1) Today in 1933, President Franklin D. Roosevelt signed Executive Order 6102 forbidding the hoarding of #gold coin, gold bullion, and gold certificates within the continental United States. Make a plan ₿ for future black swan events. The technology is available. #Bitcoin #XAUT

2) In 1971, President Nixon ended the Bretton Woods agreement and un-tethered the Dollar from Gold, attacking gold once more. Yet gold is still around and went from $35/oz to $2,000+ today. Even states and central banks use gold as a hedge. Gold became what it is under pressure.

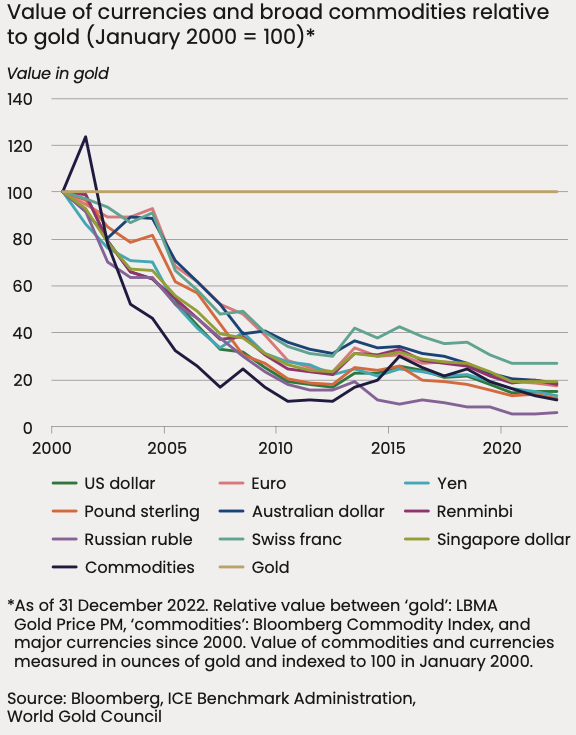

3) While many say that Gold failed as money, the purchasing power of major fiat currencies and commodities have significantly eroded relative to Gold in modern markets. Don't sleep on hard moneys such as Bitcoin and #Gold.

4) In fact, central bank Gold purchases in 2022 were the highest on record since the 1950s. Even central banks are increasingly hedging against their own currencies and macro bets.

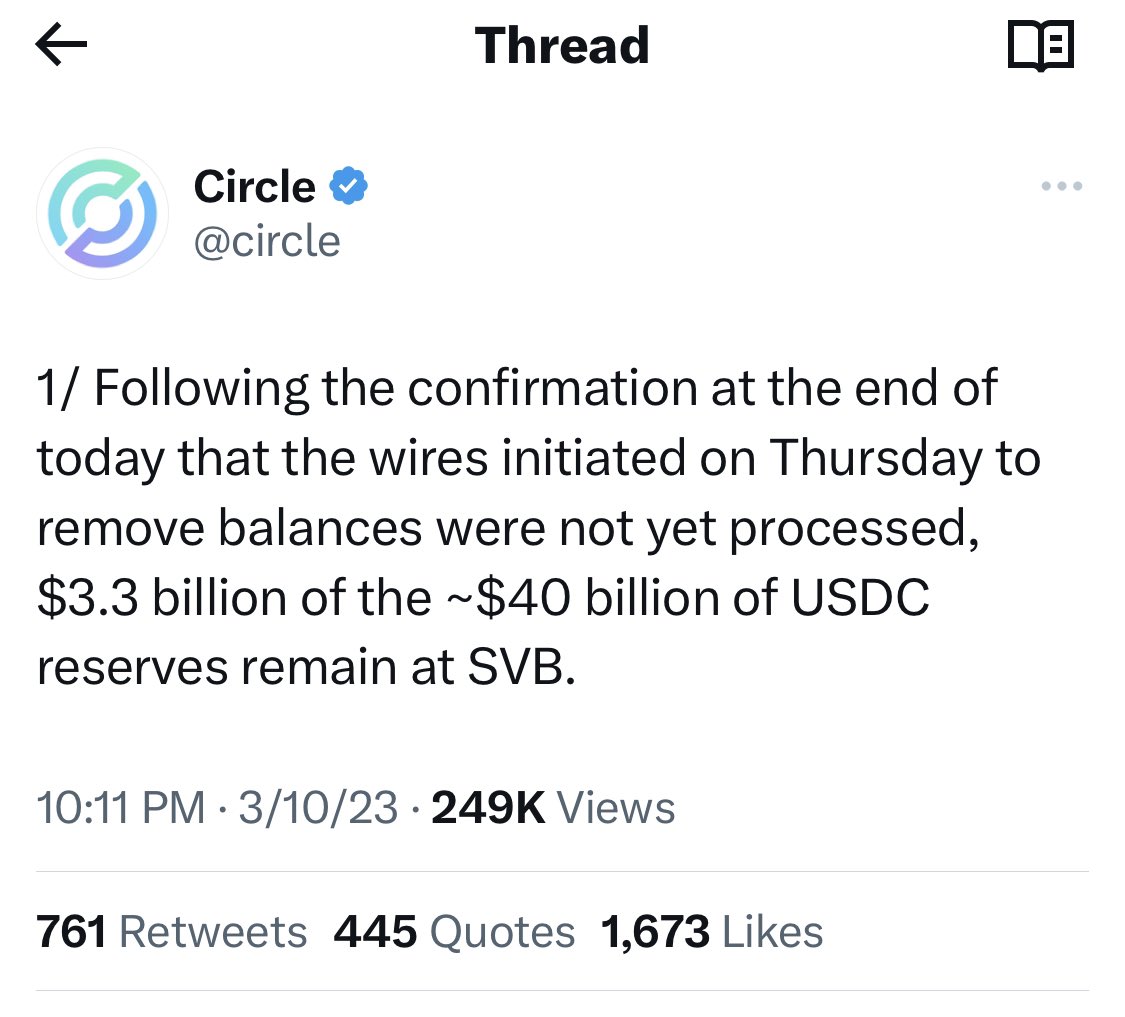

5) Furthermore, the U.S. Dollar and many leading economies are most likely still safe at a basic level in case of a currency collapse because of Gold.

https://twitter.com/gaborgurbacs/status/1635301292494180353?s=20

6) IMO, Tether Gold is what the U.S. Dollar could have been if the Bretton Woods System didn’t end in 1971. Technology and distribution channels weren’t available to support commodity-based hard moneys in the 1970s. Today the technology is available and it can change everything.

7) Lastly, it's no coincidence that Satoshi's birthday is April 5. It indeed goes back to Gold's history and executive order 6102. Bitcoin is growing and gold is digitized. Hard money is gaining traction. We are working on it. Happy Birthday Satoshi!

https://twitter.com/LuganoPlanB/status/1643527836102270979?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter