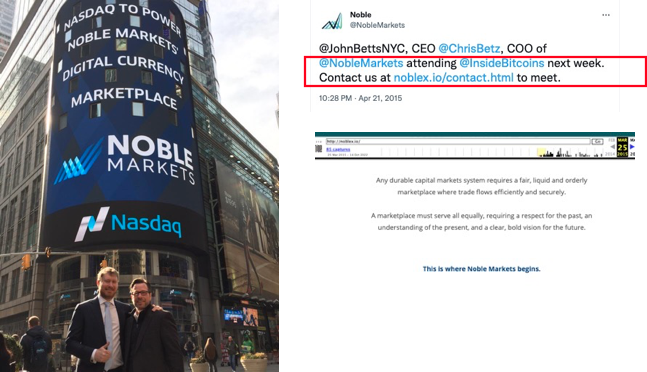

peeps would recognise a few other connected domain names. noblex.io was one of the domains for #nobleinvestment bank.

There were even claims that Noble was Nasdaq's 'trogan horse' into the bitcoin world (ya know...the institutions are coming.....)

But it wasn't a partnership, they didn't trade shit and they ended up being a #deaddonkey and not #troganhorse

But it wasn't a partnership, they didn't trade shit and they ended up being a #deaddonkey and not #troganhorse

the only midly interesting fact about the Noble team/investors were previous cuddle buddies in #sunlotholdings the failed attempt to save the failed exchange #mtgox

where #noble CEO #johnbetts was bag boy for Sunlot . .

where #noble CEO #johnbetts was bag boy for Sunlot . .

oh yeah forgot to mention the little grub #brockpierce

No one really remembers #noblemarkets apart from overstating a partnership with @nasdaq which was more a service relationship i.e. Noble paid Nasdaq.

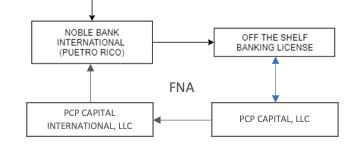

Anyway back to Noble....its main game became #nobleinvestmentbank

which Betsy boy used to promote as the worlds first non-fractionalised bank...vomit vomit....

which Betsy boy used to promote as the worlds first non-fractionalised bank...vomit vomit....

Its worthwhile noting that Roszak and Bettsy sunlot partner Brocky P setup shop down in #puertorico as self appointed #king of #crypto bellends.

I mention this coz non fractionalised first of its kind Nasdaq partnering institutional to digital trogan horse bank #noble wasn't quite all that.

It was actually a very cheap off-the shelf company with a flimsy banking charter incorporated as PCP Capital, renamed PCP Capital International before it was bought from $250k (and $500k bond) and rebranded

But really for all its self promoting fluff #noble really just became #tether and #bitfinex banking bitch

and even took $2m cash to keep itself afloat while it shuffled accounts for #thewiz

and even took $2m cash to keep itself afloat while it shuffled accounts for #thewiz

I'm gonna put a pin in it here. I'm off to the pub to knock back a few coldies.

part 2 and or 3 tomorrow (with or without hangover)

#cryptogang #talltales

part 2 and or 3 tomorrow (with or without hangover)

#cryptogang #talltales

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh