A thread 🧵 on #CentralBanks for your awareness.

Gold has been considered hard money for 5000 years. 20% of all the gold ever mined is owned by central banks of the world. Why do central banks buy gold?

- Balancing foreign exchange reserves

- Hedging against fiat currencies

-… twitter.com/i/web/status/1…

Gold has been considered hard money for 5000 years. 20% of all the gold ever mined is owned by central banks of the world. Why do central banks buy gold?

- Balancing foreign exchange reserves

- Hedging against fiat currencies

-… twitter.com/i/web/status/1…

How much gold do we have in the entire world?

A cube (22m x 22m x 22m) is all the gold ever mined.

- 201,296 tons of gold (above ground, extracted)

- 53,000 tons of gold (below ground, unextracted)

46% used for jewelry

17% held by central banks

22% held by private investors… twitter.com/i/web/status/1…

A cube (22m x 22m x 22m) is all the gold ever mined.

- 201,296 tons of gold (above ground, extracted)

- 53,000 tons of gold (below ground, unextracted)

46% used for jewelry

17% held by central banks

22% held by private investors… twitter.com/i/web/status/1…

Here’s a prev 🧵 on #FederalReserve the largest central bank in the world

https://twitter.com/DeepBlueCrypto/status/1636010204142641154

If you want to understand how quickly money changes hands, what M2 money supply is and how debts are cleared… go watch this 2 min clip 👍

#BankingCrisis hit so hard and markets have such low confidence on #CreditSuisse, they offered $0.5 per share totaling $2 billion wiping out $68 billion it was valued at just a couple of years ago… fire-sale

Banks are broke everywhere. They’re begging central banks for liquidity👇

#FederalReserve hasn’t ever been independently audited for its gold quantity or quality. What if they’re faking the reserves at 8,200 metric tons without audits just like the JPMorgan Nickel stash which turned out to be stones 🤷♂️

#CreditSuisse paid $11.5 billion in misdemeanor slap on the wrist fines alone. UBS acquired it for 1/4th that.

USD vs. #Bitcoin

A MUST WATCH CLIP 🔥🔥🔥🔥

A senator asks tough questions to Janet Yellen and she stumbles to answer those #JanetYellen

A senator asks tough questions to Janet Yellen and she stumbles to answer those #JanetYellen

When they say they’re bailing out the banks without any sort of impact to the taxpayers… don’t trust them

Funny it resembles our banking system

Fiat central banking with money printing without any backing of value is plunder. Plunder is the way of life for all #CentralBanks including the #FED

CPI is garbage when they can cook the books on what factors go in & out. If the reported inflation is 6%, the real inflation is at least 2x-3x that number.

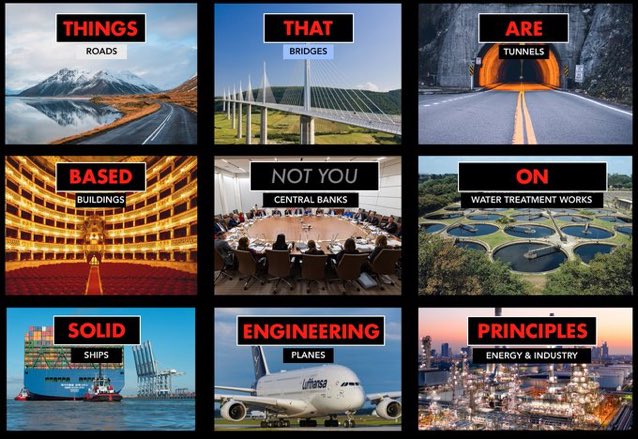

#FederalReserve and #CentralBanks are not based on sound economic policies. All that Fiat economists do is stealth wealth stealing and hope no one notices it until it dies off. They extend the charade with a new Fiat.

Chancellor on the brink of a third bailout for banks. The flood is upon us all. Are you on the #Bitcoin ark yet?

The #FederalReserve dot plot

• • •

Missing some Tweet in this thread? You can try to

force a refresh