5 Confirmations for better trade entries ::

#StockMarket #nifty50 #investing

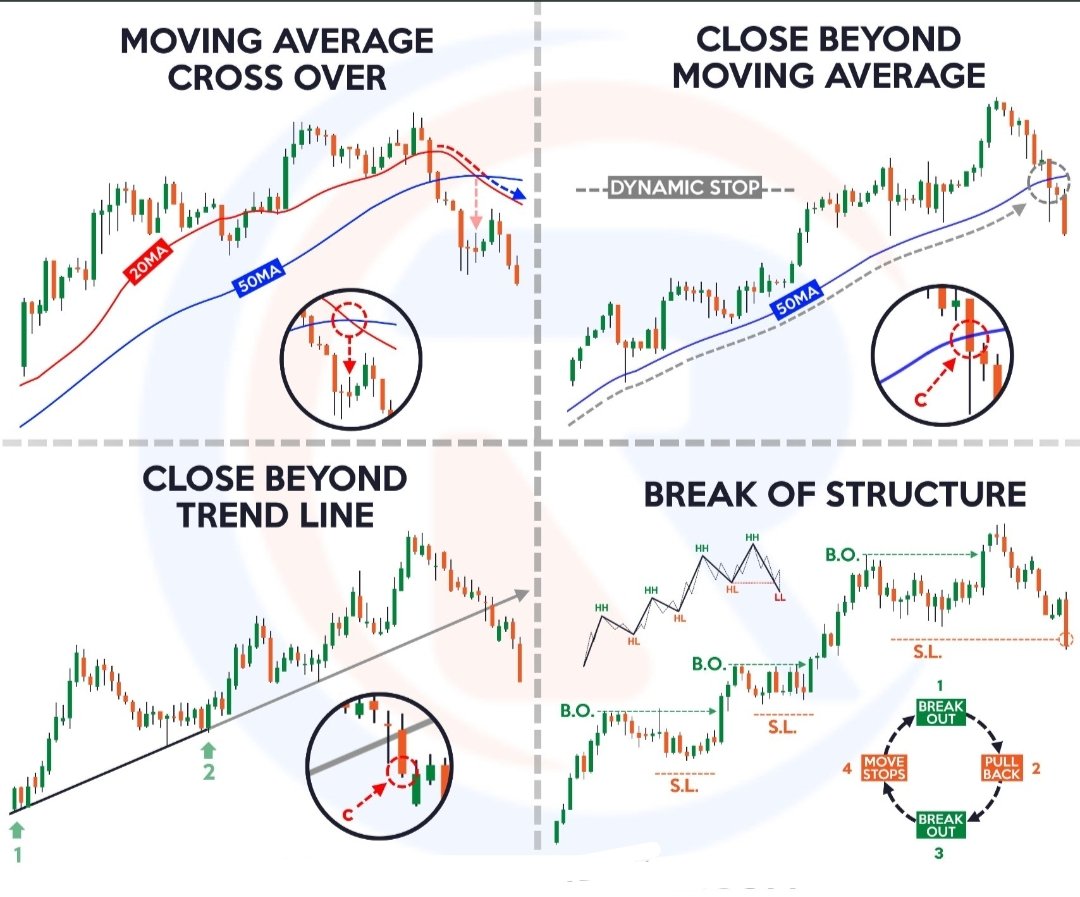

1️⃣ Restest/Pullback after at a Breakout Level

Retest after a breakout might not happen all the time; you can at least wait for a pullback and continuation in those cases.

#StockMarket #nifty50 #investing

1️⃣ Restest/Pullback after at a Breakout Level

Retest after a breakout might not happen all the time; you can at least wait for a pullback and continuation in those cases.

2️⃣ Volume Spikes

An increased volume in your intended trade direction signifies a good follow-up move. If they are falling, then you need to be careful too.

An increased volume in your intended trade direction signifies a good follow-up move. If they are falling, then you need to be careful too.

3️⃣ Wick Rejections

Long bottom wicks during pullbacks in an uptrend signify a follow-up move. Long top wicks in a downtrend can singal in more fall.

Long bottom wicks during pullbacks in an uptrend signify a follow-up move. Long top wicks in a downtrend can singal in more fall.

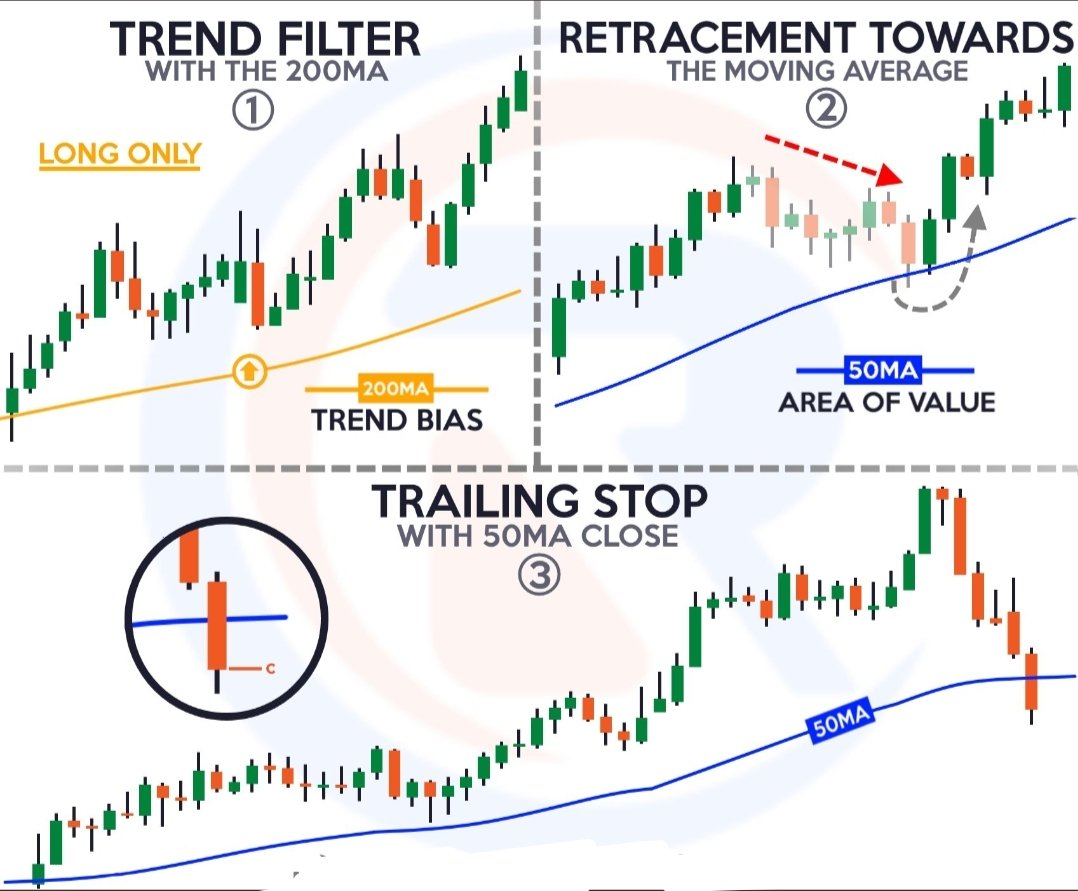

4️⃣ Key Crossovers

Although moving average is a lagging indicator, it can give an additional confirmation of a trend change, and when combined with price action, you can take better entires.

Although moving average is a lagging indicator, it can give an additional confirmation of a trend change, and when combined with price action, you can take better entires.

5️⃣ Look for Immediate S/R levels

Even after your strategy confirms you to take up a trade, keep a look at key immediate support or resistance levels as it can help you to stay away from low probable trades.

Even after your strategy confirms you to take up a trade, keep a look at key immediate support or resistance levels as it can help you to stay away from low probable trades.

• • •

Missing some Tweet in this thread? You can try to

force a refresh