🚨.@Gemini is moving the $100M+ (95.8K) $ETH collected from @GenesisTrading.

Between late 2020 and mid-2021, two #Genesis addresses moved a total of 95.8K ETH to a contract deployed by Gemini.

2022/11/21, the contract transferred $ETH to an EOA that gas provided by Gemini.

Between late 2020 and mid-2021, two #Genesis addresses moved a total of 95.8K ETH to a contract deployed by Gemini.

2022/11/21, the contract transferred $ETH to an EOA that gas provided by Gemini.

That ETH was later moved to the newly created EOA address again, and finally, 2 hours ago, the ETH ended up in the following address:

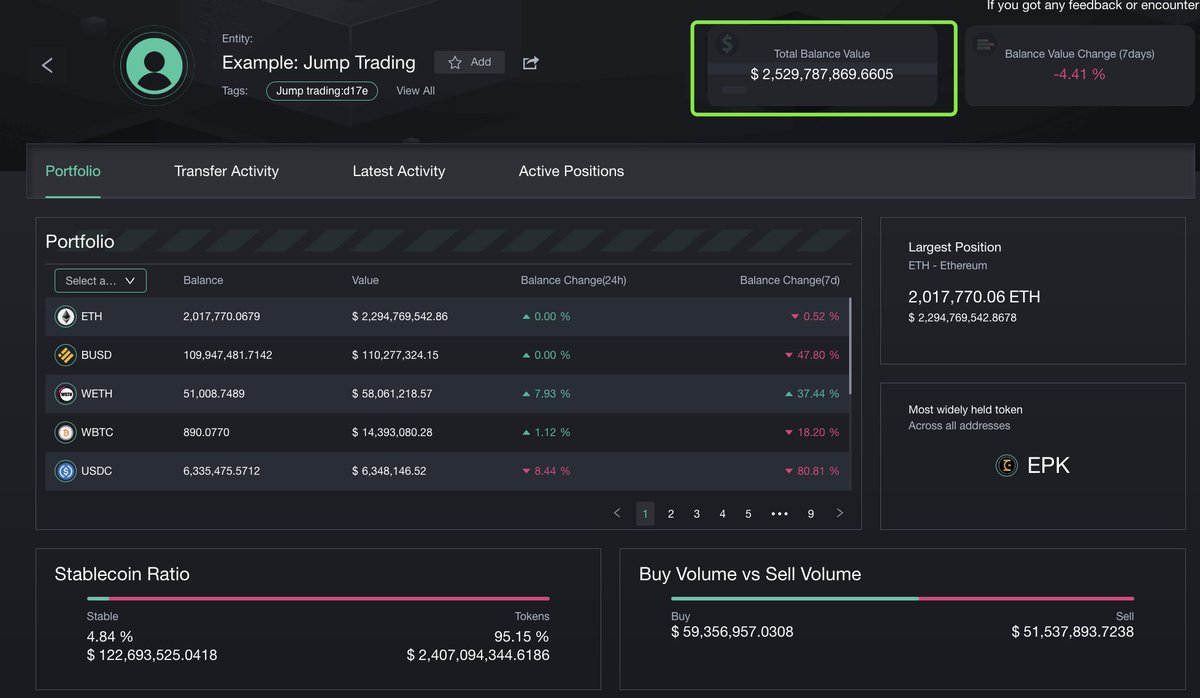

watchers.pro/#/address/0x8c…

We will monitor the later movement closely:

watchers.pro/#/address/0x8c…

We will monitor the later movement closely:

Check out the above money-flow chart to access the flow and addresses👇:

watchers.pro/#/moneyFlow/0x…

watchers.pro/#/moneyFlow/0x…

• • •

Missing some Tweet in this thread? You can try to

force a refresh