CEO of a #microcap/nanocap co. who basically said:“wow, investors never call us, let’s chat”.

4/42 To show you how comfortable and valuable a chat with company management can be, here is a clip from a #FireSide chat @BobbyKKraft conducted with the CEO of $RELL, one of our (@geoinvesting) best performing stocks in a tough 2022 (~85%).

5/42 Now, let’s dive into 8 tips to ensure you have engaging and meaningful dialogues between you and company management teams. #ManagementInterviews

6/42 Interview Tip 1: Get Ready - A great way to calm your nerves is to prepare, prepare, prepare! CEOs are busy; respect their time. Doing homework before a call makes for a fluid conversation, helps you ask questions as the convo progresses & earns the respect of management.

7/42 It helps to start a conversation with an icebreaker by letting mgmt. know that you've done your homework by reading press releases, conference call transcripts & SEC filings. Right from the get-go, throw out a few facts or a business summary to show you've done your work.

8/42 It's beneficial to establish a script of the right questions. This will help you get the most from your time to gather as much info as you can on the 1st call with management, when you have their ear. You never know when they'll have time for a follow-up call.

9/42 In preparation of each interview, I create a shared $GOOG doc that my team and I populate with news, history, SEC filing excerpts, financial data & the questions we want to ask, with room for our notes. Here is an example of our $SPOK prep doc:👇

docs.google.com/document/d/1_G…

docs.google.com/document/d/1_G…

10/42 In the case of $SPOK, we want to know:

* As the market leader, how can they grow?

* Why do many investors “hate” the Co?

* Can the 15% div yield be maintained

* At a P/S of 1x, why are shares selling under the 13x sales multiple that its comp $VCRX, got acquired for by $SYK

* As the market leader, how can they grow?

* Why do many investors “hate” the Co?

* Can the 15% div yield be maintained

* At a P/S of 1x, why are shares selling under the 13x sales multiple that its comp $VCRX, got acquired for by $SYK

11/42 Some questions to ask any Co. include:

* Where are products and services in their life cycle & when were most recent offerings launched?

* How long does it take new sales reps to start being effective?

* One of my favs:What are plans to gain more rev from current customers?

* Where are products and services in their life cycle & when were most recent offerings launched?

* How long does it take new sales reps to start being effective?

* One of my favs:What are plans to gain more rev from current customers?

12/42 I like to find out if a company works closely with analysts if estimates are published. If they don’t, I’m going to probably put less trust in those estimates. Furthermore, I’ll be able to gain an edge over the street if I think analyst estimates are too low or too high.

13/42 Dive into each segment’s revenue, margins and growth prospects. One bad segment can punish valuations even if other segments are humming. You also want to know if a weaker segment is “siphoning” cash flow from stronger segments. #ManagementInterviews

14/42 You might want to ask management if there is seasonality in a company’s quarter-to-quarter performance & how big of an impact it makes. Ask them if they're doing anything to take a reactive approach to these trends, or if they even can. How does it impact cash flow needs?

15/42 Interview Tip 2: Background- I start every interview by asking management about past business ventures, leading up to their current position & challenges they've faced & how they got through them.This gives me some level of confidence that they won't make the same mistakes.

16/42 Something I’ve learned throughout my 30+ yrs of investing is that common mistakes management make surround sales & marketing issues & product launch mishaps. In the end, it’s refreshing to hear mgmt. admit their mistakes as you diagnose if they’ve really learned from them.

17/42 In fact $INX.V $INXSF CEO’s admission of miscalculations made on the sales/marketing front when he was appointed CEO, combined with how quickly he successfully addressed his mistakes gave me early insight into his ability to solve problems when I first spoke to him in 2019.

18/42 Here is a recent video clip from a live business update call I hosted for @Geoinvesting with the CEO of $INX.V $INXSF, where he reminisced about a sub-optimal marketing strategy he put in place and his solution to address the issue. It’s currently one of my favorite stocks.

19/42 Interview Tip #3 - Exploring a company's #revenue and #earnings potential. Ultimately, this topic will provide insight into what type of valuation to assign to a stock. #ManagementInterviews

20/42 As you may already know, I am pounding the table that earnings will be more important than ever as we transition into a new #GARP bull market.

https://twitter.com/majgeoinvesting/status/1583148503911387138

21/42 Start by addressing the most recent financials & if there are notable industry/company-specific trends worth noting. You can cross-reference #EarningsReports & SEC filings of comps for some confirmation that mgmt. is aware of trends that might impact growth trajectories.

22/42 I like to look for companies that emphasize #ProfitableGrowth, not just growing sales to gain #MarketShare. Ask the company what's more important to them, sales or earnings? Here’s what Peter Lynch has to say about earnings:

23/42 Ask manufacturers of products capacity-related questions to assess growth. How is #Manufacturing capacity being utilized? When at or near total capacity, what kind of capital expenditures will be needed to expand capacity? Can excess capacity needs be outsourced?

24/42 Portfolio manager @AbrilQuim centers his investment strategy around analyzing a company’s key performance indicators (KPIs) that can impact revenue, earnings and growth potential. In case you missed it, I dive into this topic with Quim in this clip:

https://twitter.com/majgeoinvesting/status/1569749675091316738

25/42 Interview Tip #4 - Exploring a company's margins. At this point, you and management will have established some rapport, and it's critical to start digging deeper into the company's earning power. #ManagementInterviews

26/42 You’ll want to find out where the company is in its margin cycle. Catching margin expansion in the early innings can lead to great multibaggers such as $RWWI, which is trading at an all-time high and up 425% since @GeoInvesting initiated coverage on the stock in 2019.

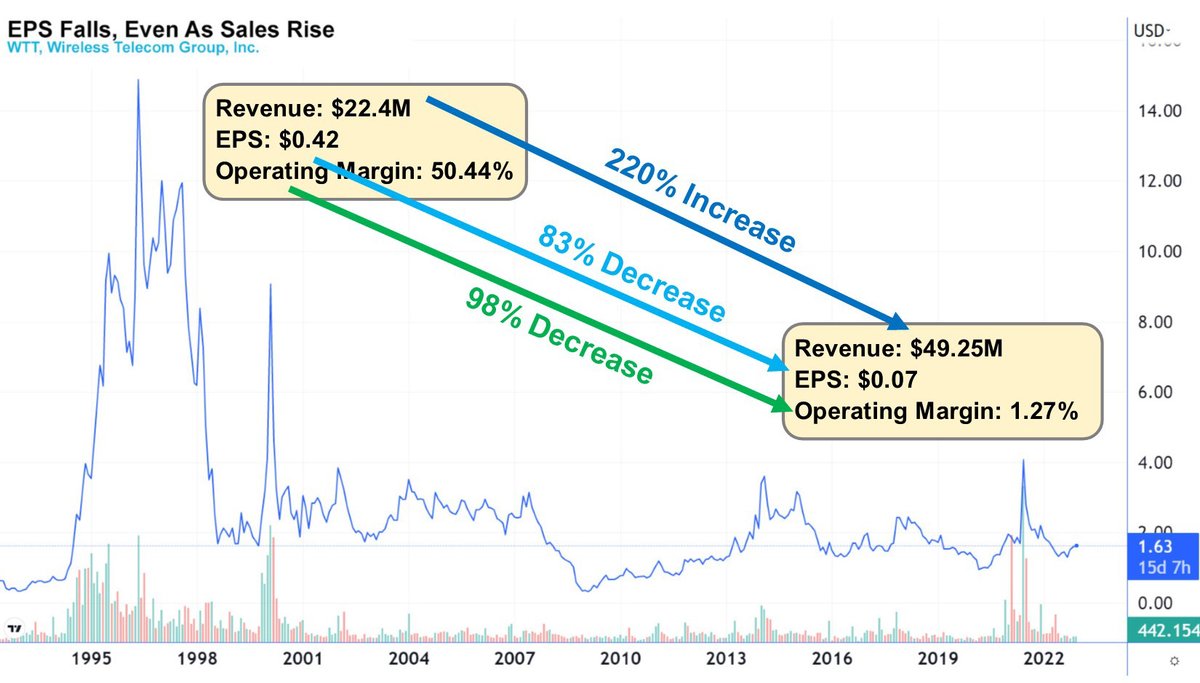

27/42 Conversely, investing at the top of a margin cycle can be devastating, as shown in this case study chart of $WTT, a stock I briefly owned in the early 90's.

28/42 Be specific when you’re talking about #margins by discussing the components of #GrossMargins AND #OperatingMargins, separately. A great multi-bagger set-up is finding a company with growing rev & expanding gross margins, where operating expenses are flattening/decreasing.

29/42 Another important line of questioning involves segment margins. Ask what segments are expected to outperform and follow up by asking if any special emphasis will be placed on certain segments based on that information. #ManagementInterviews

30/42 On the flipside, you’re also going to want to find out if underperforming segments may experience margin expansion, possibly giving a huge lift to earnings per share, surprising the market. #ManagementInterviews

31/42 Don’t forget to discuss the company’s margins as it compares to some of its competitors. Ask what they plan to do to exceed or approach target industry margins, given their current position. #ManagementInterviews

32/42 On a side note, you may want to interview companies with the weakest industry margins to find out if they have a chance for improving them. If you #ShortStocks, a similar approach should be used for margin leaders in an industry. Can they maintain them?

33/42 Interview Tip #5 - Exploring a company's #FinancingNeeds. Need for capital is one of the most important topics you can discuss with company management. Does the company have enough money to support current operations AND growth?

34/42 Assessing a company's #liquidity needs is more important than ever given the risky interest rate environment we're in. Investors are going to punish comps that are in dire need to raise capital or execute a business plan.The days of free money at absurd valuations are over.

35/42 Interview Tip 6 - Exploring #AnalystCoverage. Smaller firms struggle to get market visibility, but many may attract analyst coverage that the market has yet to notice. Analyst coverage is a double-edged sword- great when companies beat estimates,but not when they miss them.

36/42 Understanding when a stock goes down due to missing analyst estimates, even when the growth was lights out, could create a #BuyingOpportunity, as well as when investors have not noticed that estimates haven't been adjusted upward after bullish developments.

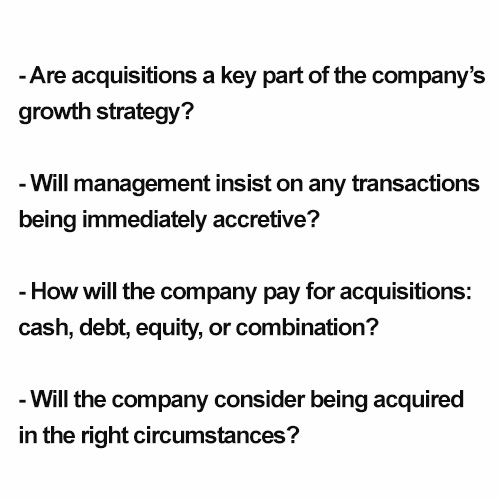

37/42 Interview Tip #7 - Diving into acquisitions. A vital part of the interview process is having a clear understanding of mgmt.'s acquisition strategy. Acquisitions are excellent ways for companies to grow. (See this multibagger case study on $UFPT)

https://twitter.com/majgeoinvesting/status/1593718327414820864

38/42 The right acquisition can create cross selling opportunities, expand geographical footprints, introduce new products/services & create amazing #EarningsPerShare accretion. We love nip & tuck acquisitions with great synergistic possibilities. They can also be less dilutive.

39/42 Interview Tip #8 - Ask a few concluding questions. It's crucial to keep notes while you interview a company management team. That way, you can refer back to your notes and ask any follow-up questions you had on certain points during the interview. #ManagementInterviews

40/42 At the end of the day, perfecting an #InterviewScript takes time and may push you out of your comfort zone, so don't freak out if things don't fall into place immediately.

41/42 Thanks for taking the time to read this thread. Our team at @Geoinvesting is having fun putting these #threads together. If you enjoyed this or got something positive out of it, please favorite & retweet. Get our complimentary newsletter:

tinyurl.com/nhkhtrpy

tinyurl.com/nhkhtrpy

42/42 If you're interested in receiving updates on an Interview Cheat Sheet that we're building to be used in preparation for management interviews and fireside chats, get alerted here.

tinyurl.com/yc68fabc

tinyurl.com/yc68fabc

• • •

Missing some Tweet in this thread? You can try to

force a refresh