Revolutionizing finance with #DeFi! 💰

Real-world problems that can finally be solved with the adoption of decentralized finance.

Share THIS the next time someone calls crypto a scam or ponzi...

Thread 1 of 4 🧵👇

0/18

Real-world problems that can finally be solved with the adoption of decentralized finance.

Share THIS the next time someone calls crypto a scam or ponzi...

Thread 1 of 4 🧵👇

0/18

2/18

Remittances are a massive business.

It's estimated that citizens transferred almost $800bil to their home countries in 2022.

Remittances are a massive business.

It's estimated that citizens transferred almost $800bil to their home countries in 2022.

3/18

The business of remittances has a massive impact on the economies of the poorest countries and tends to account for a huge portion of their GDP.

The WEF outlines how significant this is in their 2023 article on 'Remittance flows and GDP Impact'.

weforum.org/agenda/2023/01…

The business of remittances has a massive impact on the economies of the poorest countries and tends to account for a huge portion of their GDP.

The WEF outlines how significant this is in their 2023 article on 'Remittance flows and GDP Impact'.

weforum.org/agenda/2023/01…

4/18

Some of the biggest beneficiaries of this business are third party remittance and payments processors who retain a fee for transferring money between borders.

Some names you might be familiar with:

Some of the biggest beneficiaries of this business are third party remittance and payments processors who retain a fee for transferring money between borders.

Some names you might be familiar with:

5/18

What's alarming is the amount of the fees that come with sending a remittance.

It's not quite as simple as sending from one bank account to another, which, unless you're with a s**t bank, is free most of the time.

What's alarming is the amount of the fees that come with sending a remittance.

It's not quite as simple as sending from one bank account to another, which, unless you're with a s**t bank, is free most of the time.

6/18

This is a list of fee types taken directly from the Western Union website:

-> Transfer fees

-> Intermediary bank fees

-> Exchange rate

-> Additional fees

This is a list of fee types taken directly from the Western Union website:

-> Transfer fees

-> Intermediary bank fees

-> Exchange rate

-> Additional fees

7/18

Over time these add up to a huge portion of the transactions which are sent, having a huge impact on how much the recipient eventually receives.

Over time these add up to a huge portion of the transactions which are sent, having a huge impact on how much the recipient eventually receives.

8/18

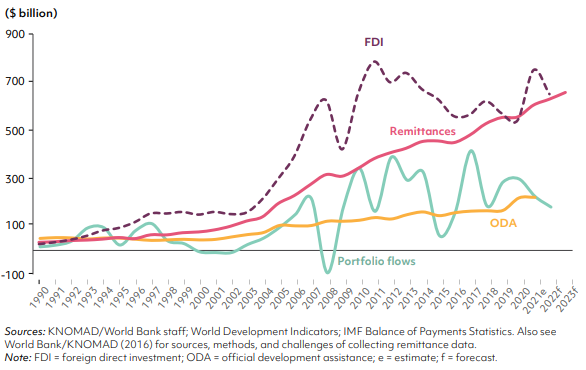

In last years report on migration and development from The World Bank group highlights how global remittance flow volumes are consistently in an uptrend year over year.

In last years report on migration and development from The World Bank group highlights how global remittance flow volumes are consistently in an uptrend year over year.

9/18

The cumulative volume of remittances is increasing, however, what's interesting is that the average proportion of fees taken by payment processors seems decreasing...

In other words, they are getting cheaper to use.

The cumulative volume of remittances is increasing, however, what's interesting is that the average proportion of fees taken by payment processors seems decreasing...

In other words, they are getting cheaper to use.

10/18

This statista report on global remittance costs only shares the data up to 2021, but it highlights the switch from higher fees (5-10% >) to the lower fee bands.

statista.com/statistics/962…

This statista report on global remittance costs only shares the data up to 2021, but it highlights the switch from higher fees (5-10% >) to the lower fee bands.

statista.com/statistics/962…

11/18

There could be many reasons for this:

🔘 Higher volume of cross-border payments

🔘 Pandemic (note the spike in fees changing in 2020)

🔘 Competition from newer and more innovative fintech biz

🔘 The accessibility of cryptocurrencies which are borderless and instant 💪

There could be many reasons for this:

🔘 Higher volume of cross-border payments

🔘 Pandemic (note the spike in fees changing in 2020)

🔘 Competition from newer and more innovative fintech biz

🔘 The accessibility of cryptocurrencies which are borderless and instant 💪

12/18

One thing is for sure, even with lower average cost of fees, 5% of all remittances is still a significant amount collected by payment processors and an equally large amount lost by both sender and recipient.

One thing is for sure, even with lower average cost of fees, 5% of all remittances is still a significant amount collected by payment processors and an equally large amount lost by both sender and recipient.

13/18

You can check out this tool from The World Bank which what the average transaction cost is for sending remittances from each country.

It fluctuates wildly.

You can see the most expensive countries below, the highest fee being almost 20%!

data.worldbank.org/indicator/SI.R…

You can check out this tool from The World Bank which what the average transaction cost is for sending remittances from each country.

It fluctuates wildly.

You can see the most expensive countries below, the highest fee being almost 20%!

data.worldbank.org/indicator/SI.R…

14/18

In contrast to these fees, the costs of sending cryptocurrency from one digital wallet from another - on the majority of networks - is negligible most of the time.

In contrast to these fees, the costs of sending cryptocurrency from one digital wallet from another - on the majority of networks - is negligible most of the time.

15/18

There are many networks which could showcase this, but I've included an example below of some of the layer-2 protocols on #Ethereum and their current associated fees.

l2fees.info

There are many networks which could showcase this, but I've included an example below of some of the layer-2 protocols on #Ethereum and their current associated fees.

l2fees.info

16/18

Not only this, but due to the archaic infrastructure payment rails are currently built on, remittances generally are slow af and can take days to move payment from one individual to another.

Not only this, but due to the archaic infrastructure payment rails are currently built on, remittances generally are slow af and can take days to move payment from one individual to another.

17/18

Considering this, and after reviewing the data above, I truly believe that some of the traditional payment processors might have had to reduce the costs of their fees so they aren't priced out of the market from the quick, easy and accessible alternative of using #crypto

Considering this, and after reviewing the data above, I truly believe that some of the traditional payment processors might have had to reduce the costs of their fees so they aren't priced out of the market from the quick, easy and accessible alternative of using #crypto

18/18

I hope you enjoyed the first of 4 mini-threads which I'll be releasing throughout this week.

Each will highlight a different real-world problem and act as a reminder why crypto & #defi exists and why we need a more decentralized finance world

👋

cryptocontemplation.substack.com

I hope you enjoyed the first of 4 mini-threads which I'll be releasing throughout this week.

Each will highlight a different real-world problem and act as a reminder why crypto & #defi exists and why we need a more decentralized finance world

👋

cryptocontemplation.substack.com

Let me know if these overviews and resources are useful to help with your conversations with non-crypto-natives!

Or, if there is anything else which would be useful to help you onboard people to #Web3.

@NFT_GOD #1percentbetter

Or, if there is anything else which would be useful to help you onboard people to #Web3.

@NFT_GOD #1percentbetter

• • •

Missing some Tweet in this thread? You can try to

force a refresh