🧵What have economists learned from the #GDPR?

I review the literature for a future NBER book on the "Economics of #Privacy" edited by @ce_tucker & @avicgoldfarb. 1/7

nber.org/books-and-chap…

I review the literature for a future NBER book on the "Economics of #Privacy" edited by @ce_tucker & @avicgoldfarb. 1/7

nber.org/books-and-chap…

Regulators & researchers seek to balance privacy & the data economy. The EU’s #GDPR is a landmark & influential regulation that defines personal data expansively. GDPR establishes:

-rules for data processing,

-rights for EU residents,

-responsibilities for firms, &

-BIG fines. 2/

-rules for data processing,

-rights for EU residents,

-responsibilities for firms, &

-BIG fines. 2/

#GDPR is hard to study:

A) Finding a suitable control group is hard because the GDPR had global spillovers. E.g., it affects EU firms & non-EU firms serving EU residents.

B) GDPR can screw with personal data: e.g., you may only see data from consenting users. 3/

A) Finding a suitable control group is hard because the GDPR had global spillovers. E.g., it affects EU firms & non-EU firms serving EU residents.

B) GDPR can screw with personal data: e.g., you may only see data from consenting users. 3/

C) Firm compliance & regulator enforcement is (ahem) variable, because it is legitimately difficult for both sides.

In data-intensive industries, we may then expect low compliance in equilibrium. But, if data thus show little impact, what have we actually learn about GDPR? 4/

In data-intensive industries, we may then expect low compliance in equilibrium. But, if data thus show little impact, what have we actually learn about GDPR? 4/

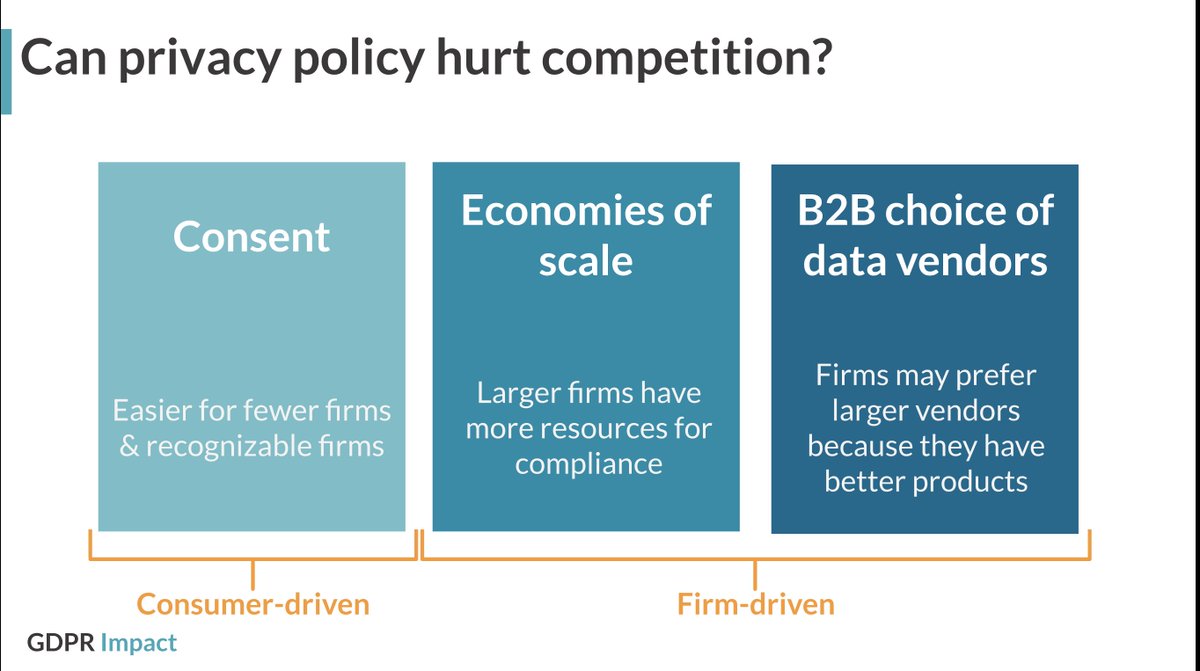

On the firm side, the #GDPR literature is mostly bleak.

Research documents harms to profits, revenue, investment, market exit, & entry.

Research also shows harms to competition, the web, & marketing, though more mixed evidence for innovation. 5/

Research documents harms to profits, revenue, investment, market exit, & entry.

Research also shows harms to competition, the web, & marketing, though more mixed evidence for innovation. 5/

On the consumer side, economists struggle to convincingly measure welfare gains from privacy (it's hard!), but illuminate this with survey, structural, & theory evidence.

Empirical research also shows objective privacy gains through post-GDPR decrease in data processing. 6/

Empirical research also shows objective privacy gains through post-GDPR decrease in data processing. 6/

Research illuminates the gap between #GDPR on paper vs. on the ground & the (unintended) consequences of the GDPR’s many elements.

I end by suggesting opportunities for future research on the GDPR as well as privacy regulation & privacy-related innovation more broadly. 7/7

I end by suggesting opportunities for future research on the GDPR as well as privacy regulation & privacy-related innovation more broadly. 7/7

PS: You can also download on SSRN if you prefer.

"Economic research on privacy regulation: Lessons from the GDPR and beyond"

ssrn.com/abstract=42908….

"Economic research on privacy regulation: Lessons from the GDPR and beyond"

ssrn.com/abstract=42908….

@threadreaderapp unroll please.

• • •

Missing some Tweet in this thread? You can try to

force a refresh