#SuperImportant #Retweet

Will #IndianRetail flows to #Equity TOP OUT?

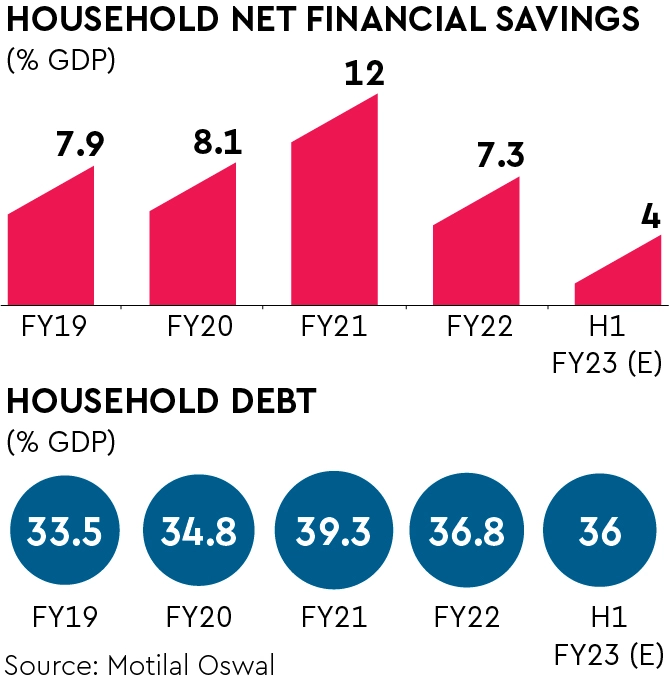

#Modinomics characterized by Record #Unemployment of the #Unorganised Sector & "unreported" #Inflation has ensured that Net Financial Savings of Indian Household is at a 30 YEAR LOW

Will #IndianRetail flows to #Equity TOP OUT?

#Modinomics characterized by Record #Unemployment of the #Unorganised Sector & "unreported" #Inflation has ensured that Net Financial Savings of Indian Household is at a 30 YEAR LOW

https://twitter.com/TheFactFindr/status/1612866448237658112

What Does this Actually Mean?

🚩In FY22, NET FINANCIAL SAVINGS of households was 7.3% of GDP (17.2 Lac Crores).

🚩In 6 months of FY23, NET FINANCIAL SAVINGS of households was 4% of GDP (Rs 5.2 Lac Crores)

🚩In FY22, NET FINANCIAL SAVINGS of households was 7.3% of GDP (17.2 Lac Crores).

🚩In 6 months of FY23, NET FINANCIAL SAVINGS of households was 4% of GDP (Rs 5.2 Lac Crores)

What Drove his Change? 2 Factors

(1) Rising LIABILITIES of households which increased to 5% of GDP in H1 FY23

(2) Sharp Fall in TOTAL SAVINGS. Past 5 odd years, TOTAL SAVING of households was ~20% of GDP. However, in H1 FY23, TOTAL SAVING of households has fallen to 15.7% of GDP

(1) Rising LIABILITIES of households which increased to 5% of GDP in H1 FY23

(2) Sharp Fall in TOTAL SAVINGS. Past 5 odd years, TOTAL SAVING of households was ~20% of GDP. However, in H1 FY23, TOTAL SAVING of households has fallen to 15.7% of GDP

What Really Happened? if you track Volume growth of most Consumer and Consumer Durable Items, there has been very anemic growth. Almost all the growth has come from PRICE HIKES and lesser so from higher volumes with Consumer Downgrades. Essentially #SHRINKFLATION

Household Incomes/Salaries have NOT kept up with INFLATION and this is pushing the consumer to eat into thier savings to live. Eg. during Sept-22 Results @ICICIBank indicated that share of Beyond Top 150 Cities as % of Deposits which was 45% had fallen to 25%.

Besides that, with the property cycle & lower interest rates, more Households are taking Loans. Bear in Mind, that the Banking System has Only about 18 million home loans (350 Million Households in India).

Unfortunately, Interest Rates are Rapidly rising and this will be visible in 2nd Half FY23 which means that the DISPOSABLE income of Households will get hurt more as they make space for Higher 15% higher EMIs. So NET Financial INVESTMENTS (Deposits, EQ MF, Insurance will Suffer)

This might partly explain why Net Mutual Fund Inflows have Collapsed by 70% in the last 12 months...

• • •

Missing some Tweet in this thread? You can try to

force a refresh