Left Investment Bank 2006. Launched BankToTheFuture 2010. Spoke at 1st Bitcoin conference & published 1st #Bitcoin book 2011. Angel Investor 💯+ #BTC Companies

2 subscribers

How to get URL link on X (Twitter) App

https://x.com/SimonDixonTwitt/status/2017973250391748990

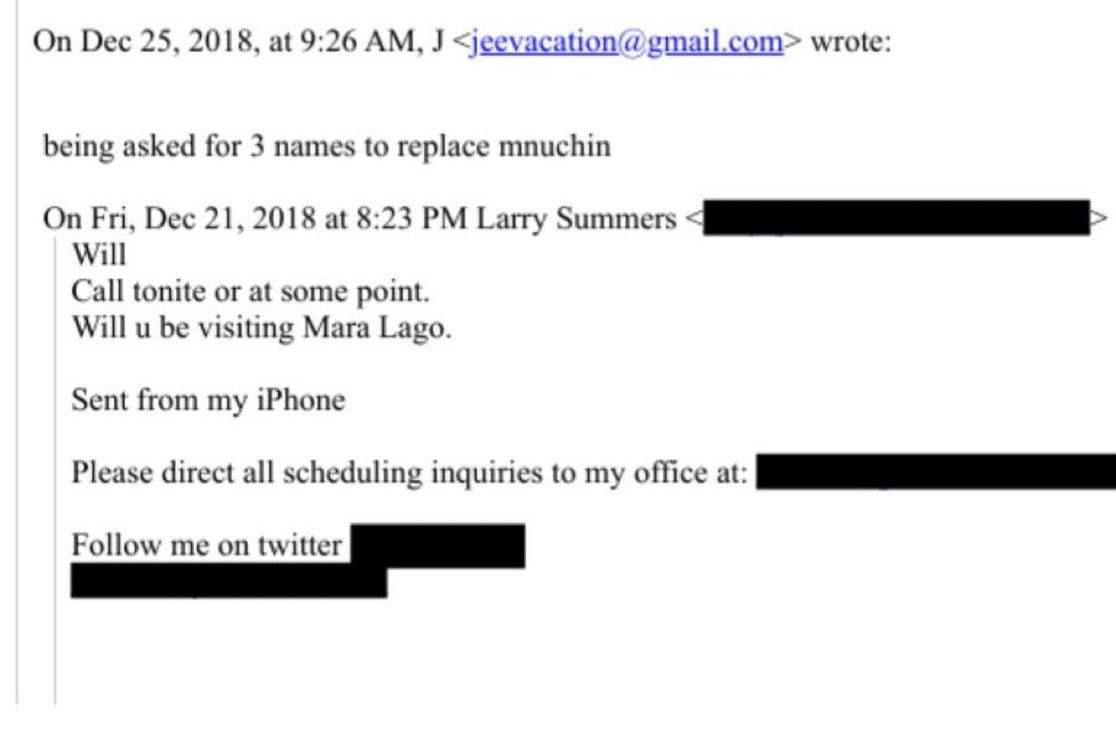

Recommended reading on this.

Recommended reading on this.

FYI @DrJackKruse

FYI @DrJackKruse

https://x.com/SimonDixonTwitt/status/2017604377133879358

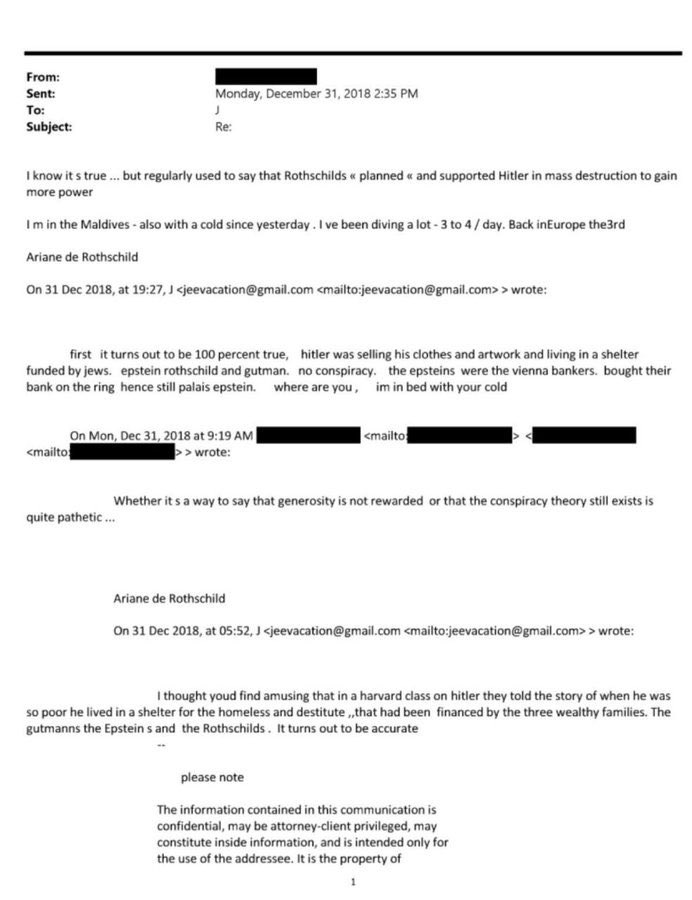

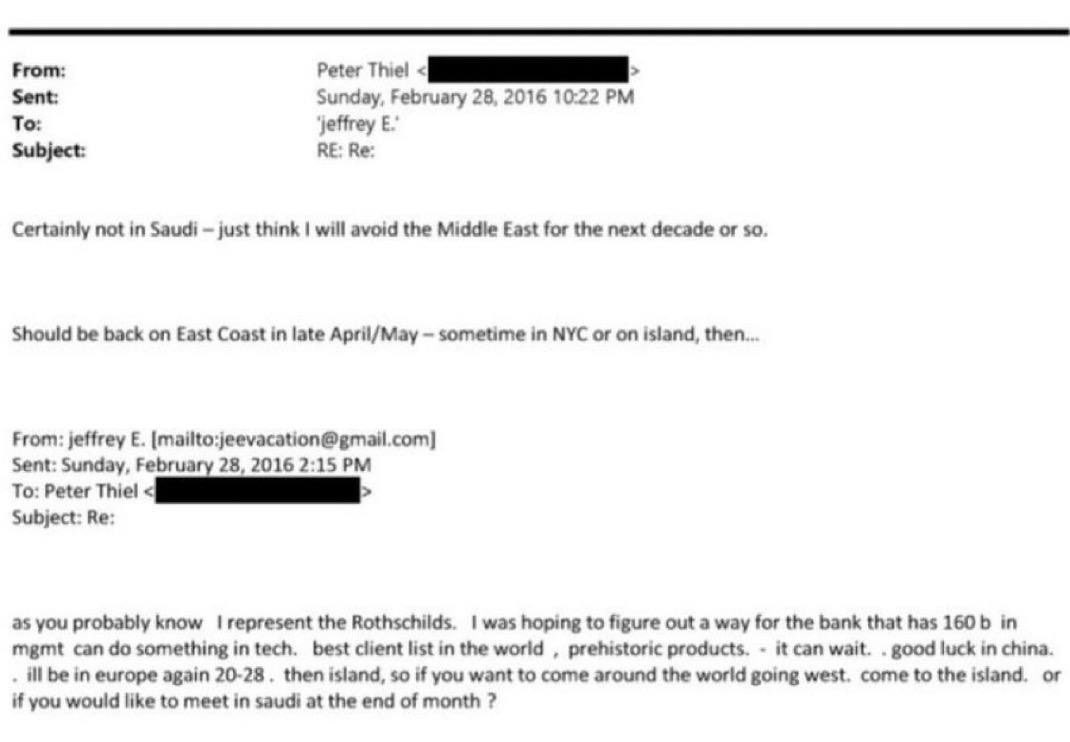

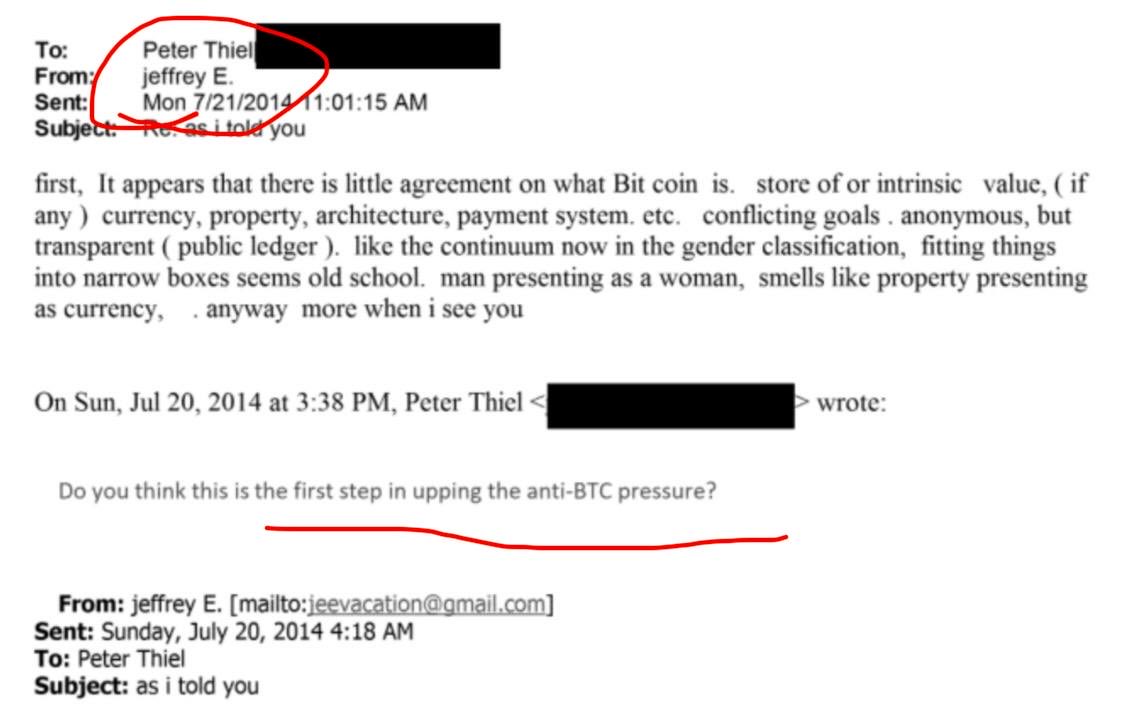

Unmasking the Epstein Bitcoin Theory: JP Morgan Links & the Trump Leverage Game

Unmasking the Epstein Bitcoin Theory: JP Morgan Links & the Trump Leverage Game

https://x.com/SimonDixonTwitt/status/2014022588759224779

In case you missed the forecast.

In case you missed the forecast.

https://twitter.com/adamemedia/status/1972977315111178531Mind Wars: A 5-Part Blog Series on Escaping Narrative & Technological Control

https://twitter.com/thecradlemedia/status/1967882154483786058Charlie Kirk’s Assassination & the Proof-of-Weapons Network via @YouTube

⚠️ Manufactured Civil Unrest: What They Don’t Want You to Know via @YouTube

⚠️ Manufactured Civil Unrest: What They Don’t Want You to Know via @YouTube

Trump’s Middle East trip is about furthering:

Trump’s Middle East trip is about furthering:

Bo Hines (Presidential Council of Advisers for Digital Assets) said stablecoin legislation is “imminent”—expect it on the President’s desk in 2 months.

Bo Hines (Presidential Council of Advisers for Digital Assets) said stablecoin legislation is “imminent”—expect it on the President’s desk in 2 months.

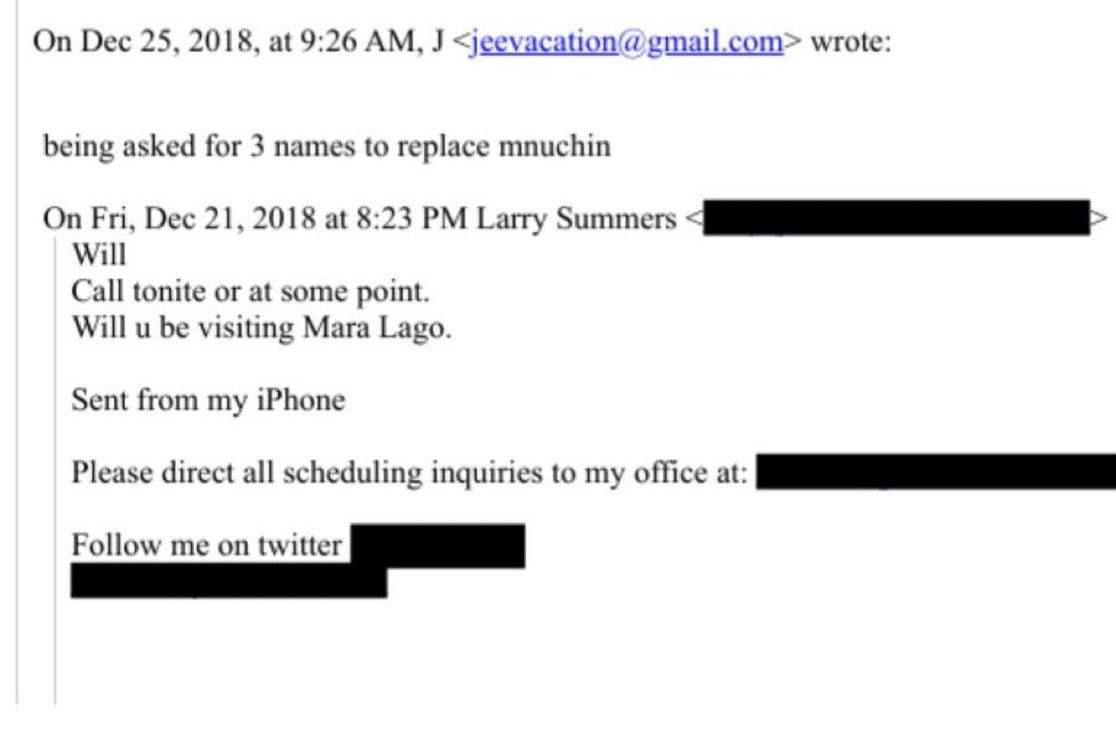

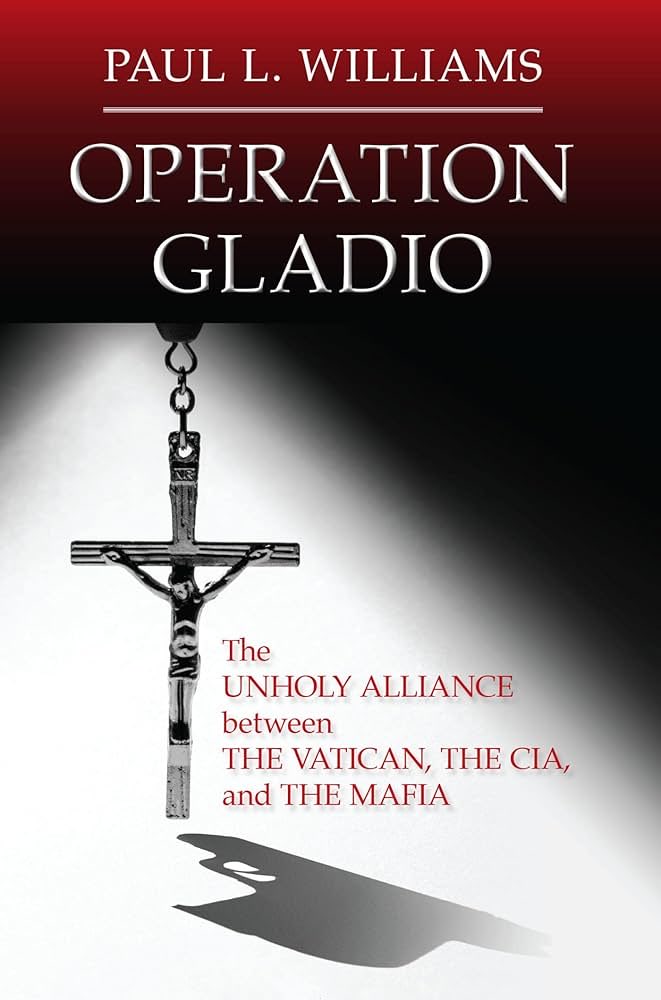

2/ REDACTED FROM JFK FILES:

2/ REDACTED FROM JFK FILES:

Would I Vote Trump or Harris?—Analysing their Bitcoin, Macro & GeoPolitical Policies | BitcoinHardTalk Episode 60

Would I Vote Trump or Harris?—Analysing their Bitcoin, Macro & GeoPolitical Policies | BitcoinHardTalk Episode 60