💥1/9: UK housing affordability since the year 1876 (UPDATED to 2022)

Average house~9x average earnings

Here’s a chart-thread of my research, as covered by:

@Bloomberg @Telegraph, @thisismoney, @TheSun, @guardian

Full article: schroders.com/en/insights/ec…

#houseprices #property

Average house~9x average earnings

Here’s a chart-thread of my research, as covered by:

@Bloomberg @Telegraph, @thisismoney, @TheSun, @guardian

Full article: schroders.com/en/insights/ec…

#houseprices #property

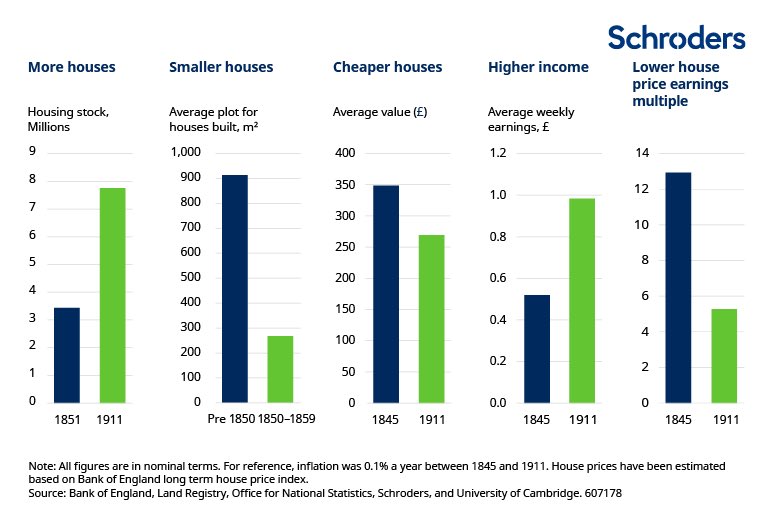

2/9 Last time UK houses were so expensive vs earnings was the year 1876

They were even more expensive previously…

What happened to change things? More houses, smaller houses, higher incomes.

They were even more expensive previously…

What happened to change things? More houses, smaller houses, higher incomes.

3/9 Most people didn’t really benefit though, as over 75% rented at that time. Home ownership didn’t take off until 2nd half of 20th century.

Note the reversal post-2001. Home ownership becoming less attainable

Note the reversal post-2001. Home ownership becoming less attainable

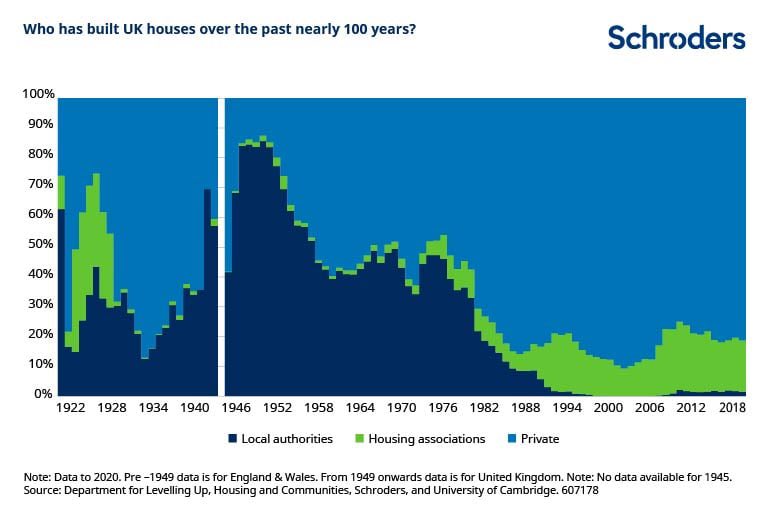

5/9 Big shifts in who has built houses. Private sector post-WW1, public sector post-WW2, private sector last 40yrs.

#SocialHousing?

#SocialHousing?

6/9 Massive regional variation.

Average London house costs over 12x average wage, Midlands~7.5x, North of England, and Wales ~6.5x, Scotland 5.5x.

Regional divergence a relatively recent phenomenon. Didn’t exist to much extent pre-2000

Average London house costs over 12x average wage, Midlands~7.5x, North of England, and Wales ~6.5x, Scotland 5.5x.

Regional divergence a relatively recent phenomenon. Didn’t exist to much extent pre-2000

7/9 #genderpaygap results in gender housing affordability gap.

Average London house costs over 14x average woman’s income.

#genderequality

Average London house costs over 14x average woman’s income.

#genderequality

8/9 falling interest rates have supported bigger mortgages

Issue hasn’t been the monthly payments, it’s been getting hold of the deposit

But now…

Potential homebuyers need to find more cash, lower their expectations, or prices have to fall (by enough)

Issue hasn’t been the monthly payments, it’s been getting hold of the deposit

But now…

Potential homebuyers need to find more cash, lower their expectations, or prices have to fall (by enough)

9/9 The full article with lots more explanation, detail, and fun historical stats can be read here schroders.com/en/insights/ec…

• • •

Missing some Tweet in this thread? You can try to

force a refresh