In light of Loblaw's inept efforts on social media to justify its super-sized inflation-fueling profits, this is an opportune time to remind shoppers of four crucial economic facts regarding supermarket profitability: 🧵

https://twitter.com/loblawco/status/1620474394282696704?t=C0Pl3OD38fCG1v7vnbWBhA&s=03#cdnecon /2

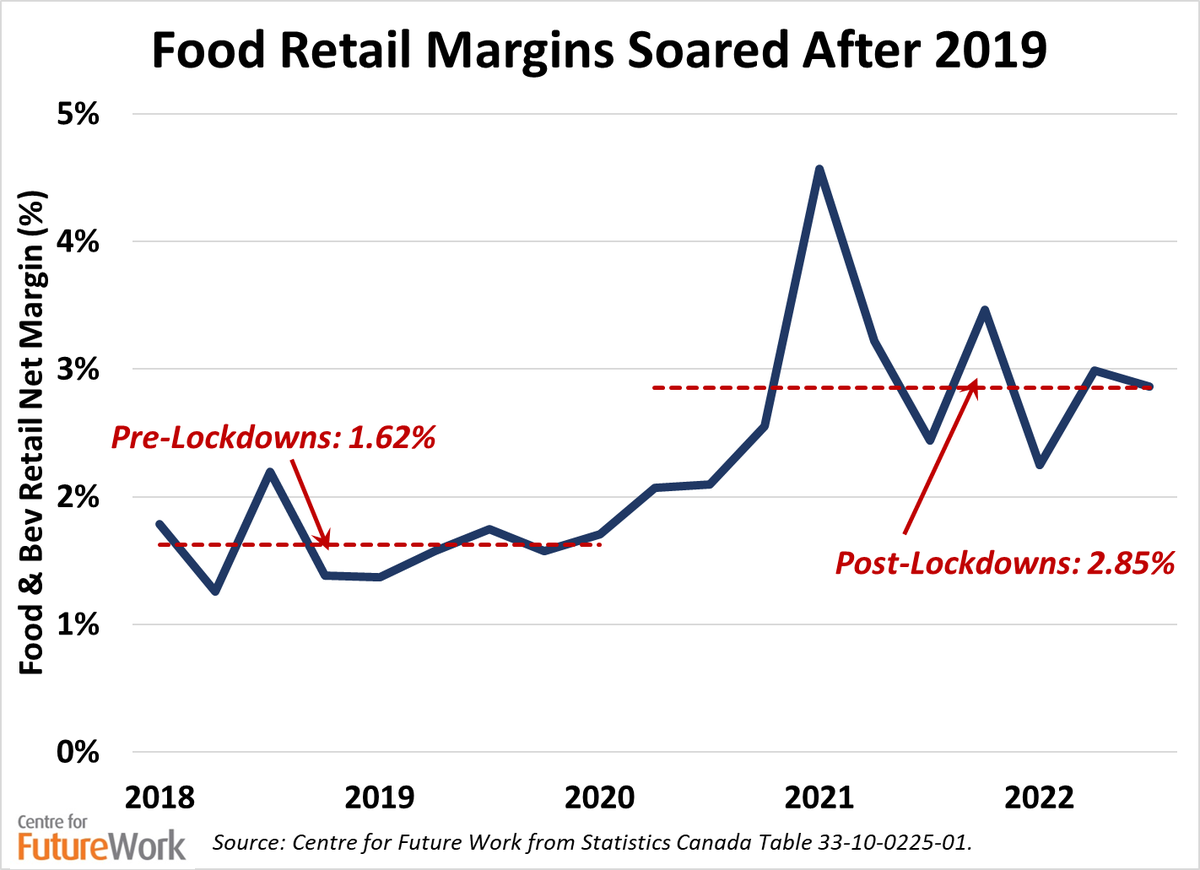

B. Their higher profits are NOT the result of a constant profit margin collected from a growing base of sales. Claims to this effect are outright lies. The average margin has increased by three-quarters since the pandemic. /4

C. Perversely, the actual VOLUME of food sales has been falling since the lockdowns & their panic buying. Painfully, Canadians are now buying LESS GROCERIES than before the pandemic (but paying much more for them). Supermarkets' REAL business is shrinking, but profits are up./5

D. Yes, food processors are jacking up their prices: and like the supermarkets, far more than justified by their own higher costs. Food manufacturing profit has also grown since the pandemic, but less dramatically than for the food retail business. /6

We don't have to take sides in finger-pointing between oligopolistic retailers like Loblaw & oligopolistic processors like Cargill or PepsiCo. Both camps have taken advantage of supply disruptions & consumer desperation to fatten profits amidst deep economic & social crisis. /7

Fun fact: BOTH food retailers & food processors made the @CntrFutureWork's top-15 list of super-profitable sectors that have led Canadian inflation. These 15 sectors account for more than 100% of the growth in economy-wide profits (to record share of GDP) & most CPI inflation. /8

However, 13 other sectors have profited even MORE dramatically from the pandemic and resulting disruptions: incl. energy, banking, mining, real estate, building materials. Supermarket super-profits should be the start of a bigger conversation. centreforfuturework.ca/2022/12/02/fif…

• • •

Missing some Tweet in this thread? You can try to

force a refresh