🧵1/Ω

#Tether unblacklisted two wallet addresses on the ethereum chain yesterday:

※:etherscan.io/address/0x9f1c…

※:etherscan.io/address/0xdec1…

#Tether unblacklisted two wallet addresses on the ethereum chain yesterday:

※:etherscan.io/address/0x9f1c…

※:etherscan.io/address/0xdec1…

🧵2/Ω 0x9f1c87c3224dca911f6412fba5865c30647bddb1 proceeded to move only a small amount of $USDT...

but also made invalid calls to the $USDT contract...

but also made invalid calls to the $USDT contract...

🧵3/Ω

#0xdec1bcaa046feb7343cb7292bb1193fa2d4fd68e doesn't seem to have done much of anything.

WTF is going on?

#0xdec1bcaa046feb7343cb7292bb1193fa2d4fd68e doesn't seem to have done much of anything.

WTF is going on?

🧵4/Ω

Separately $700mm moved from wallet tagged "#Binance: BTC Proof Of Reserves".

etherscan.io/tx/0xa0ed5235d…

If those tags are correct¹ that begs a few questions:

a) Why are there BTC chain reserves on the eth chain?

b) Whose BTC is backed by $USDT

¹ (def not a given)

Separately $700mm moved from wallet tagged "#Binance: BTC Proof Of Reserves".

etherscan.io/tx/0xa0ed5235d…

If those tags are correct¹ that begs a few questions:

a) Why are there BTC chain reserves on the eth chain?

b) Whose BTC is backed by $USDT

¹ (def not a given)

🧵5/Ω

His Excellency's supposed "chain swap" of $400mm eth backed $USDT to Tron because ??? shows up in the data as a $400mm increase in the size of Tether's treasury wallet.

His Excellency's supposed "chain swap" of $400mm eth backed $USDT to Tron because ??? shows up in the data as a $400mm increase in the size of Tether's treasury wallet.

https://twitter.com/HuobiGlobal/status/1613900107149099011

🧵6/Ω

Also note that the "Binance: BTC Proof of Assets" wallet shows an earlier transaction of $$609mm being sent to one of #Binance's user wallets.

Also note that the "Binance: BTC Proof of Assets" wallet shows an earlier transaction of $$609mm being sent to one of #Binance's user wallets.

🧵7/Ω

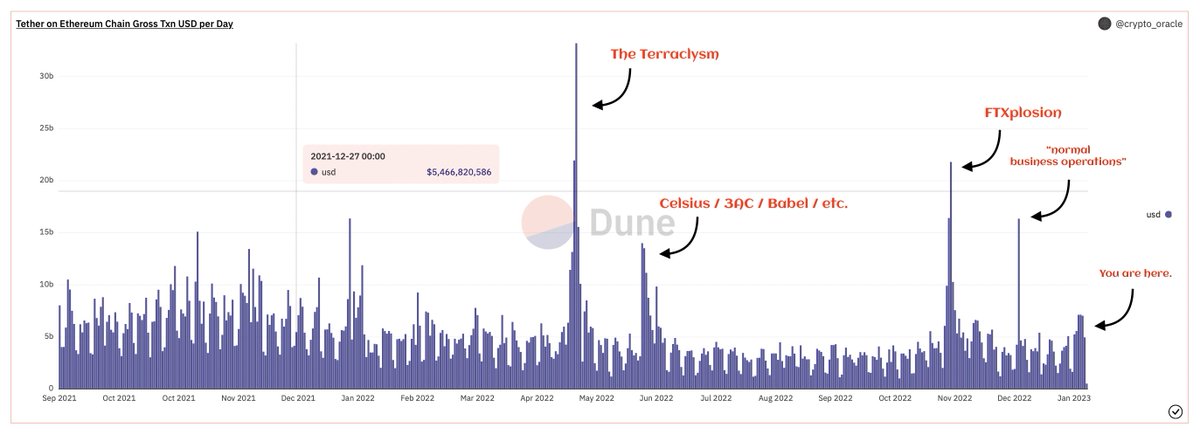

Volume of tethers moved per day on-chain is a good historical indicator of big events like #FTXplosion or the #Terraclysm.

Not spiking right now but... it is *consistently* high in way we have not seen before.

Volume of tethers moved per day on-chain is a good historical indicator of big events like #FTXplosion or the #Terraclysm.

Not spiking right now but... it is *consistently* high in way we have not seen before.

🧵8/Ω

Data came from checking in on my @DuneAnalytics dashboard for $USDT on the eth chain. Feel free to take a look and thanks to Dune for making this incredible tool free. cc @DesoGames @DylanLeClair_ @ramahluwalia @BennettTomlin @CasPiancey

dune.com/crypto_oracle/…

Data came from checking in on my @DuneAnalytics dashboard for $USDT on the eth chain. Feel free to take a look and thanks to Dune for making this incredible tool free. cc @DesoGames @DylanLeClair_ @ramahluwalia @BennettTomlin @CasPiancey

dune.com/crypto_oracle/…

🧵9/Ω

PSA: this account is often exiled to The Shadows of Bǟn and thus tweets will not be allowed to have organic growth so RT if you think your followers might want to see

PSA: this account is often exiled to The Shadows of Bǟn and thus tweets will not be allowed to have organic growth so RT if you think your followers might want to see

• • •

Missing some Tweet in this thread? You can try to

force a refresh