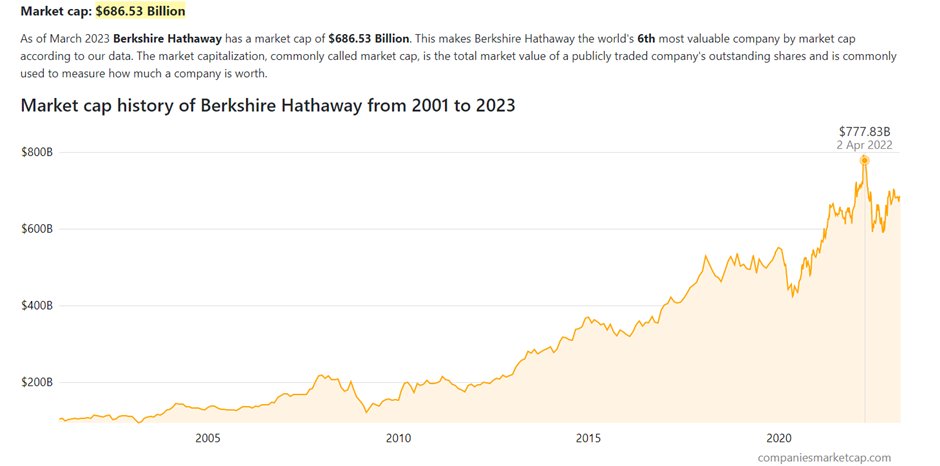

1/ #BerkshireHathaway is one of the world’s largest companies in terms of market cap ($686 billion, sixth largest). It is also one of the top few (top 15) globally in terms of total revenue.

Here is a thread briefly exploring the company.

Here is a thread briefly exploring the company.

3/ Whenever the company is mentioned, one often finds charts like the following (a comparison with S&P 500) to highlight the value that #BerkshireHathaway has created for its investors over time.

4/ Company’s business - “Its main business and source of capital is insurance, from which it invests the float (the retained premiums) in a broad portfolio of subsidiaries, equity positions and other securities.”

They also refer to themselves as a diffuse conglomerate.

They also refer to themselves as a diffuse conglomerate.

5/ There are many different businesses in the company. One way to look at the business of this conglomerate is five different groves in a forest (as mentioned in their 2018 letter)

6/ One of the key groves is the insurance business which provides the company with the ‘float’.

Amongst insurance subsidiaries (listed here), some are primary insurers, some reinsurance companies. Most are in the Property & Casualty Insurance space.

Amongst insurance subsidiaries (listed here), some are primary insurers, some reinsurance companies. Most are in the Property & Casualty Insurance space.

7/ The underwriting part of the insurance business is handled by the operating companies, while investing is handled by Warren Buffet and team.

8/ The ‘float’ from insurance business was $39 million in 1970. It grew to $164 bn in 2022. “Since 1967, an increase of 8,000-fold through acquisitions, operations and innovations.”

This ‘float’ is the key source of funds which is invested across a range of public companies

This ‘float’ is the key source of funds which is invested across a range of public companies

9/ The second grove is a series of businesses/ Operating Companies owned 80-100% by Berkshire Hathaway.

“the most valuable grove in Berkshire’s forest remains the many dozens of non-insurance businesses that Berkshire controls (usually with 100% ownership and never with <80%).”

“the most valuable grove in Berkshire’s forest remains the many dozens of non-insurance businesses that Berkshire controls (usually with 100% ownership and never with <80%).”

10/ Here is the list of operating companies owned. (Insurance has been discussed as grove 1).

There are several companies spanning across railroads, energy, manufacturing, services and retailing.

There are several companies spanning across railroads, energy, manufacturing, services and retailing.

11/ Berkshire’s runner-up grove by value is its collection of equities, typically involving a 5-10% ownership position in a very large company. Here is a 2021 year-end list of the key minority investments.

12/ The 2022 year-end list not available, but to note that these are carried at market value in the Berkshire Hathaway Balance Sheet, and annual fluctuations are recognised in Income Statement.

Here is a May 2022 infographic

Here is a May 2022 infographic

13/ Apart from (a) insurance, (b) operating companies, (c) public company investments from float, there are 3-4 companies where the control is shared. (26.6% of Kraft Heinz, 21% of Occidental Petroleum, Pilot travel centres (now majority owned) and Berkadia Commercial Mortgage.

14/ The final grove is the cash and liquid assets held by the company. Here is a snapshot. ~$87 billion was held as cash while ~$25 million in fixed maturity securities.

15/ So the five groves are: (1) insurance business (float source), (2) the different non-insurance operating companies, (3) minority investments in public securities, (4) shared control companies and (5) cash.

16/ In the 2021 letter, they share another way to look at their holdings – what they call the four giants or the largest chunks of value: (i) Insurance Business, (ii) shareholding in Apple, (iii) BNSF (railroad) and (iv) BHE (energy), and then everything else.

17/ Here is a list of acquisition criteria from their website from 1995.

The business is like a very large Investment Fund without limits on deal size, holding term (they need not sell) etc. The source of funds is Insurance Float rather than third party or institutional capital

The business is like a very large Investment Fund without limits on deal size, holding term (they need not sell) etc. The source of funds is Insurance Float rather than third party or institutional capital

18/ In terms of people employed - the Corporate Office has only 26 people, but the group of businesses – Berkshire and its consolidated subsidiaries employ ~383,000 people worldwide.

19/ Here is the Income Statement, Balance Sheet and Cash Flow Statement of #BerkshireHathaway.

The consolidated revenue is $302 billion, and a net loss of $22 billion for FY2022.

The operating earning though is $30.8 billion for 2022.

The consolidated revenue is $302 billion, and a net loss of $22 billion for FY2022.

The operating earning though is $30.8 billion for 2022.

20/ Most of the above information is from #BerkshireHathaway Annual Reports and the shareholder letters over the years.

• • •

Missing some Tweet in this thread? You can try to

force a refresh