EXPOSED - SEBI DROP THE HAMMER ON BRIGHTCOM ⚠️

BEAT THE STREET EXPOSED MULTIPLE REDFLAGS, CG ISSUES LONG AGO

SEBI HAS EXPOSED MORE DARKER SIDE OF BCG - Misleading disclosures, profits, shareholding patterns, CG issues

Thread 🧵

#brightcom #brightcomgroup #bcg #sebi #redflag

BEAT THE STREET EXPOSED MULTIPLE REDFLAGS, CG ISSUES LONG AGO

SEBI HAS EXPOSED MORE DARKER SIDE OF BCG - Misleading disclosures, profits, shareholding patterns, CG issues

Thread 🧵

#brightcom #brightcomgroup #bcg #sebi #redflag

https://twitter.com/BeatTheStreet10/status/1498514487598407682

Preface SEBI order covers

1. Misleading Promoter SHP

2. Undisclosed & Non - audited subsidiaries FS

3. DAUM Settlement

4. Misleading Disclosures

5. Statutory Auditor & Indep Director - inelligible

6. Accounting irregularities

This order is one of the best, give it a read

1. Misleading Promoter SHP

2. Undisclosed & Non - audited subsidiaries FS

3. DAUM Settlement

4. Misleading Disclosures

5. Statutory Auditor & Indep Director - inelligible

6. Accounting irregularities

This order is one of the best, give it a read

1. Misleading Promoter Shareholding - comparing promoter shareholding disclosed to the exchanges & available with RTA, Sebi found promoters inflated shareholding by 10% to 29% since 2016🧐😯 (see table below), we wrote this about in our previous thread

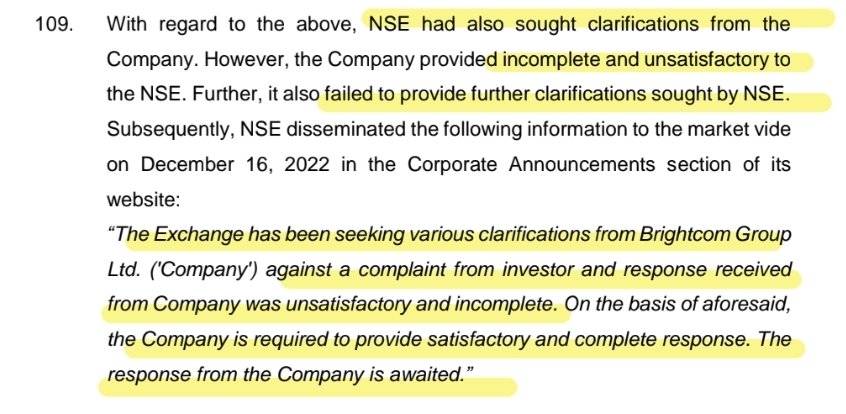

NSE also sought clarification from BCG on shareholding but there responses were unsatisfactory and incomplete (mainly related to pledge - which we also analyzed long back and found untenable)

SHP should have been sourced from the data maintained by RTA. However, even though the shareholding data of RTA was matching with data of Depositories, it appeared that Company had deliberately misrepresented its SHP. The co intentionally concealed the material info.

Sebi said this pledging and transfer of shares to lenders cast doubt over voting results

Sebi found BCG promoters guilty under SEBI SAST & PIT regulations as there actual shareholding is just 3.51%

There is strong connection between RTA & Statutory Auditor (covered later)

Sebi found BCG promoters guilty under SEBI SAST & PIT regulations as there actual shareholding is just 3.51%

There is strong connection between RTA & Statutory Auditor (covered later)

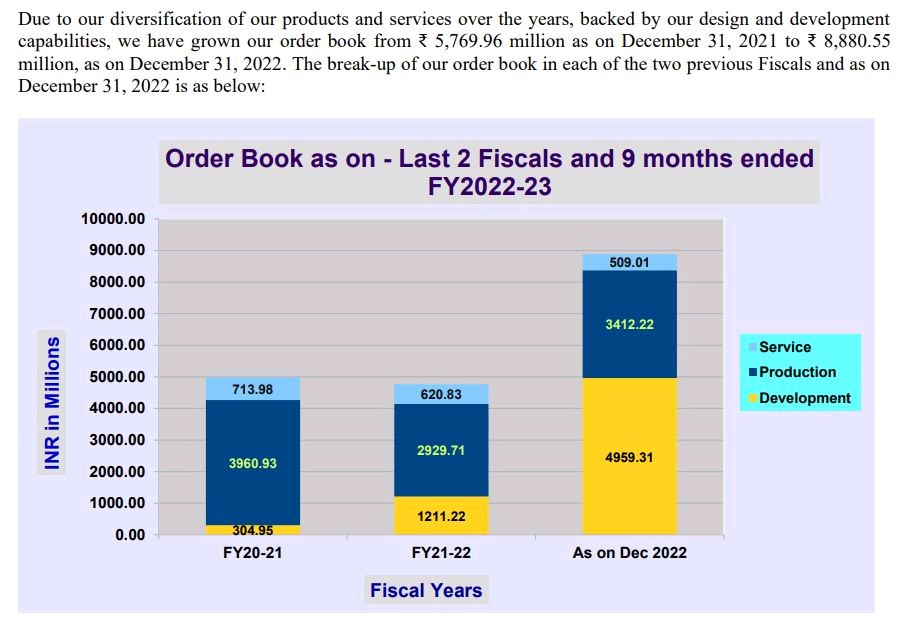

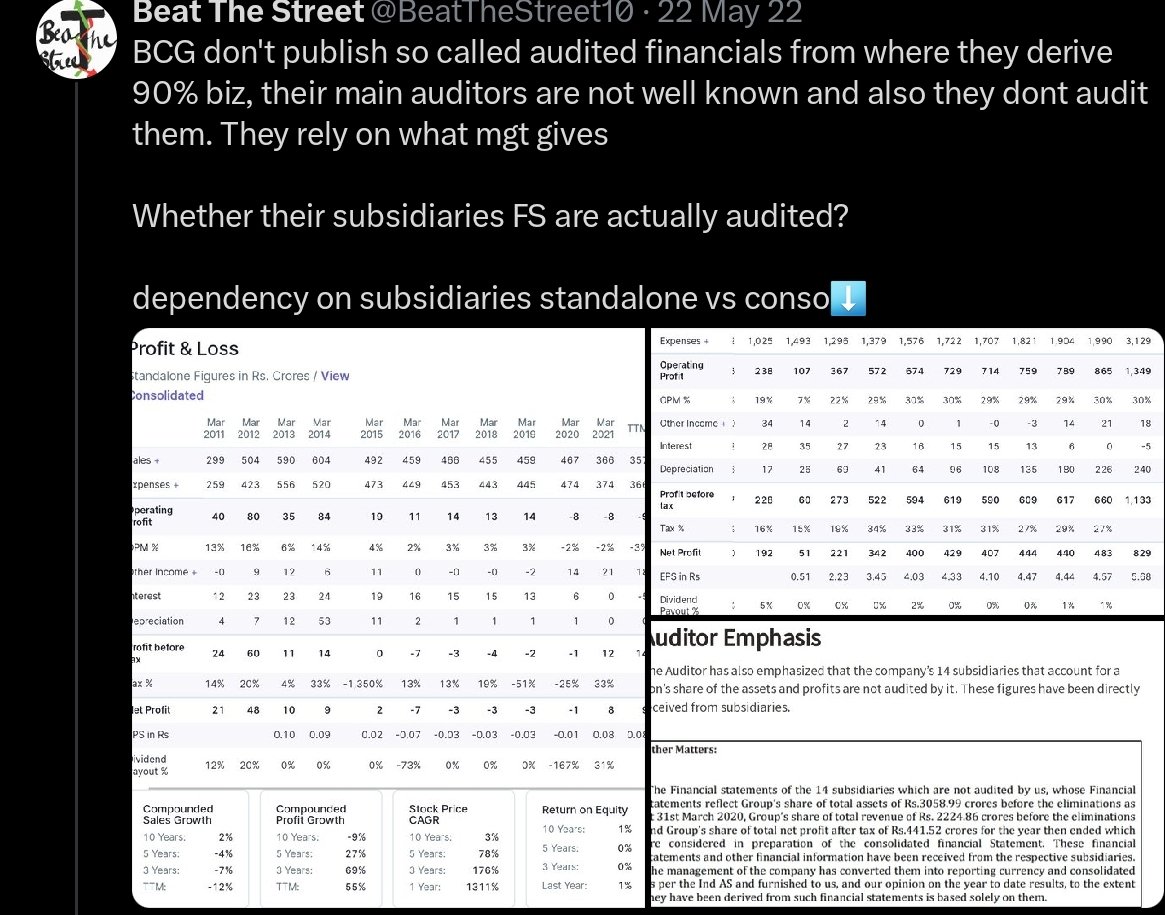

2. Non audited subsidiaries - SEBI LODR requires atleast 80% of assets, revenue, PAT should have been reviewed

In case of Brightcom, almost 80% of assets, revenue, PAT were unaudited - A major corporate governance issue raised by us long ago

In case of Brightcom, almost 80% of assets, revenue, PAT were unaudited - A major corporate governance issue raised by us long ago

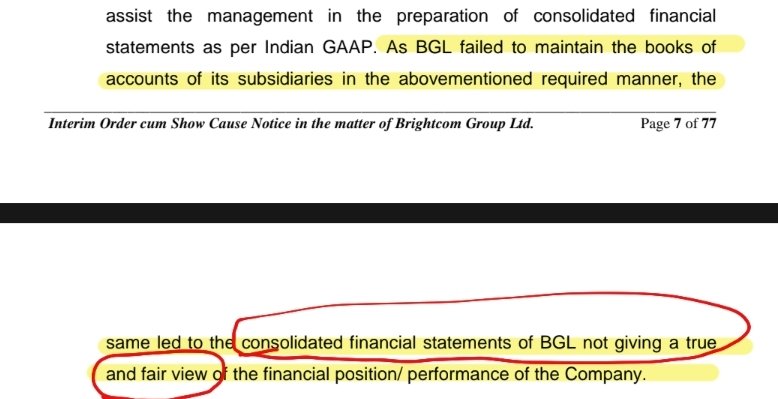

2. Subsidiary FS & books of accounts were not maintained. Noted significant differences & discrepancies in subsidiaries accounting.

Hence consolidated FS of BCG are not giving true & fair picture

This issue was also highlighted by us long back

Hence consolidated FS of BCG are not giving true & fair picture

This issue was also highlighted by us long back

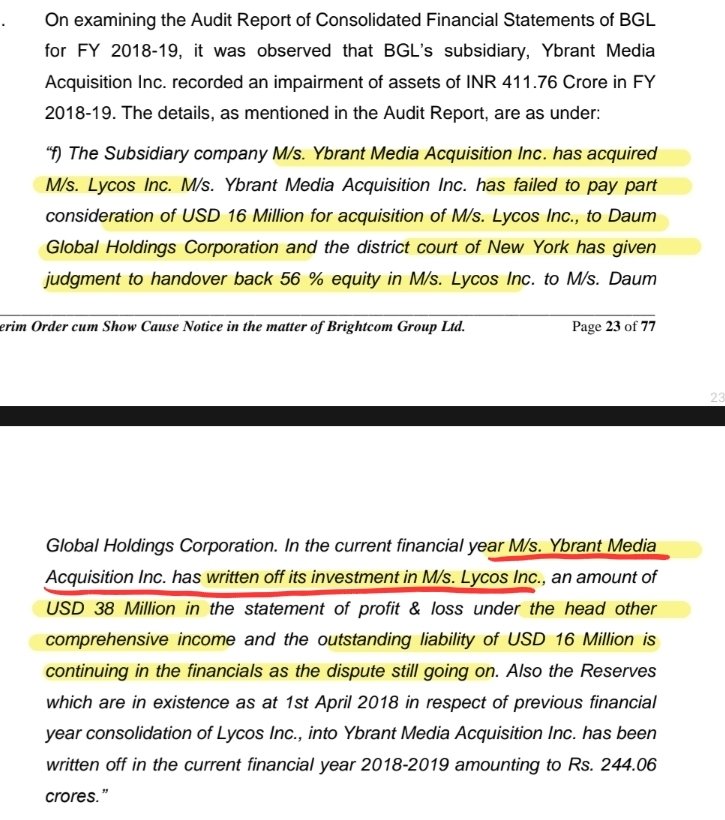

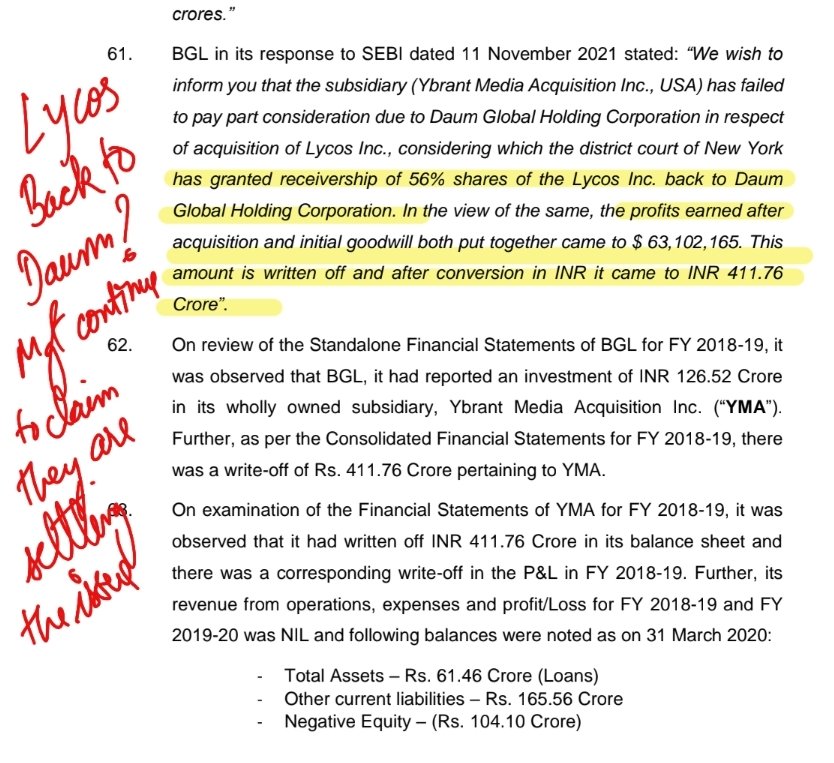

3. Lycos - Daum Settlement

The co (Ybrant) which acquired Lycos has fully written off its investment into Lycos post adverse court ruling and there will be no refund of amount already paid ($20Mn)

Shareholding of Lycos has been given to DAUM, currently Lycos is not a subs

The co (Ybrant) which acquired Lycos has fully written off its investment into Lycos post adverse court ruling and there will be no refund of amount already paid ($20Mn)

Shareholding of Lycos has been given to DAUM, currently Lycos is not a subs

Ybrant filed for bankruptcy in 2015 just to delay the settlement & payment to DAUM

MD said they still expect resolution by Oct-Nov 2022, which as of today is still pending

Beat The Street raised concerns on never ending Mgt guidance about settlement

MD said they still expect resolution by Oct-Nov 2022, which as of today is still pending

Beat The Street raised concerns on never ending Mgt guidance about settlement

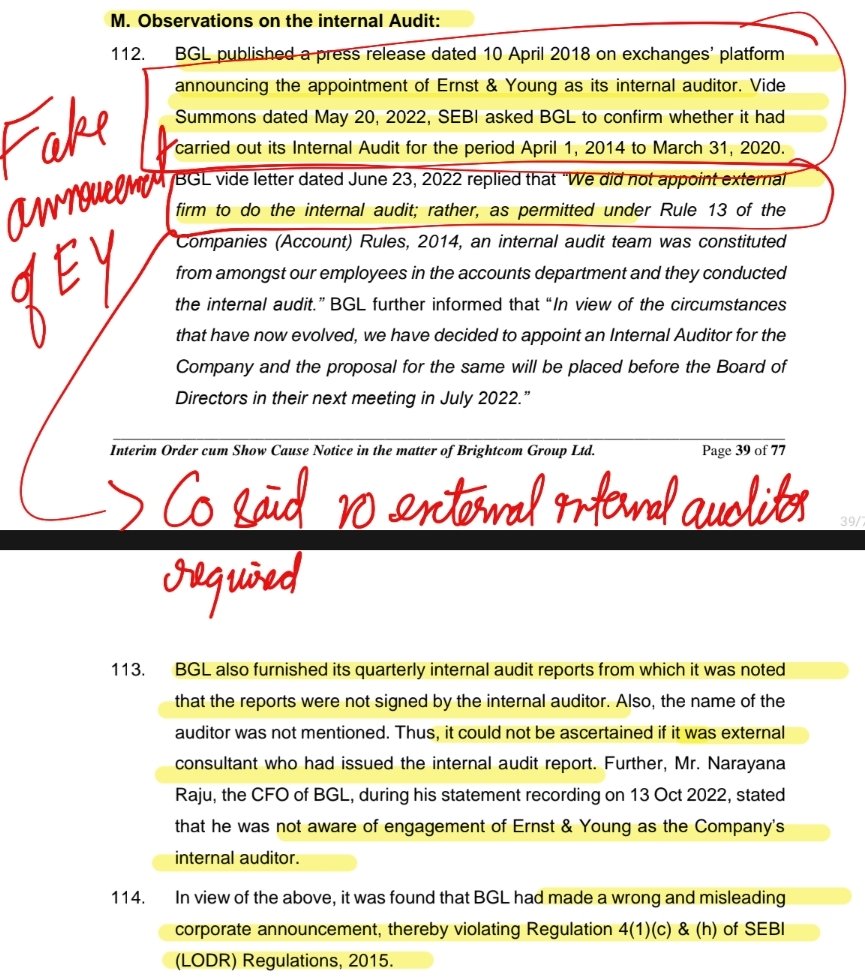

4. Misleading disclosures

Company said they appointed EY as internal auditor. When report was sought by SEBI, it was found that report was not from EY or external party

BCG said they are not in need of external auditors, if that is the case then why they misleading disc earlier

Company said they appointed EY as internal auditor. When report was sought by SEBI, it was found that report was not from EY or external party

BCG said they are not in need of external auditors, if that is the case then why they misleading disc earlier

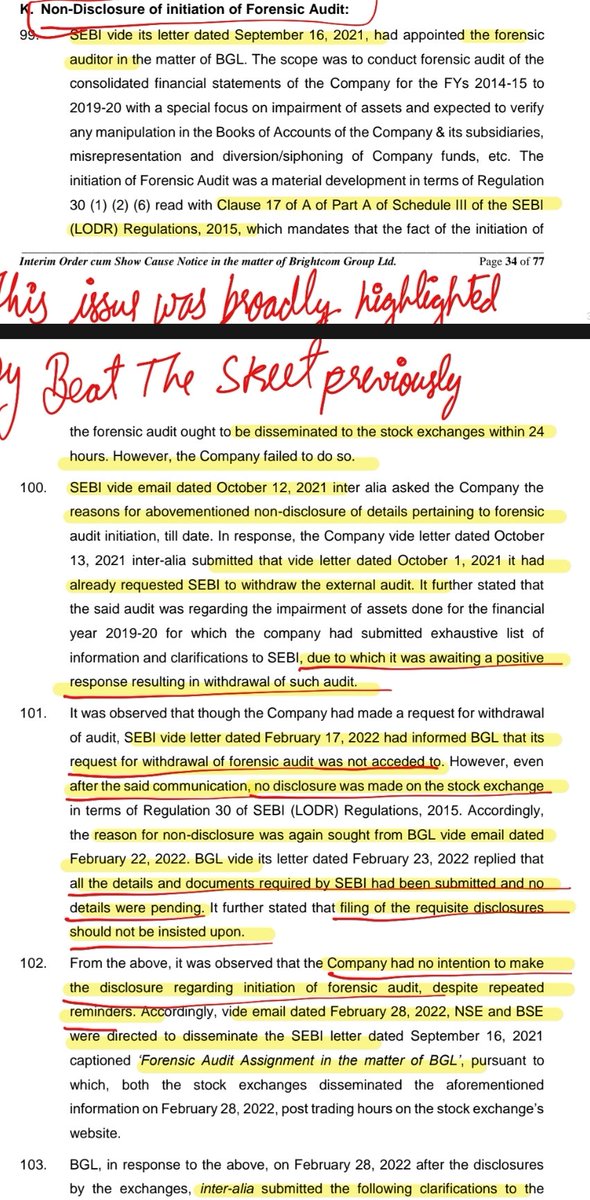

Misleading Disclosures of FORENSIC AUDIT - disclosed after substantial delay of 165 days that too when exchanges gave disclosures after repetead follow - ups

Beat The Street alerted about this non disclosure long ago

Beat The Street alerted about this non disclosure long ago

Reasons of non disclosure

Initial - requested Sebi for withdrawal, expect positive outcome. Sebi denied withdrawal.

Then they said they have given all relevant documentation and disclosure of forensic audit shouldn't be insisted upon.

NSE & SEBI made multiple follow-ups

Initial - requested Sebi for withdrawal, expect positive outcome. Sebi denied withdrawal.

Then they said they have given all relevant documentation and disclosure of forensic audit shouldn't be insisted upon.

NSE & SEBI made multiple follow-ups

5. Independent Director - inelligible

ID can be appointed only after Board Resolution + Ordinary

Resolution(1st term) / Special Resolution (2nd term)

BCG appointed Raghunath as ID for 2nd term without

shareholder resolution. Sebi said his appointment is not as per

law.

ID can be appointed only after Board Resolution + Ordinary

Resolution(1st term) / Special Resolution (2nd term)

BCG appointed Raghunath as ID for 2nd term without

shareholder resolution. Sebi said his appointment is not as per

law.

Hence, audit committee is also not as per law

Also daughter of ID is also an employee making him inelligible

for being an ID

Also daughter of ID is also an employee making him inelligible

for being an ID

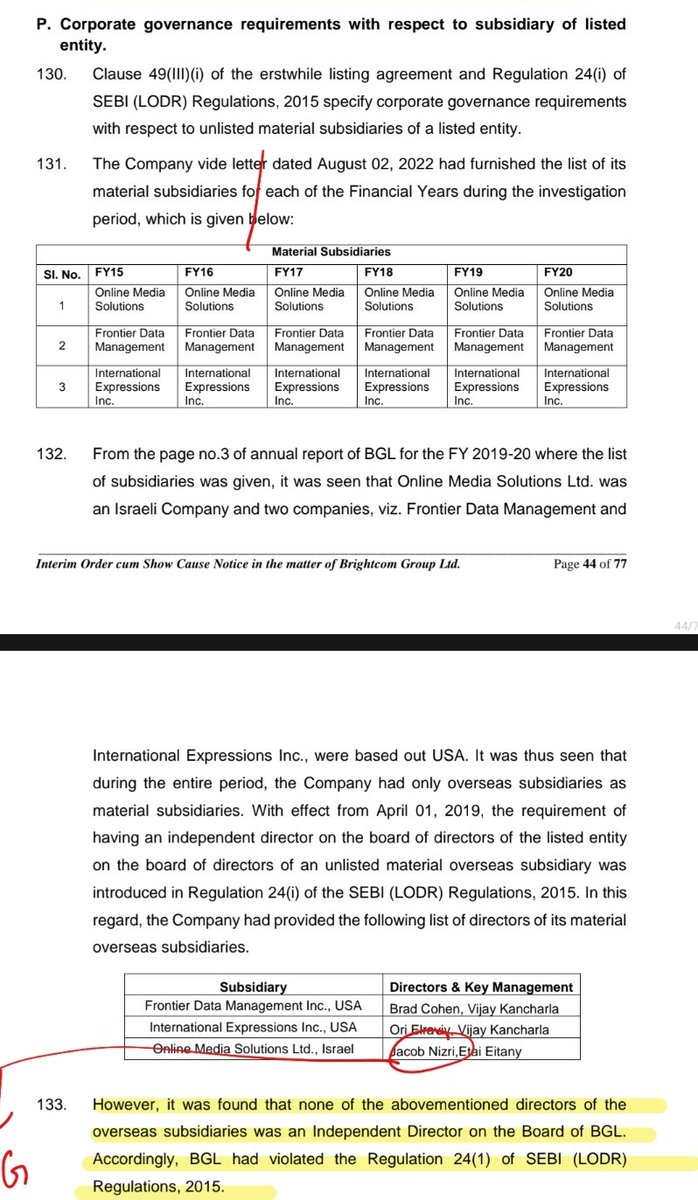

NON APPOINTMENT OF INDEPENDENT DIRECTORS ON

MATERIAL SUBSIDIARIES

SEBI LODR requires appointment of atleast one independent

director on board of material subsidiaries

In case of BCG, no subsidiaries had independent directon

MATERIAL SUBSIDIARIES

SEBI LODR requires appointment of atleast one independent

director on board of material subsidiaries

In case of BCG, no subsidiaries had independent directon

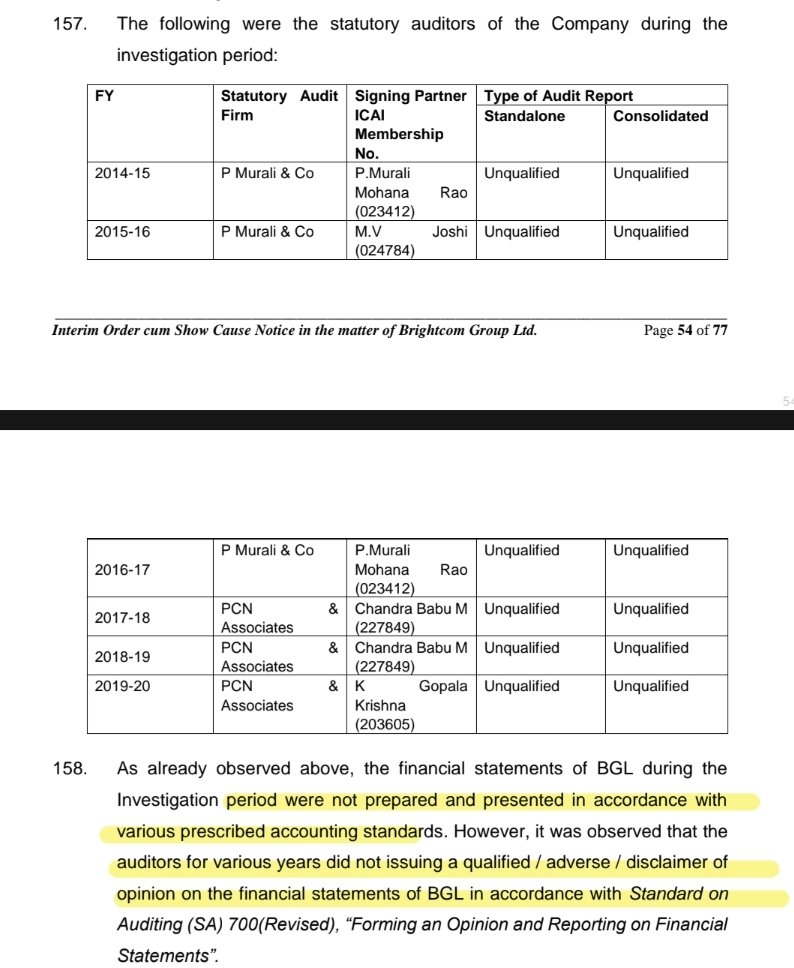

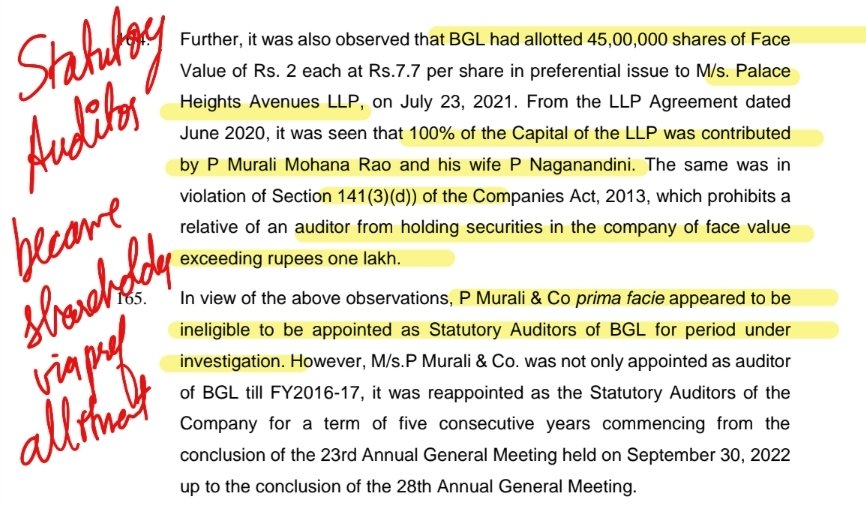

STATUTORY AUDITORS OF SAME NETWORK

both statutory auditors are related to each other as partners of

one firm are either former employee or article of another firm

both statutory auditors are related to each other as partners of

one firm are either former employee or article of another firm

Statutory Auditor of the BCG acquired shares of the company

via preferential allotment- making his appointment inelligible

via preferential allotment- making his appointment inelligible

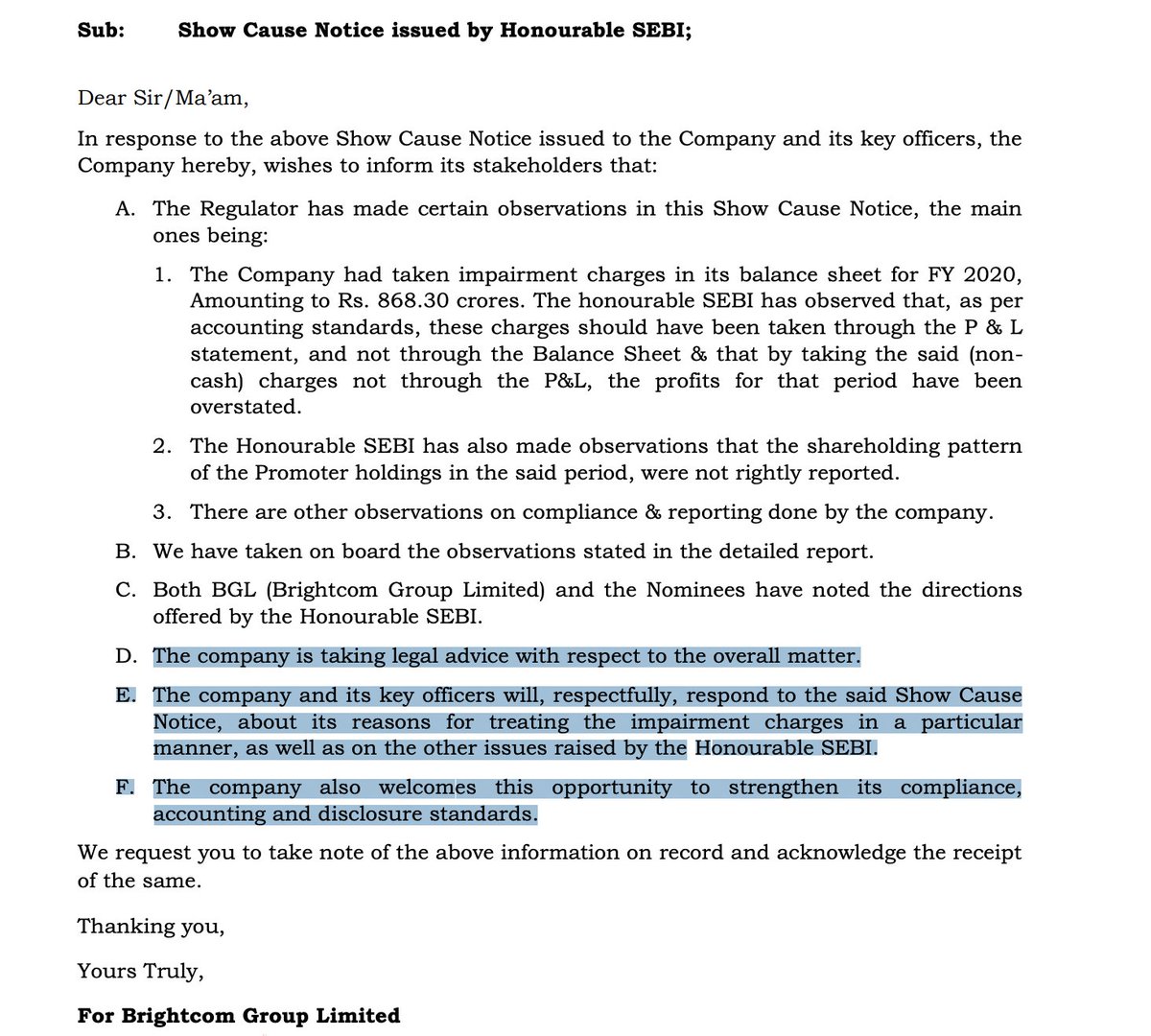

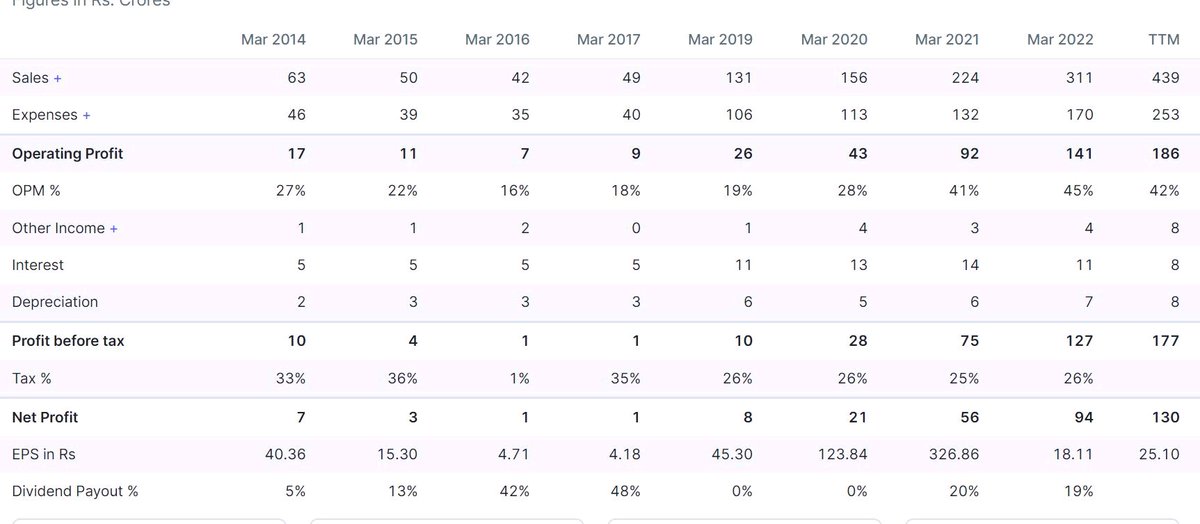

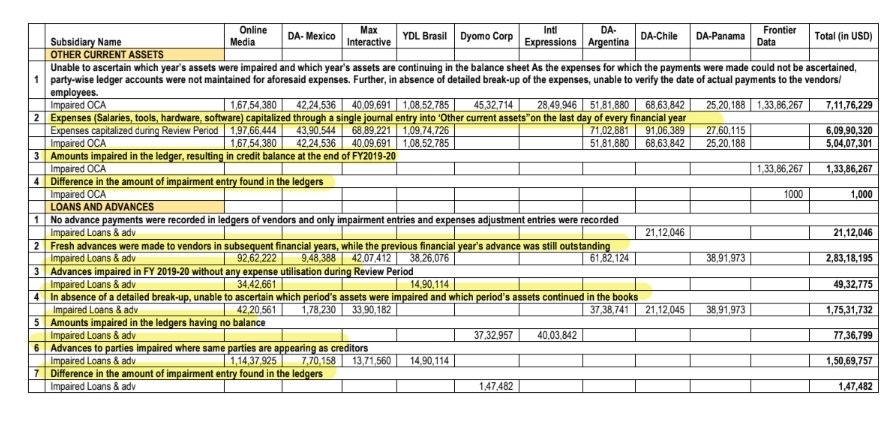

6. Accounting irregularities of INR 1280 crores

A. Intangible Assets under development added in current year

were capitalized next year even if these assets not met

recognition criteria

A. Intangible Assets under development added in current year

were capitalized next year even if these assets not met

recognition criteria

B. Impairment loss (INR 411 Crore) of FY19 have been disclosed

in Other Comprehensive Income instead of P&L leading to

inflated profits by 92%

In FY20, similar issue noted and if rightly accounted then

company would have been into loss

in Other Comprehensive Income instead of P&L leading to

inflated profits by 92%

In FY20, similar issue noted and if rightly accounted then

company would have been into loss

C. Capitalized research phase expenses which should have

been expensed out through P&L leading to unde-recognition of

expenses and over-recognition of assets

been expensed out through P&L leading to unde-recognition of

expenses and over-recognition of assets

E. BCG furnished four different responses with respect to

initial recognition of the impaired assets in the books of

accounts of its subsidiaries and consolidated financial

statements

A big lapse

initial recognition of the impaired assets in the books of

accounts of its subsidiaries and consolidated financial

statements

A big lapse

Even after giving time of more than 1 yr, BCG still not able to provide all documents to the satisfaction of regulator

Sebi also took note of non disclosure of promoter stake sale of approx 19%

One of the main reason which led to Sebi investigation

One of the main reason which led to Sebi investigation

Sebi said

BCG painted rosy picture

Not hesitate to bend rules

On top of that, the Company, from the very start, resorted

to delaying tactics, so that the investigation process got stalled.

BCG painted rosy picture

Not hesitate to bend rules

On top of that, the Company, from the very start, resorted

to delaying tactics, so that the investigation process got stalled.

Finally Sebi directed

1. Promoters to not sell shares, file correct SHP

2. Disclose subsidiaries FS

3. Get Subsidiaries audited

4. Make relevant changes in FS

- End

1. Promoters to not sell shares, file correct SHP

2. Disclose subsidiaries FS

3. Get Subsidiaries audited

4. Make relevant changes in FS

- End

It took us almost 8 hours to read, analyze and present 77 pager SEBI order against BRIGHTCOM to bring out all important facts pointed out by SEBI

If you find this valuable, please do follow us, like, retweet,comment

Thanks for being patient while reading

If you find this valuable, please do follow us, like, retweet,comment

Thanks for being patient while reading

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter