There is a lot of confusion on this #UPI charges and its being made to spread multiple 'fake news' in a area where there is clarity. This directly stems from fact - who is allowed to price on what?

#CashlessConsumer will attempt to decode this in a 🧵

#CashlessConsumer will attempt to decode this in a 🧵

https://twitter.com/AbhiChtrj/status/1640401813102030849

1. What is being announced?

NPCI will charges #MDR for transactions above ₹2000 - when the payment mode by user is a wallet.

Note - this is not the same as using PhonePe / GPay.

It is applicable only when you use Wallet - PhonePe / PayTM are popular wallets still exist.

NPCI will charges #MDR for transactions above ₹2000 - when the payment mode by user is a wallet.

Note - this is not the same as using PhonePe / GPay.

It is applicable only when you use Wallet - PhonePe / PayTM are popular wallets still exist.

It is not applicable when you use UPI via banks.

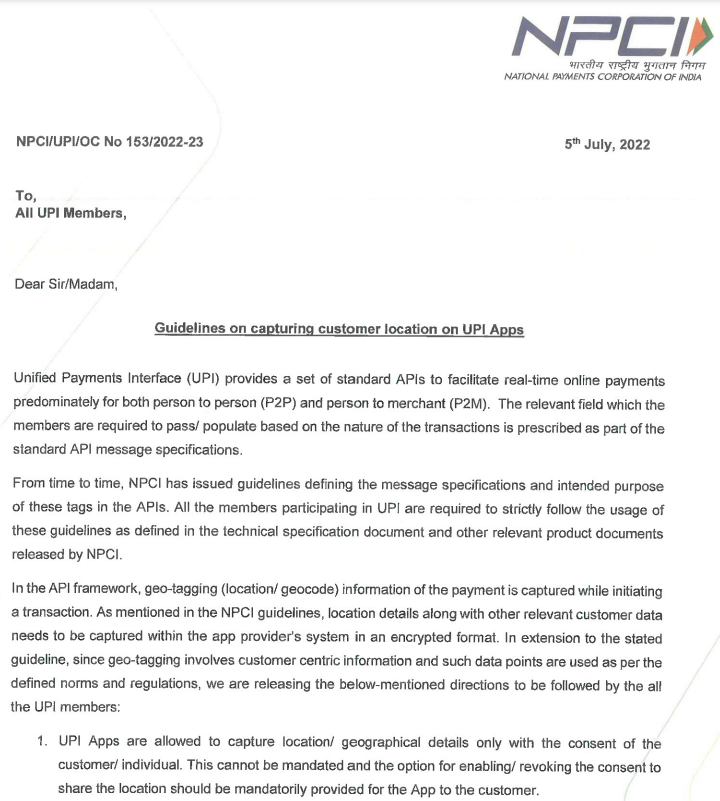

2. Who is making this announcement?

NPCI.

3. Can NPCI make this announcement?

All Payment operators are at liberty to price payment products - except ATM interchange - which @RBI actively regulates.

2. Who is making this announcement?

NPCI.

3. Can NPCI make this announcement?

All Payment operators are at liberty to price payment products - except ATM interchange - which @RBI actively regulates.

4. Will consumer pay more?

Of course - merchant will price 1% more implicitly- for he doesn't know when you scan via QR - you are using wallet / bank account.

Think merchant = Mutual fund SIP - not chai sutta corner - which will still be mostly free.

Of course - merchant will price 1% more implicitly- for he doesn't know when you scan via QR - you are using wallet / bank account.

Think merchant = Mutual fund SIP - not chai sutta corner - which will still be mostly free.

5. Does NPCI really have rights to make this announcement?

Actually NOT - Because Finance Act 2019 notification - does not make a distinction between UPI & UPI via wallets So this notification for 269SU applicable for all tax paying merchants CANNOT be overruled by NPCI circular

Actually NOT - Because Finance Act 2019 notification - does not make a distinction between UPI & UPI via wallets So this notification for 269SU applicable for all tax paying merchants CANNOT be overruled by NPCI circular

6. Does @NPCI_NPCI think its bound by law?

Historically - yes - they will just lobby via their patrons to basically update the law. Expect @FinMinIndia to update notification above mentioned in coming days

Historically - yes - they will just lobby via their patrons to basically update the law. Expect @FinMinIndia to update notification above mentioned in coming days

7. So which merchants will charge more?

Large merchants - think Amazon / large retail stores / online portals - where scale is so large - will update their pricing to include 1% (They already price 2% higher for Credit card MDR) - so mostly won't change ....

Large merchants - think Amazon / large retail stores / online portals - where scale is so large - will update their pricing to include 1% (They already price 2% higher for Credit card MDR) - so mostly won't change ....

Places like small hospitals etc - who have so far accepted UPI, but not accepted cards because it carries a cost - will now either update pricing / stop accepting UPI (which is outlawed by same Finance Act btw)

Though people use PayTM wallet / PhonePe wallet - the population is significantly lower (single digit %) when compared to UPI userbase which uses bank account

Most likely you are using UPI with your bank acc. Among wallets - only icici pockets is actually fully supported

Most likely you are using UPI with your bank acc. Among wallets - only icici pockets is actually fully supported

Then where else is "prepaid wallet" comes into picture where #MDR is applicable.

Answer is #eRUPI - which is a prepaid voucher issued by government for #DBT. Increasingly more schemes are brought under voucher system.

MDR will be charged from these issuers (mostly govt)

Answer is #eRUPI - which is a prepaid voucher issued by government for #DBT. Increasingly more schemes are brought under voucher system.

MDR will be charged from these issuers (mostly govt)

This was also originally designed for "vaccination vouchers" to be given by employers. That didn't greatly kick off / by that time - vaccination itself hit a dud / government made vaccines free

Some 'clarification'

https://twitter.com/NPCI_NPCI/status/1640964585267281926

But - given the skew in acceptance + pushing of #eRUPI as against #DBT - The 0.001 will increase.

Since its UPI - basically - there is a centralized log of interchange by top 2 acquirers - and the interchange rate is function (Electoral bonds) :)

Since its UPI - basically - there is a centralized log of interchange by top 2 acquirers - and the interchange rate is function (Electoral bonds) :)

https://twitter.com/deepakabbot/status/1640991982108516359

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter