Roundup on #crypto and #macro

🧵

✅ 2023 > 2022 on liquidity

✅ 5% terminal rate

✅ China de-risk for global econ

🤔 War de-escalates

🤔 Q1 earnings, recession?

Crypto

✅ Similar to 2015 cycle

✅ Deleveraged

🚩@DCGco GBTC

🚩Imminent regulation

🤔 $ETH vs #BTC

I’m long here🐂

🧵

✅ 2023 > 2022 on liquidity

✅ 5% terminal rate

✅ China de-risk for global econ

🤔 War de-escalates

🤔 Q1 earnings, recession?

Crypto

✅ Similar to 2015 cycle

✅ Deleveraged

🚩@DCGco GBTC

🚩Imminent regulation

🤔 $ETH vs #BTC

I’m long here🐂

1. Terminal rate ~5%, priced in for an extended time of high interest rate (no easing for 1-2 years). Pace of rate hike to slow down, but liquidity is still bad.

2. Fear of recession is the biggest risk, all eyes on Q1 earnings and outlooks.

2. Fear of recession is the biggest risk, all eyes on Q1 earnings and outlooks.

3. US M2 grew 25% in 2020 and 12% in 2021, much higher than 7% avg cagr since 1995. We are still at ~10% excessive supply versus where we “should” be. Liquidity for 2023 is marginal better than 2022, creating some support for price, but major rally seems unlikely.

4. First “recession” of big tech as revenue growth stalls and profit falls. Big layoffs and cost savings will change the utopia of Silicon Valley. But imo tech is cyclical as well, valuation multiples should expand during trough. Covid helped digitalization which is irreversible

5. I strongly recommend folks to read Sea Change by Howard Marks @Oaktree. Future investment is going to be very different from the past 40 years 🤣 in absence of a declining interest rate. As 💦 is a scarce resource, fundamental matters more.

cnt.oaktreecapital.com/insights/memo/…

cnt.oaktreecapital.com/insights/memo/…

6. China 🇨🇳 finally ended 0 Covid policy in late 2022. Stock rallied, CNY exchange rate rallied and life is back to normal. I’m optimistic. Domestic consumption should have pretty prints yoy, not good for inflation, but a de-risk for a global recession - which is more important

7. Russia 🇷🇺 Ukraine 🇺🇦 - the brutal war continues but it seems Russia is open for negotiation. Ukraine refused as their counter-offensive got support from NATO countries. I’m interested to see how this unveils as Russia now scored some success in Bakhmut. Both sides are tired.

8. Crypto - crypto downturn since Nov 2021 is highly correlated with @Nasdaq, tech stocks, @Tesla and $ARKK. #btc unfortunately is not a inflation hedge but a highly volatile risky asset driven by liquidity and sentiment. Let’s admit the fact.

9. The epic fall of giants - @terra_money, #3ac, @CelsiusNetwork, @BabelFinance, @investvoyager, @SBF_FTX @FTX_Official marks this crypto downturn due to high leverage, bad risk mgmt or even fraud. The ongoing drama at @DCGco @BarrySilbert might be the last, for now.

10. Past cycles - data from @ArcaneResearch shows #btc peak to trough time horizen. We might be close to the bottom now according to the past cycles in 2015 and 2019 despite different macro situation.

2015 #btc started to rise as fed started to exit QE.

2015 #btc started to rise as fed started to exit QE.

11. So for this cycle, are we more similar to 2015 or 2019? 🤔

I think 2015, as Fed is unlikely to lower interest rate like 2019. That means we are bottoming around august 2023.

Max drawdown

2015 - 80%

2019 - 82%

2023 - so far 76%

I think 2015, as Fed is unlikely to lower interest rate like 2019. That means we are bottoming around august 2023.

Max drawdown

2015 - 80%

2019 - 82%

2023 - so far 76%

12. For $ETH vs #BTC debate

I’m currently overweight $ETH and I expect flipping to happen in the 2-3 years.

