🚨 The @justinsuntron is super active on #Tron today.

Here's what he did:

1. Withdraw 62M USDT on #Justlend

2. Buy 2M USDD using 2M USDT on #Sun

3. Withdraw 6M USDC on #JustLend and transferred out

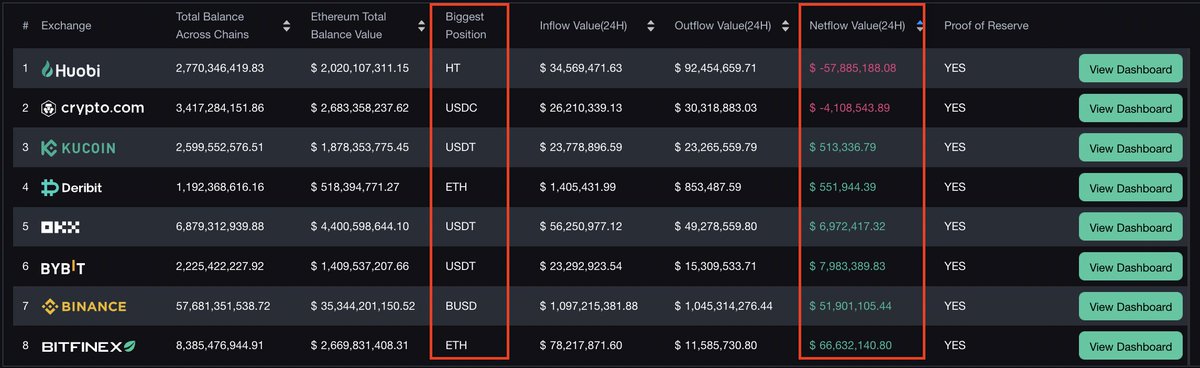

4. Transfer 60M USDT to @binance

tronscan.org/#/address/TPyj…

Here's what he did:

1. Withdraw 62M USDT on #Justlend

2. Buy 2M USDD using 2M USDT on #Sun

3. Withdraw 6M USDC on #JustLend and transferred out

4. Transfer 60M USDT to @binance

tronscan.org/#/address/TPyj…

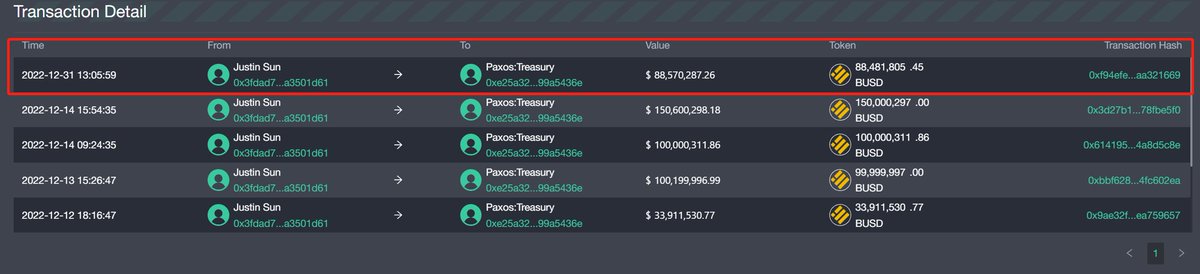

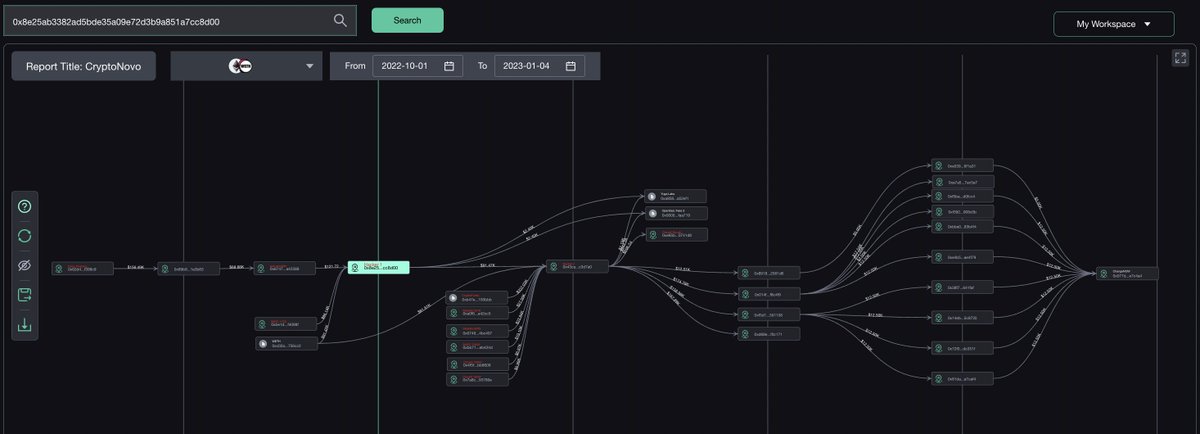

Based on the record, Justin usually:

1. Transfer $USDT on #Tron to binance

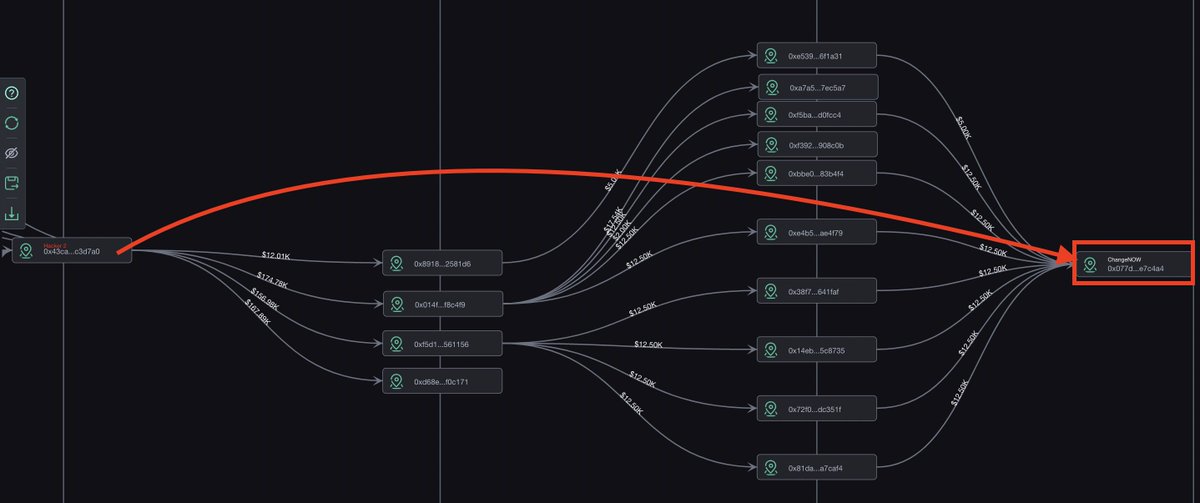

2. Transfer $USDC/ $BUSD out from binance on Ethereum

3. Cashed out them on #Paxos and #Circle.

Let's see if Justin will do this again.

1. Transfer $USDT on #Tron to binance

2. Transfer $USDC/ $BUSD out from binance on Ethereum

3. Cashed out them on #Paxos and #Circle.

Let's see if Justin will do this again.

https://twitter.com/ScopeProtocol/status/1607983914907500544

@justinsuntron @binance 🚨Justin is ready to go, let's see what's he gonna do with these $100M stablecoins.

• • •

Missing some Tweet in this thread? You can try to

force a refresh