1) With the launch of #Arbitrum and the upcoming blockchain from coinbase (#base) layer-2 protocols without their native token in gas fees have become more popular.

Another protocol that follows this niche is @LightLinkChain 🧵👇

Another protocol that follows this niche is @LightLinkChain 🧵👇

2) #LightLink is a Layer 2 blockchain secured by Ethereum, purposefully built for Metaverse, NFT and Gaming applications.

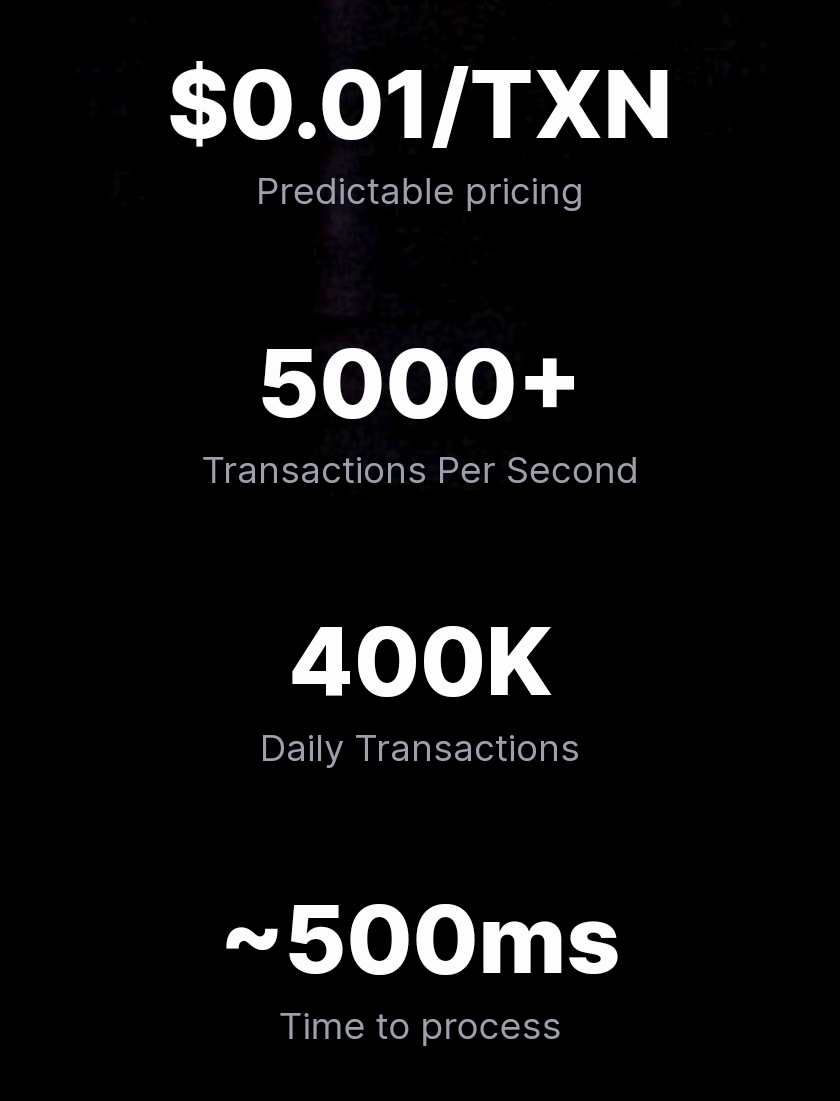

It promises:

• Low cost

• High speed

• Effortless scale

Their chain is secured, and decentralised by Ethereum.

It promises:

• Low cost

• High speed

• Effortless scale

Their chain is secured, and decentralised by Ethereum.

3) By choice #LightLink does not use its own token for gas fees.

Instead it uses $ETH to process transactions to remove the hurdle of having to always swap to other coins to use a chain.

It uses #ETH et a far lower cost however.

Instead it uses $ETH to process transactions to remove the hurdle of having to always swap to other coins to use a chain.

It uses #ETH et a far lower cost however.

4) Because it's a Layer-2 built on #ethereum they are:

• EVM compatible

• Layer 2 scaling

• Low fees

• Enterprise ready

There's even a "gas-free" mode to allow organisations to bypass gas costs at a monthly subscription.

To simplify their experience.

• EVM compatible

• Layer 2 scaling

• Low fees

• Enterprise ready

There's even a "gas-free" mode to allow organisations to bypass gas costs at a monthly subscription.

To simplify their experience.

5) #LightLink does have a token even when it's not used natively for gas-fees.

It's used for governance rights and participating in network growth.

As well as paying for certain other transactions.

It's used for governance rights and participating in network growth.

As well as paying for certain other transactions.

6) The team involves some big names with a diversified background experience.

All of them are fully doxxed and can be further looked at on their LinkedIn pages.

All of them are fully doxxed and can be further looked at on their LinkedIn pages.

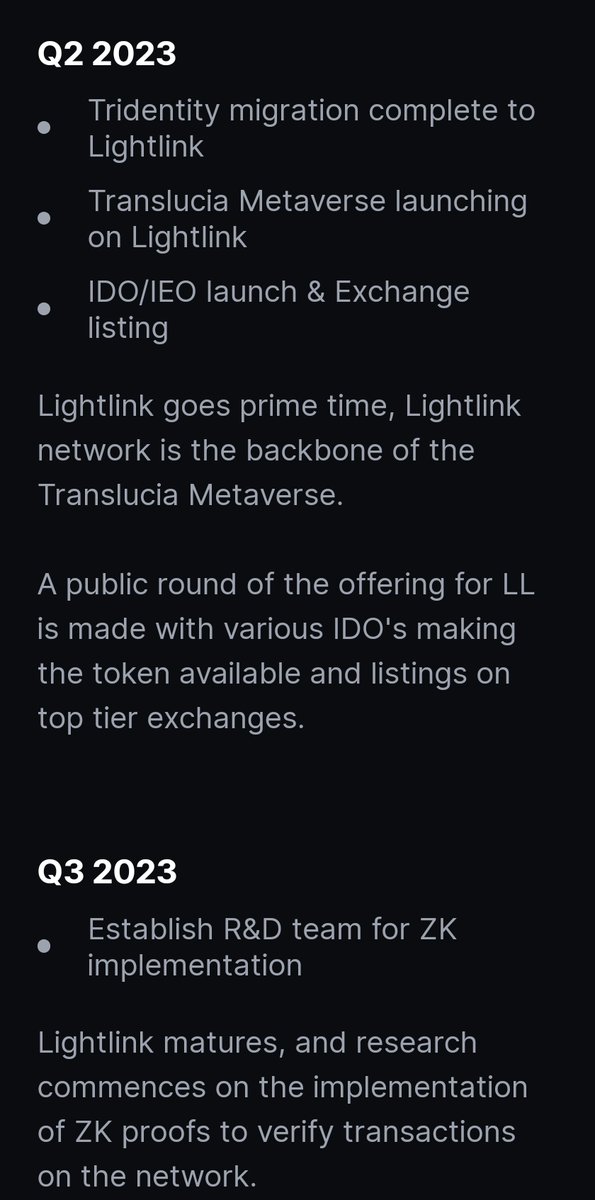

7) #LightLink is planned to go live later on this year but it's product has been in development a lot longer.

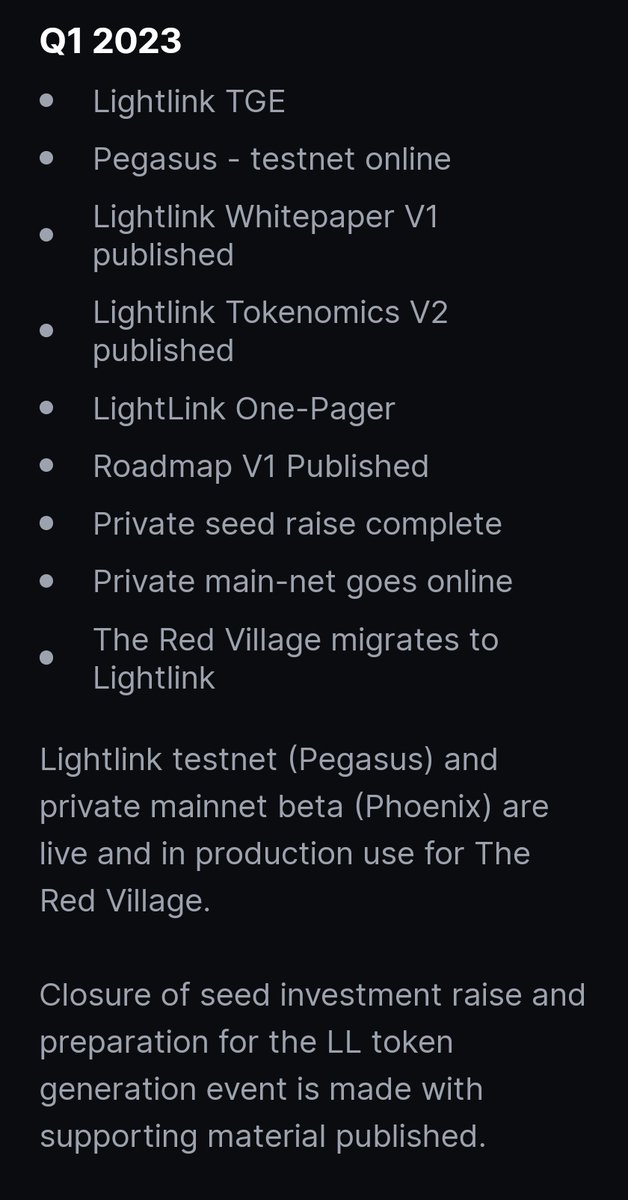

The full length of their roadmap ambitions can be seen in the images below.

The full length of their roadmap ambitions can be seen in the images below.

8) ⭐ Conclusion

#LightLink is in its very early stages of being a battle-tested product.

With its mainnet to go live later on this year it's always tough to know if something will see mass adoption.

#LightLink is in its very early stages of being a battle-tested product.

With its mainnet to go live later on this year it's always tough to know if something will see mass adoption.

9) Choosing to built on ethereum however makes it easy for developers to onboard their dApps without any struggle.

If they can present their solution to enough people they might have something good going.

I'm Interested to follow and see where they are headed.

Nova out ❤️

If they can present their solution to enough people they might have something good going.

I'm Interested to follow and see where they are headed.

Nova out ❤️

10) I hope you've found this thread helpful.

Follow me @CryptoGirlNova for more.

Like/Retweet the first tweet below if you can:

Follow me @CryptoGirlNova for more.

Like/Retweet the first tweet below if you can:

https://twitter.com/CryptoGirlNova/status/1631643443025051649

• • •

Missing some Tweet in this thread? You can try to

force a refresh