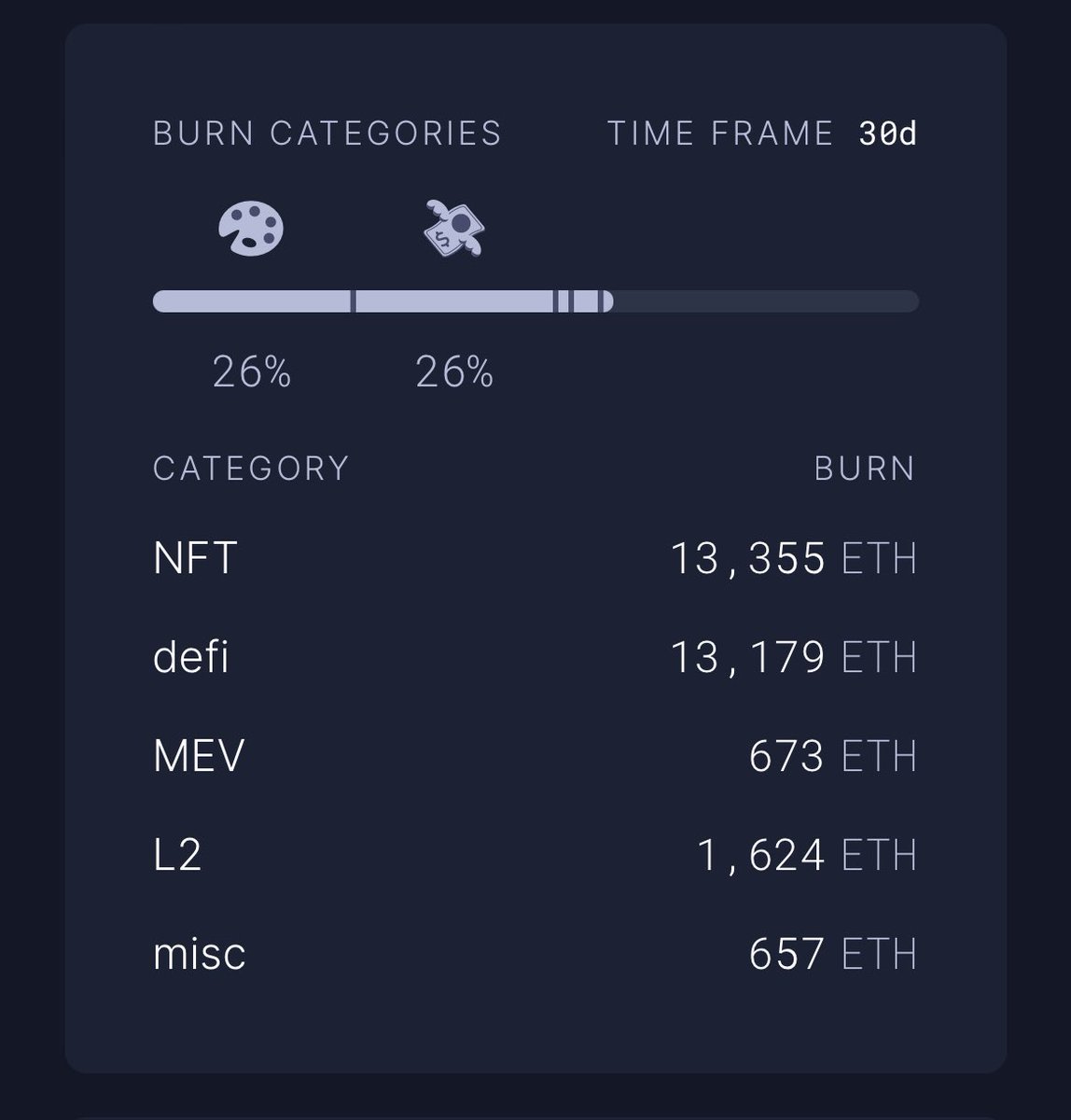

@ethereum community consensus is stronger than ever with clear roadmap. $ETH burn rate is ~1% / year over the past 524 days (both bull and bear market), solid 100x PE

I’m currently overweight $ETH and I expect flipping to happen in the 2-3 years.

