#AdaniGroup #GQGPartners $2Bn Block Deal is FAILSthe SMELL TEST in my opinion….. here is why

1) Avg PE Multiple of all the PUBLIC Portfolios of #GQGPartners is 7 to 8X …. Adani Stocks bought are at 25x, 144x, 89x & 77x.

2) NO MONEY goes to the Co. ONLY PROMOTER margin call

1) Avg PE Multiple of all the PUBLIC Portfolios of #GQGPartners is 7 to 8X …. Adani Stocks bought are at 25x, 144x, 89x & 77x.

2) NO MONEY goes to the Co. ONLY PROMOTER margin call

Let’s look at #GQGPartners in more detail. Here is an interesting Interview & Bloomberg

On the 3rd Minute he discusses Adani. Does not matter in my view & I will explain in new few tweets gqgpartners.com/insights/bloom…

On the 3rd Minute he discusses Adani. Does not matter in my view & I will explain in new few tweets gqgpartners.com/insights/bloom…

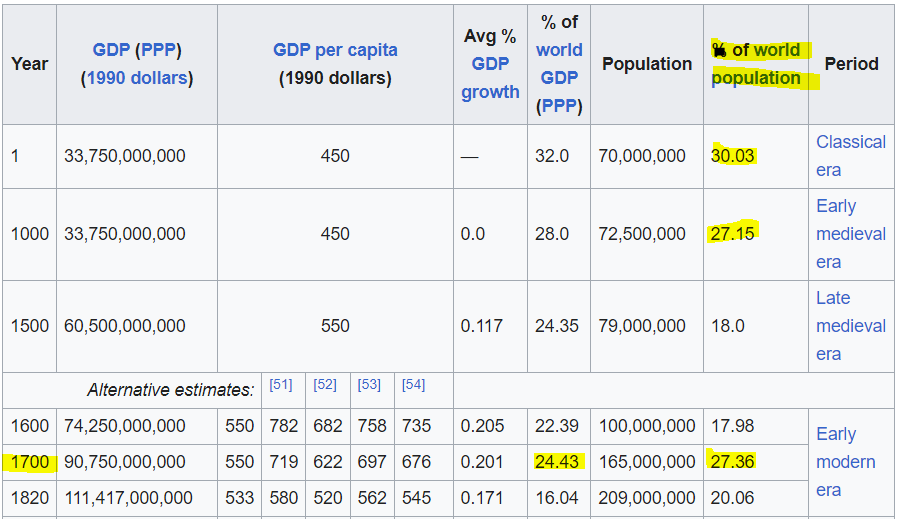

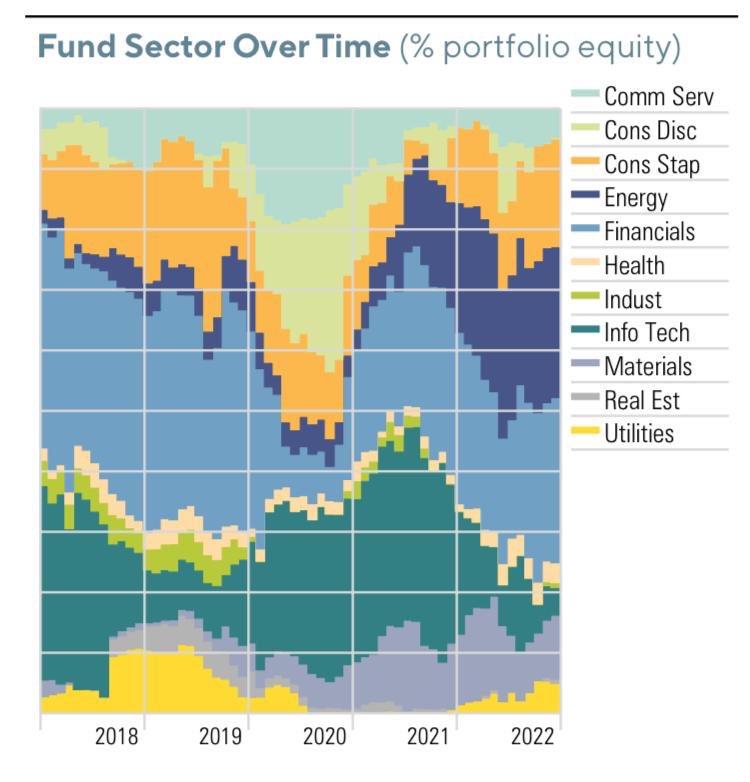

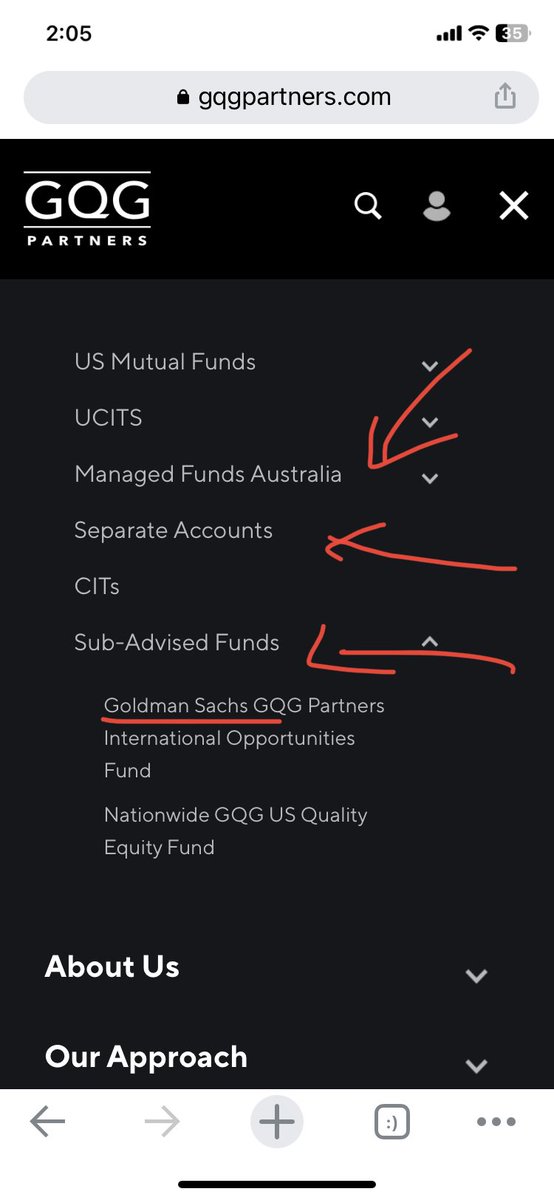

A look at FUNDS offered by #GQGPartners indicates that they mostly offer QUALITY, HIGH DIV YIELD and VALUE FOCUS.

Adani Group does NOT fit anywhere

Adani Group does NOT fit anywhere

Let’s look at their Sectors. BIG FOCUS on Consumer STAPLES (you will notice in later tweets, it’s mostly Tobacco), ENERGY (Low PE), FINANCIALS (low PE & Value) & COMMODITIES (Low PE)

BIG Underweight are TECH (Growth) & Consumer DISCRETIONARY (Cyclicals)

BIG Underweight are TECH (Growth) & Consumer DISCRETIONARY (Cyclicals)

Let’s look at the STOCKS. All are a combination of QUALITY, High DIVIDEND Yield, Low VALUATIONS (Financials, Energy & Commodities)

They have Focussed on India but have always focused on VALUE. With 34% of the Portfolio in India (High PE Market), it’s OVERALL portfolio PE is just 7X which means that even the Indian stocks have low PE or P/B

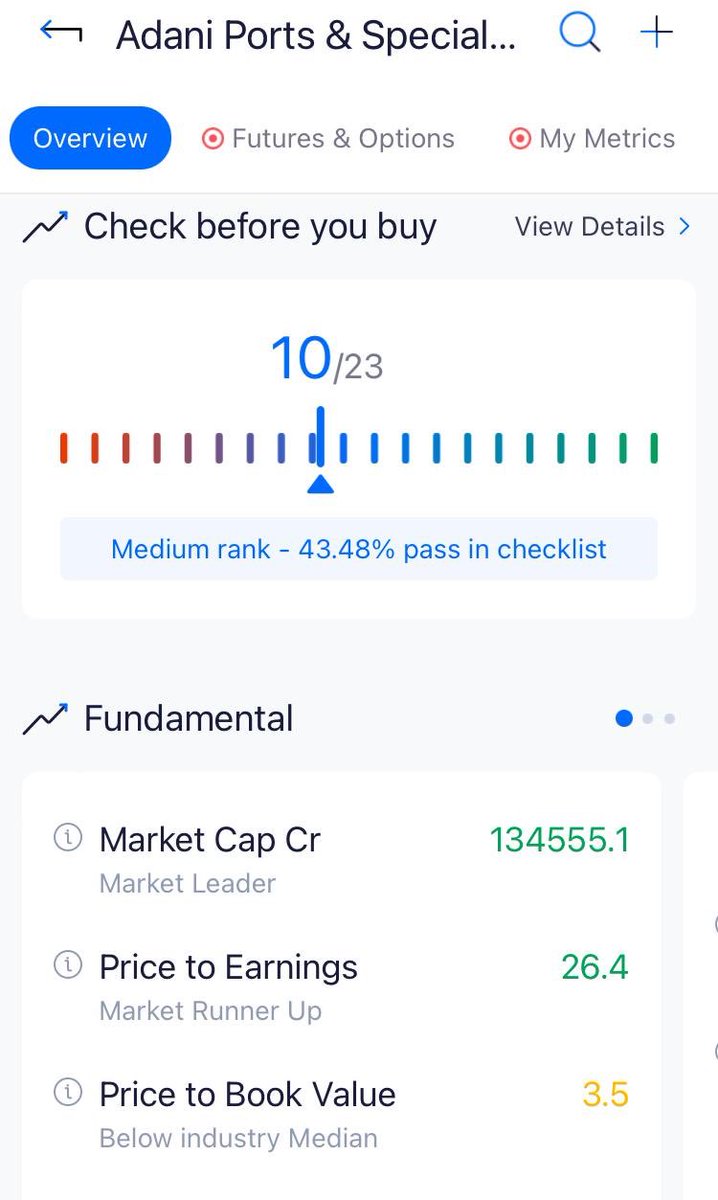

Let’s look at the PE Valuations of the ADANI Stocks.

PORTS @ 26X,

GREEN @ 144X,

ENTERPRISES at 89X, TRANSMISSION @ 72X.

All Eye Watering PEs

PORTS @ 26X,

GREEN @ 144X,

ENTERPRISES at 89X, TRANSMISSION @ 72X.

All Eye Watering PEs

Now if you NOTICE frm the website of #GQGPartners, apart from the Usual UCITS funds & US Listed Funds, they have Many SPECIAL Classes of Shares for existing EM/International Funds. Also lots of “Managed Accounts” and “client accounts”

YOU CAN PUT 2 & 2 Together to conclude

YOU CAN PUT 2 & 2 Together to conclude

Also, there are RUMOURS that Goldman SACHS Invested. It’s Actually GS GQG funds …. So it’s for Goldman SACHS High Value Clients or HNIs.

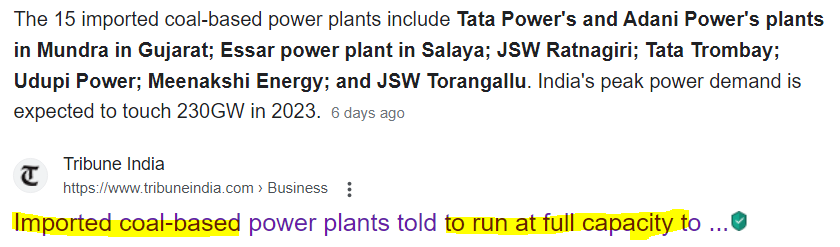

Impacts on the group borrowing ? NO MONEY goes to the ADANI Group but MONEY GOES to the PROMOTERS who may have had to cough up this money due to the $14bn of Leverage for ACC & ACEM deal. At 10% cost of Financing (UST 1yr is 6%), that’s about $120mn a month or $700mn every 6 mth

Who All Knew about the deal by 10am ? BTW… when ever a Institutional broker does a BIG BLOCK, they tell the entire mkt they have done the BIG BLOCK…. And they usually indicate the CHARACTERISTICS of the BUYER and SELLER without givinv oit the name. Ppl are able to guess enough

WHO ALL KNEW BUT THEY DIDN’T ACT.??

This block happened at 9.30am… by 10am the institutions would have an idea. Any INSTITUTION that was SELLING stock in India would have stopped his trade midway …. And YET, they sold Ra3000cr adj for the Adani Rs15000cr Net Buy

This block happened at 9.30am… by 10am the institutions would have an idea. Any INSTITUTION that was SELLING stock in India would have stopped his trade midway …. And YET, they sold Ra3000cr adj for the Adani Rs15000cr Net Buy

So RETAIL Investors will all get EXCITED … While FII Institutionals will use that to keep selling due to rising rates ….

WILL LIC BUY ? NO IN MY VIEW.

So RETAIL be a bit careful

WILL LIC BUY ? NO IN MY VIEW.

So RETAIL be a bit careful

DONT you find it STRANGE that all the FIIz who we’re prepared to BUY #AdaniEnterprises at Rs3200 were NOT part of today’s BLOCK Deal.

STRANGE! Why ONLY #GQGPartners

Am sure the INVESTMENT BANKERS would have approached everyone.

STRANGE! Why ONLY #GQGPartners

Am sure the INVESTMENT BANKERS would have approached everyone.

For all these reasons, I FEEL THAT there is something FISHY about the entire #AdaniGroup Sale to #GQG partners and it does NOT pass the SMELL TEST

It’s also INTERESTING & COINCIDENTAL that GQG is based out of Sydney, Australia, the CFO of AdaniGroup is based out of Sydney, Australia as he purchased his $48mn home in Sydney Australia.

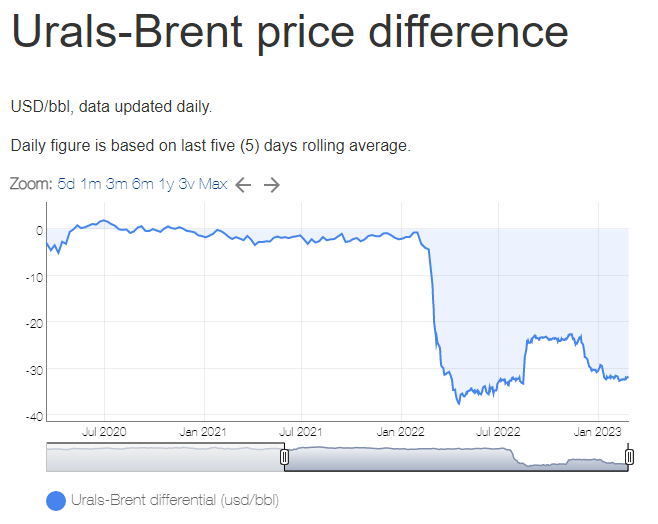

In his recent PODCAST, Rajiv primary spoke about the mistake that he made in his long career and interestingly never once mentioned about Infrastructure but was focused on ENERGY & COMMODITIES which eventually fed into INFLATION. He Liked RUSSIA, BRAZIL

gqgpartners.com/insights/podca…

gqgpartners.com/insights/podca…

In his Dec 2022 CIO Perspectives, #GQGPartners Rajiv Jain continues to talk about BRAZIL and preferring cos with high earnings yield and low valuations.

NONE of the Adani Cos fit that criteria. gqgpartners.com/insights/4q-20…

NONE of the Adani Cos fit that criteria. gqgpartners.com/insights/4q-20…

#AdaniGroup @GQGPartners does not pass the smell test!! @adaniwatch

Why am I not surprised? 👇🤣

#Australian Pension Funds Call up #GQGPartners about their Adani Investment.

reuters.com/business/austr…

Why am I not surprised? 👇🤣

#Australian Pension Funds Call up #GQGPartners about their Adani Investment.

reuters.com/business/austr…

Remember that #RajivJain is 68% Shareholder in #GQGPartners so in some way he is Baap of the company.

• • •

Missing some Tweet in this thread? You can try to

force a refresh