Once in a life A Once in a Lifetime Opportunity in German Residential Real Estate Stocks🏘️💰🇩🇪

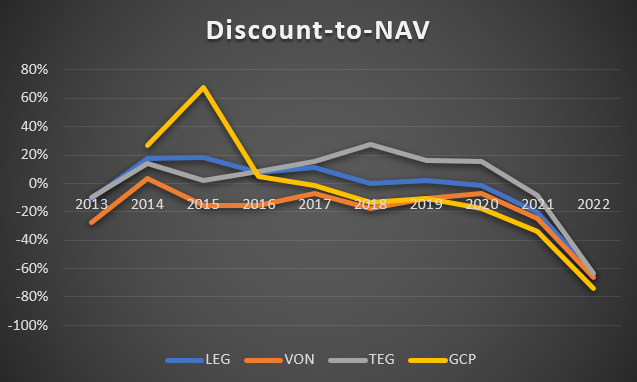

1/ Vonovia, $LEG, $TAG, $GCP currently trade at a 67% discount to NAV, with a potential 200% mid term upside. It's a rare opportunity to buy into this market at a bargain price.

1/ Vonovia, $LEG, $TAG, $GCP currently trade at a 67% discount to NAV, with a potential 200% mid term upside. It's a rare opportunity to buy into this market at a bargain price.

2/ Key stocks to watch: Vonovia, LEG Immobilien, TAG Immobilien, and Grand City Properties. They're trading at deep discounts to NAV, providing an attractive entry point for investors.

3/ Historically, these stocks traded close to their NAV. But today, they're trading at an average 67% discount, offering residential real estate in Germany at a two-thirds discount. #valueinvesting #opportunity

4/ The current NAV discount is unprecedented, even during the Global Financial Crisis, residential real estate stocks only reached a 50% discount. This is a unique chance to buy into the German residential market. #marketcrash #investing

5/ Cash Flow Perspective: German Residential Real Estate stocks offer potential 10% dividend yield!

Historically, these stocks traded at a 3-4% yield, reflecting the safety & strong fundamentals of the German residential market.

Historically, these stocks traded at a 3-4% yield, reflecting the safety & strong fundamentals of the German residential market.

6/ However, since August 2021 the share price of these stocks has been in free fall:

· LEG Immobilien lost 61%

· Vonovia lost 70%

· TAG Immobilien lost 75%

· Grand City Properties lost 69%

· LEG Immobilien lost 61%

· Vonovia lost 70%

· TAG Immobilien lost 75%

· Grand City Properties lost 69%

7/ As a result of this drawdown the four stocks currently trade at an average yield of 10.00% relative to their 2021 dividend. Note that for the year 2022, all stocks except Vonovia have suspended dividends as a precautionary measure to strengthen their balance sheets.

8/ Based on their underlying FFO, German residential real estate stocks have the potential to re-establish their 2021 dividends. Based on normalized dividend yields of 3-4%, these stocks have 200% near term upside.

9/ Underlying Strength of the German Residential real estate market:

While the German residential real estate market had a good run over the last few years, inflation adjusted home prices are still at about the same level as 40 years ago, leaving strong upside.

While the German residential real estate market had a good run over the last few years, inflation adjusted home prices are still at about the same level as 40 years ago, leaving strong upside.

13/ Steady rental growth, entering steeper stage.

Rents in Germany have increased 1.8% in Q1 relative to Q4 2022, and they have increased 5.8% year over year.

According to online-platform Immowelt, asking rents for Berlin in Q1 have even increased 23%(!) in Q1.

Rents in Germany have increased 1.8% in Q1 relative to Q4 2022, and they have increased 5.8% year over year.

According to online-platform Immowelt, asking rents for Berlin in Q1 have even increased 23%(!) in Q1.

14/ Balance Sheets are Healthy

LTV ratios are low

Interst Coverage ratios are high

Interst rates are fixed

Loans on average mature only in 6.5 years

LTV ratios are low

Interst Coverage ratios are high

Interst rates are fixed

Loans on average mature only in 6.5 years

16/ With the 2022 level of FFO, the companies could pay back about 5% of the debt each year. After 5 years, the total level of debt could hence be 25% lower. This could actually a counteract any nominal increase in interest rates.

17/ Short Term Investment Case

50% short term upside to close the NAV discount to a still draconic -50%

50% short term upside to close the NAV discount to a still draconic -50%

18/ Mid Term Investment Case

About 200% mid-term upside to recover to their NAV per share or normalized dividend ratios. How fast this scenario arises will largely depend on the interest rate trajectory. Inflation in Germany and Europe is now already sharply trending down.

About 200% mid-term upside to recover to their NAV per share or normalized dividend ratios. How fast this scenario arises will largely depend on the interest rate trajectory. Inflation in Germany and Europe is now already sharply trending down.

19/ Long Term Investment Case

I believe this is a generational opportunity to diversify the portfolio into German residential real estate, which is as solid of a long term investment as it gets. I am locking in this investment at just one third of the fundamental value...

I believe this is a generational opportunity to diversify the portfolio into German residential real estate, which is as solid of a long term investment as it gets. I am locking in this investment at just one third of the fundamental value...

20/...long term:

Locking in a 10% dividend yield on today’s share price alone is a 100% return over a decade. Add to that 200% from the recovery to NAV, gives a 300% return over 10 years. Another 50% from growth in NAV and dividends is possible -> 18.5% CAGR

Locking in a 10% dividend yield on today’s share price alone is a 100% return over a decade. Add to that 200% from the recovery to NAV, gives a 300% return over 10 years. Another 50% from growth in NAV and dividends is possible -> 18.5% CAGR

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter