🐻♉️↗️↘️↔️⚠️🚩🔺🔻💰

Macro Review 03/10/23

🧵 1/8

The #Kraken may have been unleashed on financial markets this week with volatility up across asset classes.

Let’s dig into the critical 🧮 from the week!

© Adobe Stock

Macro Review 03/10/23

🧵 1/8

The #Kraken may have been unleashed on financial markets this week with volatility up across asset classes.

Let’s dig into the critical 🧮 from the week!

© Adobe Stock

2a/8

After a week of reflation and my #CrashRiskRising call from 02/26/23, Jay Powell stepped up to the plate and told us “dot plot going higher.”

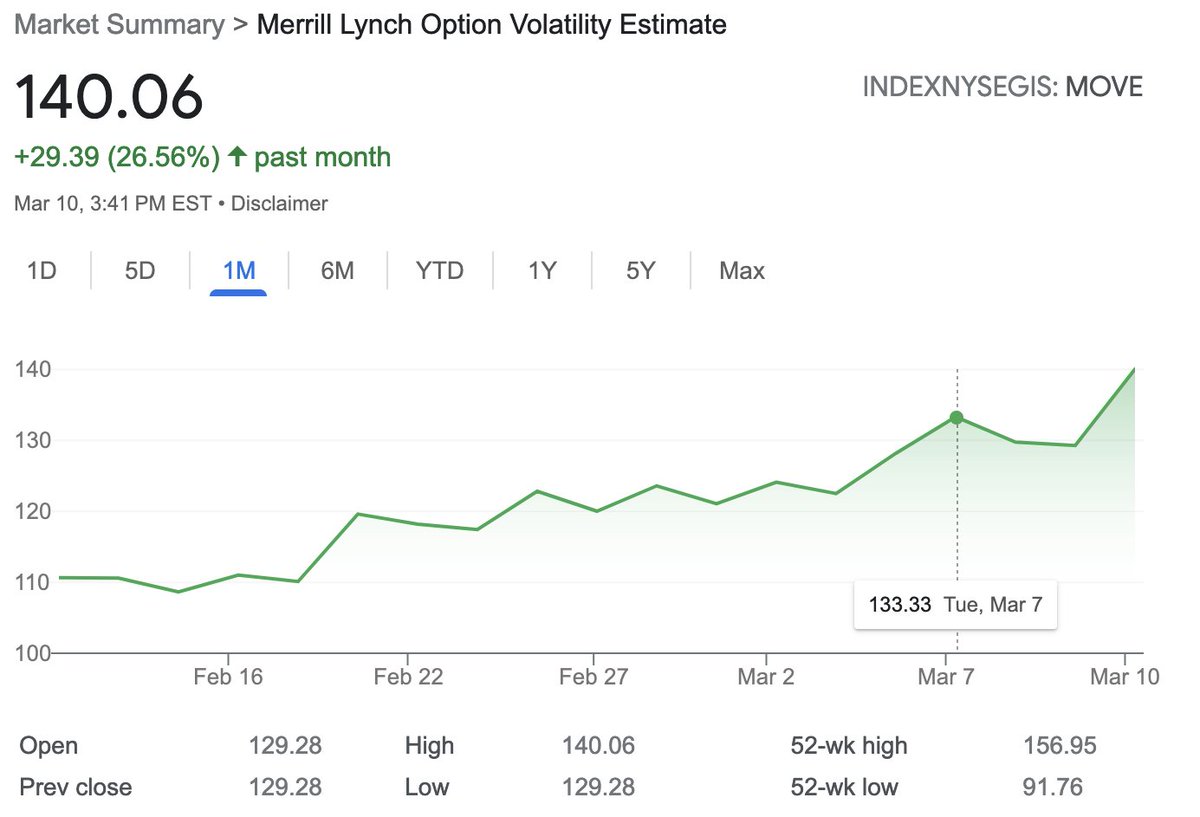

The UST2Y ripped, the curve inverted further, and the MOVE ↗️

Chart: MOVE index 140.06

After a week of reflation and my #CrashRiskRising call from 02/26/23, Jay Powell stepped up to the plate and told us “dot plot going higher.”

The UST2Y ripped, the curve inverted further, and the MOVE ↗️

Chart: MOVE index 140.06

2b/8

After two days of Powell chatting with Congress, the UST 2Y accelerated to 5.05%, a multi-year high, before crashing hard on the SVB news.

Chart: $UST2Y with -1.6 STD move in 2 days

After two days of Powell chatting with Congress, the UST 2Y accelerated to 5.05%, a multi-year high, before crashing hard on the SVB news.

Chart: $UST2Y with -1.6 STD move in 2 days

2c/8

By the end of the week, the 10Y3M curve re-inverted to a a cycle low of -131 bps

“It’s nothing, bro.” It’s priced in. You can't make money with a consensus view by buying bonds because you think a recession is coming.

Yup, this time is different. ✅

Chart: 10Y3M

By the end of the week, the 10Y3M curve re-inverted to a a cycle low of -131 bps

“It’s nothing, bro.” It’s priced in. You can't make money with a consensus view by buying bonds because you think a recession is coming.

Yup, this time is different. ✅

Chart: 10Y3M

2d/8

By the end of the week, long bonds were ripping on the SVB news.

You see - the freaking MOVE and the inverted yield curve were telling you something. #Kraken

Chart: TLT daily +3.46% in a single day

By the end of the week, long bonds were ripping on the SVB news.

You see - the freaking MOVE and the inverted yield curve were telling you something. #Kraken

Chart: TLT daily +3.46% in a single day

3a/8

And then we have equities.

Mike Wilson, the highly respected MS CIO who had maintained a consistently bearish outlook, capitulated on Monday, March 6

And then we have equities.

Mike Wilson, the highly respected MS CIO who had maintained a consistently bearish outlook, capitulated on Monday, March 6

https://twitter.com/tdarling1/status/1632914359209934850?s=20

3b/8

The $VIX hit a low of 18.14 the same day Mike capitulated; it steadied, rose on Powell, and ripped on SVB

Chart: $VIX daily closed at 24.80 after tagging 28.97 intraday on Friday. #Kraken

The $VIX hit a low of 18.14 the same day Mike capitulated; it steadied, rose on Powell, and ripped on SVB

Chart: $VIX daily closed at 24.80 after tagging 28.97 intraday on Friday. #Kraken

3d/8

The $SPX put in a big higher low at 4078 the very day Mike capitulated, before 🤮

Chart: $SPX daily shed -4.7% in 4 days #Kraken

The $SPX put in a big higher low at 4078 the very day Mike capitulated, before 🤮

Chart: $SPX daily shed -4.7% in 4 days #Kraken

3e/8

Small caps starting selling on Monday and never looked back

Chart: $IWM daily -8.0% on the week #Kraken

Small caps starting selling on Monday and never looked back

Chart: $IWM daily -8.0% on the week #Kraken

4/8

#NFP came out relatively hot on Friday +311,000 with wages +4.6% y/y, but it didn’t matter as it was quickly subsumed by SVB, the 15th largest bank in the US, imploded to FDIC receivership

Chart: US Average Hourly Earnings #AHE ticked up to +4.6%

#NFP came out relatively hot on Friday +311,000 with wages +4.6% y/y, but it didn’t matter as it was quickly subsumed by SVB, the 15th largest bank in the US, imploded to FDIC receivership

Chart: US Average Hourly Earnings #AHE ticked up to +4.6%

5/8

On any other day, the $USD would have ripped higher as +50 BPS became fully priced into the 3/22 #FOMC meeting. But SVB called that all into question as the Fed may be forced to ease rather than tighten to avoid a banking #Kraken

On any other day, the $USD would have ripped higher as +50 BPS became fully priced into the 3/22 #FOMC meeting. But SVB called that all into question as the Fed may be forced to ease rather than tighten to avoid a banking #Kraken

6/8

GOLD, on the other hand, benefited from the drop in yields and the USD as well as the underlying concern about more bank runs.

Chart: $GOLD, after putting in a short-term double bottom at 1813, climbed +2.7% in 2 days

Kryptonite for the #Kraken

GOLD, on the other hand, benefited from the drop in yields and the USD as well as the underlying concern about more bank runs.

Chart: $GOLD, after putting in a short-term double bottom at 1813, climbed +2.7% in 2 days

Kryptonite for the #Kraken

7a/8

Was it Powell? Was it SVB?

Doesn’t matter - our concern could quickly shift from sticky #inflation to outright deflation if more banks are forced to realize losses by selling their “pristine” reserves, notably USTs and MBS. #Kraken

Was it Powell? Was it SVB?

Doesn’t matter - our concern could quickly shift from sticky #inflation to outright deflation if more banks are forced to realize losses by selling their “pristine” reserves, notably USTs and MBS. #Kraken

7b/8

Banks have been complacent for too long with free deposits.

Investors have discovered money markets yielding 4.5% and T-bills at 5%

Depositors pull deposits, and banks are forced to realize losses on collateral, setting up a self-reinforcing downward spiral #Kraken

Banks have been complacent for too long with free deposits.

Investors have discovered money markets yielding 4.5% and T-bills at 5%

Depositors pull deposits, and banks are forced to realize losses on collateral, setting up a self-reinforcing downward spiral #Kraken

8/8

Crash risk is no longer rising.

It is right in front of us.

Next week will be telling and complex with a HUGE March #OPEX on Friday, Uncle Carl ITM, and big risks to the down side

Avoid the #Kraken and have a super profitable 💰 week!

Crash risk is no longer rising.

It is right in front of us.

Next week will be telling and complex with a HUGE March #OPEX on Friday, Uncle Carl ITM, and big risks to the down side

Avoid the #Kraken and have a super profitable 💰 week!

• • •

Missing some Tweet in this thread? You can try to

force a refresh