TL:DR Pre #Celsius Chapter 11 Court Hearing Updates:

Ignat Tuganov, via counsel, has concerns related to the UCC @CelsiusUcc being the representative for the class claim motion. He wants more specifics related to amount of, voting rights related to, and possible settlement conditions for the class claim. He is concerned about the… twitter.com/i/web/status/1…

The UCCs omnibus reply to the other parties regarding their class claim motion. They largely reiterate and expand on their previous reasonings for the class claim, countering the series B preferred objections along the way. They have also included language in the proposed order… twitter.com/i/web/status/1…

Manny @mannymane , Frishberg @DanielFCelsius, & Rebecca support the UCC class claim and believe it will streamline the process. They are also requesting that any bar date extensions be done for all creditors until a path forward is made clearer. They want the ability to do… twitter.com/i/web/status/1…

UCC is revising their proposed schedule on the intercompany claim to reconcile the differences they had with #Celsius' proposed schedule and to incorporate changes to allay some of the series B preferred objections cases.stretto.com/public/x191/11…

Series B Preferred is again arguing that the intercompany loan estimations should be handled first as the other issues brought forth in these expanded schedules are not fully fleshed out yet to warrant scheduling cases.stretto.com/public/x191/11…

Manny and Frishberg joinder to the objections by the US Trustee and pro se creditors against the KEIP. They also argue it is just a KERP disguised as a KEIP and is not truly incentivizing anything. They maintain that the motion was a complete waste of time and money and K&E… twitter.com/i/web/status/1…

Manny and Frishberg joinder to Ignat Tuganov's response to the Series B Preferred's objection to the UCC class claim motion. They agree with Tuganov's proposal to appoint a third party fiduciary to assert the non-contract claims on behalf of creditors. They then go point by point… twitter.com/i/web/status/1…

K&E replying to the objections by Frishberg and Ubierna de las Heras regarding their fees. They basically say their work was required, the costs would be similar regardless of the venue, and their bills have already been reviewed by the Fee Examiner and adjusted when there were… twitter.com/i/web/status/1…

The US Trustee believes a class claim would violate the UCCs fiduciary duties for all creditors as it would only be beneficial to the account holders. They mention but don't have an opinion on the third-party fiduciary option other than to say they have concerns on the costs… twitter.com/i/web/status/1…

Earn Ad-hoc has entered the fray! We got Manny, Nicholas Farr and Brett (Both top 50 creditors) represented on the docket cases.stretto.com/public/x191/11…

Earn Ad-Hoc lawyer offitkurman.com/attorney/joyce…

UCC agreeing with K&E regarding their objection to Frishberg and Ubiernas fee objections cases.stretto.com/public/x191/11…

$CEL Ad Hoc being formed by Alex Mashinsky

https://twitter.com/simondixontwitt/status/1647971257160220672

All #Celsius Stalking Horse bids submitted today & negotiations begin

https://twitter.com/SimonDixonTwitt/status/1647980018293719040

Join me on my Post Court Hearing Space tomorrow. Set a reminder twitter.com/i/spaces/1lDxL…

Latest episode of Slack Helsius Files by @camcrews

https://twitter.com/simondixontwitt/status/1647877170281213953

#Celsius Ongoing Activities Update presentation for tomorrow's hearing from CEO Chris Ferraro cases.stretto.com/public/x191/11…

If you have coins in #Celsius custody & wish to settle you have till April 24th. Pay attention now & act accordingly. Nothing to do if you are Earn or Borrow. Updated stats here:

Mining update. What this tells me. #Celsius in Chapter 11 are a mining disaster. Number inconsistent from coin report. Uptime is the key to success & these numbers suck, BUT in the hands of a competent #BItcoin operator where we own the shares - we need that ASAP for recovery.

More details on #Celsius revenue. We are finally starting to get the full picture. Selling stablecoins, assets like GK8 & withdrawing funds from exchanges is considered revenue? We need these assets in the hand of competent operators & out of Chapter 11 ASAP for recovery.

Updated Schedule and Procedures related to the Custody Users for those in #Celsius Custody cases.stretto.com/public/x191/11…

Amended Schedule for tomorrow's hearing. Everything heating up from all angles now. TL:DR - We need to get out of Chapter 11 ASAP, but we have shareholders v creditors, Alex Mashinsky v. Creditors, Stalking Horse v Bidders & Earn v. Borrow to resolve next cases.stretto.com/public/x191/11…

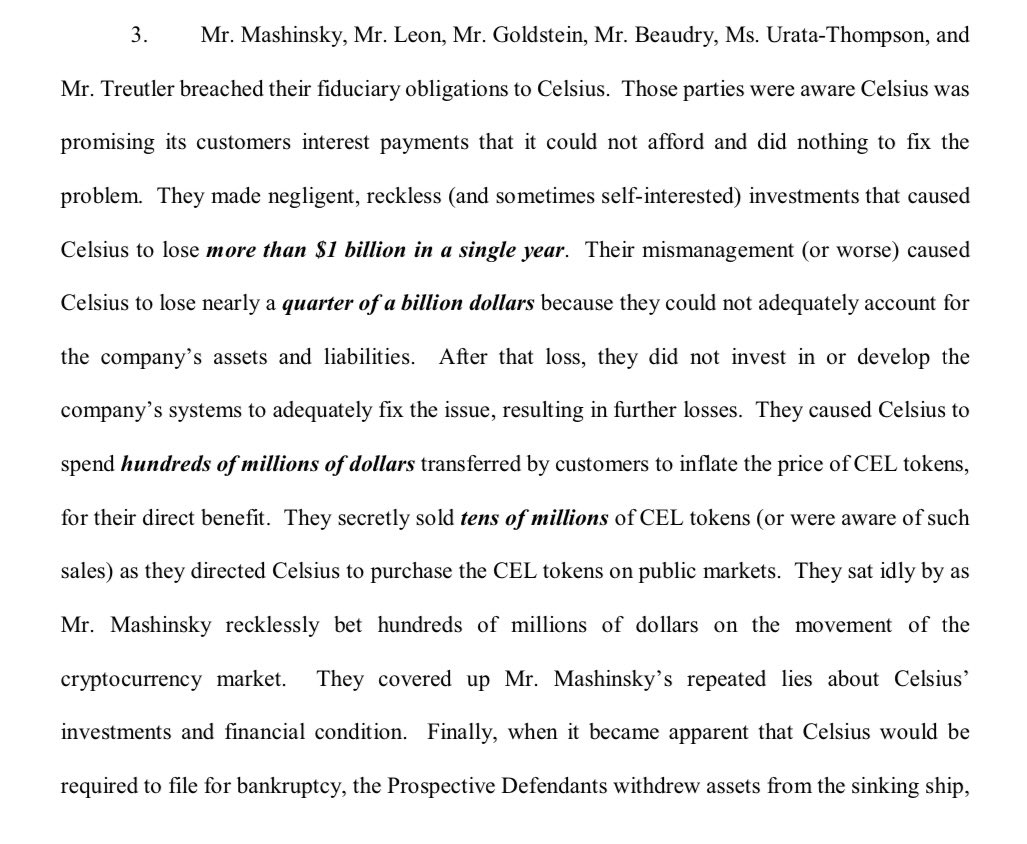

For those that called me FUD yesterday you should know by now that I release ahead of official announcements based on sound strategy analysis & good sources. Still don’t believe Alex Mashinsky wants to drain the estate with his $CEL & shares - maybe trust his partners in crime…

If you want to stay several steps ahead of every shady move in #Celsius Chapter 11, join the guy that’s kept you ahead, disclosed conflicts & agendas from Day One & has had your back from the beginning. In this case we fight until good wins over criminals twitter.com/i/spaces/1lDxL…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter