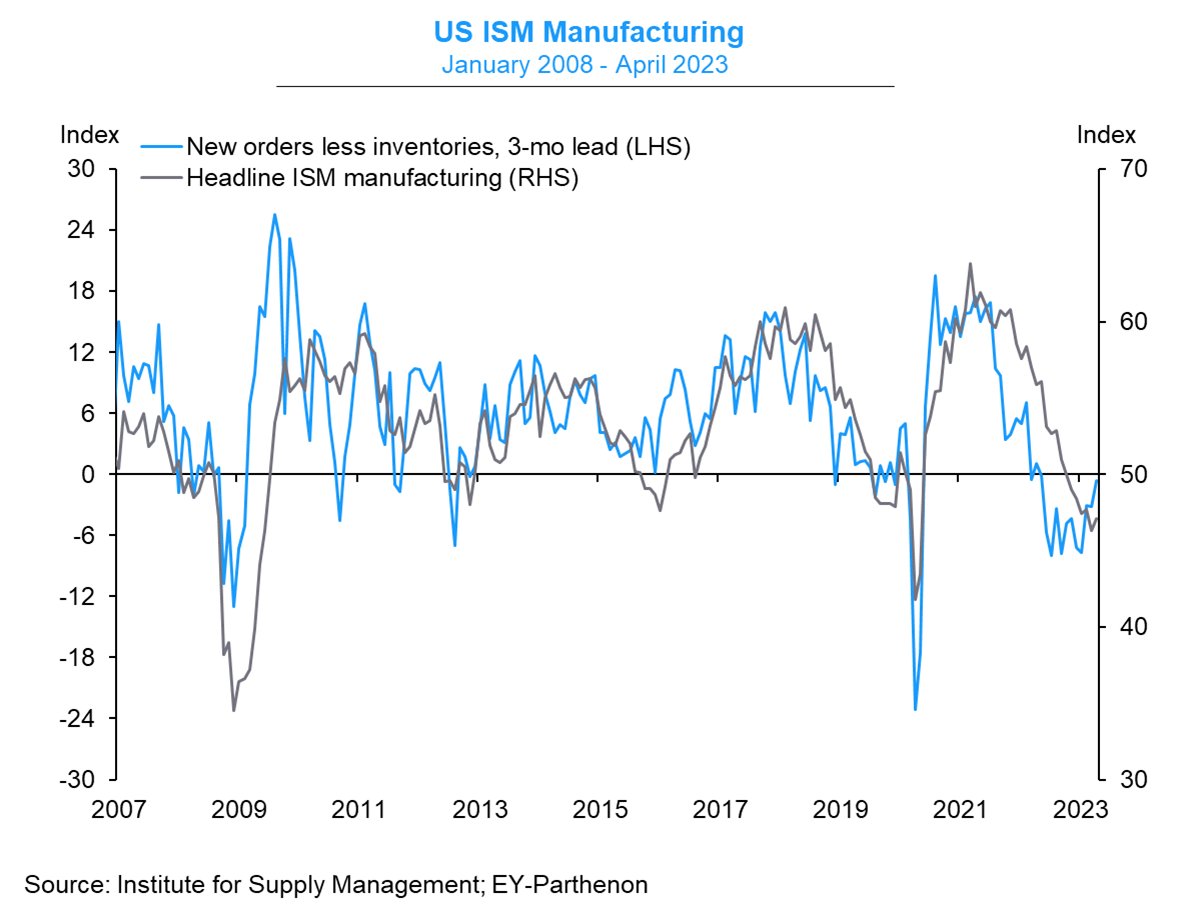

🇺🇸@ism #Manufacturing +0.8pt to 47.1 in April -- still near low since May 2020

"Softening at slower pace"

❌New Orders 45.7 (+1.4pt)

❌Production 48.9 (+1.1pt)

✅Employment 50.2 (+3.3pt)

❌Supplier Deliveries 44.6 (-0.2pt)

❌Backlogs 43.1 (-1.2pt)

⬆️Inflation 53.2 (-2.1pt)

"Softening at slower pace"

❌New Orders 45.7 (+1.4pt)

❌Production 48.9 (+1.1pt)

✅Employment 50.2 (+3.3pt)

❌Supplier Deliveries 44.6 (-0.2pt)

❌Backlogs 43.1 (-1.2pt)

⬆️Inflation 53.2 (-2.1pt)

"We seem to be in a season of contradictions. Business is slowing, but in some ways, it isn’t. Prices for some commodities are stabilizing, but not for others. Some product shortages are over, others aren’t. Trucking is more plentiful, except when it isn’t..."

"It’s hard to make projections at the moment"

Purchasing managers generally reporting elevated uncertainty, softer demand, excess inventories and reduced pricing power, but this is truly a multispeed environment.

Purchasing managers generally reporting elevated uncertainty, softer demand, excess inventories and reduced pricing power, but this is truly a multispeed environment.

The prices index rebounded above 50 indicating some modest inflationary pressures -- in line with pre-pandemic period -- even as the supplier deliveries index remains well in contraction territory

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter