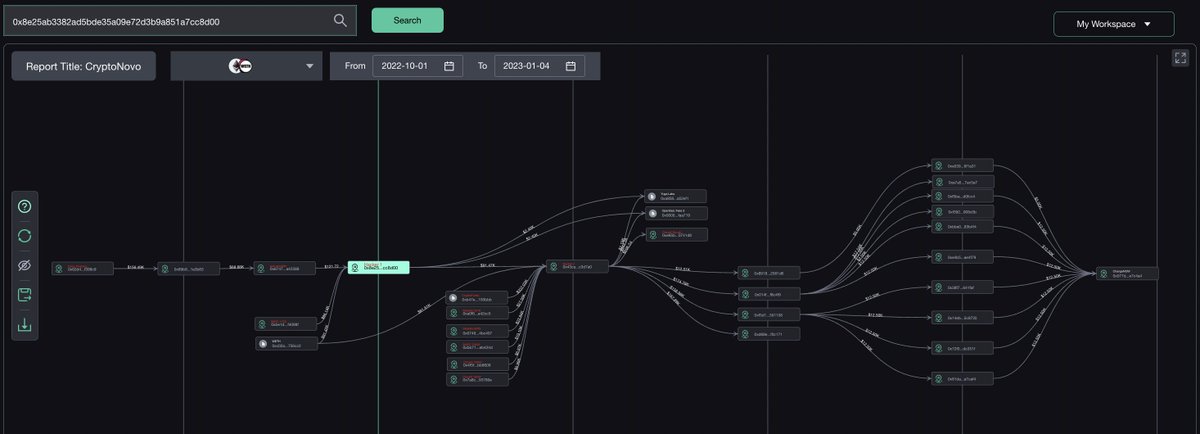

🚨Massive NFTs have been hacked including multiple #BAYC & #CryptoPunks & #Meetbits of @CryptoNovo311, the total hacked value is $6M+.

We identify the whole process and hacker address, and those funds ended up in @ChangeNOW_io.

We identify the whole process and hacker address, and those funds ended up in @ChangeNOW_io.

Before his NFT got transferred, it seems he approved the hacked collection to

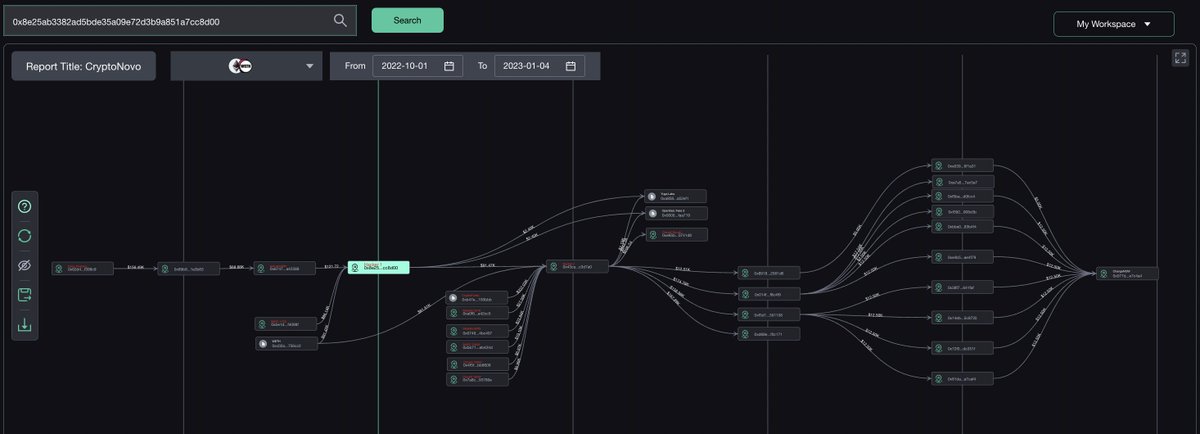

0x8e25ab3382ad5bde35a09e72d3b9a851a7cc8d00 (0x8e)

and then 0x8e transfer all NFT to:

0x43ca3957a188ee03da87d6bed138bcc8d5c3d7a0(0x43)

0x8e25ab3382ad5bde35a09e72d3b9a851a7cc8d00 (0x8e)

and then 0x8e transfer all NFT to:

0x43ca3957a188ee03da87d6bed138bcc8d5c3d7a0(0x43)

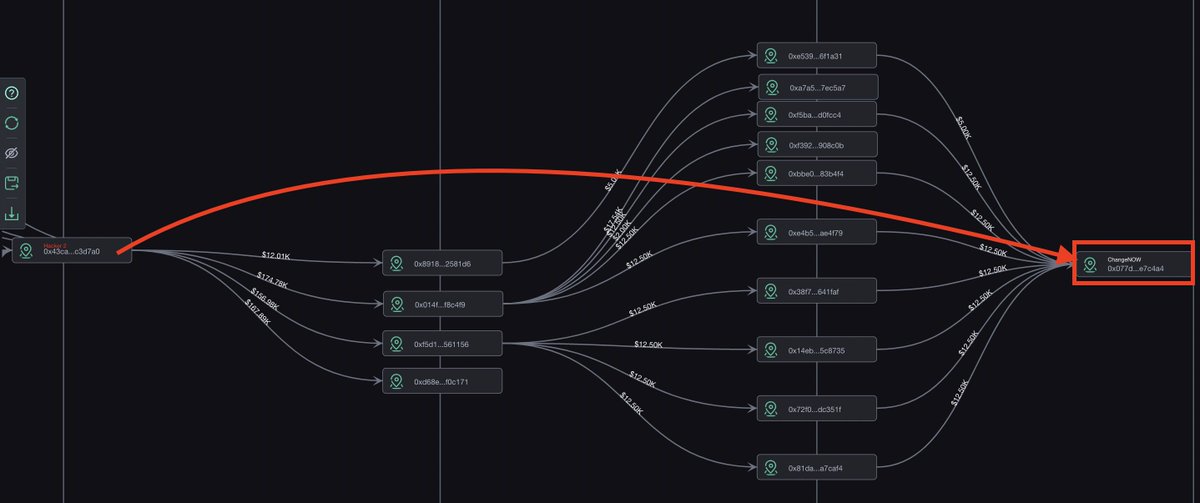

0x43 takes all the offers and swapped the $ETH he gets to $ETH and goes to #changenow.

(hacker tries to confuse others but with money flow, you can clearly see where the $ETH goes)

(hacker tries to confuse others but with money flow, you can clearly see where the $ETH goes)

For now, the hacker has cleared all the ETH positions to #changenow.

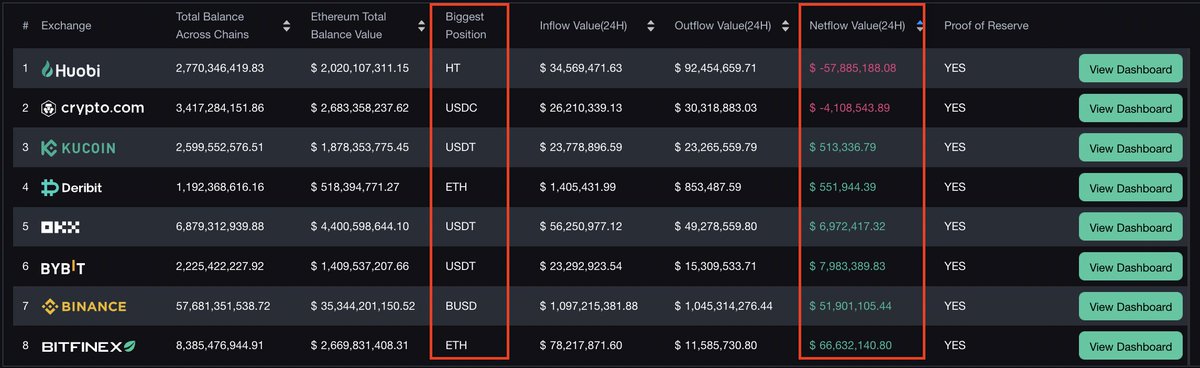

Recently, #changenow and #fixfloat has become the major money laundry hub for the crypto exploiters, this should be worth some attention.

Recently, #changenow and #fixfloat has become the major money laundry hub for the crypto exploiters, this should be worth some attention.

Furthermore:

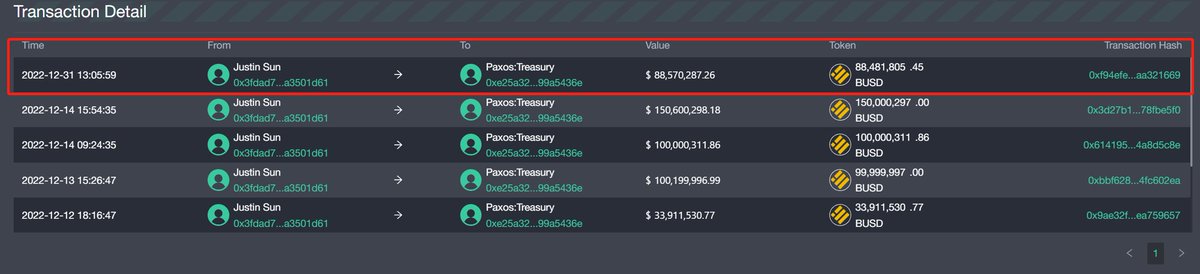

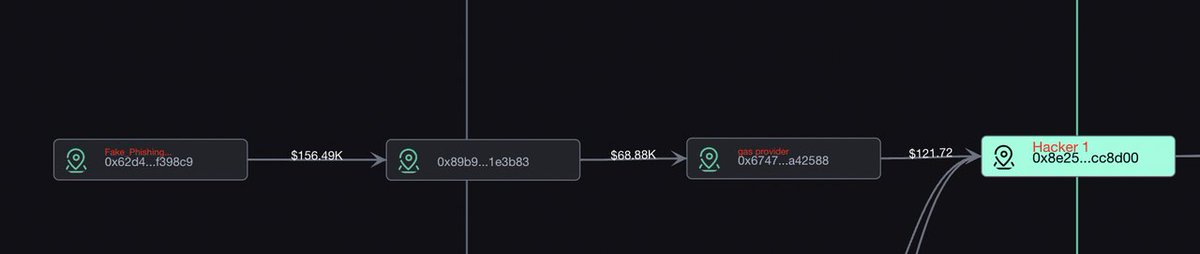

Hacker's initial gas from:

0x67472bef5eef545ea05c919589f7b287c7a42588

and this address can trace back to:

0x62d480a2771796493eebb03965da676c97f398c9

Which performed another exploit.

Hacker's initial gas from:

0x67472bef5eef545ea05c919589f7b287c7a42588

and this address can trace back to:

0x62d480a2771796493eebb03965da676c97f398c9

Which performed another exploit.

• • •

Missing some Tweet in this thread? You can try to

force a refresh