We all experiencing a very long bear market in #Bitcoin and #cryptocurrencies. We are about -77% in #Bitcoin price and below -90% in many altcoins🩸 In the following 🧵we want to show why we see this as an opportunity not the other way around.Your Stockmoney Lizards🦎

The market situation of #Bitcoin is often referred to as dead and there is no shortage of postulating new lows.

-12k, -10k (very popular), -8k or even -6k🩸🩸🩸 Everything is possible, but much is priced in already. We trade the future, not the present😘

-12k, -10k (very popular), -8k or even -6k🩸🩸🩸 Everything is possible, but much is priced in already. We trade the future, not the present😘

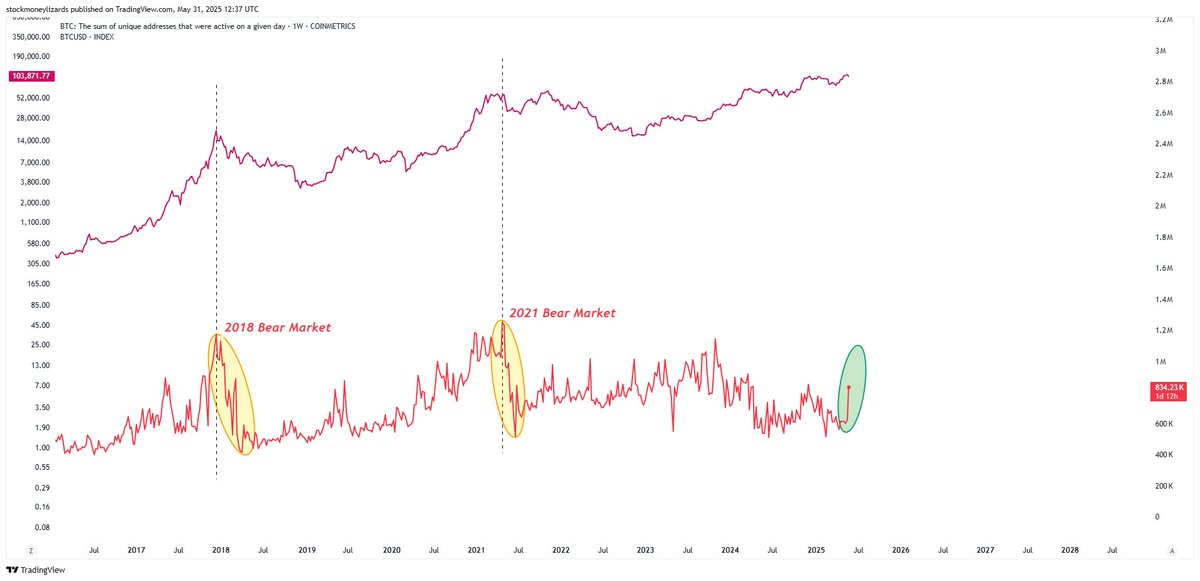

Currently, we have the 4th major bear market in #Bitcoin. Compared to the last bear markets, there are clear patterns that repeat themselves🧊

We think we are at the end of the current bear market. All bear markets show falling wedge formation that needs to be broken.

We think we are at the end of the current bear market. All bear markets show falling wedge formation that needs to be broken.

In fact, there is always a so-called washout phase at the end, when many investors (most likely retail investors) leave the market. This is the last phase before the accumulation phase of #Bitcoin beginns.

Overall, the current bear market is marked by the post Covid-19 era. Inflation, Recession, increasing interest rates. In the end, however, it must be noted that #Bitcoin is an asset, not a stock with no earnings. #BTC is and remains inflation proof due to well known reasons.

Many technical indicators are literally screaming overbought. This is from the Markoanalyse always a good sign to enter a strong HODL position🧋

Note, we are not talking about short-term trading. #Bitcoin

Note, we are not talking about short-term trading. #Bitcoin

The history of Bitcoin is lined with crash and so-called black-swan events. Especially the crypto exchanges play a special role here🥲

#FTX was and is such an event. But one thing is for sure, #Bitcoin will recover.

#FTX was and is such an event. But one thing is for sure, #Bitcoin will recover.

Especially the investment cycle of 2015 shows clear parallels and to the current market situation. Like today, at the end of the bear market and after final washout, the #Bitfinex crash happened (like #FTX crash now) 🦢

Currently, the price action of #Bitcoin looks very similar to 2015, although the macroeconomic circumstances are much worse. A popular comment under the tweets is: "this time is different" 🤡

Richard Wykoff, a famous stock investor, has described different market phases. One of the most interesting is the accumulation phase #Bitcoin is in. The Wykoff accumulation is divided into 5 phases, we are in phase C (Spring)🍿

It may well be that we still see a sideways price movement for a while, but we think that the worst is behind us, and especially technically speaking, there is hardly any room for 10k. The probability for the upward movement is much higher.

DYOR. Your Stockmoney Lizards🦎🦎🦎

DYOR. Your Stockmoney Lizards🦎🦎🦎

Props to my CT family:

@TheRealPlanC

@TATrader_Alan

@el_crypto_prof

@seth_fin

@MikybullCrypto

@moonshilla

@GameofTrades_

🔥🔥🔥🔥

@TheRealPlanC

@TATrader_Alan

@el_crypto_prof

@seth_fin

@MikybullCrypto

@moonshilla

@GameofTrades_

🔥🔥🔥🔥

• • •

Missing some Tweet in this thread? You can try to

force a refresh