#THREAD A text-book example that we can learn many fine points of classical charting and technical analysis. $LAUL.NS #INDIA #SENSEX #NIFTY

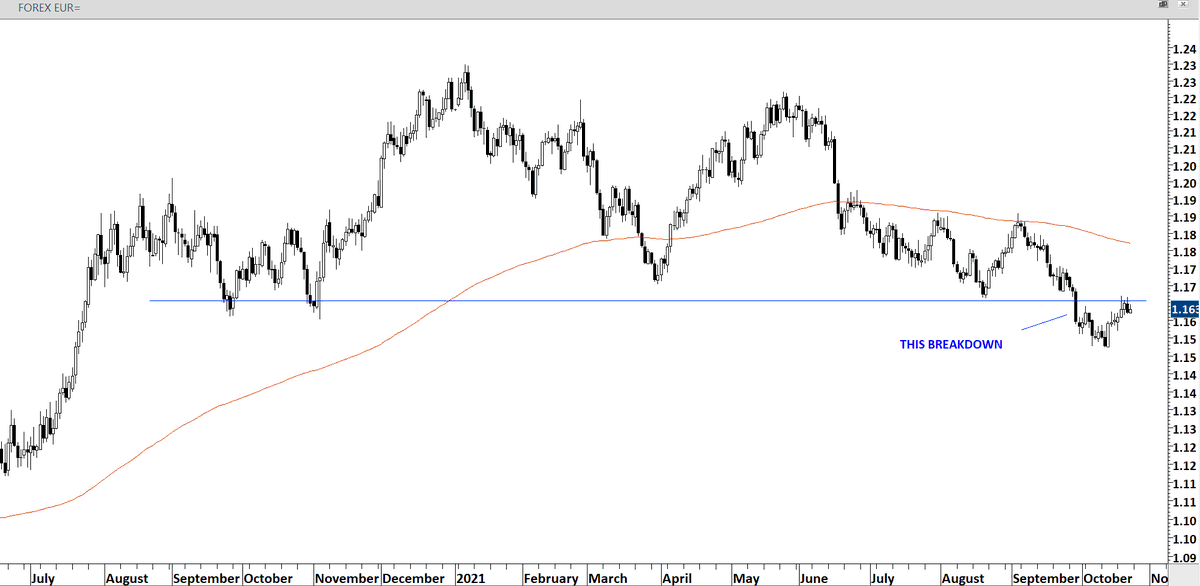

1) A well-defined horizontal boundary being tested several times before a breakout or breakdown.

2) Right before the breakdown, a short-term chart pattern (pennant) is forming in preparation for a breakdown. Difficulty to rebound from strong support, early indication of a pending breakdown.

3) Breakdown from a well-defined chart pattern took place below the 200-day average. I like to see breakdowns below taking place in a downtrend and breakouts in an uptrend.

• • •

Missing some Tweet in this thread? You can try to

force a refresh