Thread🧵of Sector Analysis

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil / @caniravkaria (Views Invited)

Covers #TechnicalAnalysis of most #sectors.

Courtesy : @YTA_School

Retweet🔁Like❤️to spread learning with all.

@KommawarSwapnil / @caniravkaria (Views Invited)

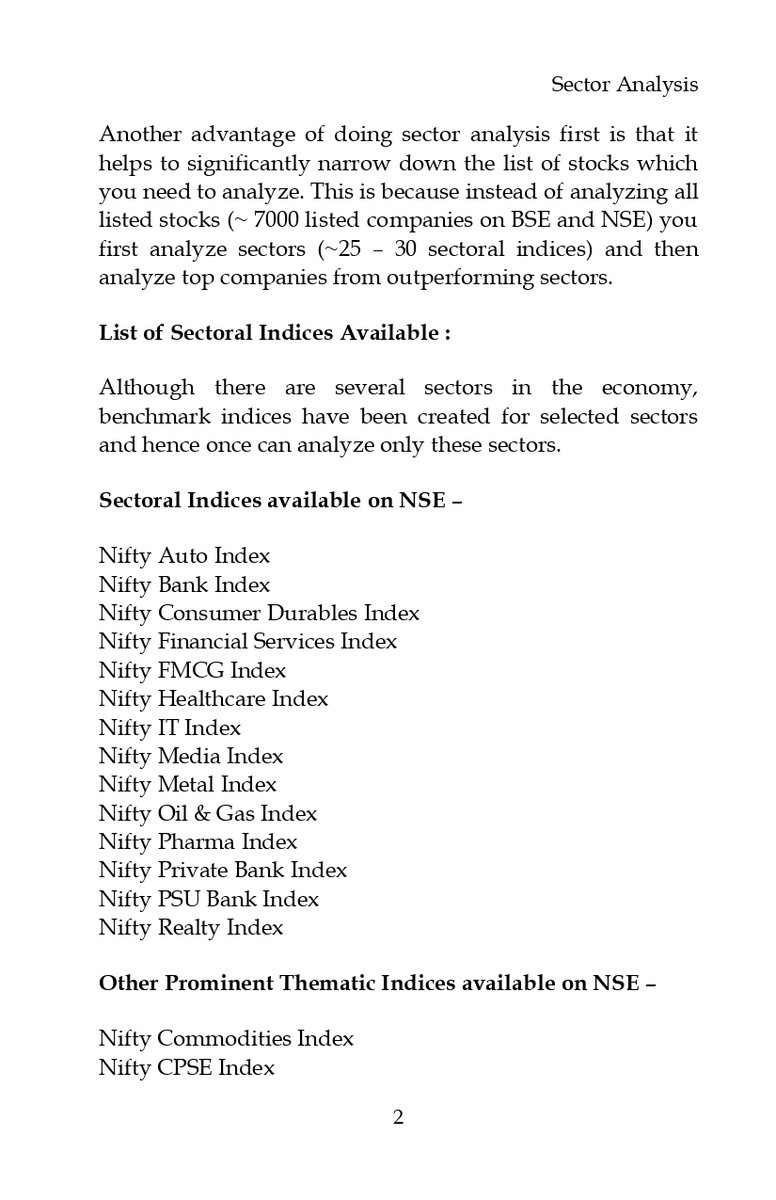

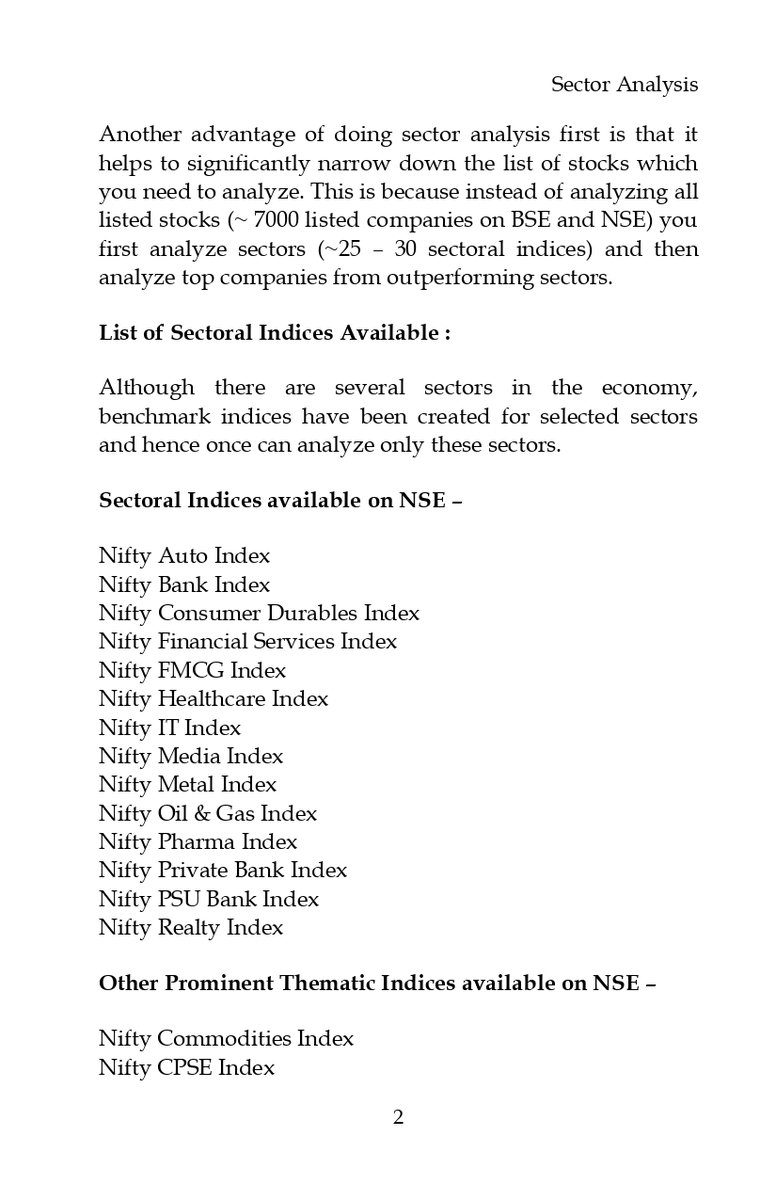

1⃣ Why Sector Analysis is Must ?

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

📘available on Amazon👉 amzn.to/3RJLYkd

#StockMarket #tradingcards

Read these 2 Pages from the Book 📘 "Relative Strength With Technical Analysis by @YTA_School

📘available on Amazon👉 amzn.to/3RJLYkd

#StockMarket #tradingcards

2⃣ NIFTY 50

Nifty was trading in short term downtrend channel. On 21 December it gave breakdown on lower end & after than nifty started correcting even more, losing more than 3.5% in just 3 trading days.

Next support is around 17650 – 17400.

#Nifty #Nifty50 #TechnicalAnalysis

Nifty was trading in short term downtrend channel. On 21 December it gave breakdown on lower end & after than nifty started correcting even more, losing more than 3.5% in just 3 trading days.

Next support is around 17650 – 17400.

#Nifty #Nifty50 #TechnicalAnalysis

3⃣ NIFTY SMALLCAP 100

Double top was formed followed by two higher lows & later strong consolidation was seen. Due to bad market sentiments, breakout happened on downside confirming further weakness.

Next support around 7920.

#NiftySmallcap #Smallcaps #TechnicalAnalysis

Double top was formed followed by two higher lows & later strong consolidation was seen. Due to bad market sentiments, breakout happened on downside confirming further weakness.

Next support around 7920.

#NiftySmallcap #Smallcaps #TechnicalAnalysis

3⃣ NIFTY MIDCAP 100

From couple of weeks, sector was consolidating at resistance. We were expecting breakout on upside but due to external situations, we again saw strong selling at that area.

Support @ 30100 (unlikely to hold). Next support @ 28500.

#NiftyMidcap #Midcaps

From couple of weeks, sector was consolidating at resistance. We were expecting breakout on upside but due to external situations, we again saw strong selling at that area.

Support @ 30100 (unlikely to hold). Next support @ 28500.

#NiftyMidcap #Midcaps

4⃣ NIFTY AUTO

Sector which was looking strong suddenly met with huge selling pressure & formed double top.

Currently very close to previous resistance @ 12235. We need to closely watch weekly closing to confirm if resistance turns into support or we see a breakdown.

#CNXAuto

Sector which was looking strong suddenly met with huge selling pressure & formed double top.

Currently very close to previous resistance @ 12235. We need to closely watch weekly closing to confirm if resistance turns into support or we see a breakdown.

#CNXAuto

5⃣ #BankNifty

Index closed slightly below support area ~ 41700 on daily closing basis. But there still exists small hope for bulls if resistance turns into support & banking stocks start moving up.

If not, then expect banknifty falling to 40850.

#TechnicalAnalysis

Index closed slightly below support area ~ 41700 on daily closing basis. But there still exists small hope for bulls if resistance turns into support & banking stocks start moving up.

If not, then expect banknifty falling to 40850.

#TechnicalAnalysis

6⃣ NIFTY COMMODITY

The sector on monthly chart trying to show some strength for long term. If breakout occurs on upside above 6445 then sector can see strong rally.

Looking at current situation, it looks like sector may stay in consolidation for some time.

#TechnicalAnalysis

The sector on monthly chart trying to show some strength for long term. If breakout occurs on upside above 6445 then sector can see strong rally.

Looking at current situation, it looks like sector may stay in consolidation for some time.

#TechnicalAnalysis

7⃣ NIFTY ENERGY

Till last week we were looking for strong breakout on upside but due to global covid scare, we got strong breakout on downside. If weakness continues sector can see further selling till 22970.

Currently staying away from energy stocks is best thing to do.

Till last week we were looking for strong breakout on upside but due to global covid scare, we got strong breakout on downside. If weakness continues sector can see further selling till 22970.

Currently staying away from energy stocks is best thing to do.

8⃣ NIFTY FMCG

FMCG sector is one of strongest sectors in entire market.

Although there has been some fall due to overall weakness in market, sector can bounce back from up trending channel levels of 43840 and bounce back to test levels of 46850.

#NiftyFMCG #TechnicalAnalysis

FMCG sector is one of strongest sectors in entire market.

Although there has been some fall due to overall weakness in market, sector can bounce back from up trending channel levels of 43840 and bounce back to test levels of 46850.

#NiftyFMCG #TechnicalAnalysis

9⃣ NIFTY IT

After giving a fake breakout couple of weeks back, sector is back inside consolidation zone.

Since consolidation is near to strong support area, once can assume that sector will again take support around 26100.

Keep sector in watchlist.

#NiftyIT #TechnicalAnalysis

After giving a fake breakout couple of weeks back, sector is back inside consolidation zone.

Since consolidation is near to strong support area, once can assume that sector will again take support around 26100.

Keep sector in watchlist.

#NiftyIT #TechnicalAnalysis

🔟NIFTY INFRA

After upside breakout couple weeks back, sector has seen serious profit booking in just 1 week due to bad market sentiments. Sector is back again to test resistance which shall now act as support. Can likely take support around 5080.

#NiftyInfra #TechnicalAnalysis

After upside breakout couple weeks back, sector has seen serious profit booking in just 1 week due to bad market sentiments. Sector is back again to test resistance which shall now act as support. Can likely take support around 5080.

#NiftyInfra #TechnicalAnalysis

1⃣1⃣ NIFTY MEDIA

For last few months, I was having lots of hope from this sector as it was rising forming higher highs. But due to market conditions, momentum got broken & strong selling pressure came in. If sector breaks below 1800 then expect more downfall.

#NiftyMedia

For last few months, I was having lots of hope from this sector as it was rising forming higher highs. But due to market conditions, momentum got broken & strong selling pressure came in. If sector breaks below 1800 then expect more downfall.

#NiftyMedia

1⃣2⃣ NIFTY METAL

Metal is also another sector which made a double top and had strong selling this week. The selling may continue till the support level around 5650.

Better to stay away from this sector.

#NiftyMetal #TechnicalAnalysis

Metal is also another sector which made a double top and had strong selling this week. The selling may continue till the support level around 5650.

Better to stay away from this sector.

#NiftyMetal #TechnicalAnalysis

1⃣3⃣ #NiftyPharma

With covid back in news, from past 3 days we see lot of pharma & healthcare stocks back in action, but same cannot be seen on chart of cnx pharma.

To be convinced about uptrend, sector first needs to trade above 13222 & later needs to close above 13740.

With covid back in news, from past 3 days we see lot of pharma & healthcare stocks back in action, but same cannot be seen on chart of cnx pharma.

To be convinced about uptrend, sector first needs to trade above 13222 & later needs to close above 13740.

1⃣4⃣ NIFTY PSU BANK

After strong rally nearly giving multiyear breakout, sector saw sharp correction thanks to overall market sentiment. Sector can soon go into consolidation.

Avoid adding new positions & keep stop loss in stocks you are holding.

#NiftyPSUBanks

After strong rally nearly giving multiyear breakout, sector saw sharp correction thanks to overall market sentiment. Sector can soon go into consolidation.

Avoid adding new positions & keep stop loss in stocks you are holding.

#NiftyPSUBanks

1⃣5⃣ NIFTY PVT BANKS

Recent breakout turned out to be false & strong reversal was seen thanks to overall bad market sentiments.

Minor support area @ 20900 followed by next support around @ 19680.

Currently avoid buying any private bank.

#NiftyPVTBanks #TechnicalAnalysis

Recent breakout turned out to be false & strong reversal was seen thanks to overall bad market sentiments.

Minor support area @ 20900 followed by next support around @ 19680.

Currently avoid buying any private bank.

#NiftyPVTBanks #TechnicalAnalysis

1⃣6⃣ NIFTY REALTY

Sector was looking promising couple of weeks back but current selling pressure has put breaks on strong rounding recovery for the sector.

Currently its best to stay away from sector as it can fall sharply & can try to reach lower rounding line.

#NiftyReality

Sector was looking promising couple of weeks back but current selling pressure has put breaks on strong rounding recovery for the sector.

Currently its best to stay away from sector as it can fall sharply & can try to reach lower rounding line.

#NiftyReality

1⃣7⃣ NIFTY HEALTHCARE

Increasing Covid cases worldwide has created panic in market but healthcare sector has not shown any great up move.

To be convinced about the reversal, sector needs to close above 8375.

#NiftyHealthcare #TechnicalAnalysis

Increasing Covid cases worldwide has created panic in market but healthcare sector has not shown any great up move.

To be convinced about the reversal, sector needs to close above 8375.

#NiftyHealthcare #TechnicalAnalysis

1⃣8⃣ NIFTY OIL AND GAS

Since few days sector was consolidating, trading above resistance level but due to overall bearish market sentiment, sector saw selling pressure.

If selling continues, sector can go back to the support level of 7810.

#NiftyOilandGas #TechnicalAnalysis

Since few days sector was consolidating, trading above resistance level but due to overall bearish market sentiment, sector saw selling pressure.

If selling continues, sector can go back to the support level of 7810.

#NiftyOilandGas #TechnicalAnalysis

1⃣9⃣ NIFTY CPSE

Sector was looking promising till last week with decent closing above resistance, but current bearish sentiments affected this sector as well.

On weekly timeframe support comes to 2480 & 2260 which is much lower from current level.

#NiftyPSE #TechnicalAnalysis

Sector was looking promising till last week with decent closing above resistance, but current bearish sentiments affected this sector as well.

On weekly timeframe support comes to 2480 & 2260 which is much lower from current level.

#NiftyPSE #TechnicalAnalysis

2⃣0⃣ NIFTY DIGITAL

As mentioned earlier, this sector is in strong consolidation.

Due to current bearish scenario, sector can easily test support level of 4997.

Better to wait. Due to current weakness there are chances that sector may give a breakout on downside.

#NiftyDigital

As mentioned earlier, this sector is in strong consolidation.

Due to current bearish scenario, sector can easily test support level of 4997.

Better to wait. Due to current weakness there are chances that sector may give a breakout on downside.

#NiftyDigital

2⃣1⃣Disclaimer: This is not recommendation on #Sector. Just a case study for educational purpose!

Our team members may be personally invested in stocks of these sectors hence their opinion may be biased.

Consult Financial Advisor before Investing!

#StockMarketIndia #Trading

Our team members may be personally invested in stocks of these sectors hence their opinion may be biased.

Consult Financial Advisor before Investing!

#StockMarketIndia #Trading

• • •

Missing some Tweet in this thread? You can try to

force a refresh