1) People keep asking for stablecoin-centric farms and since my last thread $Stablz has been steadily rising.

What have they accomplished so far and more importantly what are we getting out of it?

An update 🧵 👇

What have they accomplished so far and more importantly what are we getting out of it?

An update 🧵 👇

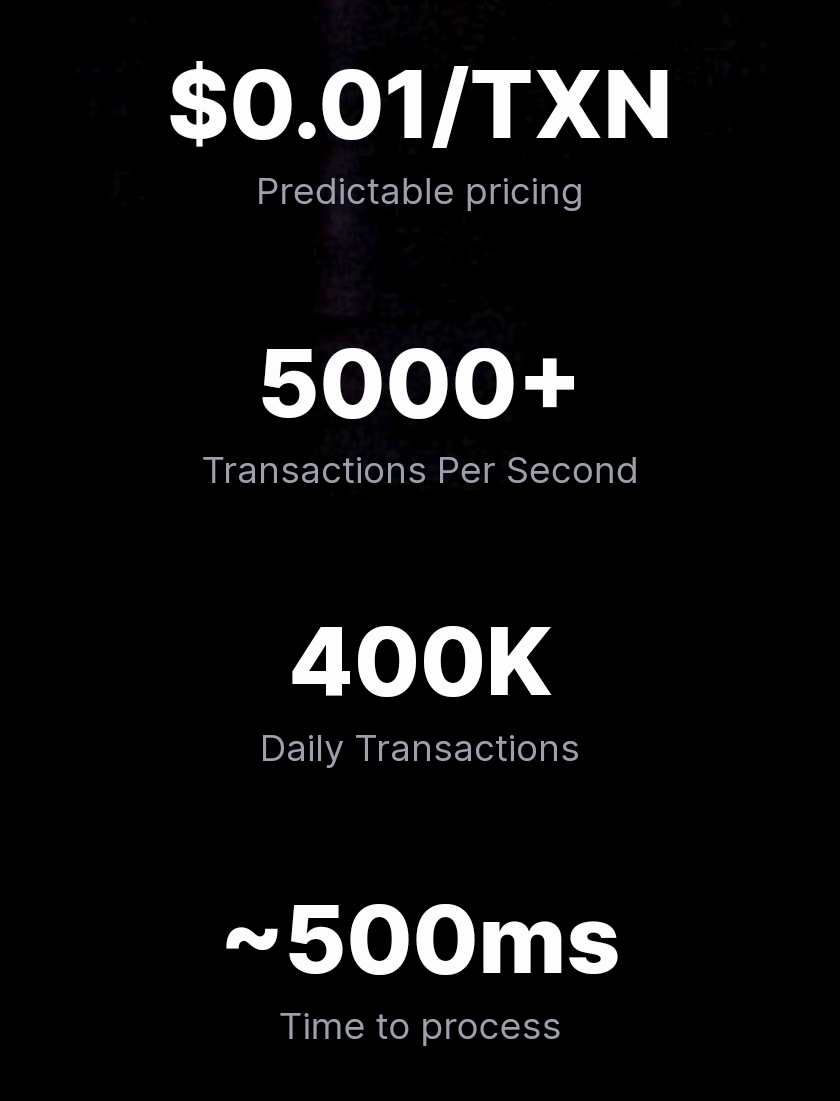

2) @Stablzone is a platform that maximizes yield with stablecoin-centric farms.

Instead of constantly minting more tokens and diluting the supply, they convert rewards to stablecoins to introduce sustainable yield.

Missed my last large overview thread? ↓

Instead of constantly minting more tokens and diluting the supply, they convert rewards to stablecoins to introduce sustainable yield.

Missed my last large overview thread? ↓

https://twitter.com/CryptoGirlNova/status/1627000363852374016

3) Since my first overview a couple of updates went live $Stablz did particularly well for themselves.

They've added a new pool which has been quite popular by the community.

The #Arcadeum pool on #arbitrum has 44% apy which even outperforms the curve pools.

They've added a new pool which has been quite popular by the community.

The #Arcadeum pool on #arbitrum has 44% apy which even outperforms the curve pools.

https://twitter.com/Stablzone/status/1631444893066227712

4) Users now have a more efficient and cost-effective way to deposit USDT and earn a higher APY.

The whitepaper has been a welcome addition to the website to further strengthen the general overview of the project.

The whitepaper has been a welcome addition to the website to further strengthen the general overview of the project.

https://twitter.com/Stablzone/status/1630319212580294657

5) Users also have the option to stake their $Stablz tokens recently to receive both yield and $OS tokens on them.

In turn they can stake their #OS tokens and receive daily profits in stablecoins (USDT).

In turn they can stake their #OS tokens and receive daily profits in stablecoins (USDT).

https://twitter.com/Stablzone/status/1628851968717234177

6) The token has seen some volatility over the past few weeks but has seen more positive growth overall.

Its social media presence has also been climbing which means people are getting more interested in putting their stables to work.

Its social media presence has also been climbing which means people are getting more interested in putting their stables to work.

7) What are your thoughts on stablz?

Will you be using them or are you looking for other ways to put your coins to work?

Let me know 👇

Nova out ❤️

Will you be using them or are you looking for other ways to put your coins to work?

Let me know 👇

Nova out ❤️

• • •

Missing some Tweet in this thread? You can try to

force a refresh