New Liquidity Book Features 🌊📘

🌊 Batch Liquidity Deployment lets you deposit your liquidity over ANY desired price range

⚡ Discrete Liquidity Removal lets you withdraw liquidity from a specific selection of Bins

Lets explore this new #BinTech 👇

🌊 Batch Liquidity Deployment lets you deposit your liquidity over ANY desired price range

⚡ Discrete Liquidity Removal lets you withdraw liquidity from a specific selection of Bins

Lets explore this new #BinTech 👇

🌊 Batch Liquidity Deployment (BLD)

Select 'Spot (Uniform)' and enter the price range that you want to supply Liquidity over.

Next, select 'Add Liquidity' for each Batch transaction to deploy your Liquidity over the desired range.

Select 'Spot (Uniform)' and enter the price range that you want to supply Liquidity over.

Next, select 'Add Liquidity' for each Batch transaction to deploy your Liquidity over the desired range.

🌊 Batch Liquidity Deployment (BLD)

Using the BLD feature you can set and deploy liquidity over a large price range, to facilitate a more passive approach to active liquidity provisioning.

Example strategy: Supply liquidity for $AVAX - $USDC over a price range of $10 to $15

Using the BLD feature you can set and deploy liquidity over a large price range, to facilitate a more passive approach to active liquidity provisioning.

Example strategy: Supply liquidity for $AVAX - $USDC over a price range of $10 to $15

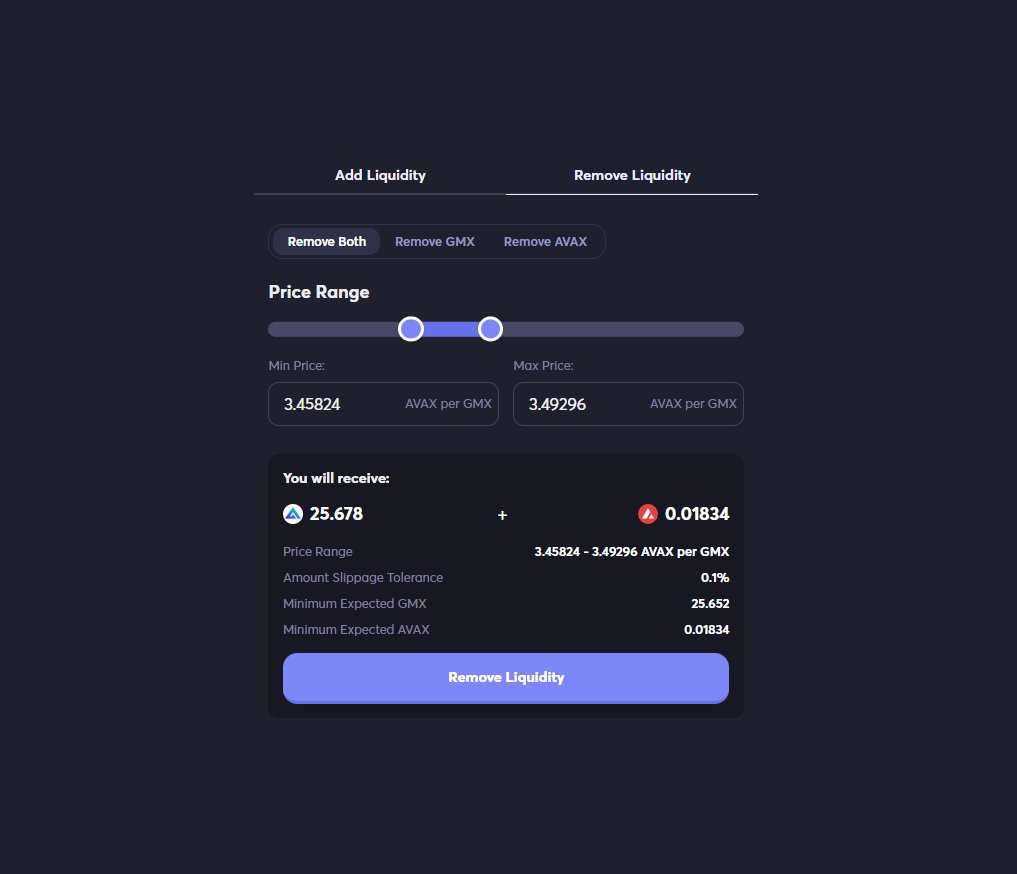

⚡ Discrete Liquidity Removal (DLR)

Select Remove Liquidity and either use the Price Range sliders, or enter in the specific price points that you want to remove Liquidity from.

Select Remove Liquidity and either use the Price Range sliders, or enter in the specific price points that you want to remove Liquidity from.

⚡ Discrete Liquidity Removal (DLR)

Using the DLR feature, you can now react dynamically to changing market conditions or perform smaller re-balancing tasks.

DLR gives you greater control and flexibility for your strategy helping you to optimize your strategy.

Using the DLR feature, you can now react dynamically to changing market conditions or perform smaller re-balancing tasks.

DLR gives you greater control and flexibility for your strategy helping you to optimize your strategy.

If you like these new features comment: #BecauseBins

• • •

Missing some Tweet in this thread? You can try to

force a refresh