Hey @cronos_chain and @cosmos Farmers! @TectonicFi incentives are live on their new isolated pools with up to 20% APY on stables!

This means farming is now more

✅ Secure

✅ Flexible

✅ Capital Efficient

How can you earn these FREE INCENTIVES? 🤑

First you gotta know

#cronos

This means farming is now more

✅ Secure

✅ Flexible

✅ Capital Efficient

How can you earn these FREE INCENTIVES? 🤑

First you gotta know

#cronos

what is @TectonicFi and @VenoFinance!

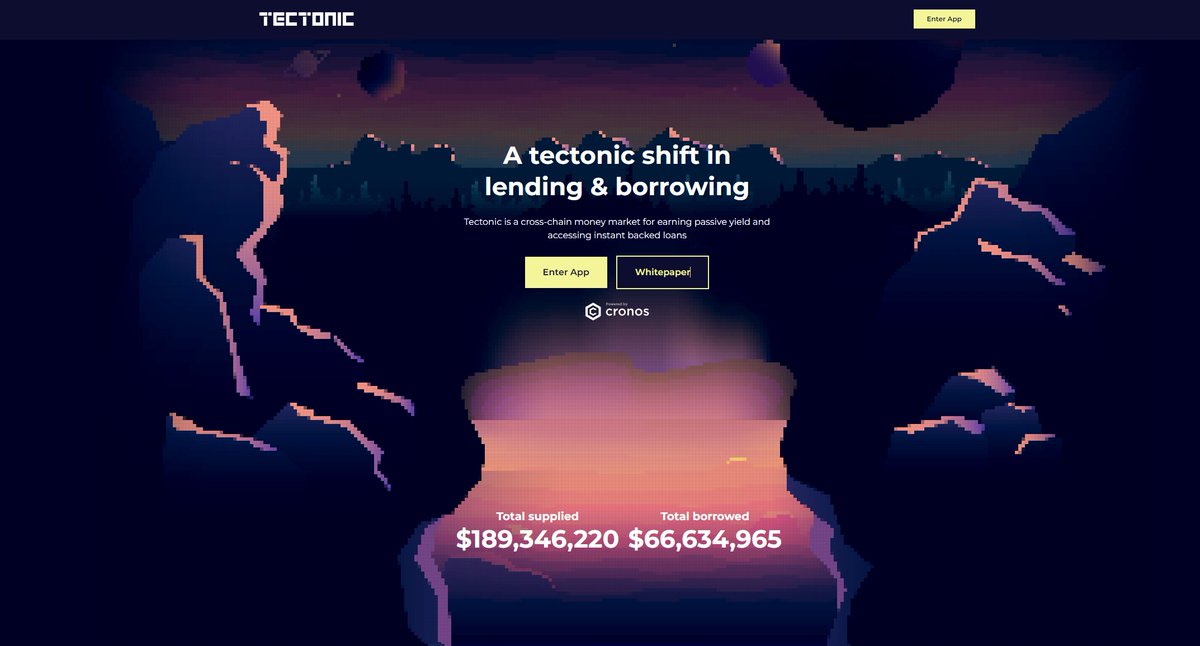

Tectonic is like @AaveAave, a cross-chain money market for earning passive yield and instant loans!

Veno is like @LidoFinance, a $CRO liquid staking protocol giving you extra APY with $LCRO, an auto-compounding yield-bearing token!

Tectonic is like @AaveAave, a cross-chain money market for earning passive yield and instant loans!

Veno is like @LidoFinance, a $CRO liquid staking protocol giving you extra APY with $LCRO, an auto-compounding yield-bearing token!

Tectonic's isolated pools allow for multiple lending markets, each supporting their own assets, like a sandbox for smaller cap coins!

Each pool has its own risks, making it safer to list smaller tokens without increasing risk for other pools.

Got it? Let's explore strategies!

Each pool has its own risks, making it safer to list smaller tokens without increasing risk for other pools.

Got it? Let's explore strategies!

The first isolated pool will be in partnership with @VenoFinance!

4 ways to be rewarded in the $LCRO Pool 🔥

1. Lending $LCRO on Tectonic

2. Using $tLCRO to earn more rewards on @VenoFinance

3. $LCRO looping for more staking rewards

4. LP on @FerroProtocol

5. Stablecoin looping

4 ways to be rewarded in the $LCRO Pool 🔥

1. Lending $LCRO on Tectonic

2. Using $tLCRO to earn more rewards on @VenoFinance

3. $LCRO looping for more staking rewards

4. LP on @FerroProtocol

5. Stablecoin looping

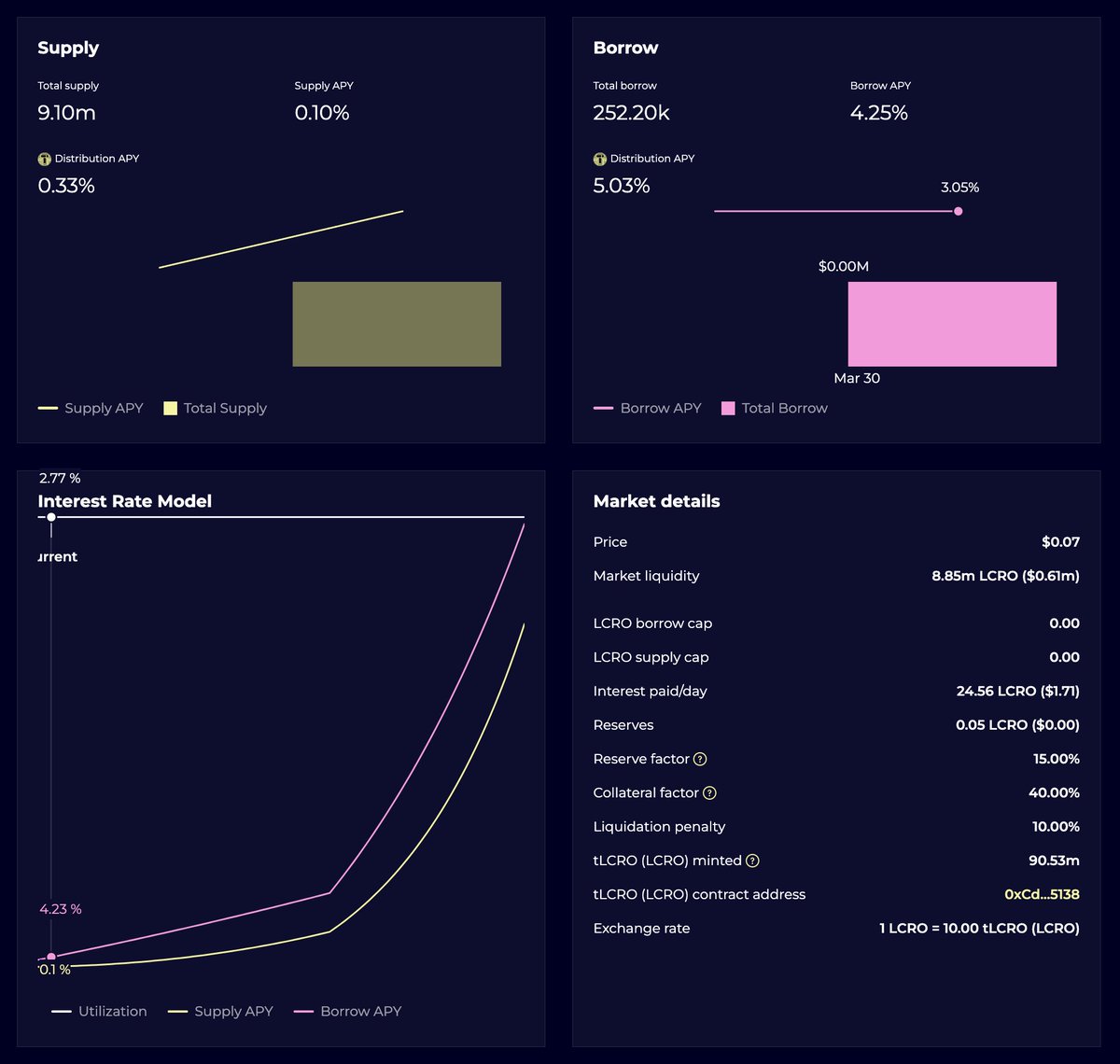

1. Lending $LCRO on Tectonic is similar to lending in the main pool but each isolated pool has its own cap, supply, APR, etc!

The available tokens for the $LCRO Pool are displayed along with their respective reserve, collateral factors, and other information.

The available tokens for the $LCRO Pool are displayed along with their respective reserve, collateral factors, and other information.

2. After supplying $LCRO on Tectonic, you will get tLCRO tokens which you can then take to @VenoFinance and deposit in the Tectonic Garden and earn rewards in $VNO, native token of @VenoFinance. 🔥

3. With your supplied $LCRO as collateral, you can borrow $CRO and stake $CRO on @VenoFinance for more $LCRO!

You can then loop this strategy to gain even more from CRO's staking rewards!

Looping boosts LCRO's ~13% APY higher, but make sure borrowing APR is lower than 13%!

You can then loop this strategy to gain even more from CRO's staking rewards!

Looping boosts LCRO's ~13% APY higher, but make sure borrowing APR is lower than 13%!

4. Alternatively, you can take the $LCRO and deposit it in @FerroProtocol's LCRO-CRO pool to earn LP rewards and then deposit the LP token to FerroGarden on @VenoFinance for more rewards!

This strategy gives around 60% APR at the moment. 🤑🔥

#composability

This strategy gives around 60% APR at the moment. 🤑🔥

#composability

5. For stablecoin farmers, you can also deposit stables, borrow, and loop to farm incentives.

For example, deposit USDT, borrow the maximum (70%) amount of USDT, deposit it, borrow more USDT, and repeat to increase the total incentives you can earn!

#stablecoin #farming

For example, deposit USDT, borrow the maximum (70%) amount of USDT, deposit it, borrow more USDT, and repeat to increase the total incentives you can earn!

#stablecoin #farming

Not to mention that on top of all these yield, you are also going to be earning $TONIC incentives for the $LCRO Pool on @TectonicFi! 🌋

$TONIC emission starts from 30 Mar 9am UTC

The early farmer gets the yield! 🫡

#yieldfarming #cronos

$TONIC emission starts from 30 Mar 9am UTC

The early farmer gets the yield! 🫡

#yieldfarming #cronos

Looking for how to bridge funds over to Cronos and farm?

Try out cronos.org/bridge if you are holding $ATOM

or

Bridge $USDC from Ethereum via multichain app.multichain.org/#/router

Try out cronos.org/bridge if you are holding $ATOM

or

Bridge $USDC from Ethereum via multichain app.multichain.org/#/router

Tagging #RealYield seekers:

@TheCryptoDog

@milesdeutscher

@OnChainWizard

@SamuelXeus

@Route2FI

@thedefiedge

@blocmatesdotcom

@CryptoHayes

@takegreenpill

@0xthade

@CryptoKaduna

@MoonKing___

@crypto_condom

@ThorHartvigsen

@AstrologyCrypto

@FranciswongCro

@andrewsaunders

@TheCryptoDog

@milesdeutscher

@OnChainWizard

@SamuelXeus

@Route2FI

@thedefiedge

@blocmatesdotcom

@CryptoHayes

@takegreenpill

@0xthade

@CryptoKaduna

@MoonKing___

@crypto_condom

@ThorHartvigsen

@AstrologyCrypto

@FranciswongCro

@andrewsaunders

Pro-tip! You can hedge your LCRO-CRO easily by shorting CRO with futures on OKX, Kucoin, and Bybit!

This way you can earn the high APR without exposure to CRO's price itself, it's how I farm high APRs in peace!

Follow me to see how I make thousands a month yield farming!

This way you can earn the high APR without exposure to CRO's price itself, it's how I farm high APRs in peace!

Follow me to see how I make thousands a month yield farming!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter