#Clownbase went public w/Wells response 🤡. We can glean some insight into what the SEC wants from it:

"Overhaul its entire biz model to register as an NSE/clearing agency potentially requiring $COIN to jettison its entire customer-facing business"

ngmi

assets.ctfassets.net/c5bd0wqjc7v0/2…

"Overhaul its entire biz model to register as an NSE/clearing agency potentially requiring $COIN to jettison its entire customer-facing business"

ngmi

assets.ctfassets.net/c5bd0wqjc7v0/2…

The SEC is not legally allowed to say a damn thing in response. $COIN trying to move the law w/the lever of public opinion might have worked before millions lost their savings to FTX, Celsius, Voyager

Now it looks like bayonet charging a machine gun nest.

bettermarkets.org/newsroom/coinb…

Now it looks like bayonet charging a machine gun nest.

bettermarkets.org/newsroom/coinb…

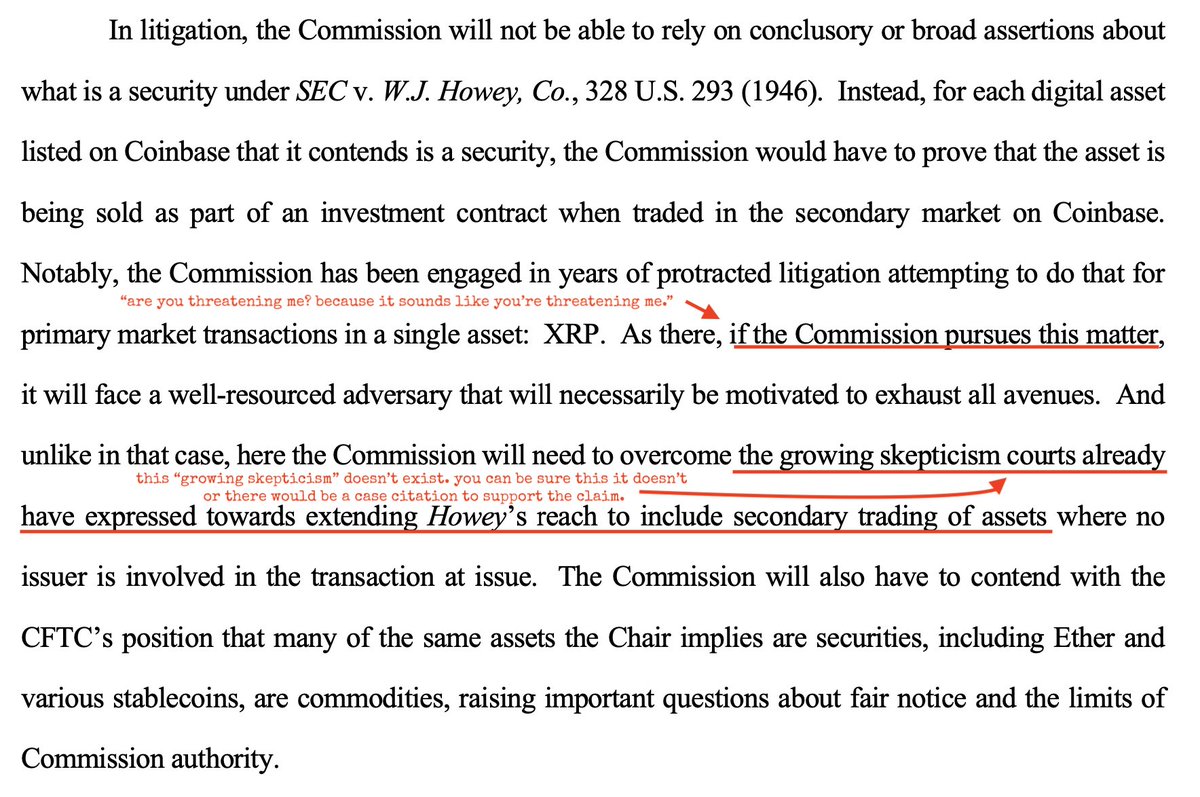

🧵 #Clownbase's wells submission:

1. threatens the SEC

2. contains blatantly untrue claims about American cryptocurrency jurisprudence

1. threatens the SEC

2. contains blatantly untrue claims about American cryptocurrency jurisprudence

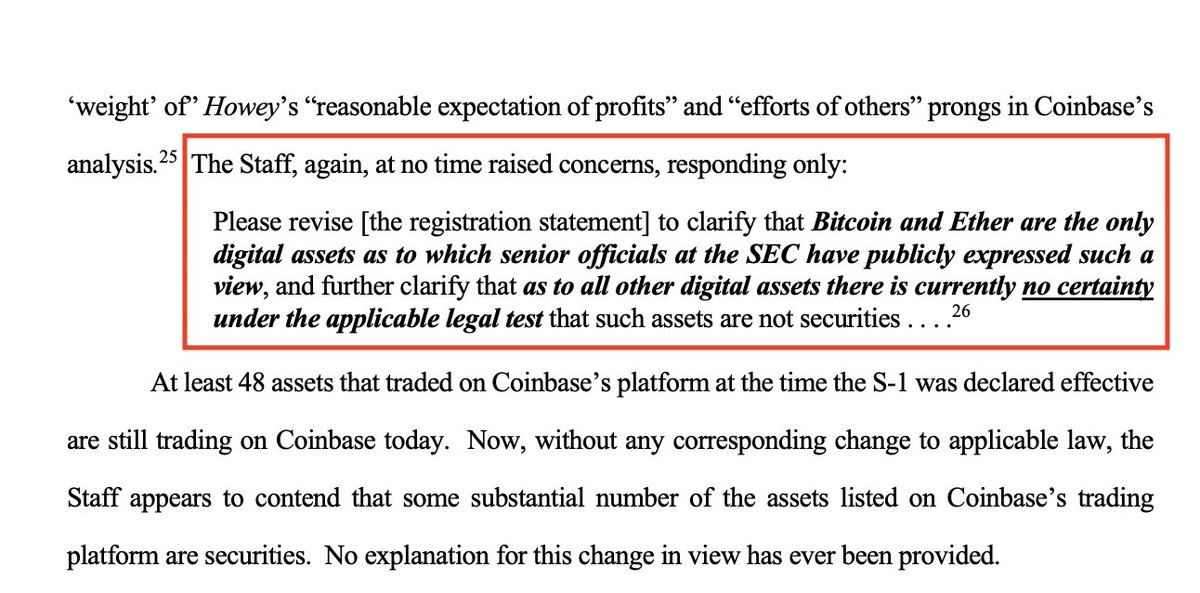

🧵 lol #Clownbase would like you to believe they could have never possibly known that anything could be a security... and yet the SEC explicitly told them everything except Ethereum (pre-proof of stake) and Bitcoin might be determined to be a security.

🧵 #Clownbase helpfully suggested to the SEC that, rather than $COIN having to change anything about how it operated, it could be the SEC that could instead make major changes to its existing processes.

🤡

🤡

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter