2022 was another challenging year for the @ecb. My personal review of the year collects some of my speeches and a few striking charts. All speeches and accompanying slides can be found on the @ecb’s website. A special thanks goes to #ECBstaff for their continuous support! 1/19

The speech “Looking through higher energy prices? Monetary policy and the green transition” (8 Jan 2022) argued that monetary policy cannot afford to look through higher energy prices if they pose a risk to medium-term price stability. #ClimateChange 2/19 ecb.europa.eu/press/key/date…

#Chart US shale oil production has been responding more slowly to rising oil prices, as fossil investments may no longer prove profitable to investors over the medium term. 3/19

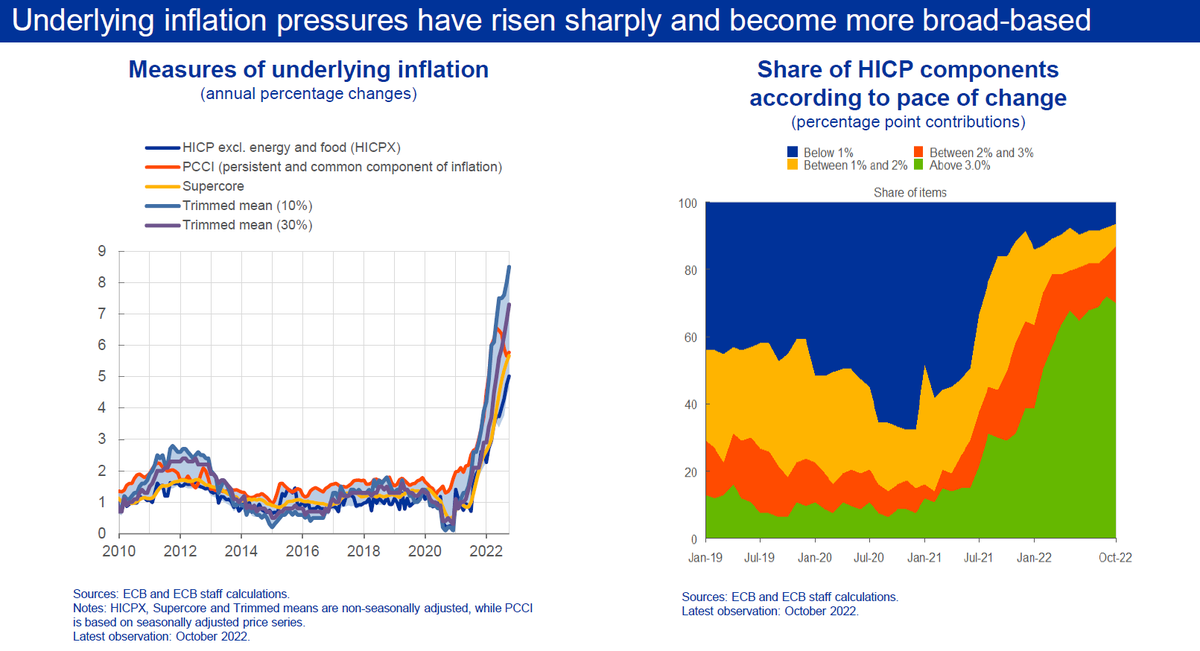

In “Finding the right sequence” (24 Feb 2022) I argued that inflation has become more broad-based and persistent, speaking in favour of a gradual and data-dependent normalisation of our various monetary policy instruments. #Sequencing 4/19 ecb.europa.eu/press/key/date…

#Chart Already before the war, underlying inflation was rising measurably and price pressures were becoming more broad-based. 5/19

The green transition will herald “A new age of energy inflation: climateflation, fossilflation and greenflation” (17 Mar 2022), leading to a prolonged period of upside pressure on inflation, which monetary policy cannot ignore. #ClimateChange 6/19 ecb.europa.eu/press/key/date…

#Chart Energy accounted for a very large share of the increase in headline inflation since 2021, driven mainly by #fossilflation. Going forward, #greenflation can also be expected to exert upward pressure on prices during the transition period. 7/19

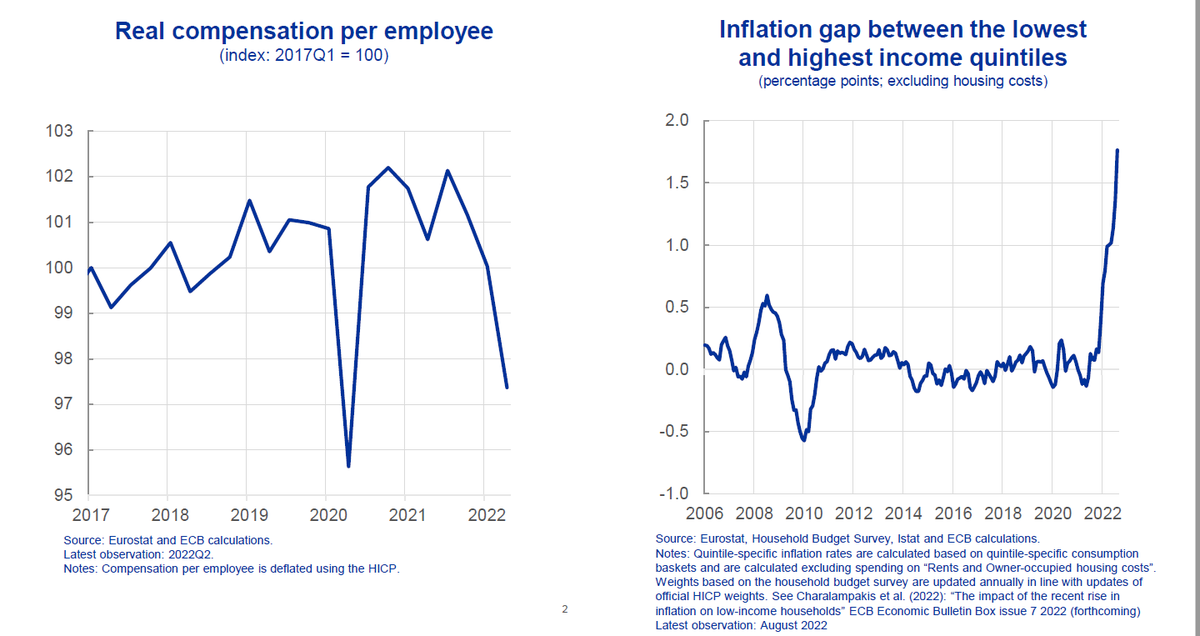

The speech “Managing policy trade-offs” (2 Apr 2022) explained why monetary policy normalisation remained appropriate in spite of Russia’s invasion of Ukraine and its economic repercussions, and what an appropriate policy mix could look like. 8/19 ecb.europa.eu/press/key/date…

#Chart Rising inflation expectations played an increasing role in our policy discussions. 9/19

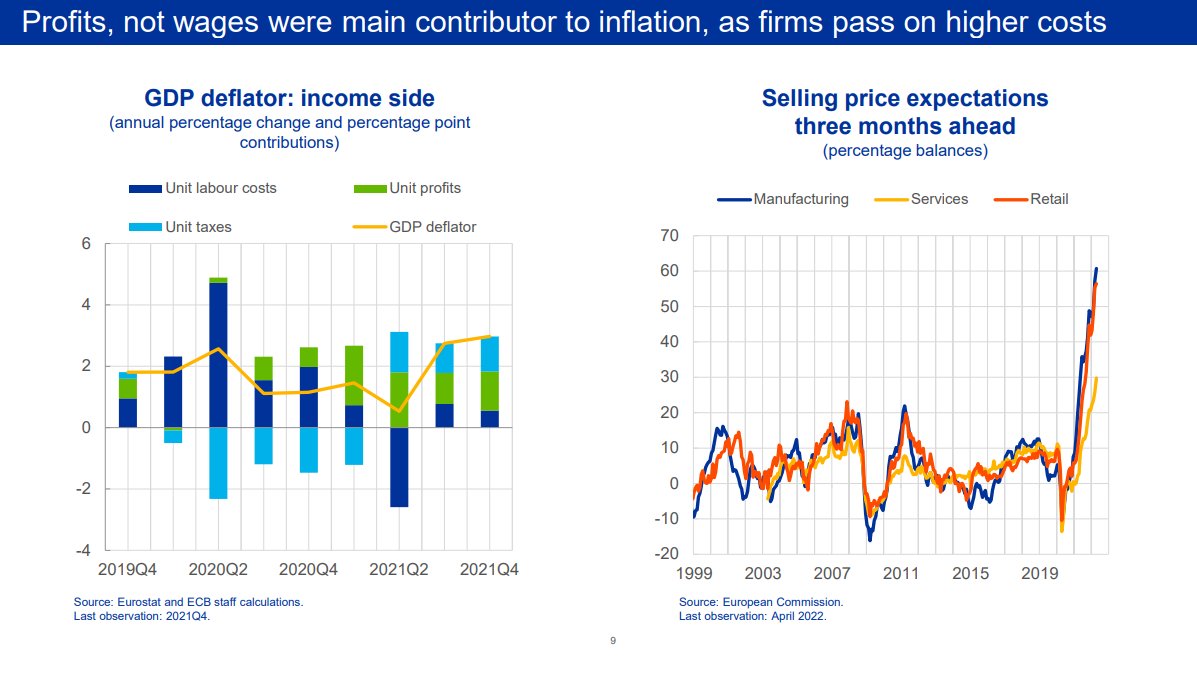

In “The globalisation of inflation” (11 May 2022) I argued that global factors matter for domestic underlying inflation and that monetary policy needs to take these factors into account. 10/19 ecb.europa.eu/press/key/date…

#Chart This graph showing that profits, not wages were a key contributor to inflation received a lot of attention at the time. 11/19

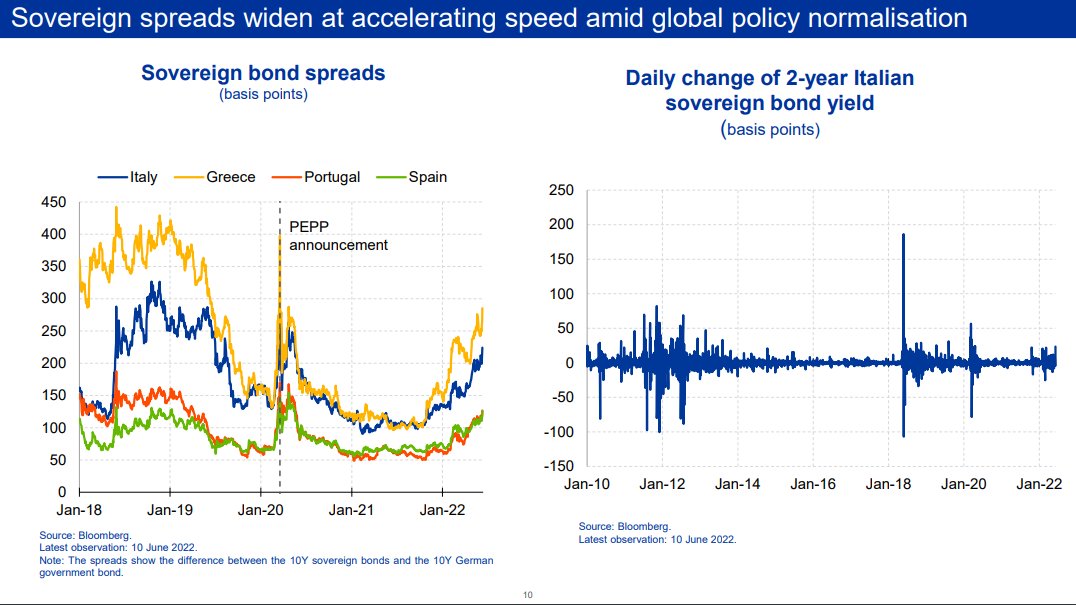

“United in diversity – challenges for monetary policy in a currency union” (14 Jun 2022) clarified that we would not allow non-fundamentally justified changes in financing conditions to impair monetary policy transmission. #fragmentation #TPI 12/19 ecb.europa.eu/press/key/date…

#Chart These charts show how sovereign bond spreads widened at an accelerated speed amid the global policy normalisation. 13/19

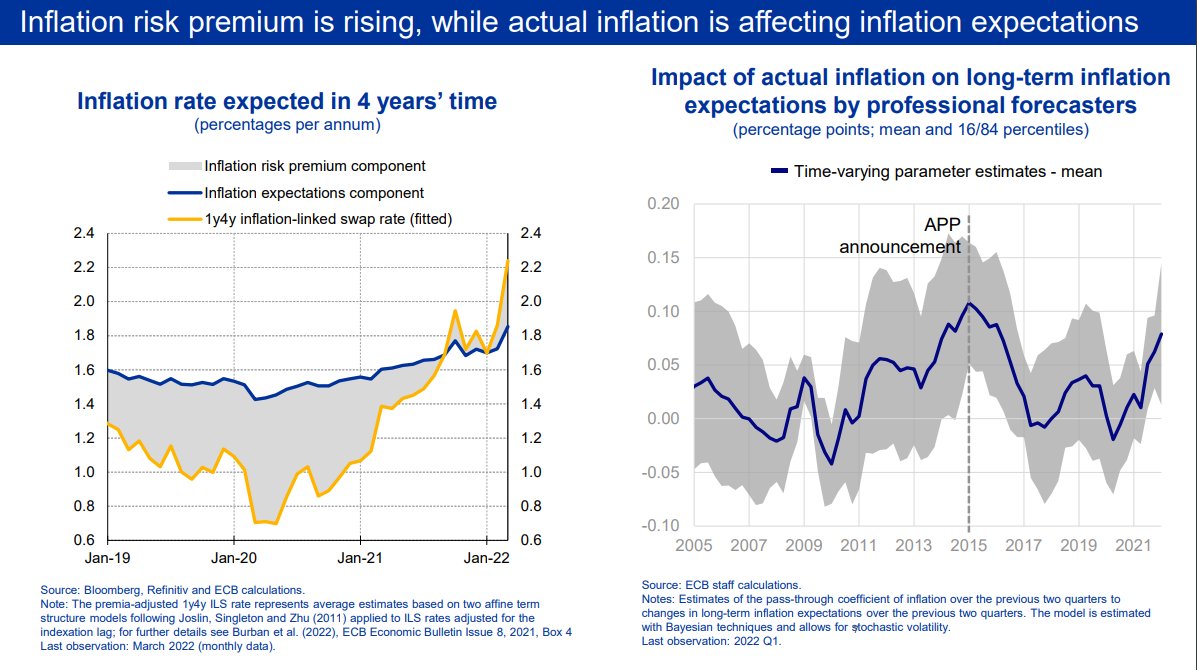

My most important speech was “Monetary policy and the great volatility” (27 Aug 2022) making the case for forceful policy action to bring inflation back to target quickly & avoid a de-anchoring of inflation expectations. #JacksonHole #RobustControl 14/19 ecb.europa.eu/press/key/date…

In “Monetary policy in a cost-of-living crisis” (30 Sep 2022) I argued that inflation was likely to remain high in spite of falling real wages weighing on aggregate demand, as the crisis dampened potential output and firms tried to protect margins. 15/19 ecb.europa.eu/press/key/date…

#Chart The secular decline in the labour share of income coincided with a decline in trade union density, while the profit share rose markedly. 16/19

My final speech “Finding the right mix: monetary-fiscal interaction at times of high inflation” (24 Nov 2022) warned that broad-based, untargeted fiscal measures risked fuelling medium-term inflation, making further monetary policy action necessary. 17/19 ecb.europa.eu/press/key/date…

#Chart These charts show that fiscal support measures in the euro area were mostly untargeted and that public investment was very low. 18/19

#ComingNext: The #2023 cycle of speeches will start with another speech on #ClimateChange, discussing the consequences of monetary policy tightening for the green transition and what this implies for governments and central banks. Stay tuned! 19/19

• • •

Missing some Tweet in this thread? You can try to

force a refresh