Hunter Biden pays $50,000 to his family in rent per month is #MoneyLaundering in plain sight.

Politicians lie, cheat, launder money, commit crimes regularly and never get caught or punished for them. Instead they get awarded & praised for supporting the #DeepState cabal.

Politicians lie, cheat, launder money, commit crimes regularly and never get caught or punished for them. Instead they get awarded & praised for supporting the #DeepState cabal.

Here’s a prev thread 🧵 on politicians

https://twitter.com/DeepBlueCrypto/status/1606793969891180544

Apparently Joe Biden was chosen by the #DeepState in 2020. Trump revealed the #DeepState to be a real entity which controlled everything that happens in USA and abroad through foreign policy.

Latest events suggest Biden is falling out of favor by them.

zerohedge.com/political/did-…

Latest events suggest Biden is falling out of favor by them.

zerohedge.com/political/did-…

@DineshDSouza is right on the money

What happens if you install the US Operating System in your country 😂

https://twitter.com/KimDotcom/status/1612876284732014592

As expected the rental amount that Hunter Biden is paying his family is the exact same amount he receives from China… and they’ll call it coincidence

trendingpoliticsnews.com/breaking-bombs…

trendingpoliticsnews.com/breaking-bombs…

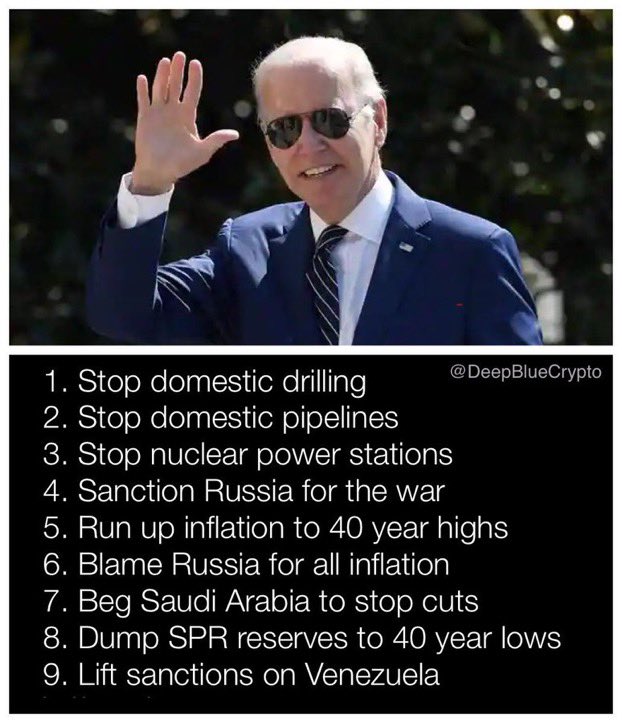

Joe Biden did a number of things which puts America last… he sent inflation sky high, sent oil prices soaring, stopped nuclear, depleted SPRs, begged Saudis to increase oil production, got caught laundering money through FTX and now is laundering China money as rental income.

WHAT ELSE CAN JOE BIDEN DO AT THIS POINT BESIDES SMILING AT HIS OWN FATE GETTING CAUGHT WITH CLASSIFIED DOCUMENTS WITHOUT ANY SECURITY CONTROLS 😂😂

https://twitter.com/RNCResearch/status/1615393651546259476

Hunter Biden needs to be punished for his sex trafficking crimes for at least 25 years if the law is served correctly. Of course we all know Hunter Biden is clearly above the law.

https://twitter.com/KanekoaTheGreat/status/1615160103795326977

It’s essential for you to study, work hard, pay your taxes so we can distribute some money who don’t and get to keep some of it through inflation and money laundering… alright

LOOKS REALLY BAD FOR THE BIDEN CRIME FAMILY

https://twitter.com/RNCResearch/status/1615875103761305601

Congressional investigation underway on the Joe Biden crime family

Even if Joe Biden falls on Air Force one it’s #ClimateChange caused by Trump

#CupOfJoe is offensive 😂

Governments can tell women what to do with their bodies when it comes to getting vaccinated

Governments cannot tell women what to do with their bodies when it comes to pregnancy & child birth

Governments cannot tell women what to do with their bodies when it comes to pregnancy & child birth

Lunatics laugh this much 😂

FBI should raid them all politicians to see what other highly sensitive classified documents are stashed up in ex presidents and VP homes.

Treat all findings irrespective of party the same. Democrats aren’t above the law.

#ClassifiedDocuments

#BidenClassifiedDocuments

Treat all findings irrespective of party the same. Democrats aren’t above the law.

#ClassifiedDocuments

#BidenClassifiedDocuments

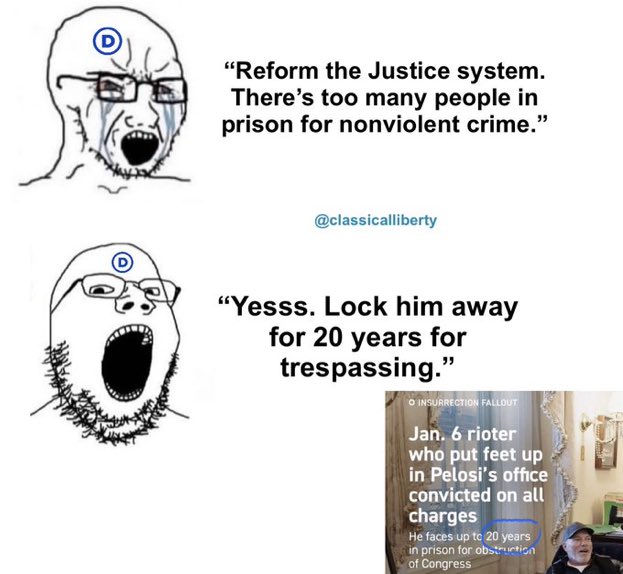

When it favors you politically, lock them away. When it favors you politically, reform the justice system.

Sounds about right given Biden’s situation with Hunter’s laptop, #TwitterFiles #ClassifiedDocuments #FTX scandals, Ukraine war funding, #MoneyLaundering and others

Both Democrats & Republicans are to be blamed for the mess we are in. They’re two sides of the same coin.

KJP on more #ClassifiedDocuments

Hillary deleted all her emails, destroyed the servers, burnt all the classified information documents & folders… dumped their ashes into the Atlantic Ocean 😂

Biden’s family running a large international criminal organization funding his adult diapers 😂😂

• • •

Missing some Tweet in this thread? You can try to

force a refresh