@ethereum community consensus is stronger than ever with clear roadmap. $ETH burn rate is ~1% / year over the past 524 days (both bull and bear market), solid 100x PE

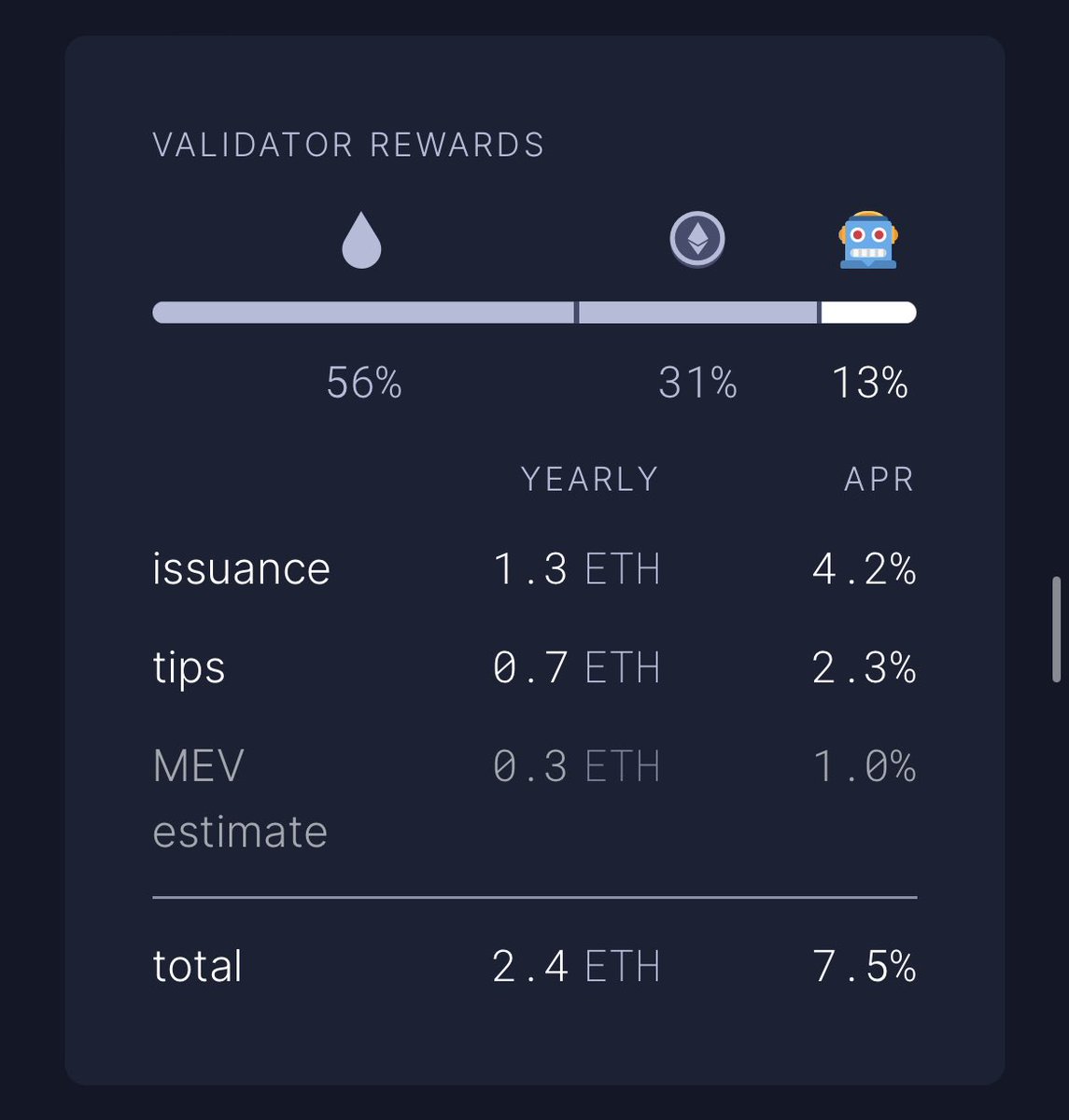

13. Ethereum validators are getting nearly half of the revenue from sustainable source (tips and MEV) compared to very small % of transaction fees for #BTC miners. In absence of centralized lenders, #BTC is hardly generating any yield for holders. Thanks @ultrasoundmoney 🦇

14. To sum up on crypto - I’m long here, around 50% of my portfolio, overweight $ETH to #BTC. Of course I’m holding on my $ARPA and $BEL for the new year progress by our awesome team @arpaofficial and @BellaProtocol. 2023 will be volatile, but definitely better than 2022. LFG 🚀

Update Jan 13

BTC at 19,200 and ETH 1,420 usd

Rebound came in too fast, I will wait for a better entry to deploy more capital.

BTC at 19,200 and ETH 1,420 usd

Rebound came in too fast, I will wait for a better entry to deploy more capital.

• • •

Missing some Tweet in this thread? You can try to

force a refresh