The #value spread is a popular method to measure how undervalued #stocks are in the market.

For deep value stocks, particularly #netnet stocks, I like to track the number of net-nets available. This number typically peaks during market sell-offs, and then closes off.

(1/n)

👇

For deep value stocks, particularly #netnet stocks, I like to track the number of net-nets available. This number typically peaks during market sell-offs, and then closes off.

(1/n)

👇

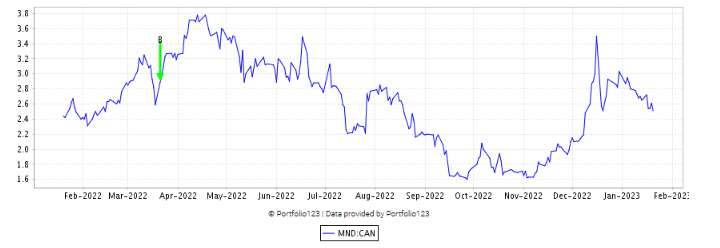

This recent sell-off has been no different, as the number of #netnets has been increased. In recent weeks, this number has been decreasing, suggesting these stocks are being bought up, and the value gap closing.

(2/n)

👇

(2/n)

👇

Some #netnet names I'm watching (and am long):

$SOS

$LSF

$IMCC

$LGL

$ROOT

Here's the allocation of the net-net portfolio (of course mostly #microcap 😉):

$SOS

$LSF

$IMCC

$LGL

$ROOT

Here's the allocation of the net-net portfolio (of course mostly #microcap 😉):

• • •

Missing some Tweet in this thread? You can try to

force a refresh